Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can somebody please help me out with question! I will thumbs up your answer if I believe it's correct! 2. (25 pts) Below is the

Can somebody please help me out with question! I will thumbs up your answer if I believe it's correct!

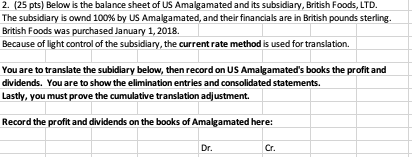

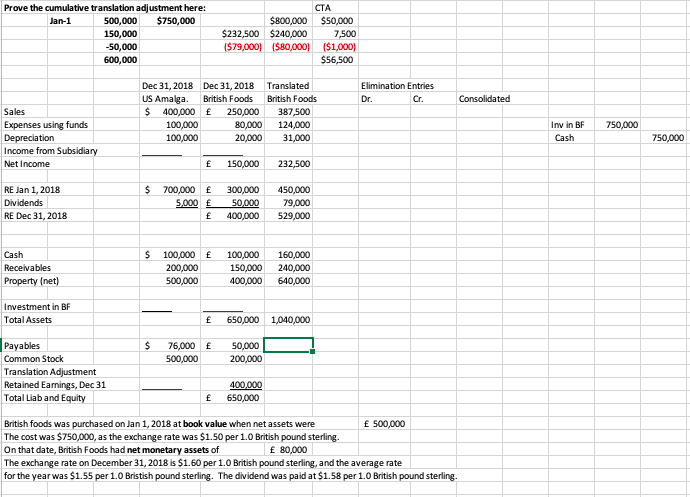

2. (25 pts) Below is the balance sheet of US Amalgamated and its subsidiary, British Foods, LTD. The subsidiary is ownd 100% by US Amalgamated, and their financials are in British pounds sterling. British Foods was purchased January 1, 2018. Because of light control of the subsidiary, the current rate method is used for translation You are to translate the subidiary below, then record on US Amalgamated's books the profit and dividends. You are to show the elimination entries and consolidated statements. Lastly, you must prove the cumulative translation adjustment Record the profit and dividends on the books of Amalgamated here: Dr. Cr. $50,000 Prove the cumulative translation adjustment here: Jan-1 500,000 $750,000 150,000 -50,000 600,000 $800,000 $232,500 $240,000 ($79,000) ($80,000) 7,500 ($1,000) $56,500 Elimination Entries Dr. Cr. Consolidated Dec 31, 2018 Dec 31, 2018 Translated US Amalga. British Foods British Foods $ 400,000 250,000 387,500 100,000 80,000 124,000 100,000 20,000 31,000 Sales Expenses using funds Depreciation Income from Subsidiary Net Income Invin BF Cash 750,000 750,000 E 150,000 232,500 RE Jan 1, 2018 Dividends RE Dec 31, 2018 $ 700,000 5,000 300,000 50,000 400,000 450,000 79,000 529,000 $ Cash Receivables Property (net) 100,000 200,000 500,000 100,000 150,000 400,000 160,000 240,000 640,000 Investment in BF Total Assets 650,000 1,040,000 $ 76,000 500,000 50,000 200,000 1 Payables Common Stock Translation Adjustment Retained Earnings, Dec 31 Total Liab and Equity 400,000 650,000 British foods was purchased on Jan 1, 2018 at book value when net assets were 500,000 The cost was $750,000, as the exchange rate was $1.50 per 1.0 British pound sterling. On that date, British Foods had net monetary assets of 80,000 The exchange rate on December 31, 2018 is $1.60 per 1.0 British pound sterling, and the average rate for the year was $1.55 per 1.0 Bristish pound sterling. The dividend was paid at $1.58 per 1.0 British pound sterling. 2. (25 pts) Below is the balance sheet of US Amalgamated and its subsidiary, British Foods, LTD. The subsidiary is ownd 100% by US Amalgamated, and their financials are in British pounds sterling. British Foods was purchased January 1, 2018. Because of light control of the subsidiary, the current rate method is used for translation You are to translate the subidiary below, then record on US Amalgamated's books the profit and dividends. You are to show the elimination entries and consolidated statements. Lastly, you must prove the cumulative translation adjustment Record the profit and dividends on the books of Amalgamated here: Dr. Cr. $50,000 Prove the cumulative translation adjustment here: Jan-1 500,000 $750,000 150,000 -50,000 600,000 $800,000 $232,500 $240,000 ($79,000) ($80,000) 7,500 ($1,000) $56,500 Elimination Entries Dr. Cr. Consolidated Dec 31, 2018 Dec 31, 2018 Translated US Amalga. British Foods British Foods $ 400,000 250,000 387,500 100,000 80,000 124,000 100,000 20,000 31,000 Sales Expenses using funds Depreciation Income from Subsidiary Net Income Invin BF Cash 750,000 750,000 E 150,000 232,500 RE Jan 1, 2018 Dividends RE Dec 31, 2018 $ 700,000 5,000 300,000 50,000 400,000 450,000 79,000 529,000 $ Cash Receivables Property (net) 100,000 200,000 500,000 100,000 150,000 400,000 160,000 240,000 640,000 Investment in BF Total Assets 650,000 1,040,000 $ 76,000 500,000 50,000 200,000 1 Payables Common Stock Translation Adjustment Retained Earnings, Dec 31 Total Liab and Equity 400,000 650,000 British foods was purchased on Jan 1, 2018 at book value when net assets were 500,000 The cost was $750,000, as the exchange rate was $1.50 per 1.0 British pound sterling. On that date, British Foods had net monetary assets of 80,000 The exchange rate on December 31, 2018 is $1.60 per 1.0 British pound sterling, and the average rate for the year was $1.55 per 1.0 Bristish pound sterling. The dividend was paid at $1.58 per 1.0 British pound sterlingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started