Can someone analyze the partial balance sheet SOS!!!

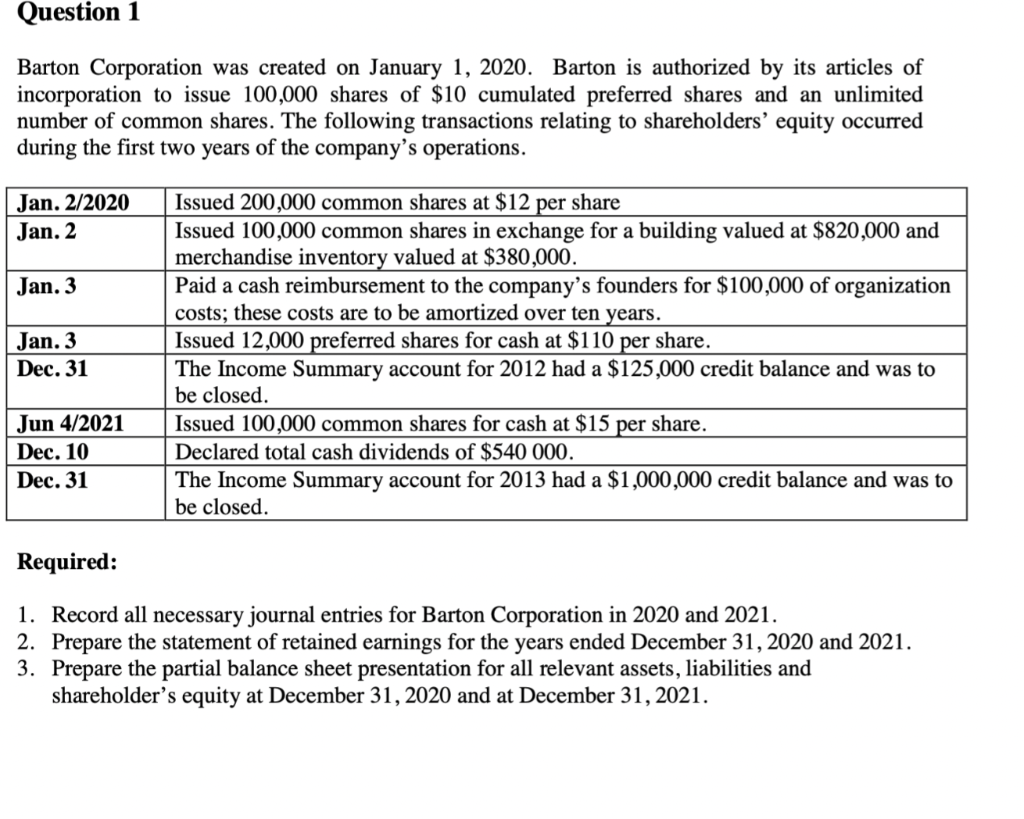

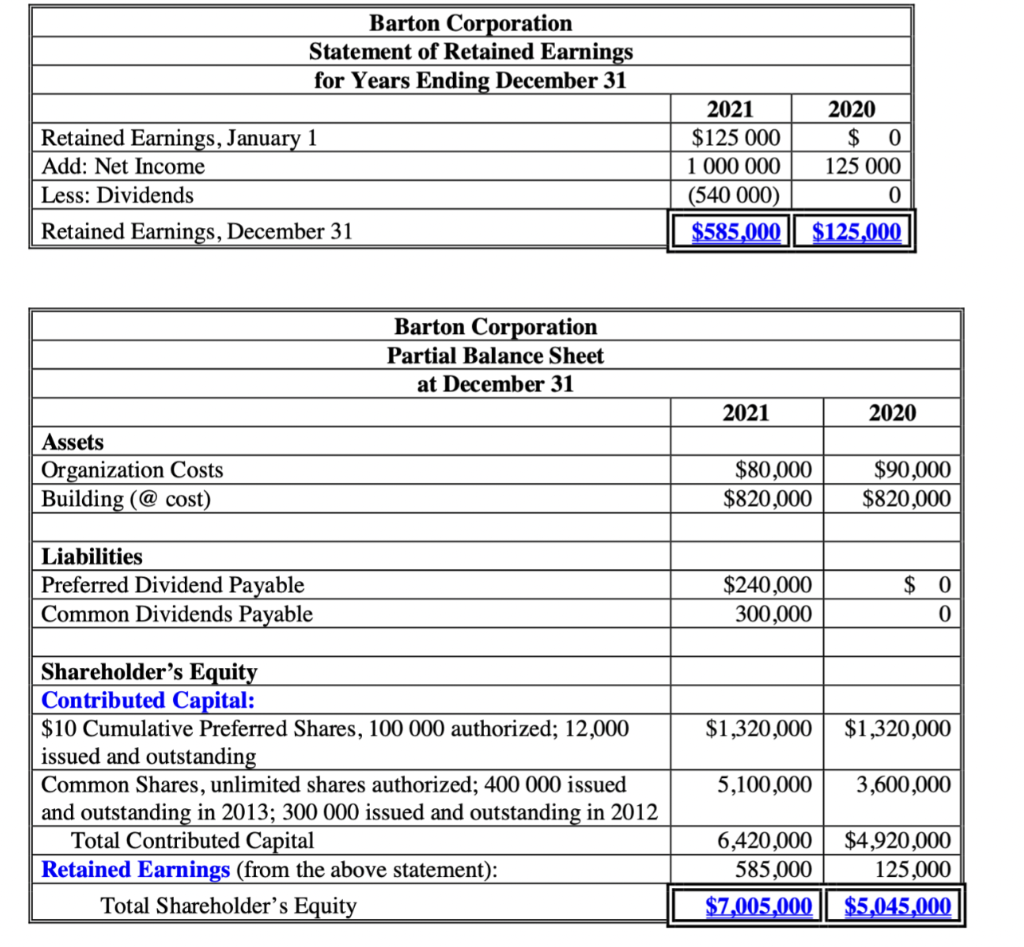

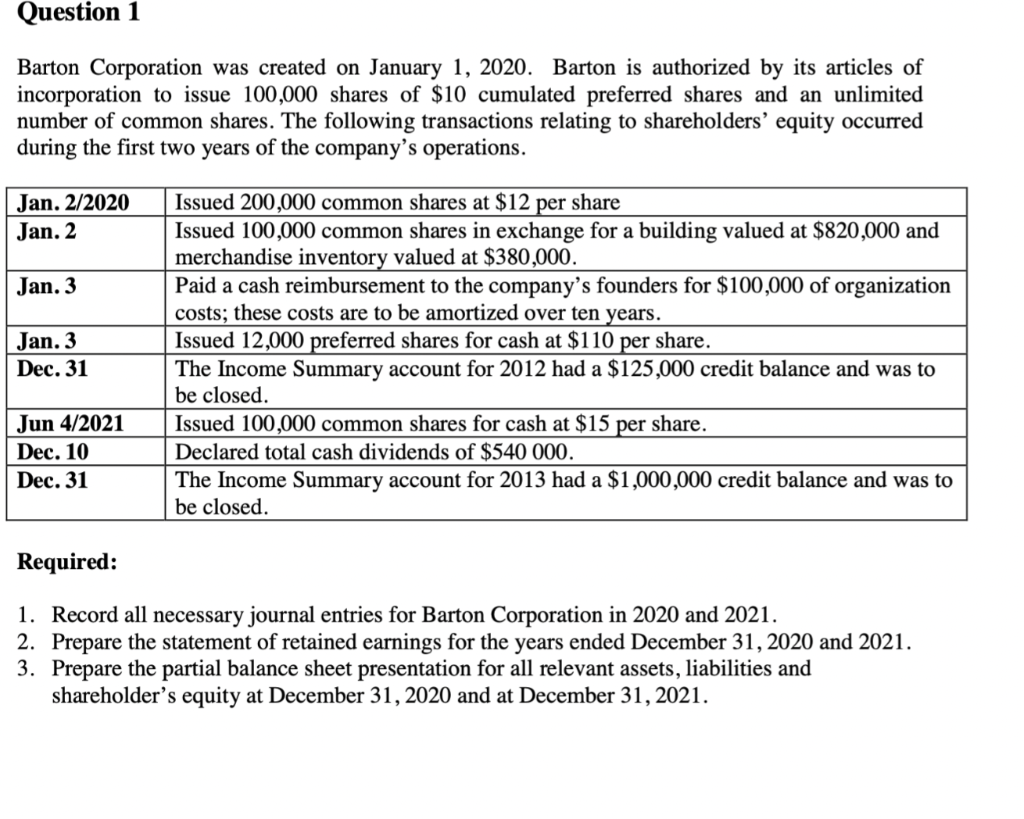

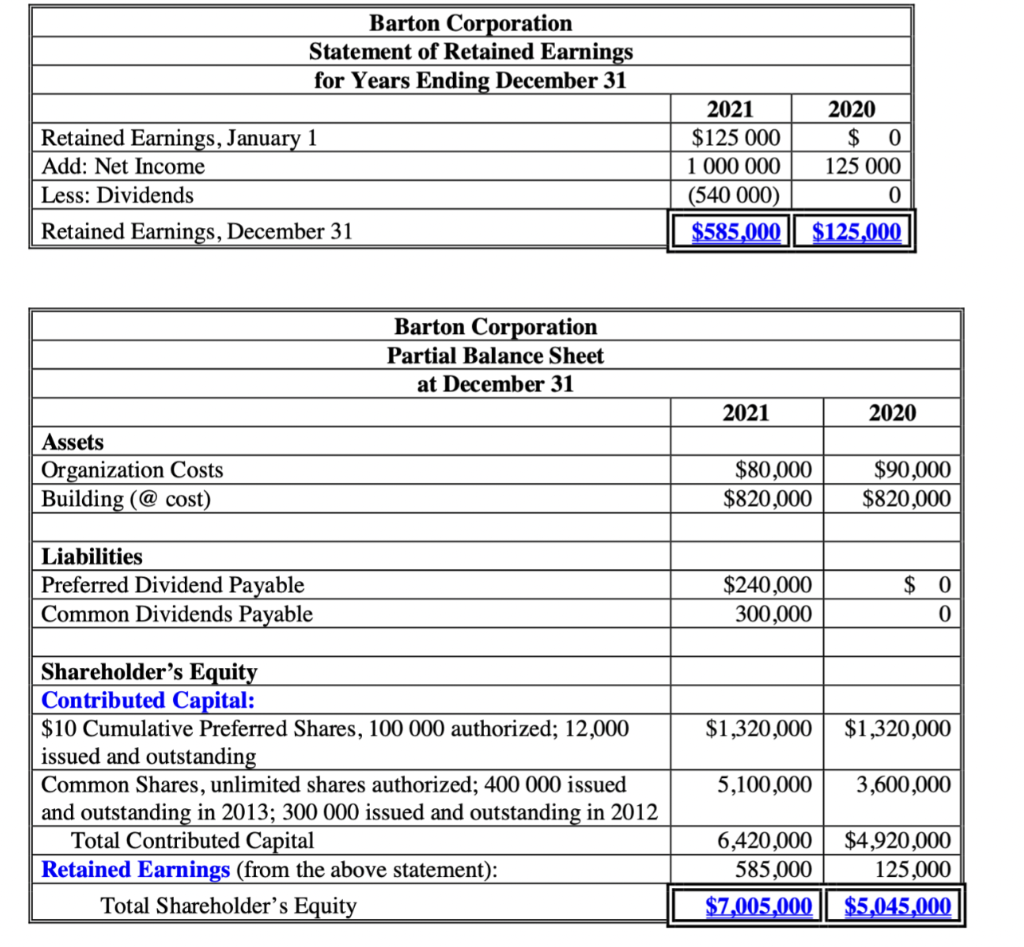

Question 1 Barton Corporation was created on January 1, 2020. Barton is authorized by its articles of incorporation to issue 100,000 shares of $10 cumulated preferred shares and an unlimited number of common shares. The following transactions relating to shareholders' equity occurred during the first two years of the company's operations. Jan. 2/2020 Jan. 2 Jan. 3 Jan. 3 Dec. 31 Issued 200,000 common shares at $12 per share Issued 100,000 common shares in exchange for a building valued at $820,000 and merchandise inventory valued at $380,000. Paid a cash reimbursement to the company's founders for $100,000 of