Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can somebody double check my work. Thanks. On January 1, 2020, Tamarisk Inc. sold 14% bonds having a maturity value of $810,000 for $868,400, which

Can somebody double check my work. Thanks.

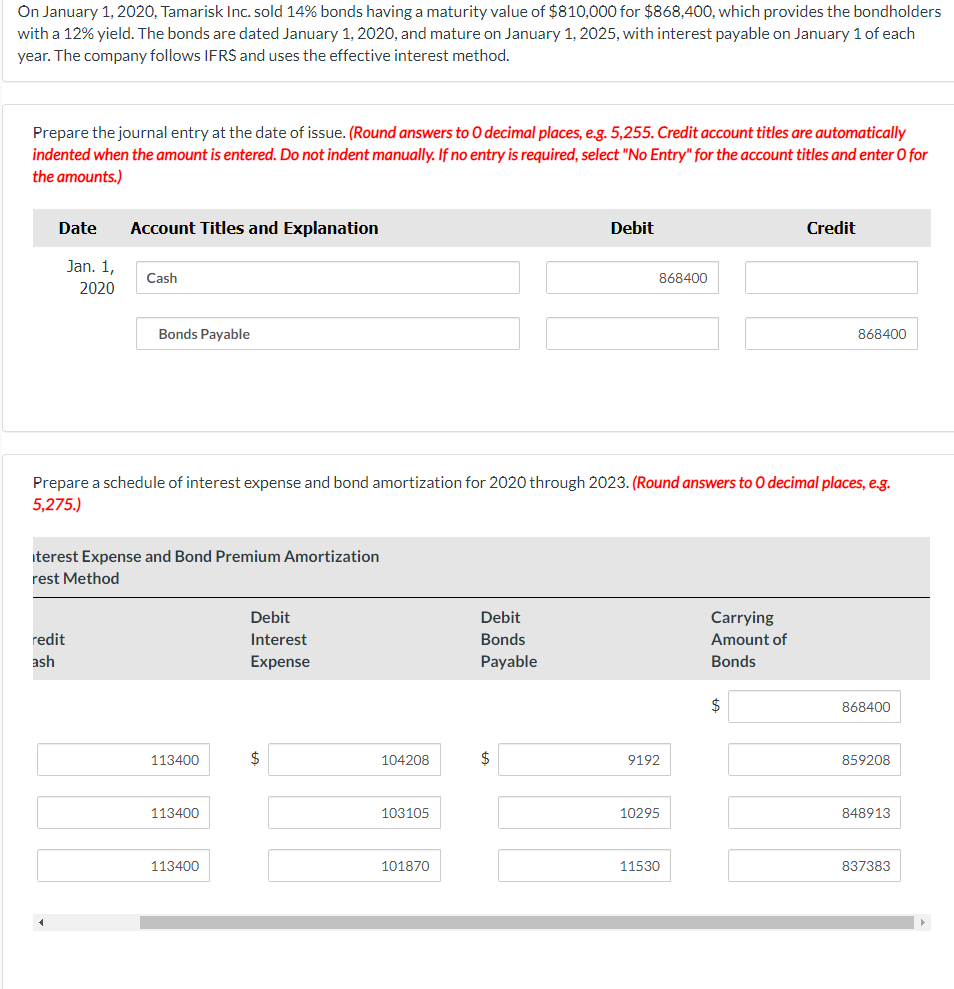

On January 1, 2020, Tamarisk Inc. sold 14% bonds having a maturity value of $810,000 for $868,400, which provides the bondholders with a 12% yield. The bonds are dated January 1, 2020, and mature on January 1, 2025, with interest payable on January 1 of each year. The company follows IFRS and uses the effective interest method. Prepare the journal entry at the date of issue. (Round answers to O decimal places, e.g. 5,255. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Jan. 1, 2020 Account Titles and Explanation redit ash Cash Bonds Payable iterest Expense and Bond Premium Amortization rest Method 113400 Prepare a schedule of interest expense and bond amortization for 2020 through 2023. (Round answers to O decimal places, e.g. 5,275.) 113400 113400 Debit Interest Expense $ 104208 103105 101870 Debit Bonds Payable Debit $ 868400 9192 10295 11530 Carrying Amount of Bonds Credit $ 868400 868400 859208 848913 837383Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started