Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can somebody help with this ASAP #4) (30 Marks) Your client Zebra Inc. has come to you and asked for your assistance. They have provided

can somebody help with this ASAP

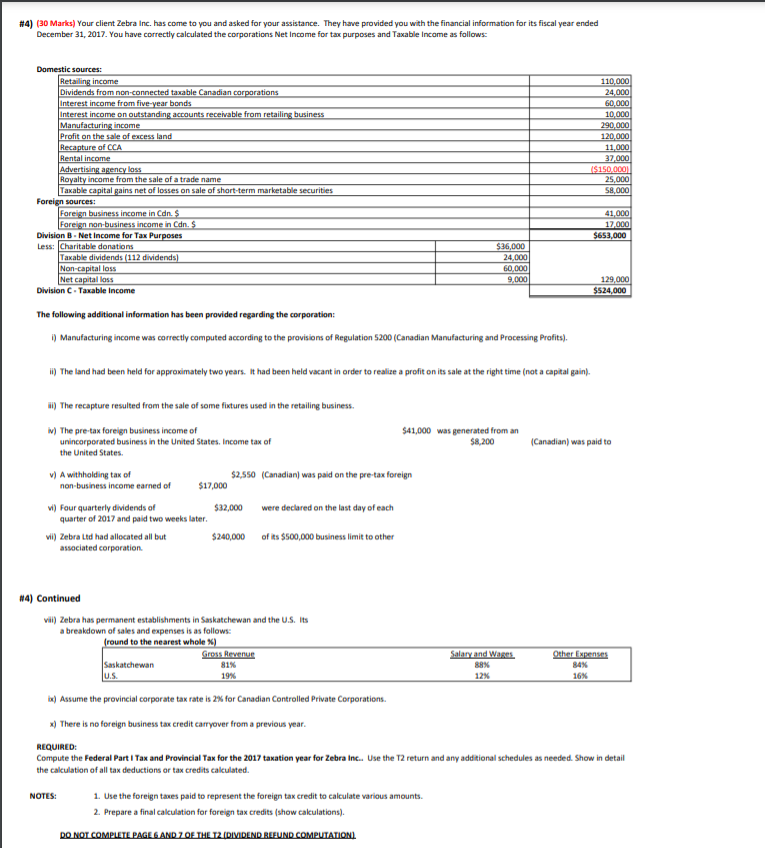

#4) (30 Marks) Your client Zebra Inc. has come to you and asked for your assistance. They have provided you with the financial information for its fiscal year ended December 31, 2017. You have correctly calculated the corporations Net Income for tax purposes and Taxable income as follows: Domestic sources: Retailing income Dividends from non-connected taxable Canadian corporations Interest income from five-year bonds Interest income on outstanding accounts receivable from retailing business Manufacturing income Profit on the sale of excess land Recapture of CCA Rental income Advertising agency loss Royalty income from the sale of a trade name Taxable capital gains net of losses on sale of short-term marketable securities Foreign sources: Foreign business income in Can. $ Foreign non-business income in Cdn. $ Division B. Net Income for Tax Purposes Less: Charitable donations Taxable dividends (112 dividends) Non-capital loss Net capital loss Division - Taxable income 110,000 24.000 60,000 10,000 290.000 120.000 11,000 37.000 $150.000 25,000 58,000 41,000 12.000 $653,000 $36,000 24,000 60,000 9,000 129,000 $524,000 The following additional information has been provided regarding the corporation: ) Manufacturing income was correctly computed according to the provisions of Regulation 5200 (Canadian Manufacturing and Processing Profits). ) The land had been held for approximately two years. It had been held vacant in order to realize a profit on its sale at the right time (not a capital gain). (Canadian) was paid to H) The recapture resulted from the sale of some fixtures used in the retailing business. 1) The pre-tax foreign business income of $41,000 was generated from an unincorporated business in the United States. Income tax of $8.200 the United States. v) A withholding tax of $2,550 (Canadian) was paid on the pre-tax foreign non-business income earned of $17,000 vi) Four quarterly dividends of $32,000 were declared on the last day of each quarter of 2017 and paid two weeks later vil) Zebra Ltd had allocated all but $240,000 of its $500,000 business limit to other associated corporation #4) Continued vil) Zebra has permanent establishments in Saskatchewan and the U.S. Its a breakdown of sales and expenses is as follows: (round to the nearest whole %) Gross Revenue Salary and Wages. Other.penses Saskatchewan 81% 88% 84% U.S. 19% 12% 16% ne) Assume the provincial corporate tax rate is 2% for Canadian Controlled Private Corporations. x) There is no foreign business tax credit carryover from a previous year. REQUIRED: Compute the Federal Part I Tax and Provincial Tax for the 2017 taxation year for Zebra Ine.. Use the 12 return and any additional schedules as needed. Show in detail the calculation of all tax deductions or tax credits calculated. NOTES: 1. Use the foreign taxes paid to represent the foreign tax credit to calculate various amounts. 