Can someone assist with this question?

Data are as shown.

Thank you.

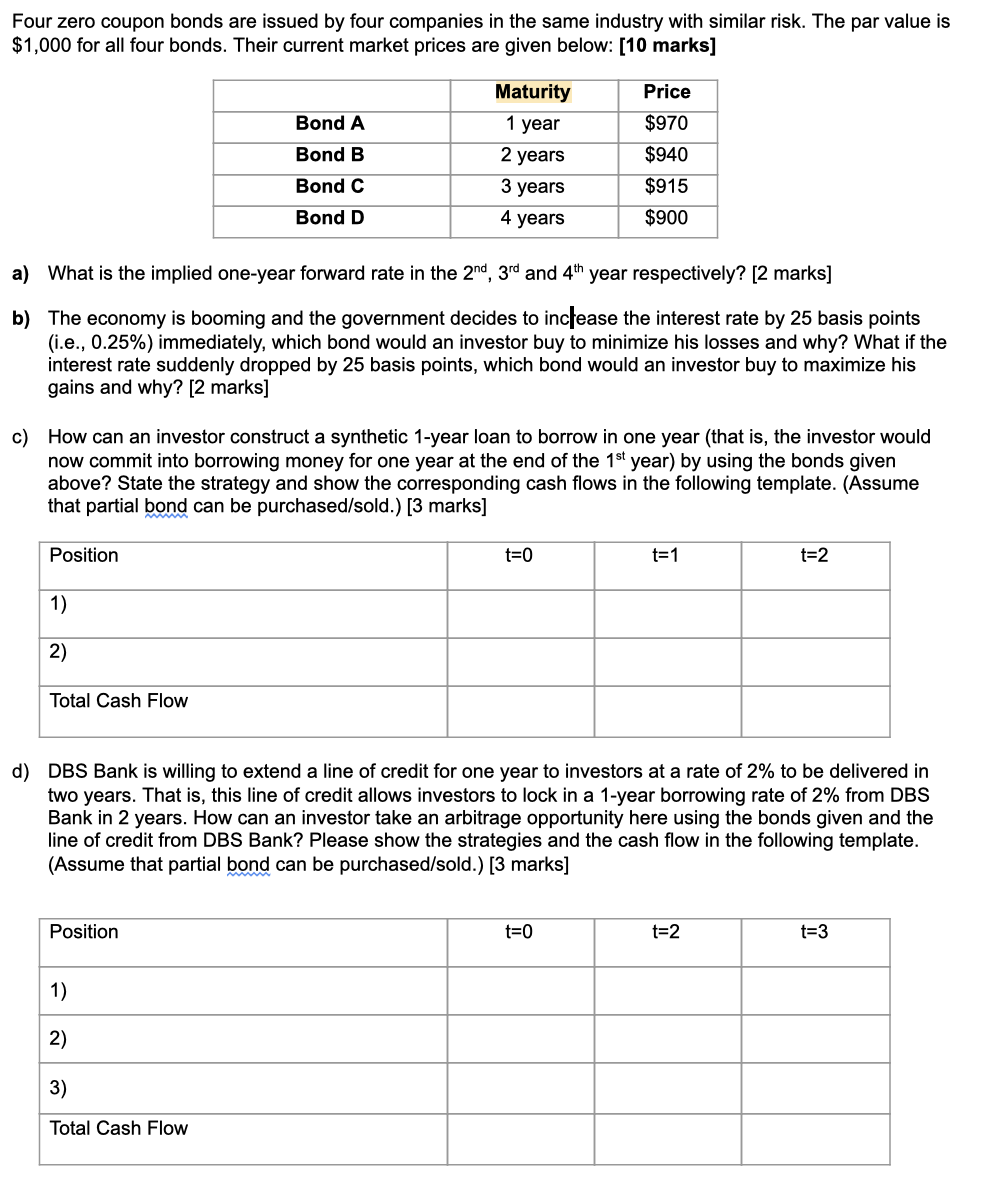

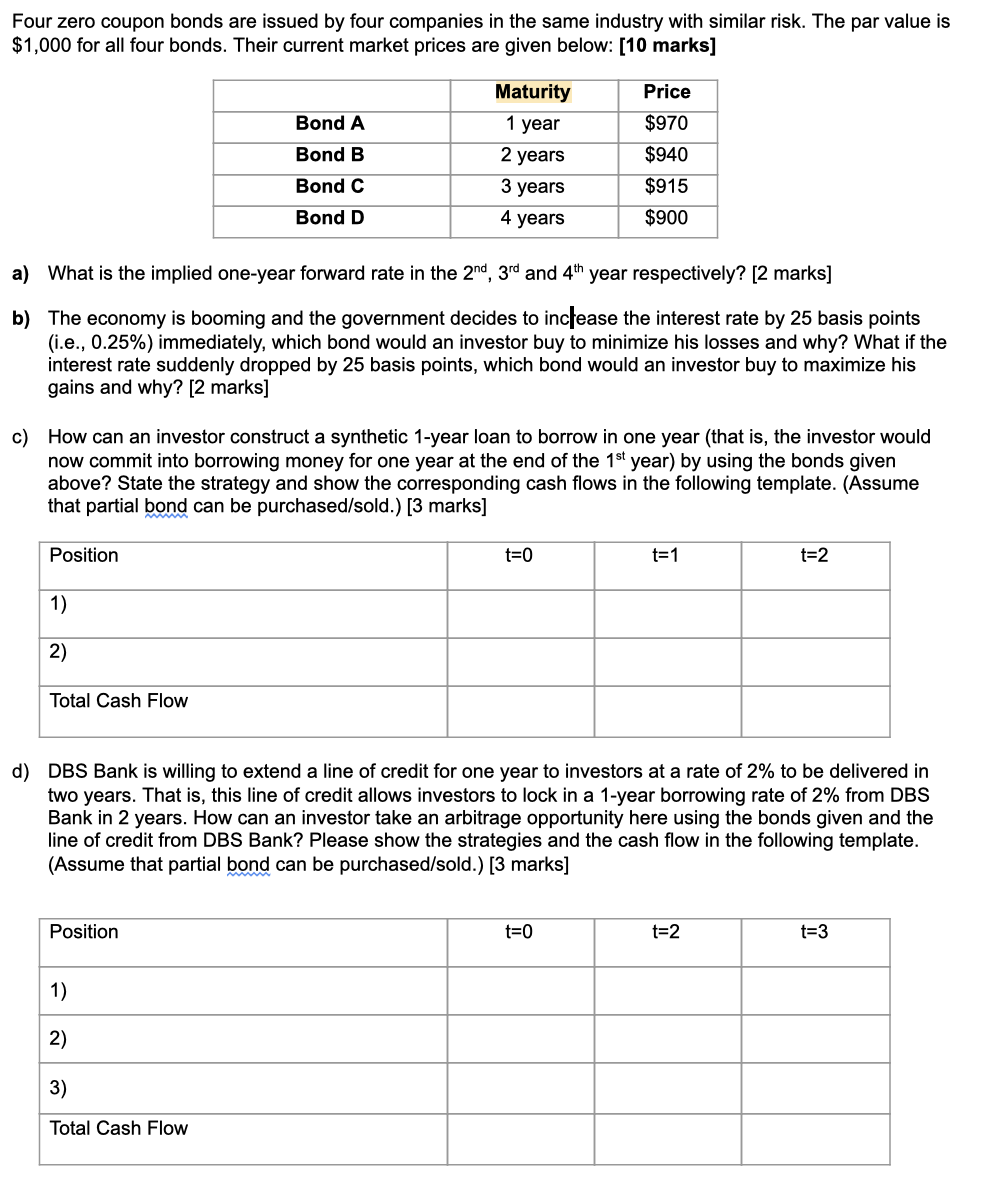

Four zero coupon bonds are issued by four companies in the same industry with similar risk. The par value is $1,000 for all four bonds. Their current market prices are given below: [10 marks] Price Bond A Maturity 1 year 2 years 3 years 4 years $970 $940 Bond B Bond C Bond D $915 $900 a) What is the implied one-year forward rate in the 2nd, 3rd and 4th year respectively? [2 marks] b) The economy is booming and the government decides to incfease the interest rate by 25 basis points (i.e., 0.25%) immediately, which bond would an investor buy to minimize his losses and why? What if the interest rate suddenly dropped by 25 basis points, which bond would an investor buy to maximize his gains and why? [2 marks] c) How can an investor construct a synthetic 1-year loan to borrow in one year (that is, the investor would now commit into borrowi money for one year at the end of the 1st year) by using the bonds giver above? State the strategy and show the corresponding cash flows in the following template. (Assume that partial bond can be purchased/sold.) [3 marks] Position t=0 t= 1 t=2 1) 2) Total Cash Flow d) DBS Bank is willing to extend a line of credit for one year to investors at a rate of 2% to be delivered in two years. That is, this line of credit allows investors to lock in a 1-year borrowing rate of 2% from DBS Bank in 2 years. How can an investor take an arbitrage opportunity here using the bonds given and the line of credit from DBS Bank? Please show the strategies and the cash flow in the following template. (Assume that partial bond