Can somebody help me with this. I will post the lessons below, so you can take a look at it.

TASK: compute for the monthly value-added tax that the company will pay to the government with the given data: Total Vatable Sales (VAT exclusive) = P300,000 Total purchases with VAT receipts (VAT exclusive) = P270,000

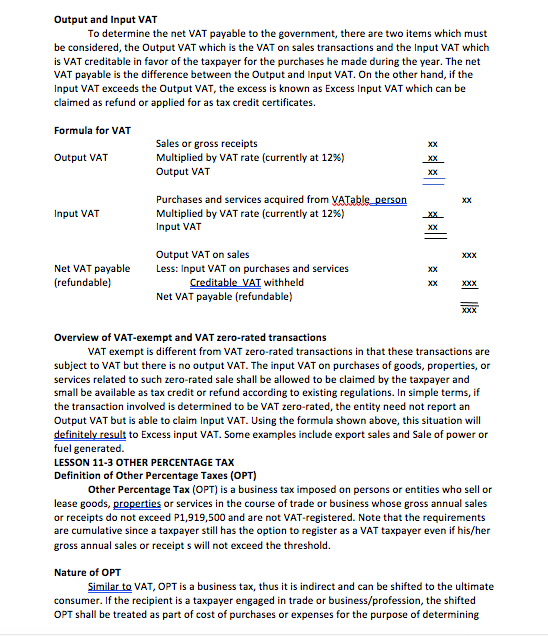

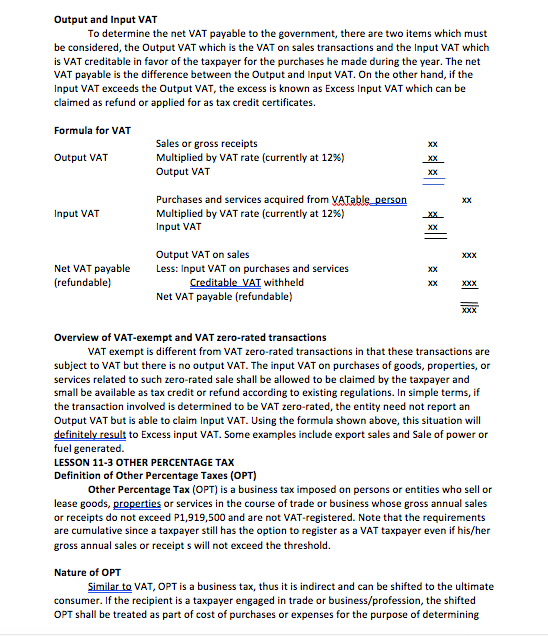

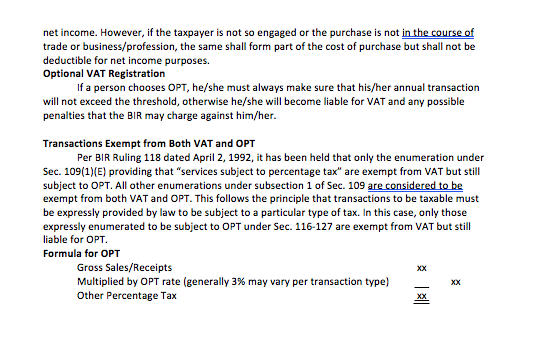

LESSON 11-1 GENERAL PRINCIPLES OF BUSINESS TAXATION Business Taxes are Privilege Taxes A privilege tax is a tax laid upon the privilege of engaging in business or pursing an occupation, calling, or profession. A privilege tax is not a tax on the person or property but on the privilege to engage in the transaction which is considered an activity conducted in the ordinary course of business. General Distinction of Value Added Tax and Other Percentage Taxes Business transactions being subject to a privilege tax, what remains is to determine the type of tax an individual is subject to. The law has provided for two possible business taxes in the sale, barter, exchange, or lease of goods, properties, and services in the Philippines and includes importation." As indirect taxes, business taxes can be shifted to the ultimate consumer or end buyer. Value Added Tax (VAT) and Other Percentage Taxes (OPT) are two examples of business taxes. A taxpayer normally engaged in business has the option of deciding whether or not to register to be a VAT taxpayer or an OPT taxpayer. The main distinction between these two taxes is that VAT is 12% whereas OPT is generally 3% but the rates for the latter may differ according to specific type of transactions. However, to even have the option to be registered under OPT, the NIRC as amended, requires that the aggregate amount of actual gross sales and receipts for the taxable year does not exceed The threshold of P1,919,500 and that the taxpayer is registered as non-VAT. There are other situations when a taxpayer is actually required to be registered under OPT. These are when the taxpayer is expressly determined to be subject to OPT such as domestic carriers like jeepneys or buses and international carriers among others. LESSON 11-2 VALUE-ADDED TAX Value-Added Tax (VAT) is a consumption tax "levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services. It is based on the gross selling price or value of the property sold, bartered, or exchanged or gross receipts derived from the sale or exchange of services. Nature of VAT 1. VAT is privilege tax. It is imposed by law directly not on the thing or service but on the act of the sale seller even if the burden of the tax will eventually be passed on to the ultimate consumer. 2. Ad valorem - It is based on the gross selling price or gross value in money of the goods or properties, or gross receipts derived from services. 3. Indirect tax - It can be shifted or passed on to the ultimate consumer who shoulders the burden; however, the seller may also choose to absorb the burden and not pass it on. Once the VAT is passed on to the consumer, it is no longer a tax but is treated as an additional cost. Output and Input VAT To determine the net VAT payable to the government, there are two items which must be considered, the Output VAT which is the VAT on sales transactions and the Input VAT which is VAT creditable in favor of the taxpayer for the purchases he made during the year. The net VAT payable is the difference between the Output and Input VAT. On the other hand, if the Input VAT exceeds the Output VAT, the excess is known as Excess Input VAT which can be claimed as refund or applied for as tax credit certificates. Formula for VAT XX Output VAT Sales or gross receipts Multiplied by VAT rate (currently at 12%) Output VAT Purchases and services acquired from VATable person Multiplied by VAT rate (currently at 12%) Input VAT Input VAT XX XXX XX Net VAT payable (refundable) Output VAT on sales Less: Input VAT on purchases and services Creditable VAT withheld Net VAT payable (refundable) XX XXX XXX Overview of VAT-exempt and VAT zero-rated transactions VAT exempt is different from VAT zero-rated transactions in that these transactions are subject to VAT but there is no output VAT. The input VAT on purchases of goods, properties, or services related to such zero-rated sale shall be allowed to be claimed by the taxpayer and small