2. Prepare a final calculation for foreign tax credits (show cakulations). DO NOT COMPLETE PAGE AND ZOE THE T2 (DIVIDEND REFUND COMPUTATION). #4) (30 Marks) Your client Zebra Inc. has come to you and asked for your assistance. They have provided you with the financial information for its fiscal year ended December 31, 2017. You have correctly calculated the corporations Net Income for tax purposes and Taxable income as follows: Domestic sources: Retailing income Dividends from non-connected taxable Canadian corporations Interest income from five-year bonds Interest income on outstanding accounts receivable from retailing business Manufacturing income Profit on the sale of excess land Recapture of CCA Rental income Advertising agency loss Royalty income from the sale of a trade name Taxable capital gains net of losses on sale of short-term marketable securities Foreign sources: Foreign business income in Can. $ Foreign non-business income in Cdn. $ Division B. Net Income for Tax Purposes Less: Charitable donations Taxable dividends (112 dividends) Non-capital loss Net capital loss Division - Taxable income 110,000 24.000 60,000 10,000 290.000 120.000 11,000 37.000 $150.000 25,000 58,000 41,000 12.000 $653,000 $36,000 24,000 60,000 9,000 129,000 $524,000 The following additional information has been provided regarding the corporation: ) Manufacturing income was correctly computed according to the provisions of Regulation 5200 (Canadian Manufacturing and Processing Profits). ) The land had been held for approximately two years. It had been held vacant in order to realize a profit on its sale at the right time (not a capital gain). (Canadian) was paid to H) The recapture resulted from the sale of some fixtures used in the retailing business. 1) The pre-tax foreign business income of $41,000 was generated from an unincorporated business in the United States. Income tax of $8.200 the United States. v) A withholding tax of $2,550 (Canadian) was paid on the pre-tax foreign non-business income earned of $17,000 vi) Four quarterly dividends of $32,000 were declared on the last day of each quarter of 2017 and paid two weeks later vil) Zebra Ltd had allocated all but $240,000 of its $500,000 business limit to other associated corporation #4) Continued vil) Zebra has permanent establishments in Saskatchewan and the U.S. Its a breakdown of sales and expenses is as follows: (round to the nearest whole %) Gross Revenue Salary and Wages. Other.penses Saskatchewan 81% 88% 84% U.S. 19% 12% 16% ne) Assume the provincial corporate tax rate is 2% for Canadian Controlled Private Corporations. x) There is no foreign business tax credit carryover from a previous year. REQUIRED: Compute the Federal Part I Tax and Provincial Tax for the 2017 taxation year for Zebra Ine.. Use the 12 return and any additional schedules as needed. Show in detail the calculation of all tax deductions or tax credits calculated. NOTES: 1. Use the foreign taxes paid to represent the foreign tax credit to calculate various amounts. 2. Prepare a final calculation for foreign tax credits (show cakulations). DO NOT COMPLETE PAGE AND ZOE THE T2 (DIVIDEND REFUND COMPUTATION)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started