Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone answer R10 and R11 Please. Thank you so much. R10: Yesterday, Investquest Corp, was selling for $262.5 per share with a market capitalication

Can someone answer R10 and R11 Please.

Thank you so much.

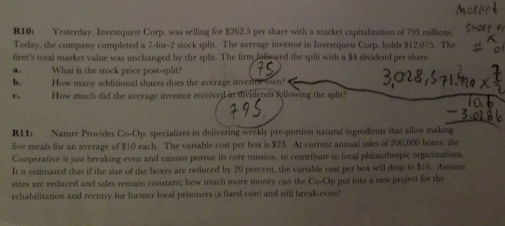

R10: Yesterday, Investquest Corp, was selling for $262.5 per share with a market capitalication of 795 millions hor Today, the company completed a 7-for-2 stock split. The average investor in Investquest Corp. holds $12,075. The firm's total market value was unchanged by the split. The lirm Salleued the split with a $4 dividend per share a. What is the stock price post-split? How many additional shares does the average invetorawn? How much did the average investor received-iordividendo fyllowing the split lo 3.013b R11: Nature Provides Co-Op specializes in delivering weekly pre-portion natural ingredients that allow making ive meals for an average of s10 each. The variable cost per box is $23. At current annual sales of 200,000 boses, the Cooperative is just breaking even and cannot pursue its core mission, It is estimated thar if the size of the boxes are reduced by 20 percent, the variable cost per box will drop to $16. Assue sizes are reduced and sales remain constant; how much more money can the Co-Op put into a new project for the rehabilitation and reentry for former local prisoners (a fixed cost) and sill break-even R10: Yesterday, Investquest Corp, was selling for $262.5 per share with a market capitalication of 795 millions hor Today, the company completed a 7-for-2 stock split. The average investor in Investquest Corp. holds $12,075. The firm's total market value was unchanged by the split. The lirm Salleued the split with a $4 dividend per share a. What is the stock price post-split? How many additional shares does the average invetorawn? How much did the average investor received-iordividendo fyllowing the split lo 3.013b R11: Nature Provides Co-Op specializes in delivering weekly pre-portion natural ingredients that allow making ive meals for an average of s10 each. The variable cost per box is $23. At current annual sales of 200,000 boses, the Cooperative is just breaking even and cannot pursue its core mission, It is estimated thar if the size of the boxes are reduced by 20 percent, the variable cost per box will drop to $16. Assue sizes are reduced and sales remain constant; how much more money can the Co-Op put into a new project for the rehabilitation and reentry for former local prisoners (a fixed cost) and sill break-evenStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started