be available as tax credit or refund according to existing regulations. In simple terms, if the transaction involved is determined to be VAT zero-rated, the entity need not report an Output VAT but is able to claim Input VAT. Using the formula shown above, this situation will definitely result to Excess input VAT. Some examples include export sales and Sale of power or fuel generated. LESSON 11-3 OTHER PERCENTAGE TAX Definition of Other Percentage Taxes (OPT) Other Percentage Tax (OPT) is a business tax imposed on persons or entities who sell or lease goods, properties or services in the course of trade or business whose gross annual sales or receipts do not exceed P1,919,500 and are not VAT-registered. Note that the requirements are cumulative since a taxpayer still has the option to register as a VAT taxpayer even if his/her gross annual sales or receipts will not exceed the threshold. Nature of OPT Similar to VAT, OPT is a business tax, thus it is indirect and can be shifted to the ultimate consumer. If the recipient is a taxpayer engaged in trade or business/profession, the shifted OPT shall be treated as part of cost of purchases or expenses for the purpose of determining net income. However, if the taxpayer is not so engaged or the purchase is not in the course of trade or business/profession, the same shall form part of the cost of purchase but shall not be deductible for net income purposes. Optional VAT Registration If a person chooses OPT, he/she must always make sure that his/her annual transaction will not exceed the threshold, otherwise he/she will become liable for VAT and any possible penalties that the BIR may charge against him/her. Transactions Exempt from Both VAT and OPT Per BIR Ruling 118 dated April 2, 1992, it has been held that only the enumeration under Sec. 109(1)(E) providing that "services subject to percentage tax" are exempt from VAT but still subject to OPT. All other enumerations under subsection 1 of Sec. 109 are considered to be exempt from both VAT and OPT. This follows the principle that transactions to be taxable must be expressly provided by law to be subject to a particular type of tax. In this case, only those expressly enumerated to be subject to OPT under Sec. 116-127 are exempt from VAT but still liable for OPT. Formula for OPT Gross Sales/Receipts Multiplied by OPT rate (generally 3% may vary per transaction type) Other Percentage Tax XX LESSON 11-1 GENERAL PRINCIPLES OF BUSINESS TAXATION Business Taxes are Privilege Taxes A privilege tax is a tax laid upon the privilege of engaging in business or pursing an occupation, calling, or profession. A privilege tax is not a tax on the person or property but on the privilege to engage in the transaction which is considered an activity conducted in the ordinary course of business. General Distinction of Value Added Tax and Other Percentage Taxes Business transactions being subject to a privilege tax, what remains is to determine the type of tax an individual is subject to. The law has provided for two possible business taxes in the sale, barter, exchange, or lease of goods, properties, and services in the Philippines and includes importation." As indirect taxes, business taxes can be shifted to the ultimate consumer or end buyer. Value Added Tax (VAT) and Other Percentage Taxes (OPT) are two examples of business taxes. A taxpayer normally engaged in business has the option of deciding whether or not to register to be a VAT taxpayer or an OPT taxpayer. The main distinction between these two taxes is that VAT is 12% whereas OPT is generally 3% but the rates for the latter may differ according to specific type of transactions. However, to even have the option to be registered under OPT, the NIRC as amended, requires that the aggregate amount of actual gross sales and receipts for the taxable year does not exceed The threshold of P1,919,500 and that the taxpayer is registered as non-VAT. There are other situations when a taxpayer is actually required to be registered under OPT. These are when the taxpayer is expressly determined to be subject to OPT such as domestic carriers like jeepneys or buses and international carriers among others. LESSON 11-2 VALUE-ADDED TAX Value-Added Tax (VAT) is a consumption tax "levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services. It is based on the gross selling price or value of the property sold, bartered, or exchanged or gross receipts derived from the sale or exchange of services. Nature of VAT 1. VAT is privilege tax. It is imposed by law directly not on the thing or service but on the act of the sale seller even if the burden of the tax will eventually be passed on to the ultimate consumer. 