Answered step by step

Verified Expert Solution

Question

1 Approved Answer

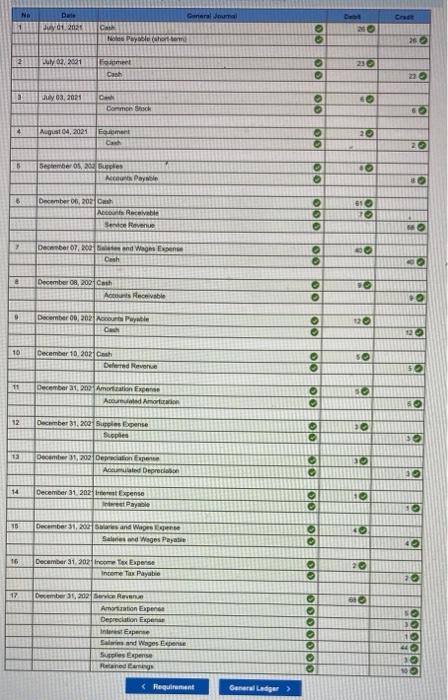

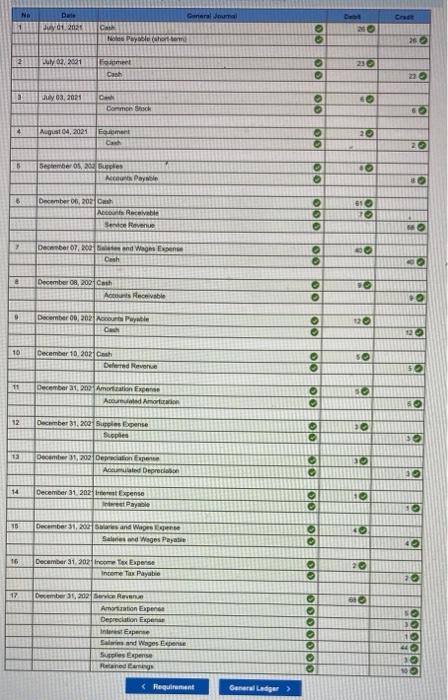

can some one point out what I did wrong? it has to be something obvious that i can not find General numa Cett NA Date

can some one point out what I did wrong? it has to be something obvious that i can not find

