Can someone correct me if I'm wrong and complete it. Please and thank you

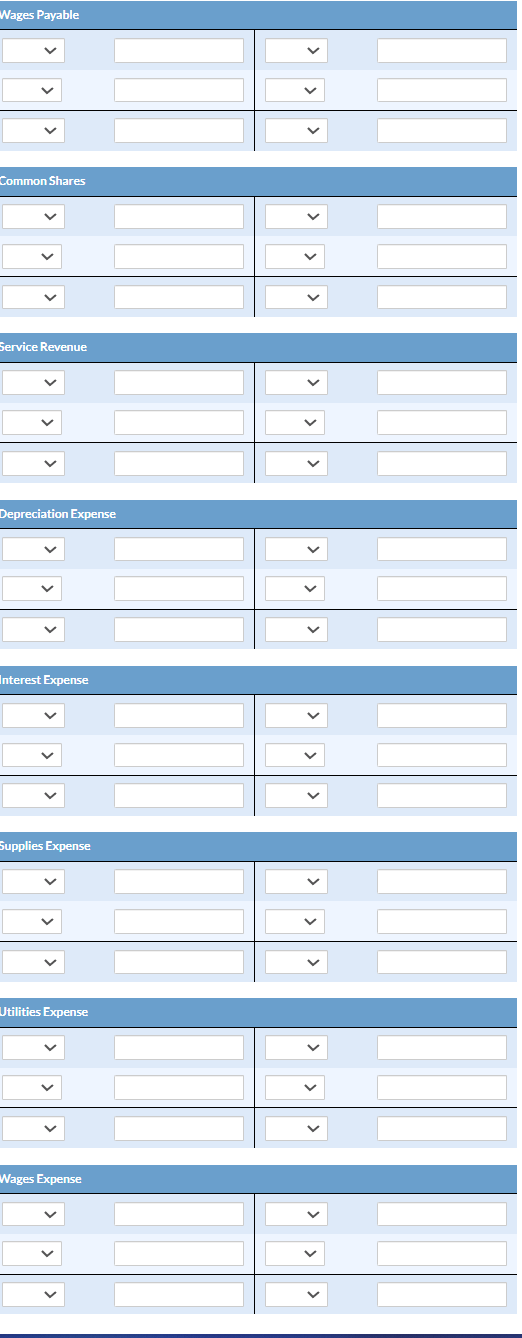

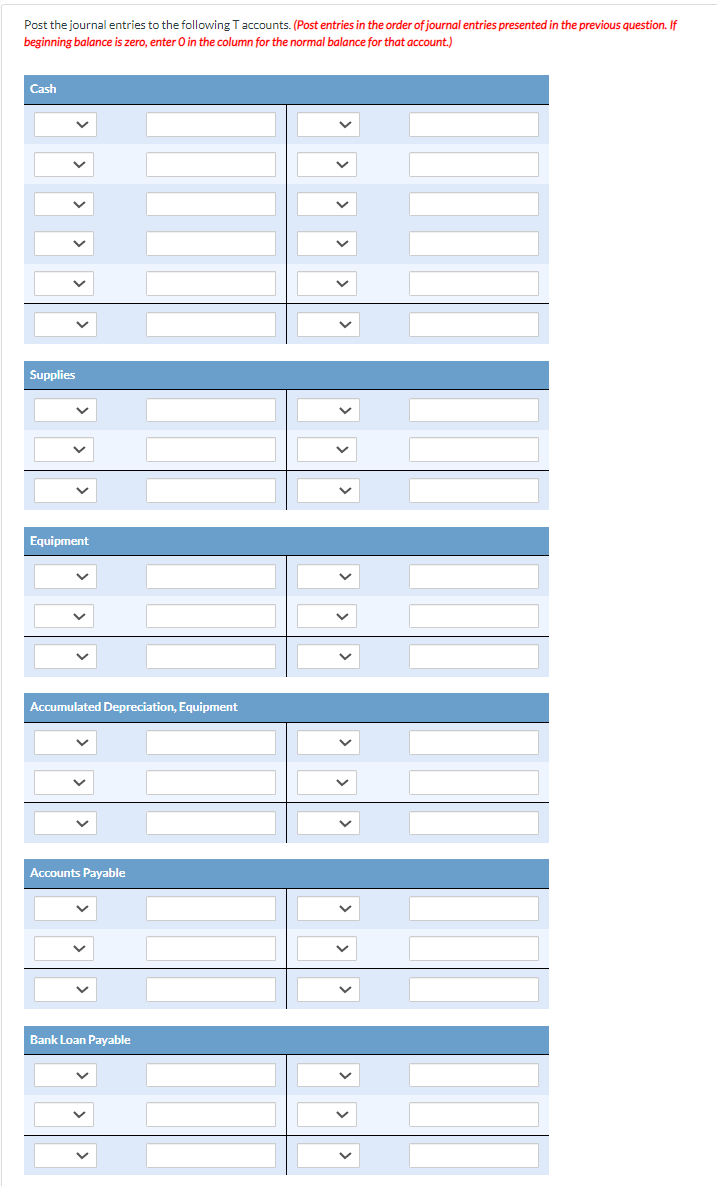

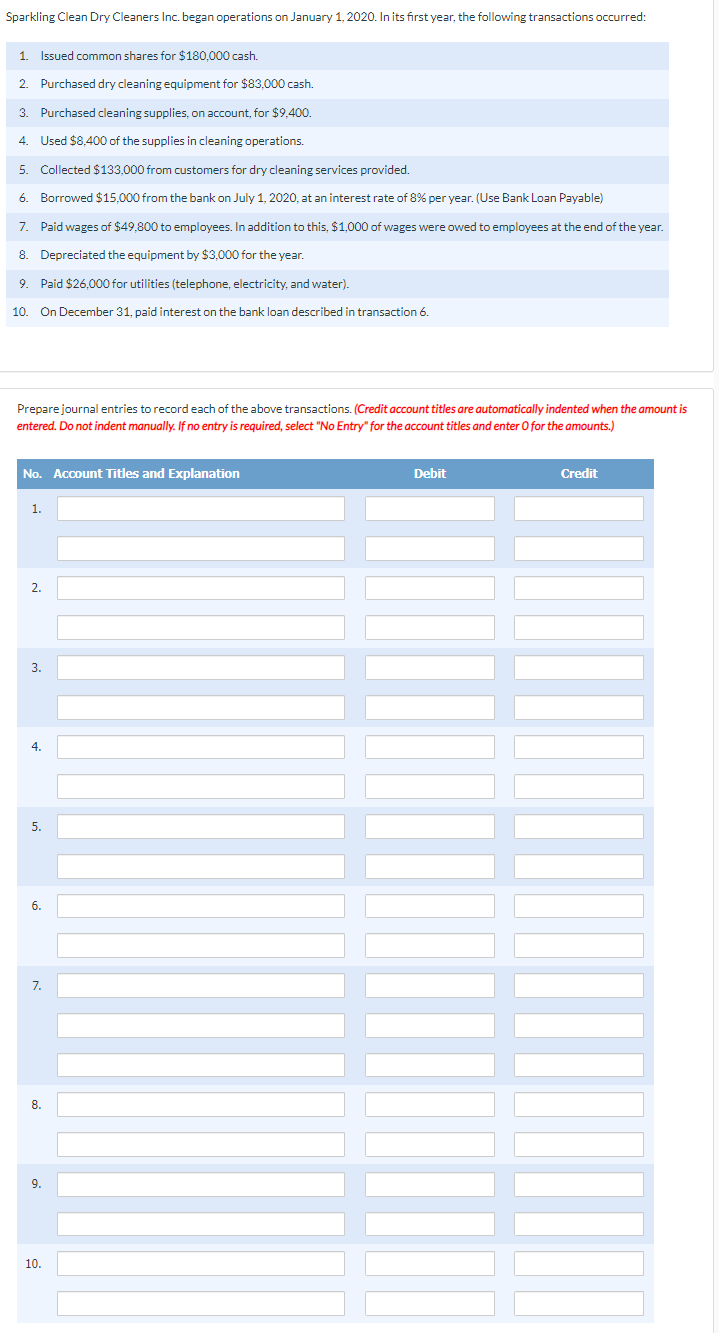

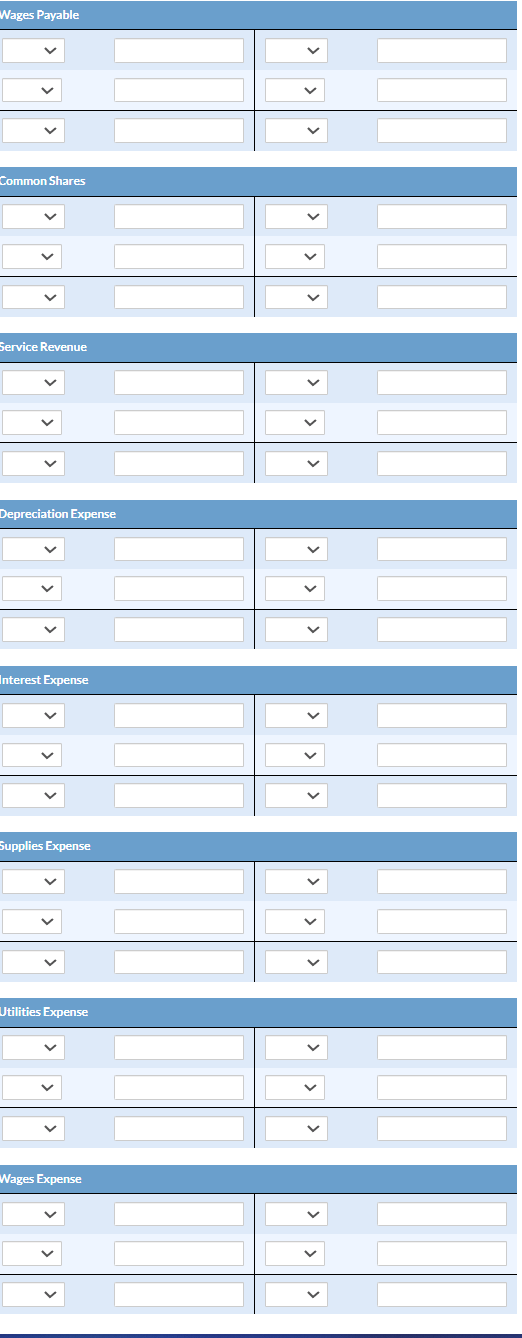

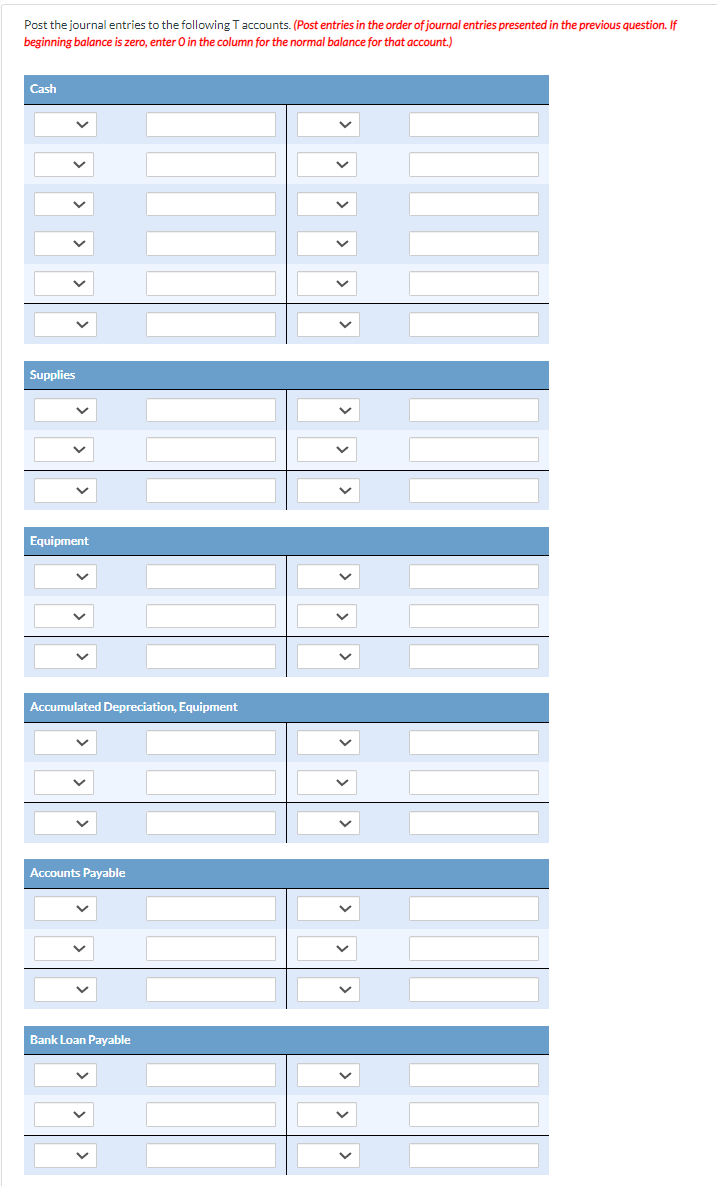

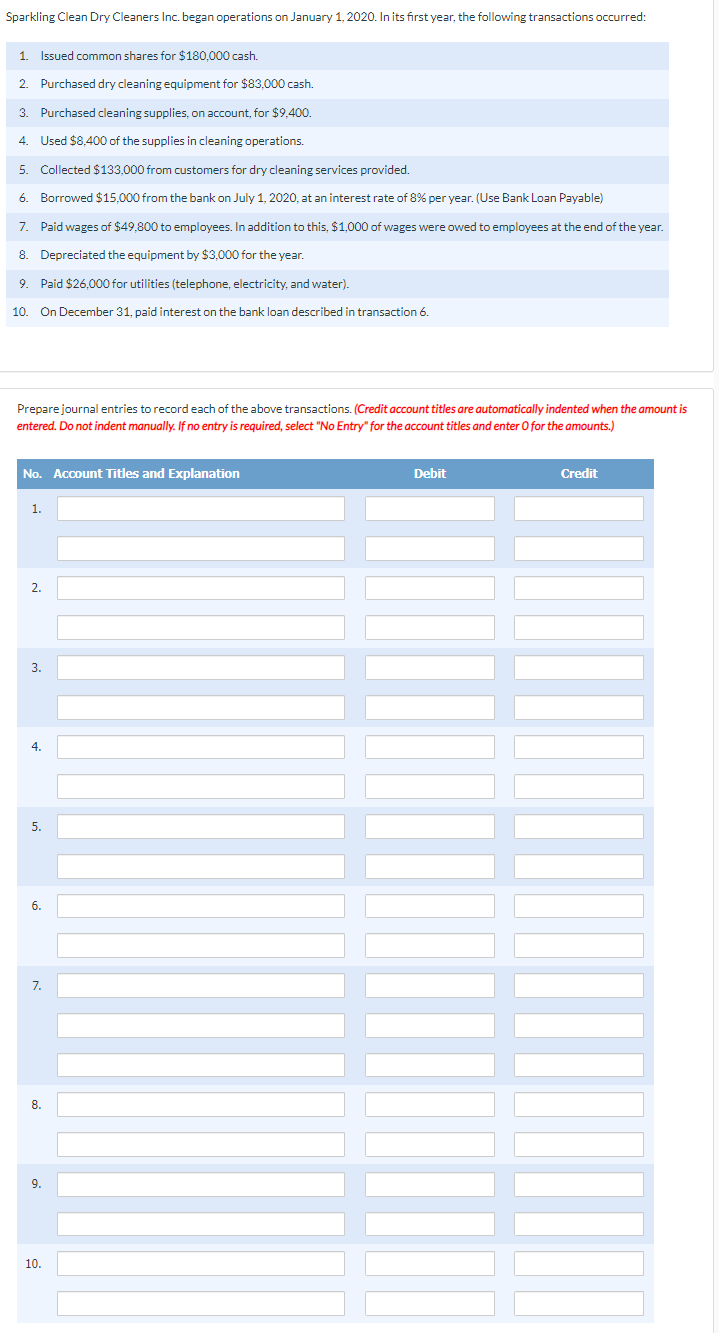

Prepare journal entries to record each of the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) No. Account Titles and Explanation Debit Credit 1. Cash 180,000 Common Shares 180000 2. Equipment 83000 Cash 83000 3. Supplies 9400 Account Payable 944 4. Supplies