Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can some show me step by step how to reach the answer for the question please and thank you. tions Asking Price on Retail Center

can some show me step by step how to reach the answer for the question please and thank you.

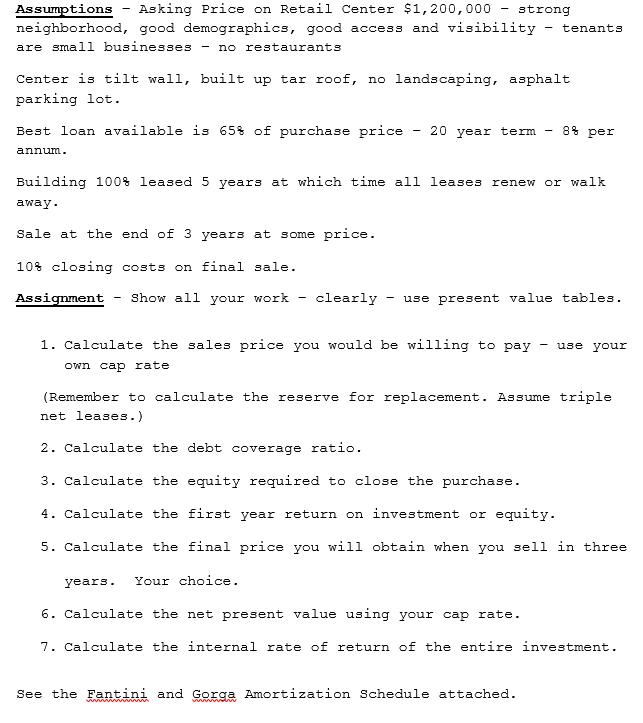

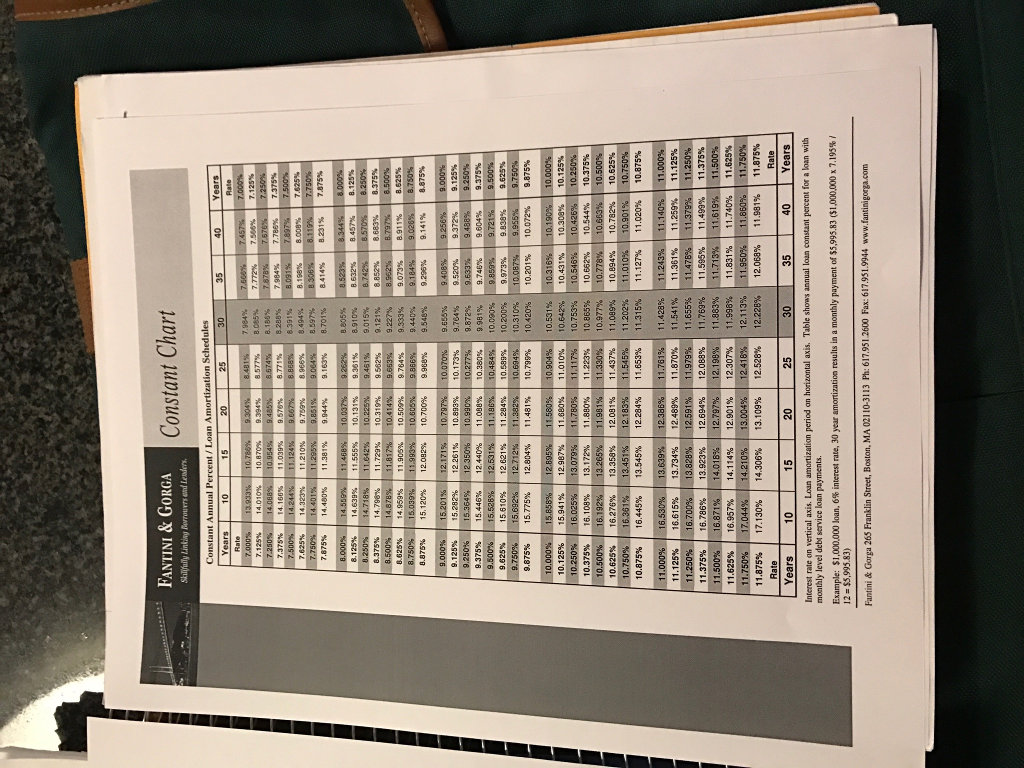

tions Asking Price on Retail Center $1,200,000 strong Ass neighborhood. good demographics, good access and visibility tenants are small businesses no restaurants Center is tilt wall, built up tar roof, no landscaping, asphalt parking lot Best loan available is 65% of purchase price 20 year term 85 per Building 100% leased 5 years at which time all leases renew or walk Way sale at the end of 3 years at some price. 10% closing costs on final sale. Assignment Show all your work clearly use present value tables. 1. Calculate the sales price you would be willing to pay use your own cap rate (Remember to calculate the reserve for replacement. Assume triple net leases.) 2 Calculate the debt coverage ratio. 3. Calculate the equity required to close the purchase 4. Calculate the first year return on investment or equity. 5. Calculate the final price you will obtain when you sell in three years. Your choice. 6. calculate the net present value using your cap rate. 7. Calculate the internal rate of return of the entire investment. See the Fantini and Gorga Amortization Schedule attachedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started