Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone answer this question? Which of the following is NOT considered a relevant cash flow in determining whether to continue or not with an

can someone answer this question?

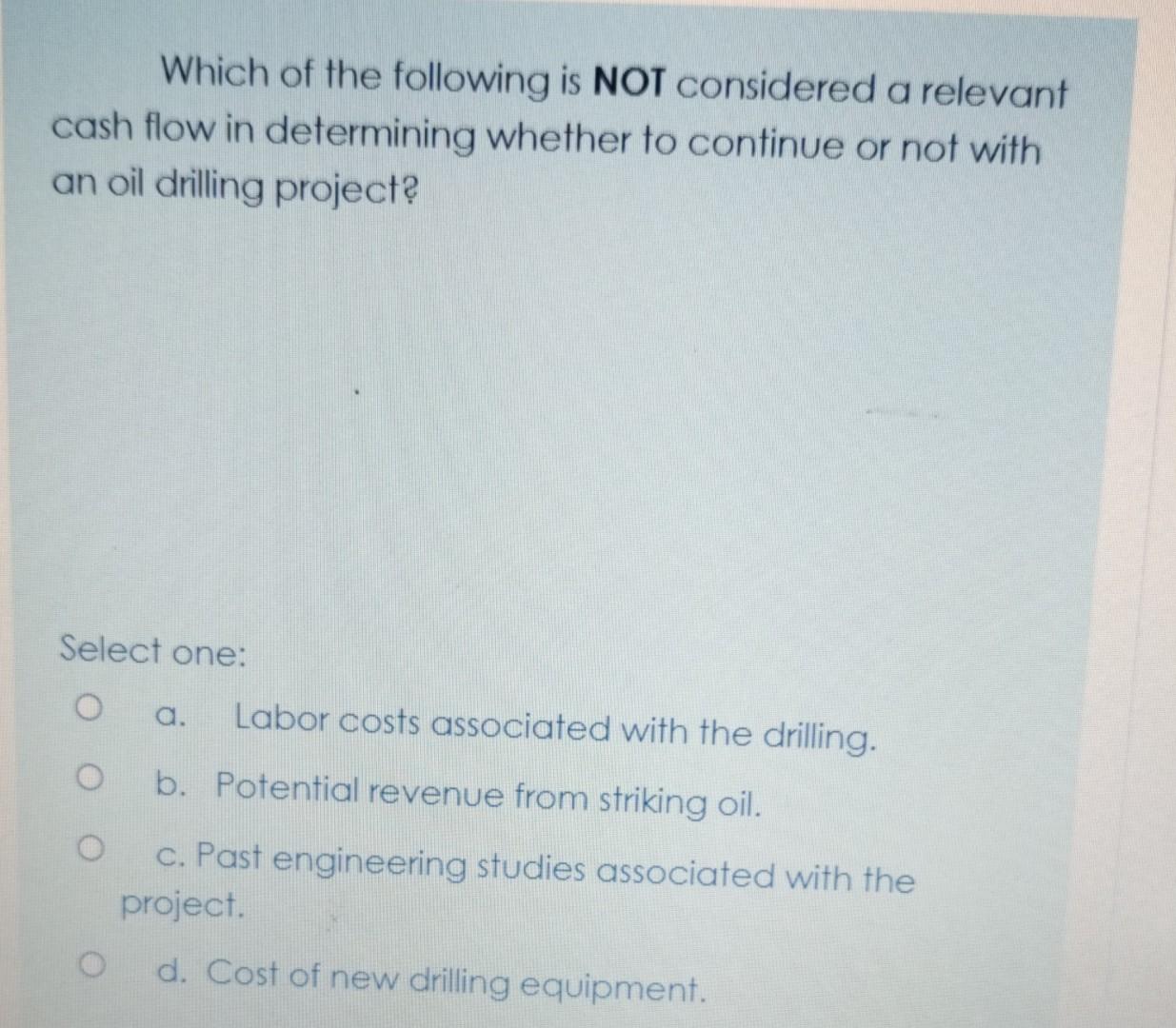

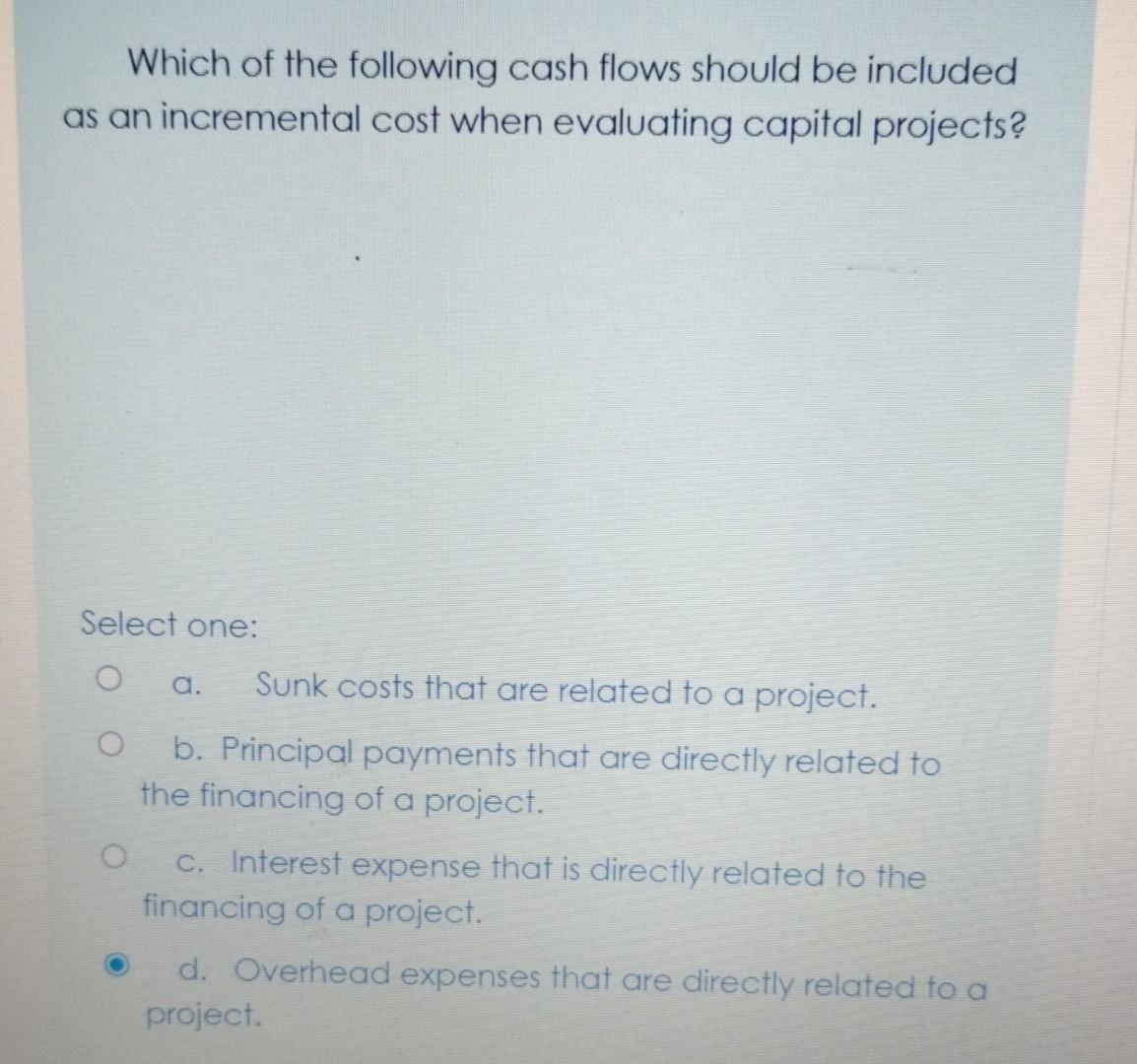

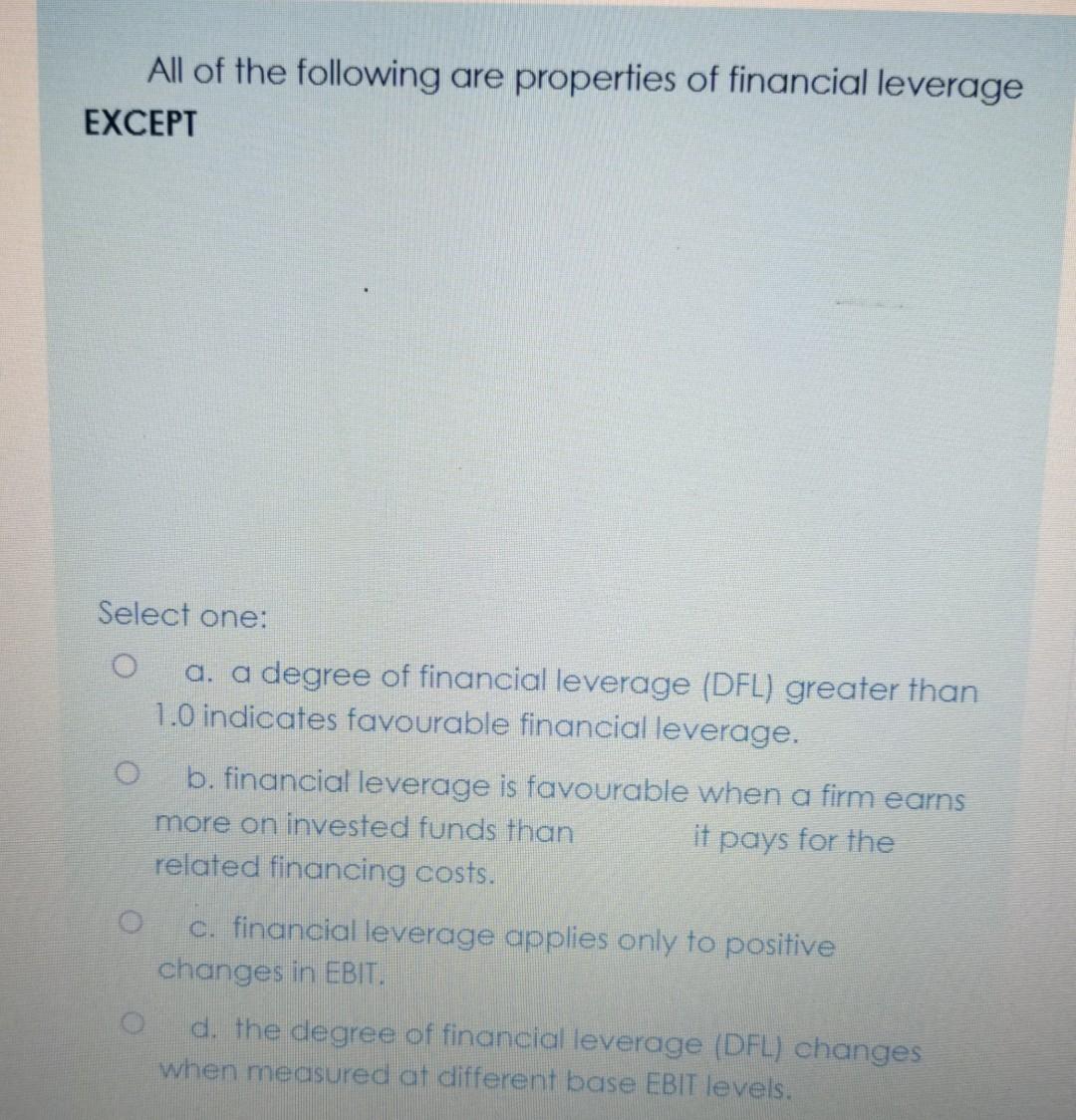

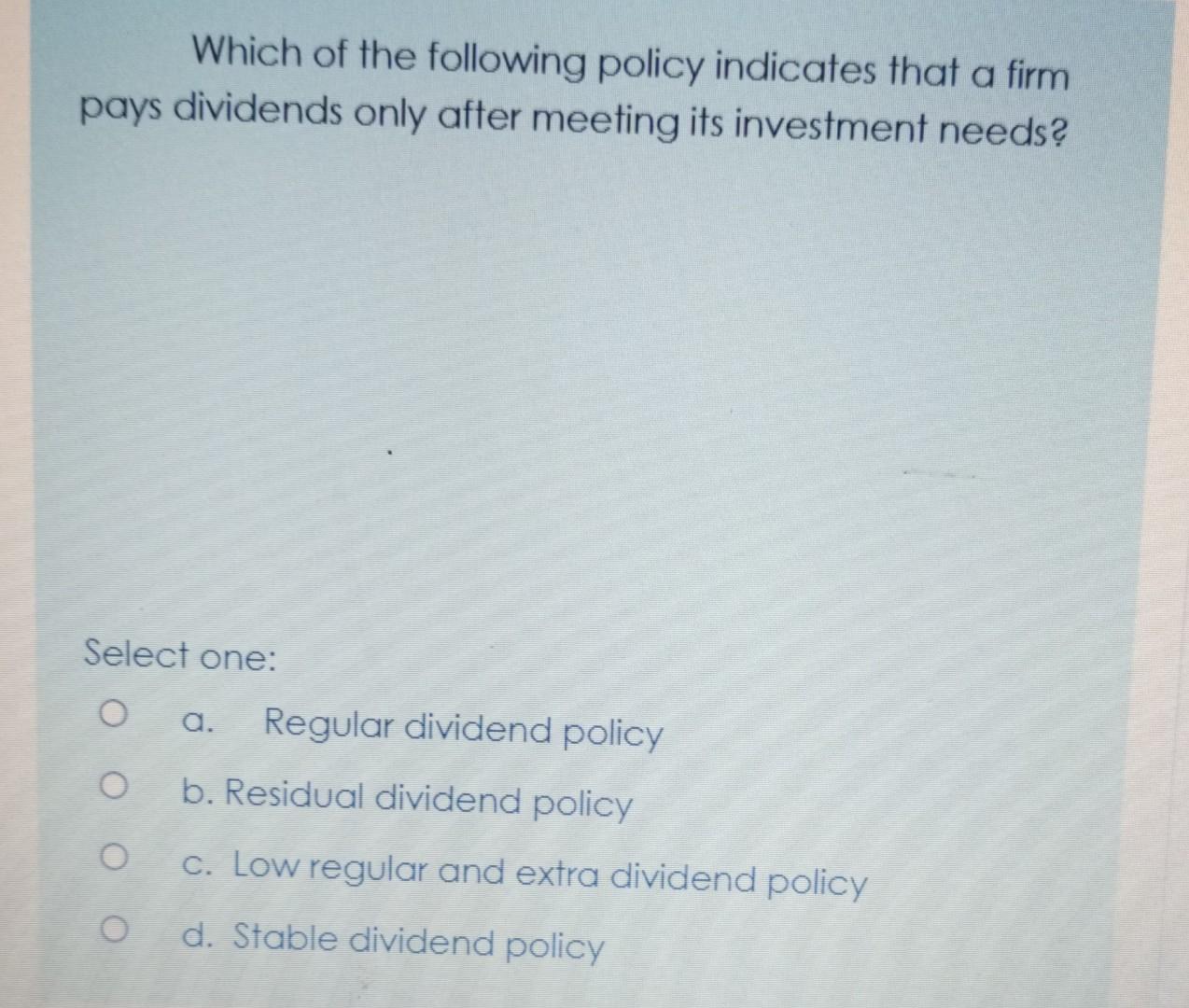