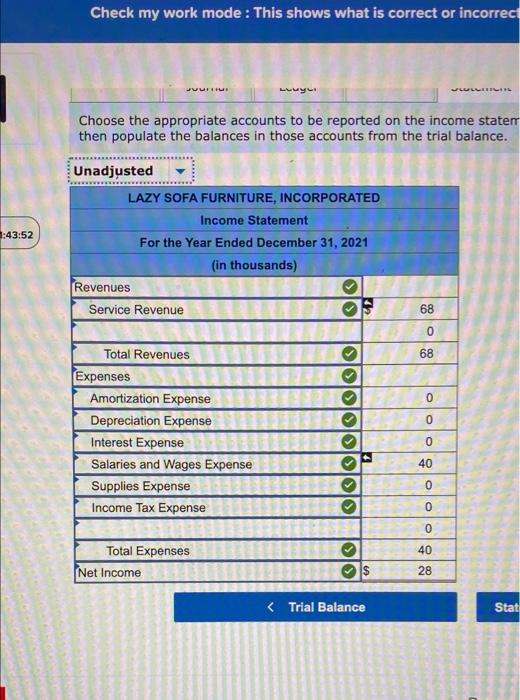

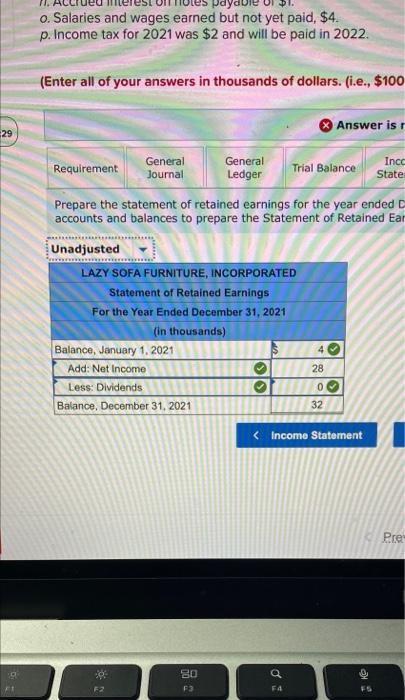

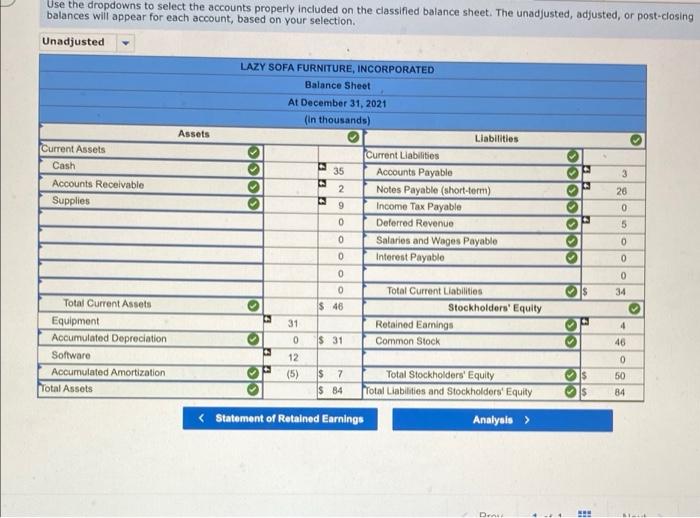

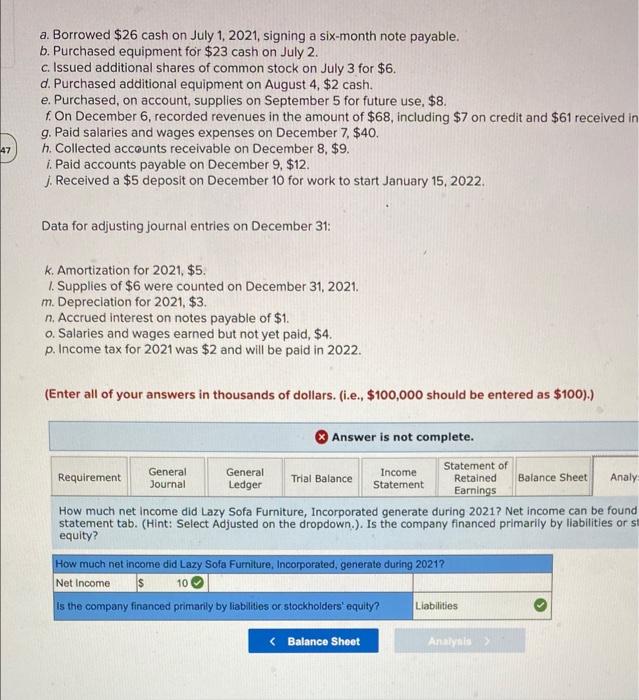

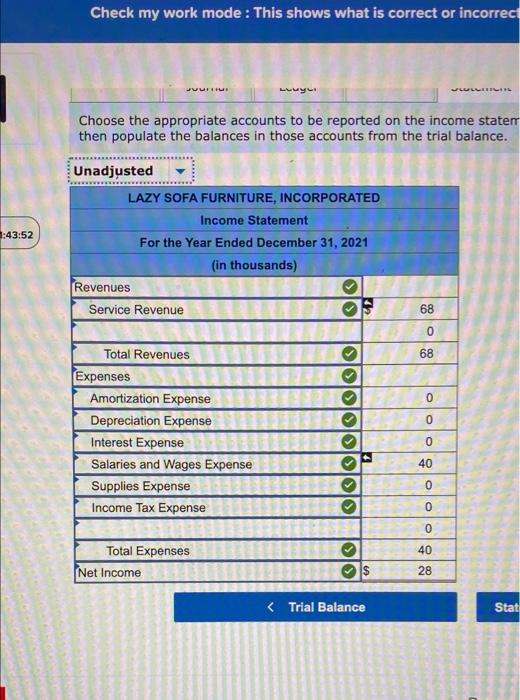

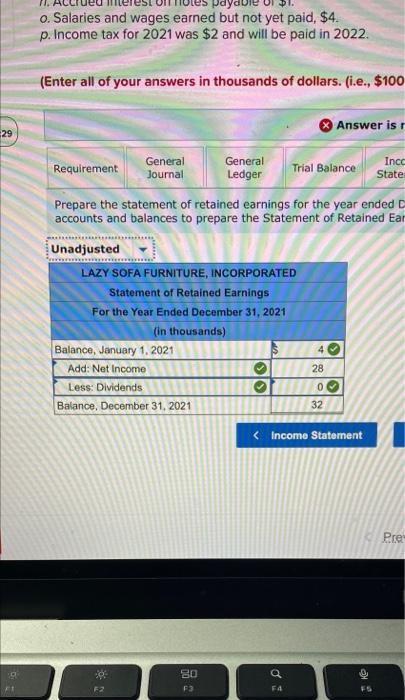

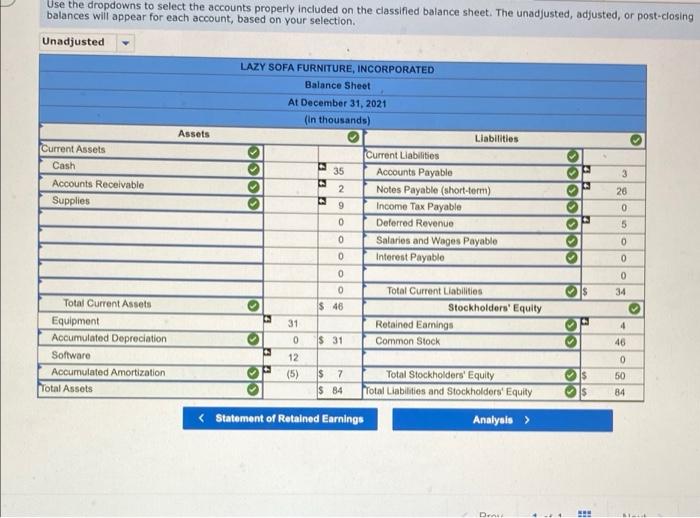

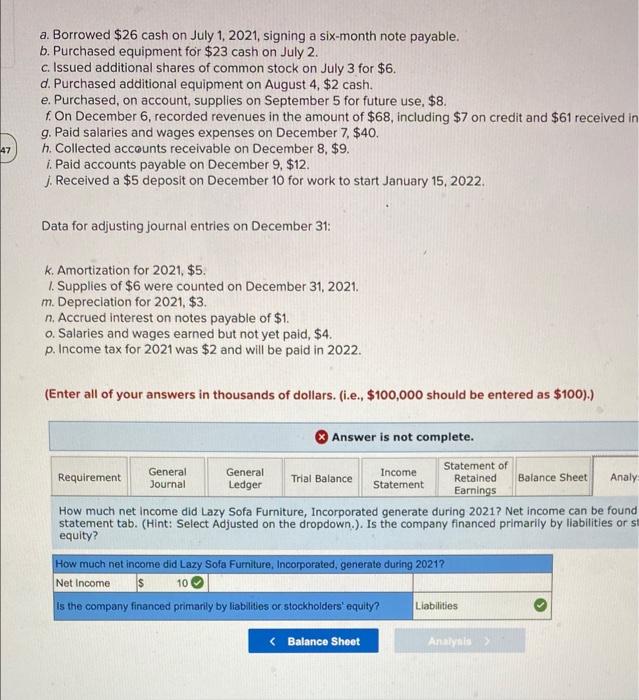

General numa Cett NA Date Hwy 1.2024 C Res Puyole here 25 2 Luly 09.2001 Foel Cash 3 July 03, 2021 Com SR 4 August 04, 2021 Foment Ch 20 20 5 September, 20 Supplies A Pays 00 00 00 00 00 00 00 00 ol 8 41 December 06, 207 As Receivable Service Revenue oo Dember 07, 200 and Wages En Cash December, 200 Cash A Recevable 10 O December 00.202A Pwylle 12 olo 12 10 December 10, 2021 Deed Rever olo 11 December 1, 20Amor Expense Acord Amor so Olo ol 12 December 31, 2004 Supplies pense Supplies ole o 13 December 31, 200 Depressione per Ad Depreciate 0 0.000 14 December 31, 202 Expense I Paya 10 15 December 31, 202 and Wages Sales and Wages Payable 40 16 December 31, 202roome Tex Expense Income Tax Payti 20 20 17 OOOO OOOOOOO 60 December 31, 200 Servieren Amortion pense Depreciation Expenda Interest Expense Salt Wages E. Supplies Expense Retened 10 BE OOOOOO Check my work mode : This shows what is correct or incorrec JVU LUVY LULLIBILI Choose the appropriate accounts to be reported on the income stater then populate the balances in those accounts from the trial balance. 3:43:52 Unadjusted LAZY SOFA FURNITURE, INCORPORATED Income Statement For the Year Ended December 31, 2021 (in thousands) Revenues Service Revenue >> 68 0 68 Total Revenues Expenses Amortization Expense Depreciation Expense Interest Expense Salaries and Wages Expense Supplies Expense Income Tax Expense OOOOOOOO 40 0 0 0 0 0 0 0 40 Total Expenses Net Income ol 28 De a. Borrowed $26 cash on July 1, 2021, signing a six-month note payable. b. Purchased equipment