can somebody help me with 37,38 and (most needed) 40 please???

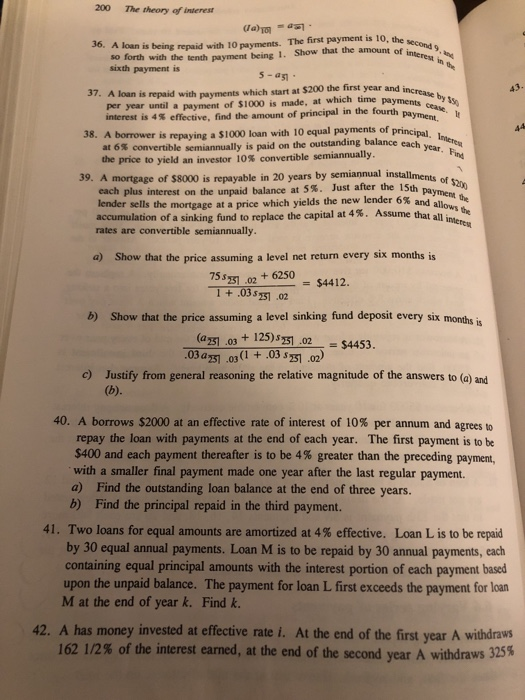

200 The theory of interest 36. A loan is being repaid with 10 payments. The first payment is 10, the second 9, d so forth with the tenth payment being 1. Show that the amount of interest in te sixth payment is 5- ag- 37. A loan is repaid with payments which start at $200 the first year and increase by $0 per year until a payment of $1000 is made, at which time payments cease. interest is 4% effective, find the amount of principal in the fourth payment. 38. A borrower is repaying a S1000 loan with 10 equal payments of principal. Ineren at 6% convertible semiannually is paid on the outstanding balance each year. Find the price to yield an investor 10% convertible semiannually. 39. A mortgage of $8000 is repayable in 20 years by semiannual installments of $200 cach plus interest on the unpaid balance at 5%. Just after the 15th payment te lender sells the mortgage at a price which yields the new lender 6% and allows the 43. 44 accumulation of a sinking fund to replace the capital at 4%. Assume that all int rates are convertible semiannually. a) Show that the price assuming a level net return every six months is 75s .02 + 6250 $4412. %3D T+.03s5.02 b) Show that the price assuming a level sinking fund deposit every six monthe i + 125)s5 .02 .03 az .03 (1 + .03 s 51.02) c) Justify from general reasoning the relative magnitude of the answers to (@) and (a. .03 = $4453. (b). 40. A borrows $2000 at an effective rate of interest of 10% per annum and agrees to repay the loan with payments at the end of each year. The first payment is to be $400 and each payment thereafter is to be 4% greater than the preceding payment, with a smaller final payment made one year after the last regular payment. a) Find the outstanding loan balance at the end of three years. b) Find the principal repaid in the third payment. 41. Two loans for equal amounts are amortized at 4% effective. Loan L is to be repaid by 30 equal annual payments. Loan M is to be repaid by 30 annual payments, each containing equal principal amounts with the interest portion of each payment based upon the unpaid balance. The payment for loan L first exceeds the payment for loan M at the end of year k. Find k. 42. A has money invested at effective rate i. At the end of the first year A withdraws 162 1/2% of the interest earned, at the end of the second year A withdraws 325%