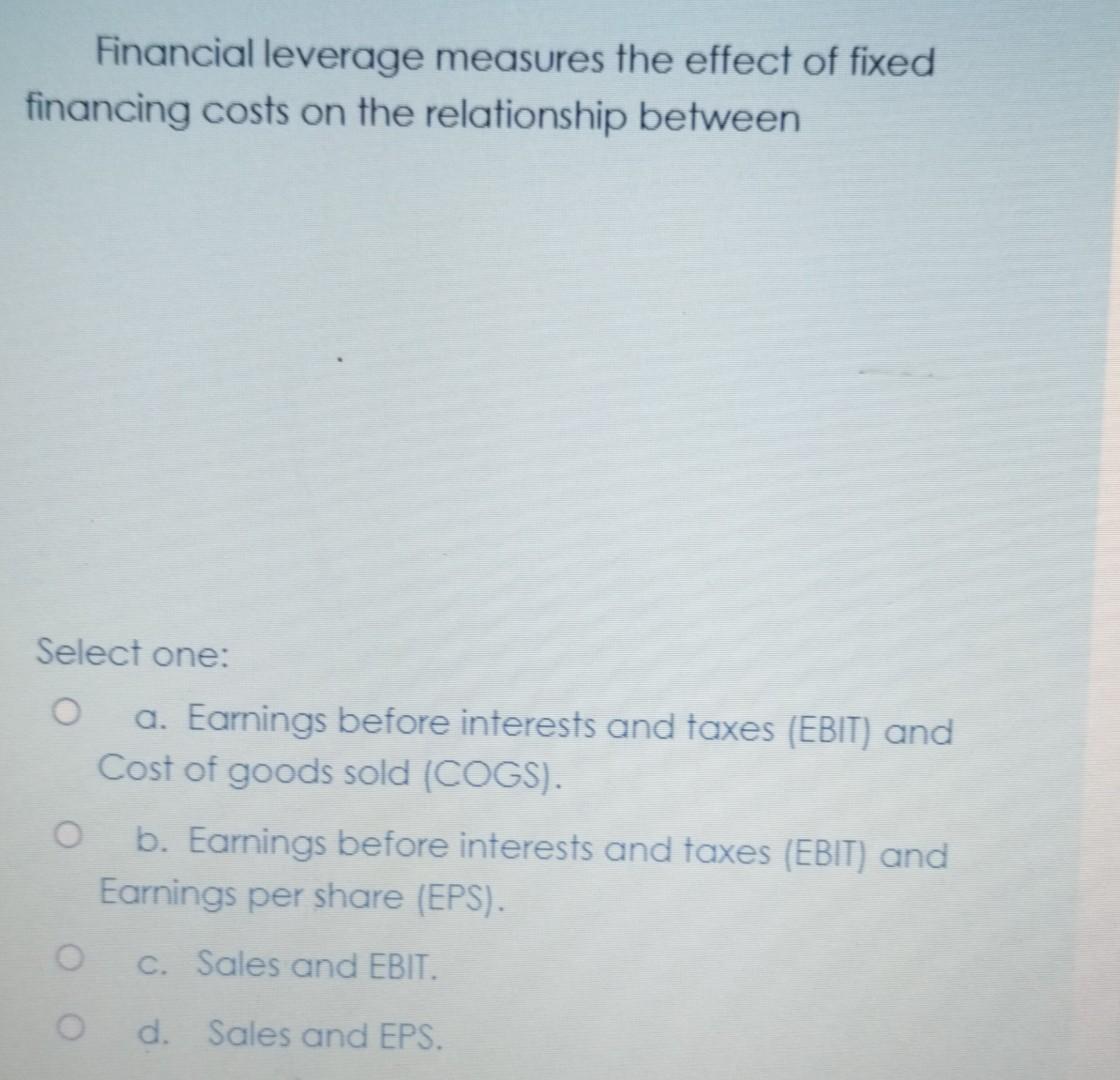

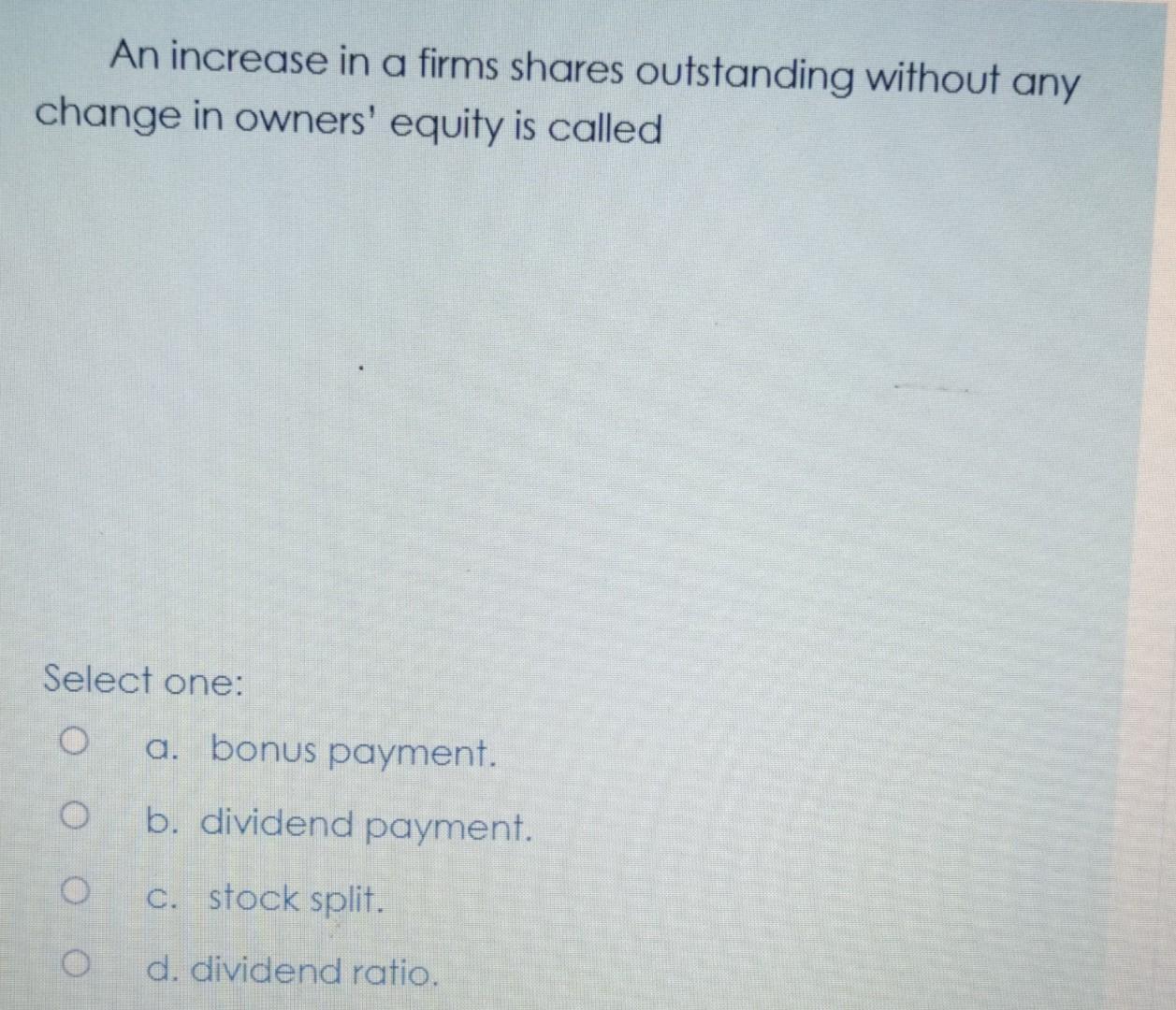

Which of the following is NOT considered a relevant cash flow in determining whether to continue or not with an oil drilling project? Select one: Labor costs associated with the drilling. a. o b. Potential revenue from striking oil. c. Past engineering studies associated with the project. o d. Cost of new drilling equipment. Which