for $23 cash on July 2. c. Issued additional shares of common stock on July 3 for $6. d. Purchased additional equipment on August 4, $2 cash. e. Purchased, on account, supplies on September 5 for future use, $8. f. On December 6, recorded revenues in the amount of $68, including $7 on credit and $61 received in g. Paid salaries and wages expenses on December 7, $40. h. Collected accounts receivable on December 8, $9. 1. Paid accounts payable on December 9, $12. J. Received a $5 deposit on December 10 for work to start January 15, 2022. 47 Data for adjusting journal entries on December 31: k. Amortization for 2021. $5. 1. Supplies of $6 were counted on December 31, 2021. m. Depreciation for 2021, $3. n. Accrued interest on notes payable of $1. o. Salaries and wages earned but not yet paid, $4. p. Income tax for 2021 was $2 and will be paid in 2022. (Enter all of your answers in thousands of dollars. (i.e., $100,000 should be entered as $100).) Answer is not complete. General Requirement Statement of General Income Retained Trial Balance Balance Sheet Journal Analy Ledger Statement Earnings How much net Income did Lazy Sofa Furniture, Incorporated generate during 2021? Net income can be found statement tab. (Hint: Select Adjusted on the dropdown.). Is the company financed primarily by liabilities or s equity? How much net income did Lazy Sofa Furniture, Incorporated, generate during 2021? Net Income 10 is the company financed primarily by liabilities or stockholders' equity? Liabilities Check my work mode : This shows what is correct or incorrec JVU LUVY LULLIBILI Choose the appropriate accounts to be reported on the income stater then populate the balances in those accounts from the trial balance. 