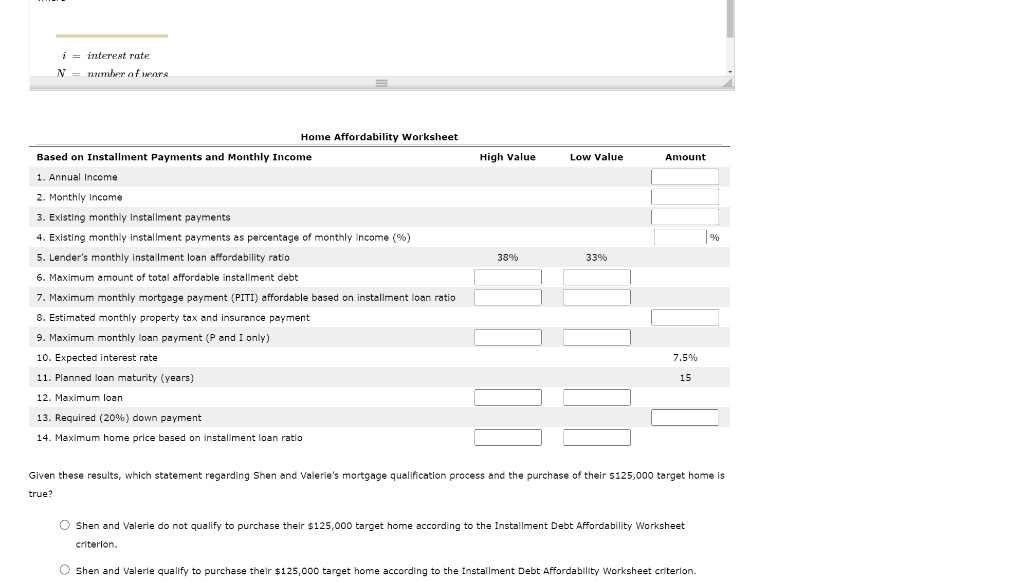

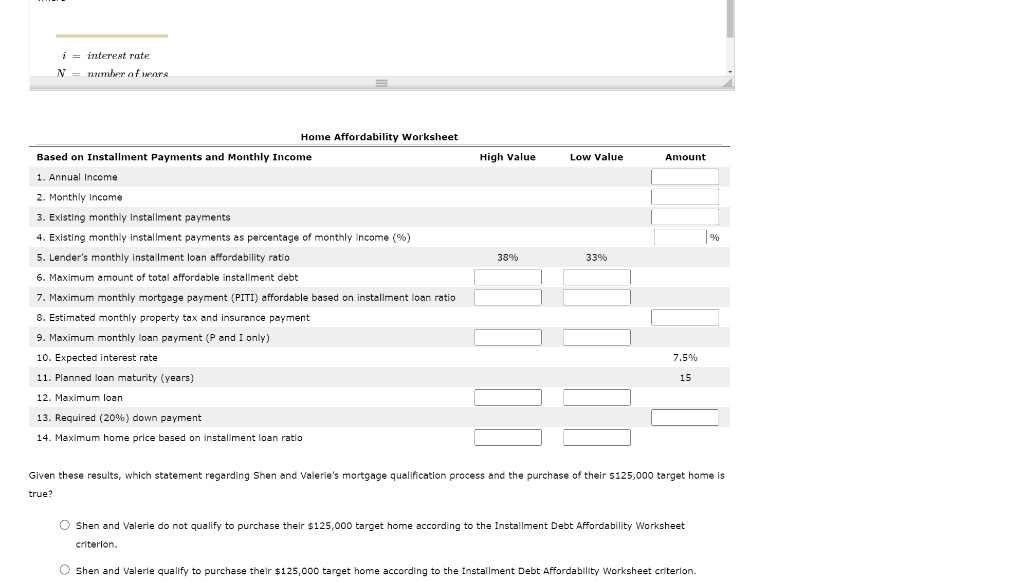

Can Shen and Valerie afford this home using the installment debt loan criterion? Next week, your frlends shen and Valerle want to apply to the Flith State Bank for a mortgage loan. They are considering the purchase of a home that is expected to cost $125,000. Given your knowledge of personal finance, they've asked for your help in completing the Hame Affardability Worksheet that follows. To assist in the preparation of the worksheet, Shen and Valerie slso collected the fallowing information: - Their financial records repart a combined gross before-tax annual income of 5105,000 and current (pre-mortgage) installment loan, credit card, and car loan debt of 51,531 per month, - Their property taxes and homeowner's insurance policy are expected to cost 51,563 per year. - Their best estimate of the Interest rate on thelr mortgage Is 7.5%, and they are Interested In obtalning a 15 -year loan. - They have accumulated savings of $32,500 that can be used to satisfy the home's down payment and closing costs, - The lender requires a minimum 20% down payment, and instaliment loan affordability ratios that range from a minimum of 33% to a maximum of 38%. Use either your financigl calculator or the maximum affordable mortgage loan formula to complete the following home affordability worksheet. (Note: When completing the form, round esch dollar amount to the nesrest whole dollar. Uniess labeled differently, all of the following values represent dollar amounts. Also, some values calculated or used in the upper section of the table may also be used in the lower section. Round your percentage answer to two decimal places.) Given these results, which statement regarding Shen and Valerie's mortgage qualification process and the purehase of their 5125 , 000 target home is trues? Shen and Valerie do not qualify to purchase their $125,000 target home according to the Installment Debt Affordability Worksheet criterion. Shen and Valerle qualify to purchase their $125,000 target home according to the Installment Debt Affordability Worksheet criterion. Can Shen and Valerie afford this home using the installment debt loan criterion? Next week, your frlends shen and Valerle want to apply to the Flith State Bank for a mortgage loan. They are considering the purchase of a home that is expected to cost $125,000. Given your knowledge of personal finance, they've asked for your help in completing the Hame Affardability Worksheet that follows. To assist in the preparation of the worksheet, Shen and Valerie slso collected the fallowing information: - Their financial records repart a combined gross before-tax annual income of 5105,000 and current (pre-mortgage) installment loan, credit card, and car loan debt of 51,531 per month, - Their property taxes and homeowner's insurance policy are expected to cost 51,563 per year. - Their best estimate of the Interest rate on thelr mortgage Is 7.5%, and they are Interested In obtalning a 15 -year loan. - They have accumulated savings of $32,500 that can be used to satisfy the home's down payment and closing costs, - The lender requires a minimum 20% down payment, and instaliment loan affordability ratios that range from a minimum of 33% to a maximum of 38%. Use either your financigl calculator or the maximum affordable mortgage loan formula to complete the following home affordability worksheet. (Note: When completing the form, round esch dollar amount to the nesrest whole dollar. Uniess labeled differently, all of the following values represent dollar amounts. Also, some values calculated or used in the upper section of the table may also be used in the lower section. Round your percentage answer to two decimal places.) Given these results, which statement regarding Shen and Valerie's mortgage qualification process and the purehase of their 5125 , 000 target home is trues? Shen and Valerie do not qualify to purchase their $125,000 target home according to the Installment Debt Affordability Worksheet criterion. Shen and Valerle qualify to purchase their $125,000 target home according to the Installment Debt Affordability Worksheet criterion