of the following cash flows should be included as an incremental cost when evaluating capital projects? Select one: Sunk costs that are related to a project. a. O b. Principal payments that are directly related to the financing of a project. c. Interest expense that is directly related to the financing of a project. d. Overhead expenses that are directly related to a project. All of the following are properties of financial leverage EXCEPT Select one: a. a degree of financial leverage (DFL) greater than 1.0 indicates favourable financial leverage. O b. financial leverage is favourable when a firm earns more on invested funds than it pays for the related financing costs. c. financial leverage applies only to positive changes in EBIT. d. the degree of financial leverage (DFL) changes when measured at different base EBIT levels. Which of the following policy indicates that a firm pays dividends only after meeting its investment needs? Select one: Regular dividend policy O b. Residual dividend policy O c. Low regular and extra dividend policy O d. Stable dividend policy Financial leverage measures the effect of fixed financing costs on the relationship between Select one: o a. Earnings before interests and taxes (EBIT) and Cost of goods sold (COGS). O b. Earnings before interests and taxes (EBIT) and Earnings per share (EPS). C. Sales and EBIT. O d. Sales and EPS. An increase in a firms shares outstanding without any change in owners' equity is called Select one: O a. bonus payment. O b. dividend payment. O c. stock split. d. dividend ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started