can someone can help me,

i need General Journal , Ledger, Worksheet, income statement, balance sheet and trial balance for june and july. please and thank you

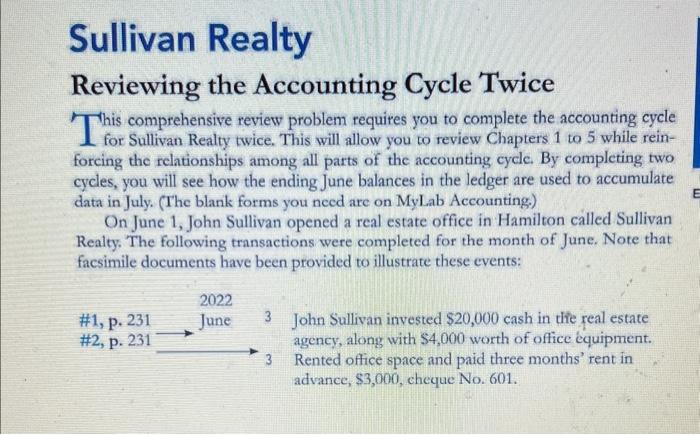

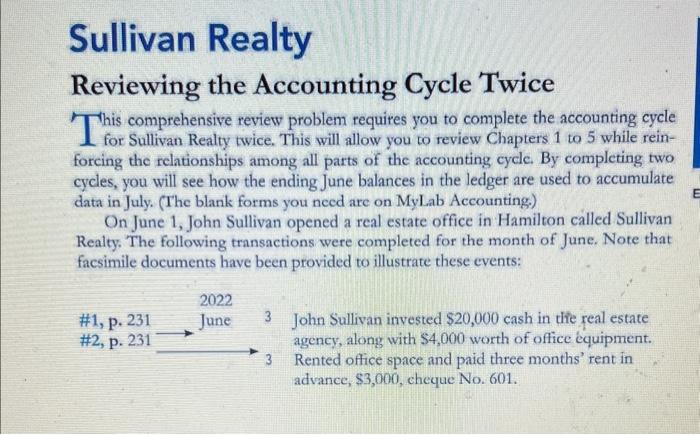

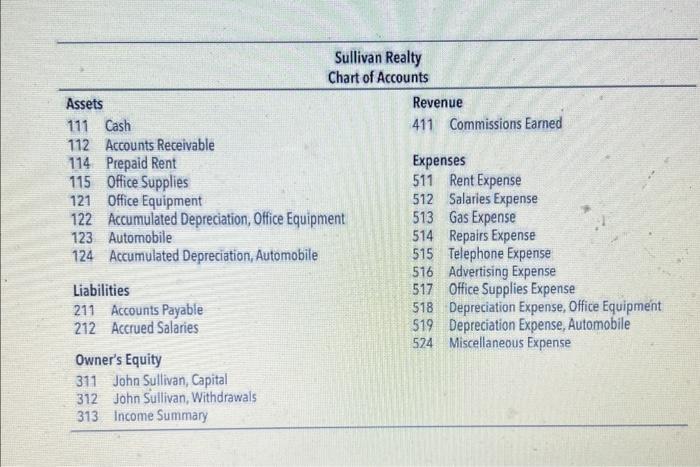

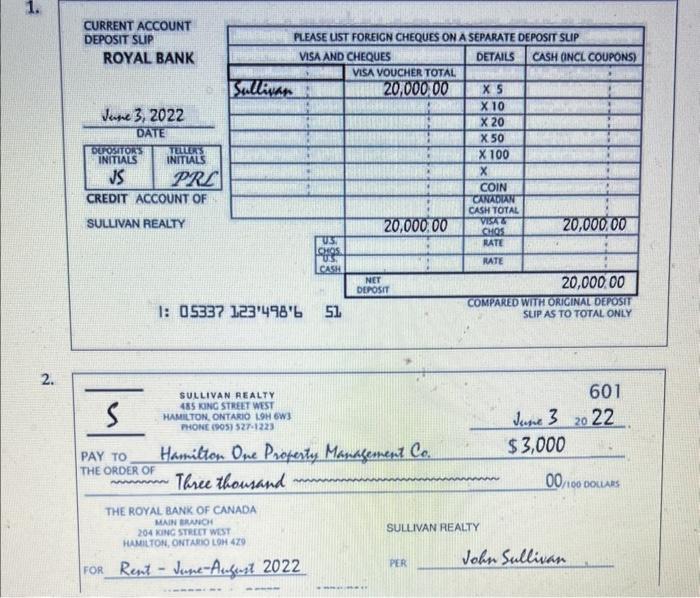

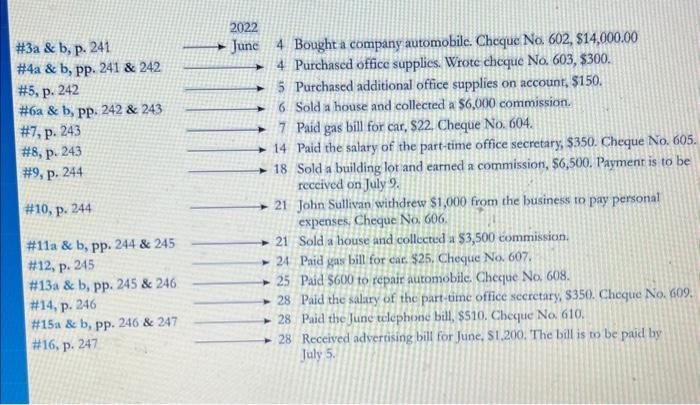

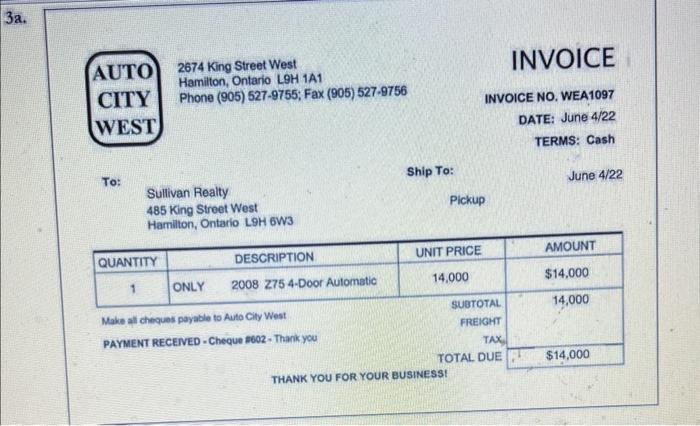

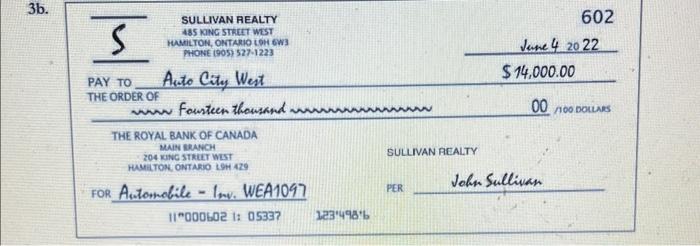

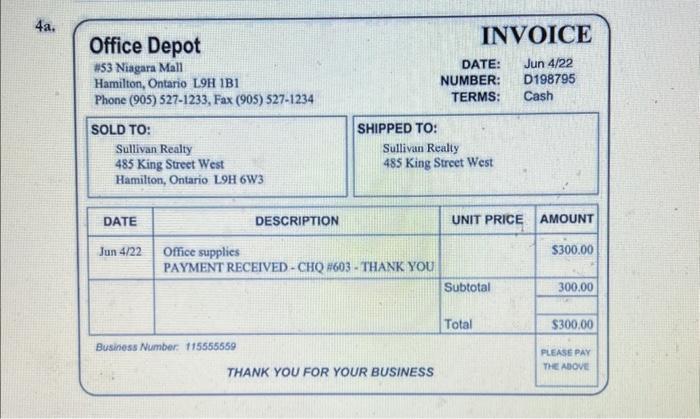

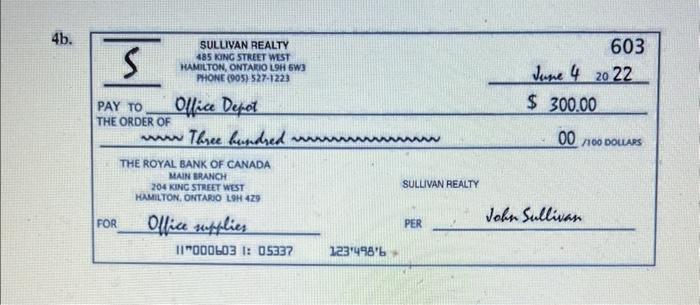

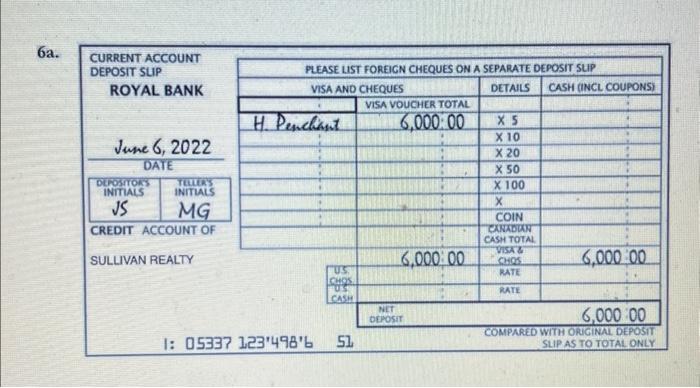

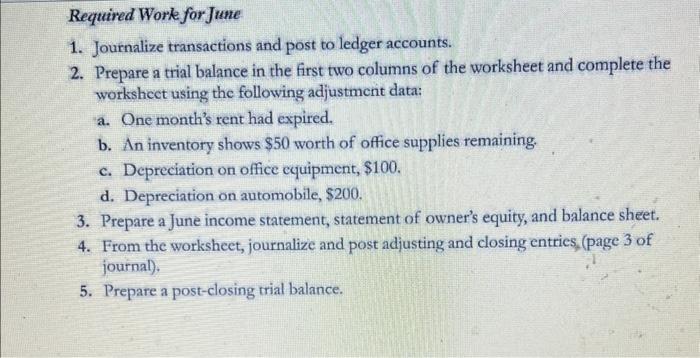

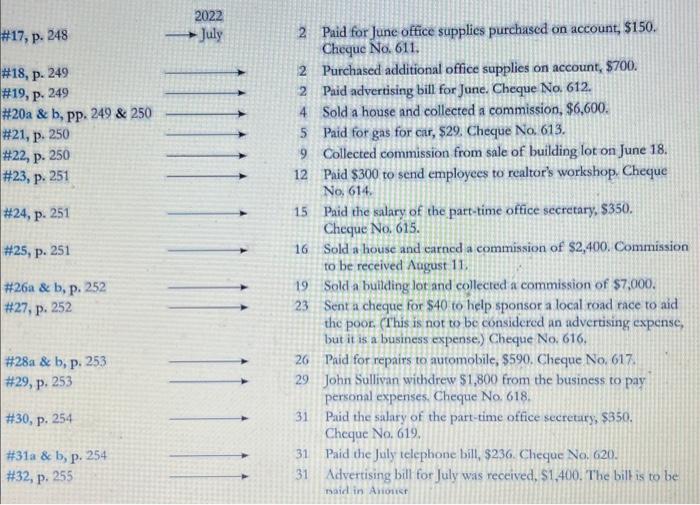

Sullivan Realty Reviewing the Accounting Cycle Twice This comprehensive review problem requires you to complete the accounting cycle for Sullivan Realty twice. This will allow you to review Chapters 1 to 5 while reinforcing the relationships among all parts of the accounting cycle. By completing two cycles, you will see how the ending June balances in the ledger are used to accumulate data in July. (The blank forms you need are on MyLab Accounting.) On June 1, John Sullivan opened a real estate office in Hamilton called Sullivan