Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone answer this question? Teduh Sdn.Bhd. manufactures canopy. Shown below is Teduh's cost structure: Variable cost per Total fixed cos canopy the year Manufacturing

can someone answer this question?

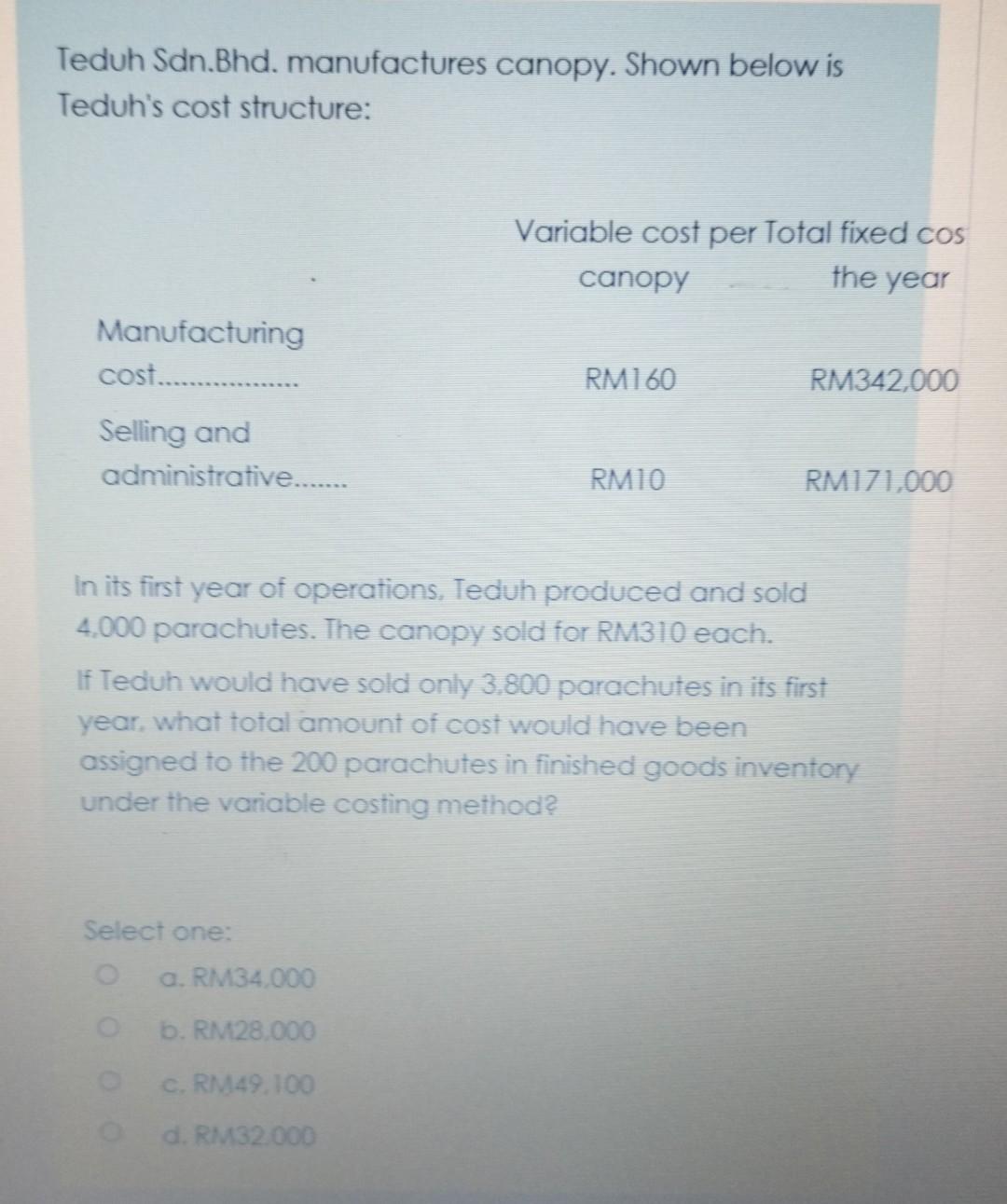

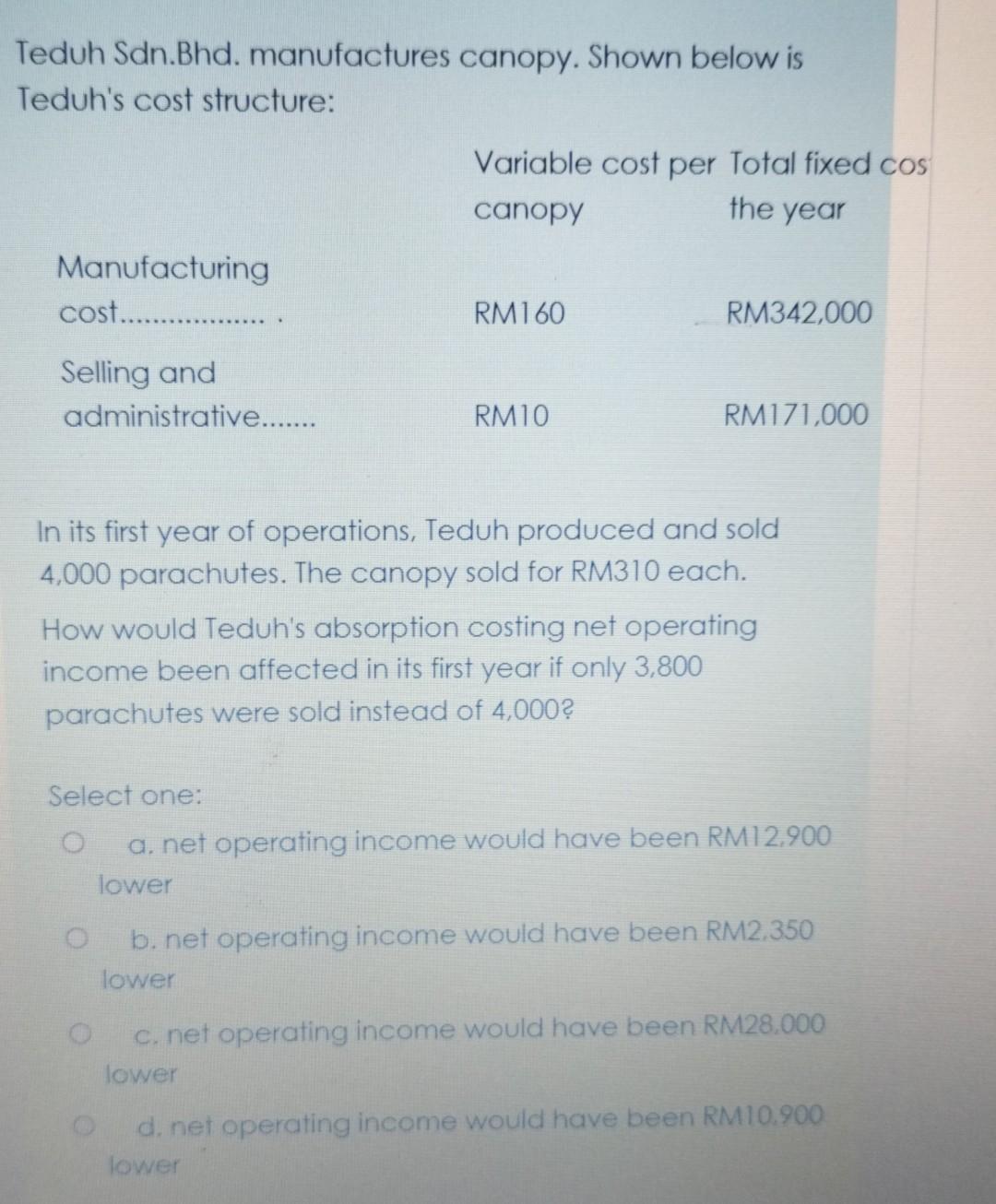

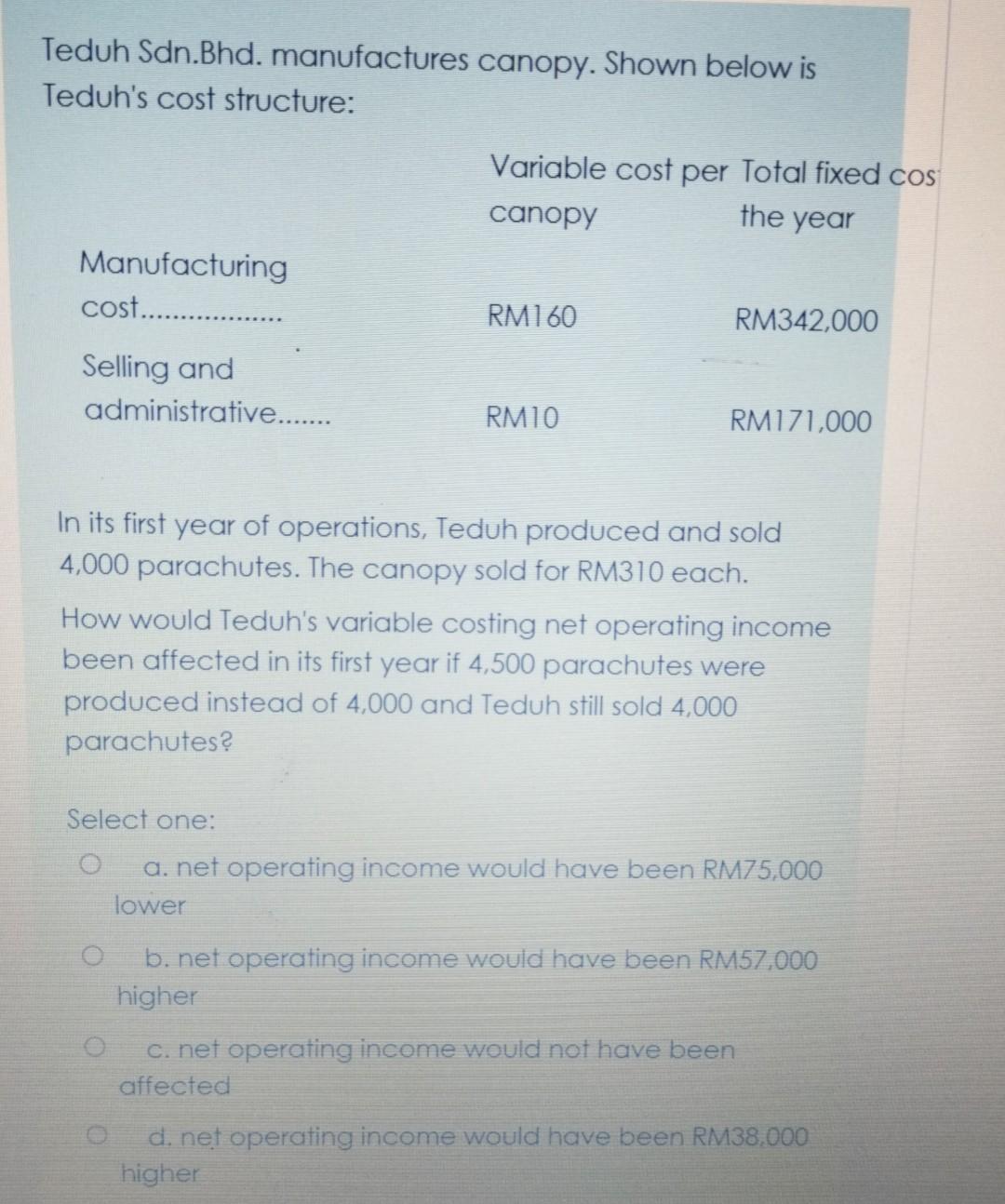

Teduh Sdn.Bhd. manufactures canopy. Shown below is Teduh's cost structure: Variable cost per Total fixed cos canopy the year Manufacturing cost................. RM160 RM342,000 Selling and administrative..... RMIO RM171,000 in its first year of operations, Teduh produced and sold 4.000 parachutes. The canopy sold for RM310 each. If Teduh would have sold only 3.800 parachutes in its first year, what total amount of cost would have been assigned to