Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can somebody please explain step by step why method to calculate the money market hedge is different between the 2 answers. How are these calculated?

Can somebody please explain step by step why method to calculate the money market hedge is different between the 2 answers.

How are these calculated?

And why are they different.

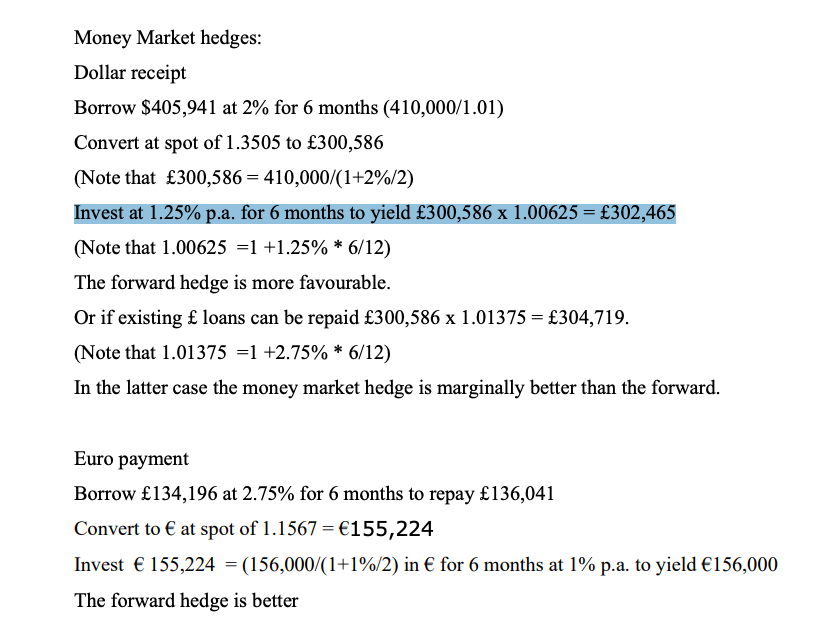

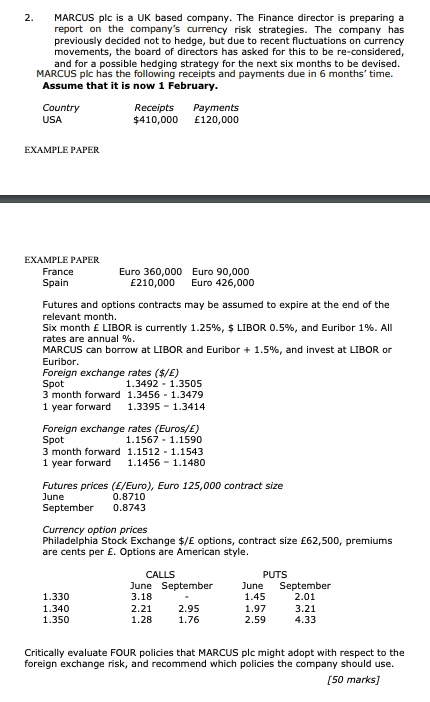

Money Market hedges: Dollar receipt Borrow $405,941 at 2% for 6 months (410,000/1.01) Convert at spot of 1.3505 to 300,586 (Note that 300,586 = 410,000/(1+2%/2) Invest at 1.25% p.a. for 6 months to yield 300,586 x 1.00625 = 302,465 (Note that 1.00625 =1 +1.25% * 6/12) The forward hedge is more favourable. Or if existing loans can be repaid 300,586 x 1.01375 = 304,719. (Note that 1.01375 =1 +2.75% * 6/12) In the latter case the money market hedge is marginally better than the forward. Euro payment Borrow 134,196 at 2.75% for 6 months to repay 136,041 Convert to at spot of 1.1567 = 155,224 Invest 155,224 = (156,000/(1+1%/2) in for 6 months at 1% p.a. to yield 156,000 The forward hedge is better 2. MARCUS plc is a UK based company. The Finance director is preparing a report on the company's currency risk strategies. The company has previously decided not to hedge, but due to recent fluctuations on currency movements, the board of directors has asked for this to be re-considered, and for a possible hedging strategy for the next six months to be devised. MARCUS plc has the following receipts and payments due in 6 months' time. Assume that it is now 1 February. Country Receipts Payments USA $410,000 120,000 EXAMPLE PAPER EXAMPLE PAPER France Spain Euro 360,000 Euro 90,000 210,000 Euro 426,000 Futures and options contracts may be assumed to expire at the end of the relevant month. Six month LIBOR is currently 1.25%, $ LIBOR 0.5%, and Euribor 1%. All rates are annual %. MARCUS can borrow at LIBOR and Euribor + 1.5%, and invest at LIBOR or Euribor. Foreign exchange rates (S/E) Spot 1.3492 - 1.3505 3 month forward 1.3456 - 1.3479 1 year forward 1.3395 - 1.3414 Foreign exchange rates (Euros/E) Spot 1.1567 - 1.1590 3 month forward 1.1512 - 1.1543 1 year forward 1.1456 - 1.1480 Futures prices (E/Euro), Euro 125,000 contract size June 0.8710 September 0.8743 Currency option prices Philadelphia Stock Exchange $/E options, contract size 62,500, premiums are cents per . Options are American style. CALLS PUTS June September June September 1.330 3.18 1.45 2.01 1.340 2.21 2.95 1.97 3.21 1.350 1.28 1.76 2.59 4.33 Critically evaluate FOUR policies that MARCUS plc might adopt with respect to the foreign exchange risk, and recommend which policies the company should use. [50 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started