Realty. The following transactions were completed for the month of June. Note that facsimile documents have been provided to illustrate these events: John Sullivan invested $20,000 cash in the real estate agency, along with $4,000 worth of office quipment. Rented office space and paid three months' rent in advance, $3,000, cheque No. 601 . Sullivan Realty Chart of Accounts I: 0533? 3a. AUTO 2674King Street West INVOICE Hamilton, Ontario L9H 1 A1 CIT Y Phone (905) 527-9755; Fax (905) 527-9756 INVOICE NO. WEA1097 WEST DATE: June 4/22 TERMS: Cash Ship To: To: June 4/22 Sullivan Realty 485 King Street West Pickup Hamilton, Ontario L9H6W3 THANK YOU FOR YOUR BUSINESS! 3b. 4a. Office Depot INVOICE * 53 Niagara Mall DATE: Jun 4/22 Hamilton, Ontario L.9H IBI NUMBER: D198795 Phone (905) 527-1233, Fax (905) 527-1234 SOLD TO: SHIPPED TO: Sullivan Realty Sullivan Really 485 King Street West 485 King Street West Hamilton, Ontario L9H 6W3 4b. 1. Journalize transactions and post to ledger accounts. 2. Prepare a trial balance in the first two columns of the worksheet and complete the workshect using the following adjustment data: a. One month's rent had expired. b. An inventory shows $50 worth of office supplies remaining. c. Depreciation on office equipment, $100. d. Depreciation on automobile, $200. 