organization costs; these costs are to be amortized over ten years. Issued 12,000 preferred shares for cash at $110 per share. The Income Summary account for 2012 had a $125,000 credit balance and was to be closed. Issued 100,000 common shares for cash at $15 per share. Declared total cash dividends of $540 000. The Income Summary account for 2013 had a $1,000,000 credit balance and was to be closed. Jun 4/2021 Dec. 10 Dec. 31 Required: 1. Record all necessary journal entries for Barton Corporation in 2020 and 2021. 2. Prepare the statement of retained earnings for the years ended December 31, 2020 and 2021. 3. Prepare the partial balance sheet presentation for all relevant assets, liabilities and shareholder's equity at December 31, 2020 and at December 31, 2021. Barton Corporation Statement of Retained Earnings for Years Ending December 31 Retained Earnings, January 1 Add: Net Income Less: Dividends Retained Earnings, December 31 2021 $125 000 1 000 000 (540 000) $585,000 2020 $ 0 125 000 0 $125,000 Barton Corporation Partial Balance Sheet at December 31 2021 2020 Assets Organization Costs Building (@ cost) $80,000 $820,000 $90,000 $820,000 Liabilities Preferred Dividend Payable Common Dividends Payable $240,000 300,000 $ 0 0 $1,320,000 $1,320,000 Shareholder's Equity Contributed Capital: $10 Cumulative Preferred Shares, 100 000 authorized; 12,000 issued and outstanding Common Shares, unlimited shares authorized; 400 000 issued and outstanding in 2013; 300 000 issued and outstanding in 2012 Total Contributed Capital Retained Earnings (from the above statement): Total Shareholder's Equity 5,100,000 3,600,000 6,420,000 585,000 $7,005,000 $4,920,000 125,000 $5,045,000