Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can some help me with this please. I am unable to bapance and i want to see where i go wrong The following are the

Can some help me with this please. I am unable to bapance and i want to see where i go wrong

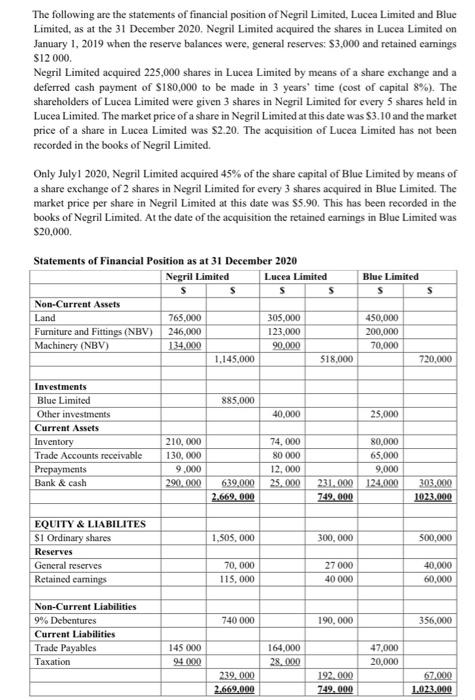

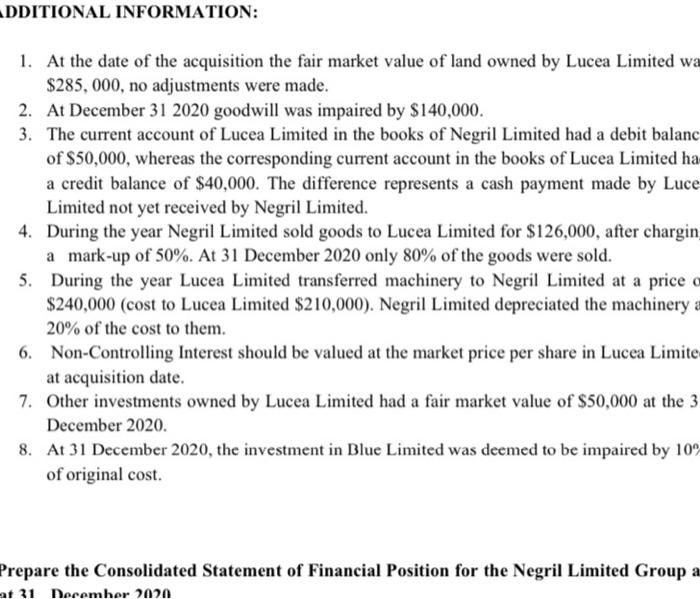

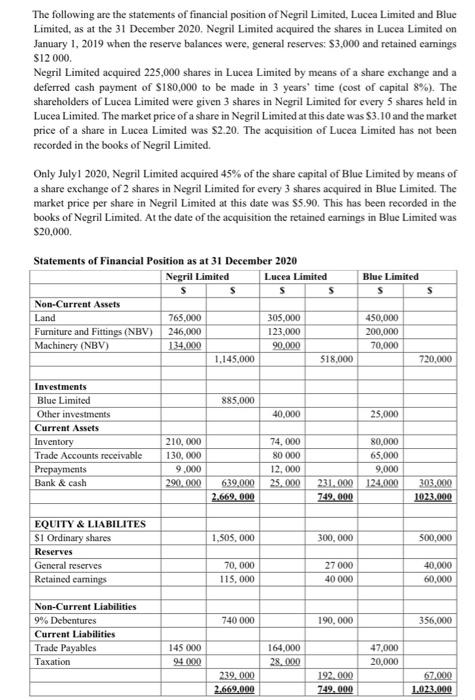

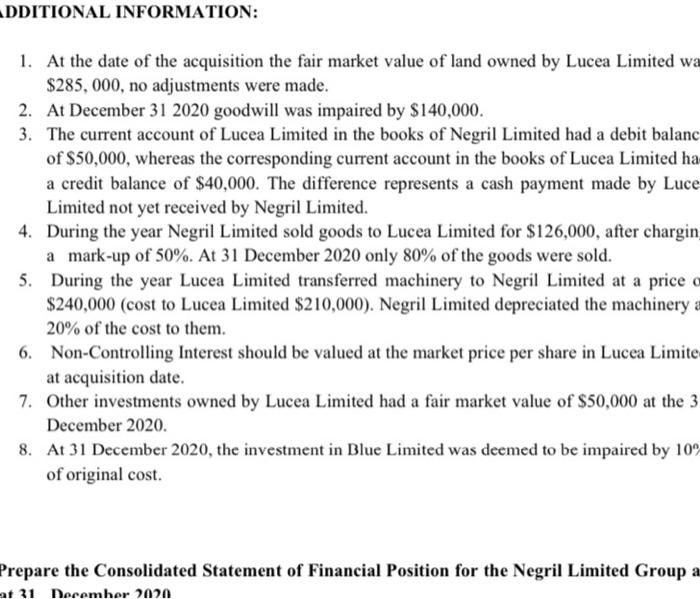

The following are the statements of financial position of Negril Limited, Lucea Limited and Blue Limited, as at the 31 December 2020. Negril Limited acquired the shares in Lucea Limited on January 1, 2019 when the reserve balances were, general reserves: $3,000 and retained earnings $12000. Negril Limited acquired 225,000 shares in Lucea Limited by means of a share exchange and a deferred cash payment of $180,000 to be made in 3 years' time (cost of capital 8% ). The shareholders of Lucea Limited were given 3 shares in Negril Limited for every 5 shares held in Lucea Limited. The market price of a share in Negril Limited at this date was $3.10 and the market price of a share in Lucea Limited was \$2.20. The acquisition of Lucea Limited has not been recorded in the books of Negril Limited. Only July1 2020, Negril Limited acquired 45% of the share capital of Blue Limited by means of a share exchange of 2 shares in Negril Limited for every 3 shares acquired in Blue Limited. The market price per share in Negril Limited at this date was \$5.90. This has been recorded in the books of Negril Limited. At the date of the acquisition the retained earnings in Blue Limited was $20,000. Statements of Financial Position as at 31 December 2020 1. At the date of the acquisition the fair market value of land owned by Lucea Limited wa $285,000, no adjustments were made. 2. At December 312020 goodwill was impaired by $140,000. 3. The current account of Lucea Limited in the books of Negril Limited had a debit balanc of $50,000, whereas the corresponding current account in the books of Lucea Limited ha a credit balance of $40,000. The difference represents a cash payment made by Luce Limited not yet received by Negril Limited. 4. During the year Negril Limited sold goods to Lucea Limited for $126,000, after chargin a mark-up of 50%. At 31 December 2020 only 80% of the goods were sold. 5. During the year Lucea Limited transferred machinery to Negril Limited at a price $240,000 (cost to Lucea Limited \$210,000). Negril Limited depreciated the machinery 20% of the cost to them. 6. Non-Controlling Interest should be valued at the market price per share in Lucea Limite at acquisition date. 7. Other investments owned by Lucea Limited had a fair market value of $50,000 at the 3 December 2020. 8. At 31 December 2020, the investment in Blue Limited was deemed to be impaired by 10, of original cost. repare the Consolidated Statement of Financial Position for the Negril Limited Group a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started