3. Prepare a June income statement, statement of owner's equity, and balance sheet. 4. From the worksheet, journalize and post adjusting and closing entries, (page 3 of journal). 5. Prepare a post-closing trial balance. Sullivan Realty Reviewing the Accounting Cycle Twice This comprehensive review problem requires you to complete the accounting cycle for Sullivan Realty twice. This will allow you to review Chapters 1 to 5 while reinforcing the relationships among all parts of the accounting cycle. By completing two cycles, you will see how the ending June balances in the ledger are used to accumulate data in July. (The blank forms you need are on MyLab Accounting.) On June 1, John Sullivan opened a real estate office in Hamilton called Sullivan Realty. The following transactions were completed for the month of June. Note that facsimile documents have been provided to illustrate these events: John Sullivan invested $20,000 cash in the real estate agency, along with $4,000 worth of office quipment. Rented office space and paid three months' rent in advance, $3,000, cheque No. 601 . Sullivan Realty Chart of Accounts I: 0533? 3a. AUTO 2674King Street West INVOICE Hamilton, Ontario L9H 1 A1 CIT Y Phone (905) 527-9755; Fax (905) 527-9756 INVOICE NO. WEA1097 WEST DATE: June 4/22 TERMS: Cash Ship To: To: June 4/22 Sullivan Realty 485 King Street West Pickup Hamilton, Ontario L9H6W3 THANK YOU FOR YOUR BUSINESS! 3b. 4a. Office Depot INVOICE * 53 Niagara Mall DATE: Jun 4/22 Hamilton, Ontario L.9H IBI NUMBER: D198795 Phone (905) 527-1233, Fax (905) 527-1234 SOLD TO: SHIPPED TO: Sullivan Realty Sullivan Really 485 King Street West 485 King Street West Hamilton, Ontario L9H 6W3 4b. 1. Journalize transactions and post to ledger accounts. 2. Prepare a trial balance in the first two columns of the worksheet and complete the workshect using the following adjustment data: a. One month's rent had expired. b. An inventory shows $50 worth of office supplies remaining. c. Depreciation on office equipment, $100. d. Depreciation on automobile, $200. 3. Prepare a June income statement, statement of owner's equity, and balance sheet. 4. From the worksheet, journalize and post adjusting and closing entries, (page 3 of journal). 5. Prepare a post-closing trial balance