Expense 8400 Supplies 8400 5. Cash 133000 Service Revenue 133000 6. Cash 15000 Bank Loan Payable 15000 7. Wages Expense 50800 Cash 49800 Wages Payable 1000 8. Depreciation Expense 3000 Accumulated Depreciation-Equipment 3000 9. Utilities Expense 26000 Cash 26000 10. Interest Expense 600 Cash 600 Wages Payable Common Shares Service Revenue Depreciation Expense Interest Expense Supplies Expense Utilities Expense Wages Expense Post the journal entries to the following T accounts. (Post entries in the order of journal entries presented in the previous question. If beginning balance is zero, enter in the column for the normal balance for that account.) Cash Supplies Equipment Accumulated Depreciation, Equipment Accounts Payable Bank Loan Payable Sparkling Clean Dry Cleaners Inc. began operations on January 1, 2020. In its first year, the following transactions occurred: 1. Issued common shares for $180,000 cash. 2. Purchased dry cleaning equipment for $83.000 cash. 3. Purchased cleaning supplies, on account, for $9.400. 4. Used $8,400 of the supplies in cleaning operations. 5. Collected $133,000 from customers for dry cleaning services provided. 6. Borrowed $15.000 from the bank on July 1, 2020. at an interest rate of 8% per year. (Use Bank Loan Payable) 7. Paid wages of $49,800 to employees. In addition to this, $1,000 of wages were owed to employees at the end of the year. 8. Depreciated the equipment by $3,000 for the year. 9. Paid $26,000 for utilities (telephone, electricity, and water). 10. On December 31, paid interest on the bank loan described in transaction 6. Prepare journal entries to record each of the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) No. Account Titles and Explanation Debit Credit 1. 2. 3. 4. 5. 6. 7. 8. 9. 10