can be purchased/sold.) [3 marks] Position t=0 t=2 t=3 1) 2) 3) Total Cash Flow Four zero coupon bonds are issued by four companies in the same industry with similar risk. The par value is $1,000 for all four bonds. Their current market prices are given below: [10 marks] Price Bond A Maturity 1 year 2 years 3 years 4 years $970 $940 Bond B Bond C Bond D $915 $900 a) What is the implied one-year forward rate in the 2nd, 3rd and 4th year respectively? [2 marks] b) The economy is booming and the government decides to incfease the interest rate by 25 basis points (i.e., 0.25%) immediately, which bond would an investor buy to minimize his losses and why? What if the interest rate suddenly dropped by 25 basis points, which bond would an investor buy to maximize his gains and why? [2 marks] c) How can an investor construct a synthetic 1-year loan to borrow in one year (that is, the investor would now commit into borrowi money for one year at the end of the 1st year) by using the bonds giver above? State the strategy and show the corresponding cash flows in the following template. (Assume that partial bond can be purchased/sold.) [3 marks] Position t=0 t= 1 t=2 1) 2) Total Cash Flow d) DBS Bank is willing to extend a line of credit for one year to investors at a rate of 2% to be delivered in two years. That is, this line of credit allows investors to lock in a 1-year borrowing rate of 2% from DBS Bank in 2 years. How can an investor take an arbitrage opportunity here using the bonds given and the line of credit from DBS Bank? Please show the strategies and the cash flow in the following template. (Assume that partial bond can be purchased/sold.) [3 marks] Position t=0 t=2 t=3 1) 2) 3) Total Cash Flow