CAN SOMEBODY PLEASE ACTULLY AWNSER ALL 10 QUESTIONS!!

i need them by tonight

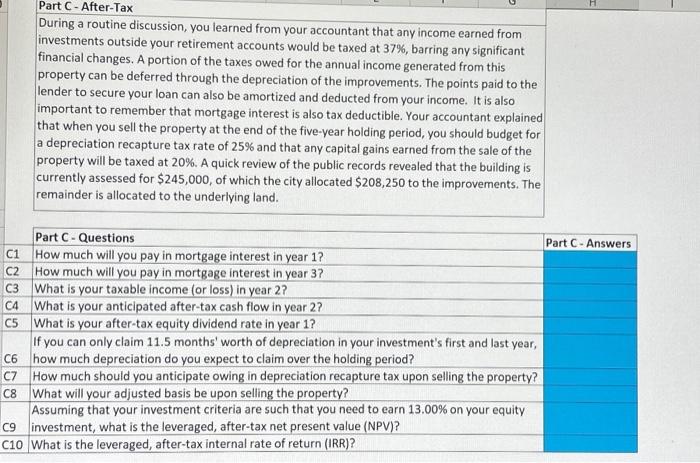

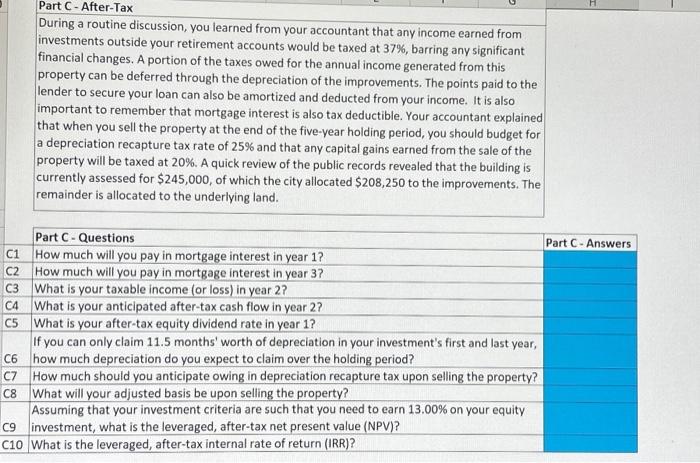

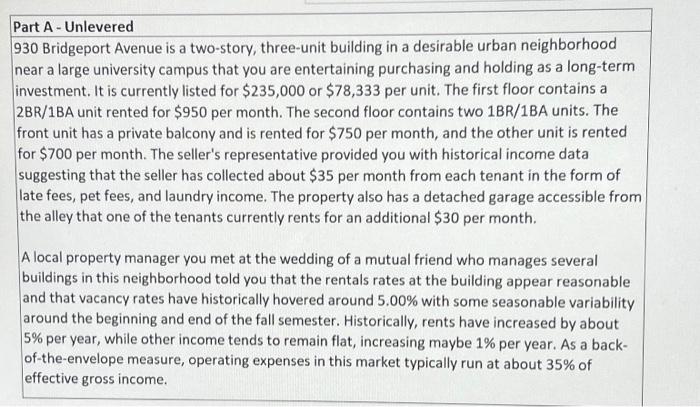

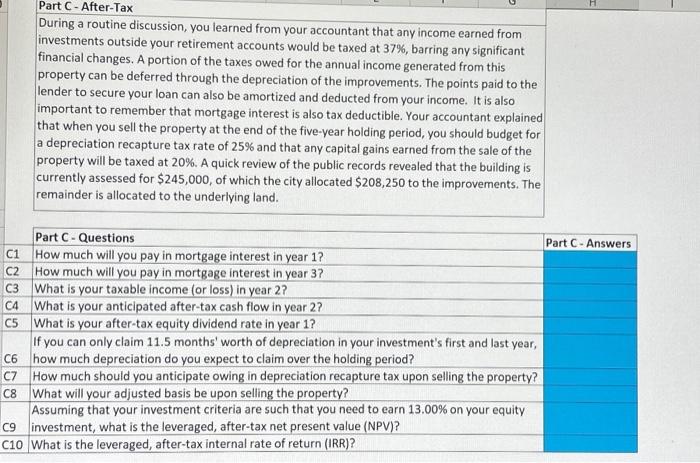

During a routine discussion, you learned from your accountant that any income earned from investments outside your retirement accounts would be taxed at 37%, barring any significant financial changes. A portion of the taxes owed for the annual income generated from this property can be deferred through the depreciation of the improvements. The points paid to the lender to secure your loan can also be amortized and deducted from your income. It is also important to remember that mortgage interest is also tax deductible. Your accountant explained that when you sell the property at the end of the five-year holding period, you should budget for a depreciation recapture tax rate of 25% and that any capital gains earned from the sale of the property will be taxed at 20%. A quick review of the public records revealed that the building is currently assessed for $245,000, of which the city allocated $208,250 to the improvements. The remainder is allocated to the underlying land. 930 Bridgeport Avenue is a two-story, three-unit building in a desirable urban neighborhood near a large university campus that you are entertaining purchasing and holding as a long-term investment. It is currently listed for $235,000 or $78,333 per unit. The first floor contains a 2BR/1BA unit rented for $950 per month. The second floor contains two 18R/1BA units. The front unit has a private balcony and is rented for $750 per month, and the other unit is rented for $700 per month. The seller's representative provided you with historical income data suggesting that the seller has collected about $35 per month from each tenant in the form of late fees, pet fees, and laundry income. The property also has a detached garage accessible from the alley that one of the tenants currently rents for an additional $30 per month. A local property manager you met at the wedding of a mutual friend who manages several buildings in this neighborhood told you that the rentals rates at the building appear reasonable and that vacancy rates have historically hovered around 5.00% with some seasonable variability around the beginning and end of the fall semester. Historically, rents have increased by about 5% per year, while other income tends to remain flat, increasing maybe 1% per year. As a backof-the-envelope measure, operating expenses in this market typically run at about 35% of effective gross income