3:43:52 Unadjusted LAZY SOFA FURNITURE, INCORPORATED Income Statement For the Year Ended December 31, 2021 (in thousands) Revenues Service Revenue >> 68 0 68 Total Revenues Expenses Amortization Expense Depreciation Expense Interest Expense Salaries and Wages Expense Supplies Expense Income Tax Expense OOOOOOOO 40 0 0 0 0 0 0 0 40 Total Expenses Net Income ol 28 De a. Borrowed $26 cash on July 1, 2021, signing a six-month note payable. b. Purchased equipment for $23 cash on July 2. c. Issued additional shares of common stock on July 3 for $6. d. Purchased additional equipment on August 4, $2 cash. e. Purchased, on account, supplies on September 5 for future use, $8. f. On December 6, recorded revenues in the amount of $68, including $7 on credit and $61 received in g. Paid salaries and wages expenses on December 7, $40. h. Collected accounts receivable on December 8, $9. 1. Paid accounts payable on December 9, $12. J. Received a $5 deposit on December 10 for work to start January 15, 2022. 47 Data for adjusting journal entries on December 31: k. Amortization for 2021. $5. 1. Supplies of $6 were counted on December 31, 2021. m. Depreciation for 2021, $3. n. Accrued interest on notes payable of $1. o. Salaries and wages earned but not yet paid, $4. p. Income tax for 2021 was $2 and will be paid in 2022. (Enter all of your answers in thousands of dollars. (i.e., $100,000 should be entered as $100).) Answer is not complete. General Requirement Statement of General Income Retained Trial Balance Balance Sheet Journal Analy Ledger Statement Earnings How much net Income did Lazy Sofa Furniture, Incorporated generate during 2021? Net income can be found statement tab. (Hint: Select Adjusted on the dropdown.). Is the company financed primarily by liabilities or s equity? How much net income did Lazy Sofa Furniture, Incorporated, generate during 2021? Net Income 10 is the company financed primarily by liabilities or stockholders' equity? Liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started