the 200 parachutes in finished goods inventory under the variable costing methods Select one: o a. RM34.000 b. RM128.000 c. RM49.100 d. RM32.000 Teduh Sdn.Bhd. manufactures canopy. Shown below is Teduh's cost structure: Variable cost per Total fixed cos canopy the year Manufacturing cost.................. RM160 RM342,000 Selling and administrative....... RMIO RM171,000 In its first year of operations, Teduh produced and sold 4,000 parachutes. The canopy sold for RM310 each. How would Teduh's absorption costing net operating income been affected in its first year if only 3,800 parachutes were sold instead of 4,000? Select one: a. net operating income would have been RM12.900 lower b. net operating income would have been RM2.350 lower c. net operating income would have been RM28.000 lower d. net operating income would have been RM10.900 lower Teduh Sdn.Bhd. manufactures canopy. Shown below is Teduh's cost structure: Variable cost per Total fixed cos canopy the year Manufacturing cost................... RM160 RM342,000 Selling and administrative....... RMIO RM171,000 In its first year of operations, Teduh produced and sold 4,000 parachutes. The canopy sold for RM310 each. How would Teduh's variable costing net operating income been affected in its first year if 4,500 parachutes were produced instead of 4,000 and Teduh still sold 4,000 parachutes? Select one: a. net operating income would have been RM75,000 lower b. net operating income would have been RM57,000 higher c. net operating income would not have been affected d. net operating income would have been RM38.000 higherStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started