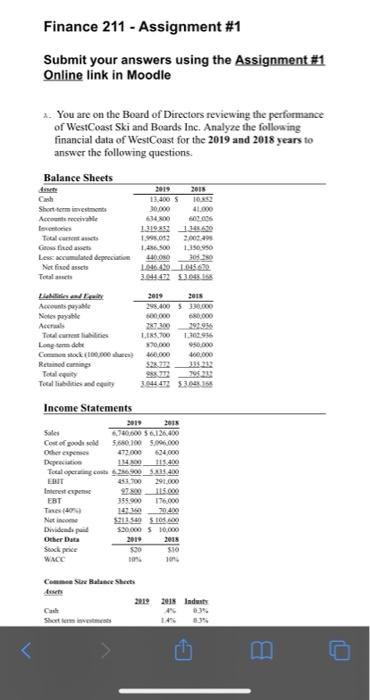

Can some help me with finding P/E ratio for both years. Please show all the steps.

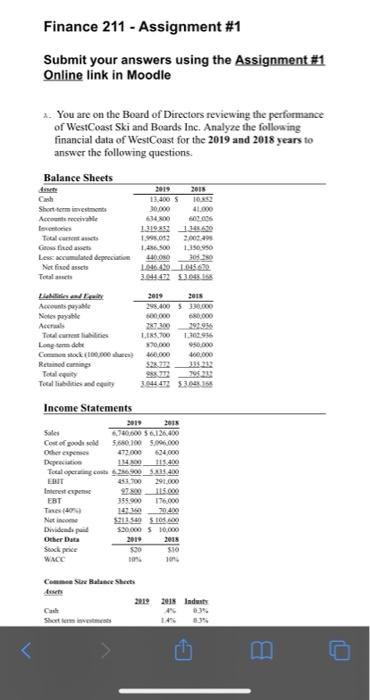

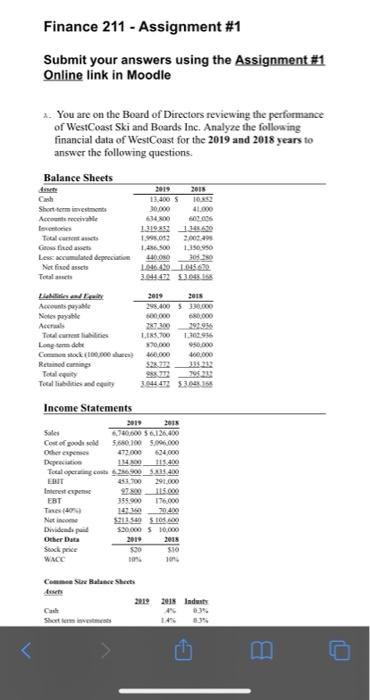

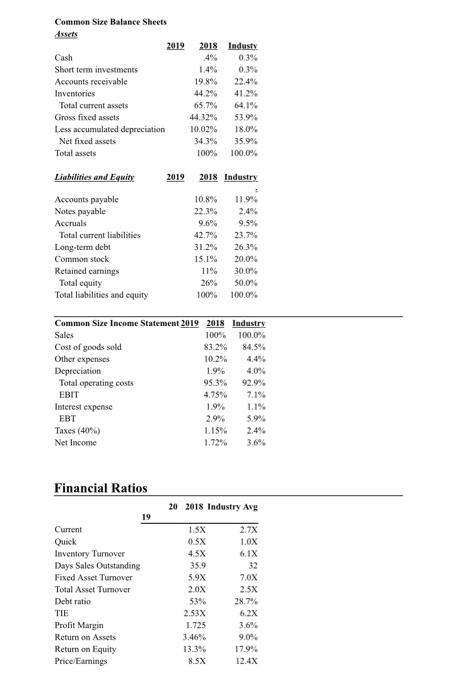

Finance 211 - Assignment #1 Submit your answers using the Assignment #1 Online link in Moodle 2. You are on the Board of Directors reviewing the performance of WestCoast Ski and Boards Inc. Analyze the following financial data of WestCoast for the 2019 and 2018 years to answer the following questions. Balance Sheets 2019 Cach Short-termine Ache 13.400 S 10:38 30,000 41.000 501006 1.31952 1.348.40 2,000.29 1050 400 Go todas Less stated deprecate Net find assets Total 2019 298.400 0.00 80.000 13629 Accounts payable Notes pas le Accra Tamilnes | Long.de Cock(0,000 Reted coming Totally Tulisan LIR 700 370.000 460.000 400.000 304443 5316 Income Statements 2019 2013 Sales 70.000 56.126.400 Cost of poodid 580,100 50.000 Depreciation IND 115400 Tocal operating co26,900_3.235.400 ERIT 191.000 Intereste 115.000 EBT 355.900 Tine 149 204 Net income 5213 5 5 106 10 Dividendspot $20.000 10.000 Other Data 2019 2015 Socke WACC Come Se Balance Sheets 2019 2018 Indus Industy 0.3% 0.3% Common Size Balance Sheets Assets 2019 Cash Short term investments Accounts receivable Inventories Total current assets Gross fixed assets Less accumulated depreciation Net fixed assets Total assets 2018 4% 1.4% 19.8% 44.2% 65.79 44.32% 10.02% 34.3% 100% 53.9% 18.0% 35.9% 100.0% Liabilities and Equity 2019 2018 Industry 11.9% Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock Retained earnings Total equity Total liabilities and equity 10.89 22.3% 9.6% 42.7% 31.2% 15.1% 11% 26% 100% 9.5% 23.7% 26.3% 20.0% 30.0% 50.0% 100.0% Common Size Income Statement 2019 2018 Industry Sales 100% 100.0% Cost of goods sold 83.2% 84.5% Other expenses 10.2% Depreciation 1.9% 4.0% Total operating costs 95.3% 92.9% EBIT 4.75% 7.1% Interest expense 1.9% 1.1% EBT 2.9% 5.9% Taxes (40%) 1.15% 2.4% Net Income 1.72% 3.6% Financial Ratios 20 2018 Industry Avg 2.7X LOX 6. IX 19 Current Quick Inventory Turnover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover Debt ratio TIE Profit Margin Return on Assets Return on Equity Price Earnings 1.5X 0.5X 45X 35.9 5.9X 2.OX 53% 2.53X 1.725 3.46% 13.3% 8.SX 7,0X 2.5X 28.7% 6.2X 3.6% 9.09 17.9% 12.4X e. Calculate the P/E Ratio. What can you conclude about what investors think about the company when compared to Industry? 7. Perform a common size analysis on the Balance Sheet for