Answered step by step

Verified Expert Solution

Question

1 Approved Answer

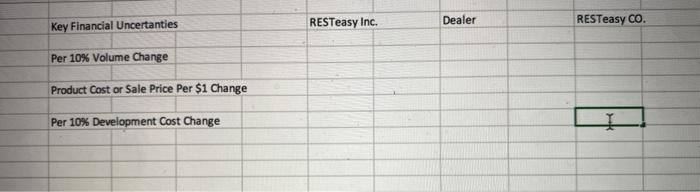

can some one please help me do a Sensitivity Analysis i re did the photo 5 16 Financial Model Assumptions Manufacturing Assumptions The pillow will

can some one please help me do a Sensitivity Analysis

i re did the photo

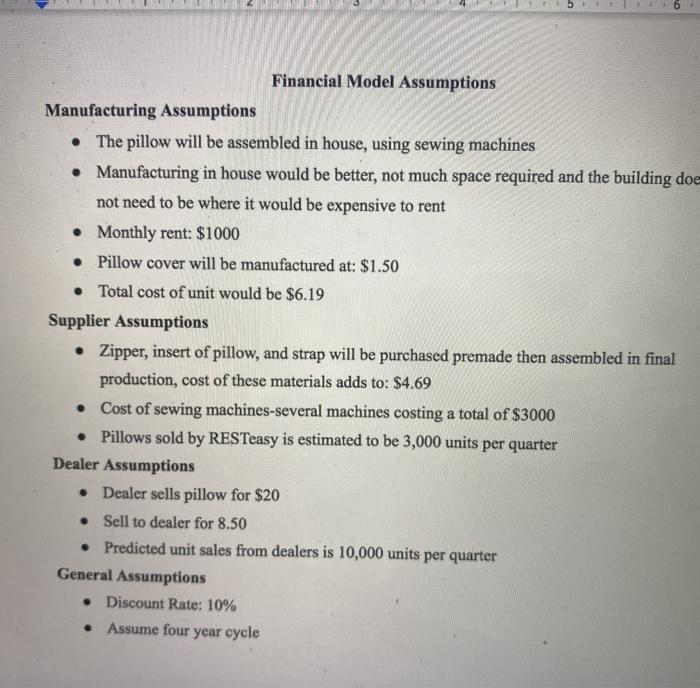

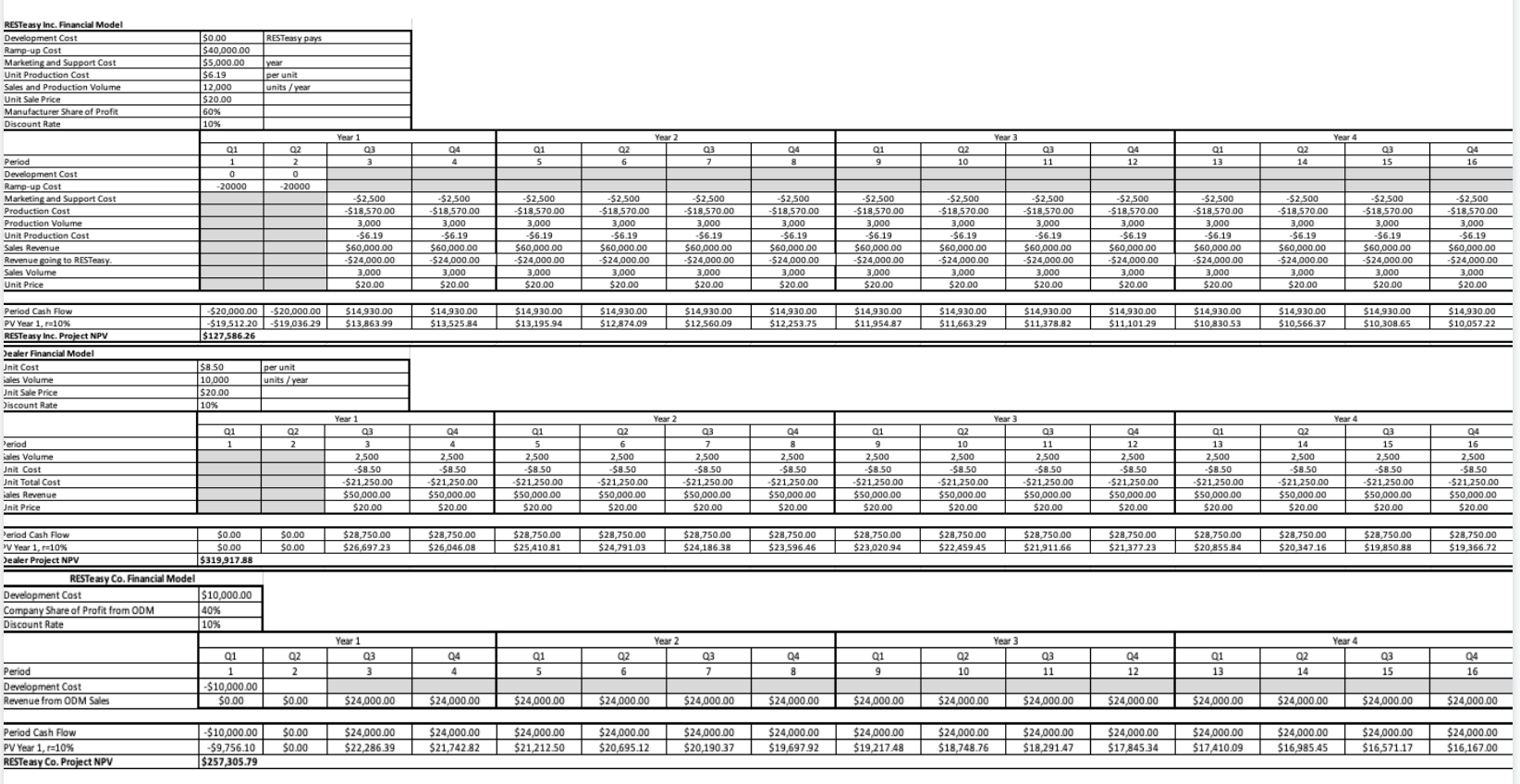

5 16 Financial Model Assumptions Manufacturing Assumptions The pillow will be assembled in house, using sewing machines Manufacturing in house would be better, not much space required and the building doe not need to be where it would be expensive to rent Monthly rent: $1000 Pillow cover will be manufactured at: $1.50 Total cost of unit would be $6.19 Supplier Assumptions Zipper, insert of pillow, and strap will be purchased premade then assembled in final production, cost of these materials adds to: $4.69 Cost of sewing machines-several machines costing a total of $3000 Pillows sold by RESTeasy is estimated to be 3,000 units per quarter Dealer Assumptions Dealer sells pillow for $20 Sell to dealer for 8.50 Predicted unit sales from dealers is 10,000 units per quarter General Assumptions Discount Rate: 10% Assume four year cycle RESTeasy pays RESTeasy Inc. Financial Model Development Cost Ramp-up Cost Marketing and Support Cost Unit Production Cost Sales and Production Volume Unit Sale Price Manufacturer Share of Profit Discount Rate $0.00 $40,000.00 $5,000.00 $6.19 12.000 $20.00 60% 10% year per unit units/year Year 2 Year 3 Year 4 Year 1 Q 3 04 01 Q1 5 02 6 03 7 04 8 02 10 03 11 04 12 01 13 02 14 Q3 15 04 16 01 1 0 -20000 02 2 0 -20000 Period Development Cost Ramp-up Cost Marketing and Support Cost Production Cost Production Volume Unit Production Cost Sales Revenue Revenue going to RESTeasy Sales Volume Unit Price -$2.500 $18,570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2,500 -$18.570.00 3.000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2,500 $18.570.00 3,000 $6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2,500 $18.570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2.500 $18.570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3.000 $20.00 -$2.500 $18.570.00 3.000 $6.19 $60,000.00 -$24,000.00 3.000 $20.00 -$2,500 $18.570.00 3,000 $6.19 $60,000.00 -$24,000.00 3.000 $20.00 -$2,500 $18 570.00 3,000 -$6.19 $60,000.00 $24,000.00 3,000 $20.00 -$2.500 -$18,570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3.000 $20.00 -$2.500 -$18,570,00 3.000 -$6.19 $60,000.00 $ -$24,000.00 3.000 $20.00 -$2,500 $18 570.00 3,000 $6.19 $60,000.00 -$24,000.00 3,000 $20.00 $2,500 $18,570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2.500 $18,570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2.500 $18.570.00 3.000 -$6.19 $60,000.00 -$24,000.00 3.000 $20.00 - $20,000.00-$20,000.00 $19,512.20 $19,036 29 $127,586.26 $14.930.00 $13.863.99 $14,930.00 $13,525.84 $14,930.00 $13,195.94 $14,930.00 $12.874.09 $14.930.00 $12.560.09 $14,930.00 $12.253.75 $14,930.00 $11.954.87 $14,930.00 $11,663 29 $14.930.00 $11 37882 $14,930.00 $11 101.29 $14,930.00 $10,830.53 $14,930.00 $10,566 37 $14.930.00 $10.308.65 $14,930.00 $10.057.22 Period Cash Flow PV Year 1 10% RESTeasy Inc. Project NPV Dealer Financial Model Jnit Cost sales Volume Jnit Sale Price Discount Rate $8.50 10.000 $20.00 10% per unit units/year Year 4 02 01 1 02 2 01 9 Period Sales Volume Jnit Cast Jnit Total Cost sales Revenue Unit Price Year 1 03 3 3 2.500 -$8.50 -$21 250.00 $50,000.00 04 4 2.500 -$8.50 -$21,250.00 $50,000.00 Q1 5 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 Year 2 Q3 7 2.500 -$8.50 -$21 250.00 $50,000.00 $20.00 8 2.500 -$8.50 -$21 250.00 $50,000.00 $20.00 2.500 $8.50 -$21,250.00 $50,000.00 $20.00 Year 3 02 03 10 11 2.500 2.500 $8.50 $8.50 -$21,250.00 $21,250.00 $50,000.00 $50,000.00 $20.00 $20.00 04 12 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 01 13 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 02 14 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 03 15 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 04 16 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 $20.00 $20.00 $0.00 $0.00 $28,750.00 $26,697.23 $28,750.00 $26,046.08 $28,750.00 $25,410.81 $28,750,00 $24,791.03 $28,750.00 $24,186.38 $28,750.00 $23.596.46 $28,750.00 $23,020.94 $28,750.00 $22.459.45 $28,750.00 $21.911.66 $28,750.00 $21377.23 $28,750.00 $20 855.84 $28,750.00 $20 347.16 $28,750.00 $19.850.88 $28,750.00 $19,366.72 Period Cash Flow $0.00 V Year 1,10% $0.00 Dealer Project NPV $319,917.88 RESTeasy Co. Financial Model Development Cost $10,000.00 Company Share of Profit from ODM 40% Discount Rate 10% Year 2 Year 3 Year 4 Year 1 03 3 02 2 04 Q1 5 02 6 03 7 04 8 Q1 9 Q2 10 03 11 04 12 Q1 13 02 14 03 15 04 16 Period Development Cost Revenue from ODM Sales 01 1 $10,000.00 $0.00 $0.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 Period Cash Flow PV Year 1, r=10% RESTeasy Co. Project NPV -$10,000.00 -$9,756.10 $257 305.79 $0.00 $0.00 $24,000.00 $22,286.39 $24,000.00 $ $21,742.82 $24,000.00 $21.212.50 $24,000.00 $20,695.12 $24,000.00 $20,190.37 $24,000.00 $19,697.92 $24,000.00 $19,217.48 $24,000.00 $18,748.76 $24,000.00 $18,291.47 $24,000.00 $17,845.34 $24,000.00 $17.410.09 $24,000.00 $16,985.45 $24,000.00 $16,571.17 $24,000.00 $16,167.00 Dealer Key Financial Uncertanties RESTeasy Inc. RESTeasy CO. Per 10% Volume Change Product Cost or Sale Price Per $1 Change Per 10% Development Cost Change I 5 16 Financial Model Assumptions Manufacturing Assumptions The pillow will be assembled in house, using sewing machines Manufacturing in house would be better, not much space required and the building doe not need to be where it would be expensive to rent Monthly rent: $1000 Pillow cover will be manufactured at: $1.50 Total cost of unit would be $6.19 Supplier Assumptions Zipper, insert of pillow, and strap will be purchased premade then assembled in final production, cost of these materials adds to: $4.69 Cost of sewing machines-several machines costing a total of $3000 Pillows sold by RESTeasy is estimated to be 3,000 units per quarter Dealer Assumptions Dealer sells pillow for $20 Sell to dealer for 8.50 Predicted unit sales from dealers is 10,000 units per quarter General Assumptions Discount Rate: 10% Assume four year cycle RESTeasy pays RESTeasy Inc. Financial Model Development Cost Ramp-up Cost Marketing and Support Cost Unit Production Cost Sales and Production Volume Unit Sale Price Manufacturer Share of Profit Discount Rate $0.00 $40,000.00 $5,000.00 $6.19 12.000 $20.00 60% 10% year per unit units/year Year 2 Year 3 Year 4 Year 1 Q 3 04 01 Q1 5 02 6 03 7 04 8 02 10 03 11 04 12 01 13 02 14 Q3 15 04 16 01 1 0 -20000 02 2 0 -20000 Period Development Cost Ramp-up Cost Marketing and Support Cost Production Cost Production Volume Unit Production Cost Sales Revenue Revenue going to RESTeasy Sales Volume Unit Price -$2.500 $18,570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2,500 -$18.570.00 3.000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2,500 $18.570.00 3,000 $6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2,500 $18.570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2.500 $18.570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3.000 $20.00 -$2.500 $18.570.00 3.000 $6.19 $60,000.00 -$24,000.00 3.000 $20.00 -$2,500 $18.570.00 3,000 $6.19 $60,000.00 -$24,000.00 3.000 $20.00 -$2,500 $18 570.00 3,000 -$6.19 $60,000.00 $24,000.00 3,000 $20.00 -$2.500 -$18,570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3.000 $20.00 -$2.500 -$18,570,00 3.000 -$6.19 $60,000.00 $ -$24,000.00 3.000 $20.00 -$2,500 $18 570.00 3,000 $6.19 $60,000.00 -$24,000.00 3,000 $20.00 $2,500 $18,570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2.500 $18,570.00 3,000 -$6.19 $60,000.00 -$24,000.00 3,000 $20.00 -$2.500 $18.570.00 3.000 -$6.19 $60,000.00 -$24,000.00 3.000 $20.00 - $20,000.00-$20,000.00 $19,512.20 $19,036 29 $127,586.26 $14.930.00 $13.863.99 $14,930.00 $13,525.84 $14,930.00 $13,195.94 $14,930.00 $12.874.09 $14.930.00 $12.560.09 $14,930.00 $12.253.75 $14,930.00 $11.954.87 $14,930.00 $11,663 29 $14.930.00 $11 37882 $14,930.00 $11 101.29 $14,930.00 $10,830.53 $14,930.00 $10,566 37 $14.930.00 $10.308.65 $14,930.00 $10.057.22 Period Cash Flow PV Year 1 10% RESTeasy Inc. Project NPV Dealer Financial Model Jnit Cost sales Volume Jnit Sale Price Discount Rate $8.50 10.000 $20.00 10% per unit units/year Year 4 02 01 1 02 2 01 9 Period Sales Volume Jnit Cast Jnit Total Cost sales Revenue Unit Price Year 1 03 3 3 2.500 -$8.50 -$21 250.00 $50,000.00 04 4 2.500 -$8.50 -$21,250.00 $50,000.00 Q1 5 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 Year 2 Q3 7 2.500 -$8.50 -$21 250.00 $50,000.00 $20.00 8 2.500 -$8.50 -$21 250.00 $50,000.00 $20.00 2.500 $8.50 -$21,250.00 $50,000.00 $20.00 Year 3 02 03 10 11 2.500 2.500 $8.50 $8.50 -$21,250.00 $21,250.00 $50,000.00 $50,000.00 $20.00 $20.00 04 12 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 01 13 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 02 14 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 03 15 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 04 16 2.500 -$8.50 -$21,250.00 $50,000.00 $20.00 $20.00 $20.00 $0.00 $0.00 $28,750.00 $26,697.23 $28,750.00 $26,046.08 $28,750.00 $25,410.81 $28,750,00 $24,791.03 $28,750.00 $24,186.38 $28,750.00 $23.596.46 $28,750.00 $23,020.94 $28,750.00 $22.459.45 $28,750.00 $21.911.66 $28,750.00 $21377.23 $28,750.00 $20 855.84 $28,750.00 $20 347.16 $28,750.00 $19.850.88 $28,750.00 $19,366.72 Period Cash Flow $0.00 V Year 1,10% $0.00 Dealer Project NPV $319,917.88 RESTeasy Co. Financial Model Development Cost $10,000.00 Company Share of Profit from ODM 40% Discount Rate 10% Year 2 Year 3 Year 4 Year 1 03 3 02 2 04 Q1 5 02 6 03 7 04 8 Q1 9 Q2 10 03 11 04 12 Q1 13 02 14 03 15 04 16 Period Development Cost Revenue from ODM Sales 01 1 $10,000.00 $0.00 $0.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 $24,000.00 Period Cash Flow PV Year 1, r=10% RESTeasy Co. Project NPV -$10,000.00 -$9,756.10 $257 305.79 $0.00 $0.00 $24,000.00 $22,286.39 $24,000.00 $ $21,742.82 $24,000.00 $21.212.50 $24,000.00 $20,695.12 $24,000.00 $20,190.37 $24,000.00 $19,697.92 $24,000.00 $19,217.48 $24,000.00 $18,748.76 $24,000.00 $18,291.47 $24,000.00 $17,845.34 $24,000.00 $17.410.09 $24,000.00 $16,985.45 $24,000.00 $16,571.17 $24,000.00 $16,167.00 Dealer Key Financial Uncertanties RESTeasy Inc. RESTeasy CO. Per 10% Volume Change Product Cost or Sale Price Per $1 Change Per 10% Development Cost ChangeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started