2. Ad valorem - It is based on the gross selling price or gross value in money of the goods or properties, or gross receipts derived from services. 3. Indirect tax - It can be shifted or passed on to the ultimate consumer who shoulders the burden; however, the seller may also choose to absorb the burden and not pass it on. Once the VAT is passed on to the consumer, it is no longer a tax but is treated as an additional cost. Output and Input VAT To determine the net VAT payable to the government, there are two items which must be considered, the Output VAT which is the VAT on sales transactions and the Input VAT which is VAT creditable in favor of the taxpayer for the purchases he made during the year. The net VAT payable is the difference between the Output and Input VAT. On the other hand, if the Input VAT exceeds the Output VAT, the excess is known as Excess Input VAT which can be claimed as refund or applied for as tax credit certificates. Formula for VAT XX Output VAT Sales or gross receipts Multiplied by VAT rate (currently at 12%) Output VAT Purchases and services acquired from VATable person Multiplied by VAT rate (currently at 12%) Input VAT Input VAT XX XXX XX Net VAT payable (refundable) Output VAT on sales Less: Input VAT on purchases and services Creditable VAT withheld Net VAT payable (refundable) XX XXX XXX Overview of VAT-exempt and VAT zero-rated transactions VAT exempt is different from VAT zero-rated transactions in that these transactions are subject to VAT but there is no output VAT. The input VAT on purchases of goods, properties, or services related to such zero-rated sale shall be allowed to be claimed by the taxpayer and small be available as tax credit or refund according to existing regulations. In simple terms, if the transaction involved is determined to be VAT zero-rated, the entity need not report an Output VAT but is able to claim Input VAT. Using the formula shown above, this situation will definitely result to Excess input VAT. Some examples include export sales and Sale of power or fuel generated. LESSON 11-3 OTHER PERCENTAGE TAX Definition of Other Percentage Taxes (OPT) Other Percentage Tax (OPT) is a business tax imposed on persons or entities who sell or lease goods, properties or services in the course of trade or business whose gross annual sales or receipts do not exceed P1,919,500 and are not VAT-registered. Note that the requirements are cumulative since a taxpayer still has the option to register as a VAT taxpayer even if his/her gross annual sales or receipts will not exceed the threshold. Nature of OPT Similar to VAT, OPT is a business tax, thus it is indirect and can be shifted to the ultimate consumer. If the recipient is a taxpayer engaged in trade or business/profession, the shifted OPT shall be treated as part of cost of purchases or expenses for the purpose of determining net income. However, if the taxpayer is not so engaged or the purchase is not in the course of trade or business/profession, the same shall form part of the cost of purchase but shall not be deductible for net income purposes. Optional VAT Registration If a person chooses OPT, he/she must always make sure that his/her annual transaction will not exceed the threshold, otherwise he/she will become liable for VAT and any possible penalties that the BIR may charge against him/her. Transactions Exempt from Both VAT and OPT Per BIR Ruling 118 dated April 2, 1992, it has been held that only the enumeration under Sec. 109(1)(E) providing that "services subject to percentage tax" are exempt from VAT but still subject to OPT. All other enumerations under subsection 1 of Sec. 109 are considered to be exempt from both VAT and OPT. This follows the principle that transactions to be taxable must be expressly provided by law to be subject to a particular type of tax. In this case, only those expressly enumerated to be subject to OPT under Sec. 116-127 are exempt from VAT but still liable for OPT. Formula for OPT Gross Sales/Receipts Multiplied by OPT rate (generally 3% may vary per transaction type) Other Percentage Tax XX