can someone do the first notes with explanation ? i would appreciate it !

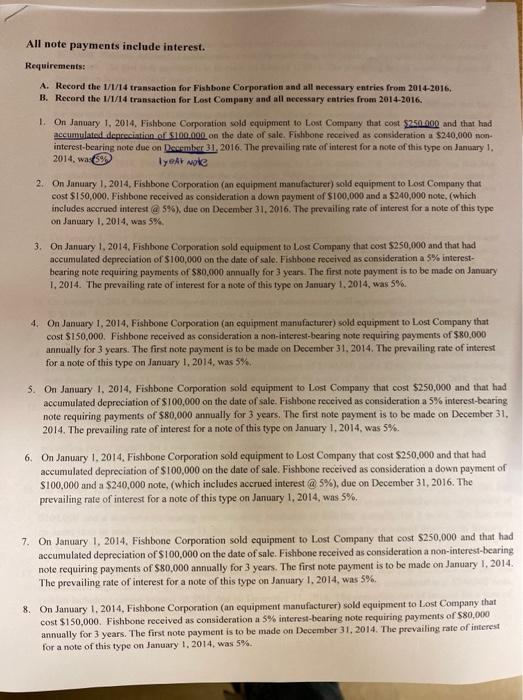

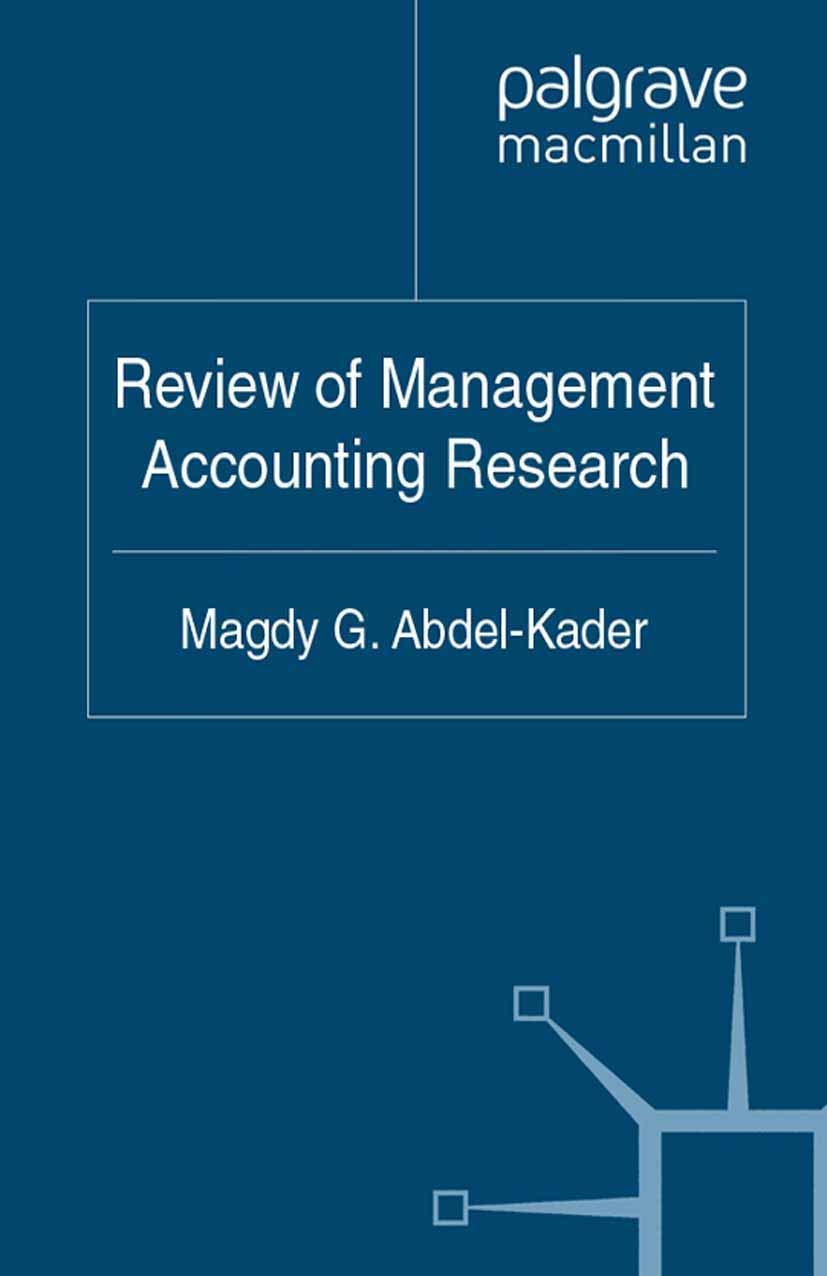

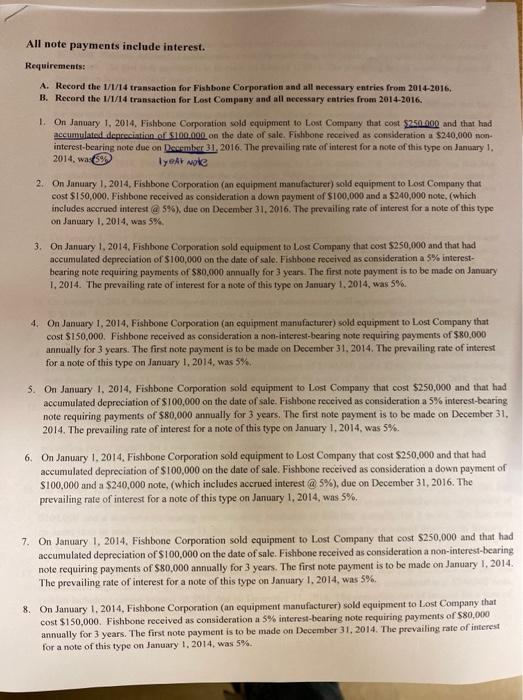

All note payments include interest. Requirements: A. Record the 1/1/14 transaction for Fishbone Corporation and all necessary entries from 2014-2016, B. Record the 1/1/14 transaction for Lost Company and all necessary entries from 2014-2016. 1. On January 1, 2014, Fishbone Corporation sold equipment to Lost Company that cost $250.000 and that had accumulated depreciation of $100.000 on the date of sale. Fishbone received as consideration a $240,000 non- interest-bearing note due on December 31, 2016. The prevailing rate of interest for a note of this type on January 1. 2014, was Iyer mole 2. On January 1, 2014. Fishbone Corporation (an equipment manufacturer) sold equipment to Lost Company that cost $150,000. Fishbone received as consideration a down payment of $100,000 and a $240,000 note, (which includes accrued interest @ S%), due on December 31, 2016. The prevailing rate of interest for a note of this type on January 1, 2014, was 5% 3. On January 1, 2014. Fishbone Corporation sold equipment to Lost Company that cost $250,000 and that had accumulated depreciation of $100,000 on the date of sale. Fishbone received as consideration a 5% interest bearing note requiring payments of $80,000 annually for 3 years. The first note payment is to be made on January 1. 2014. The prevailing rate of interest for a note of this type on January 1, 2014, was 5%. 4. On January 1, 2014. Fishbone Corporation (an equipment manufacturer) sold equipment to Lost Company that cost $150,000. Fishbone received as consideration a non-interest-bearing note requiring payments of $80.000 annually for 3 years. The first note payment is to be made on December 31, 2014. The prevailing rate of interest for a note of this type on January 1, 2014, was 5%. 5. On January 1, 2014, Fishbone Corporation sold equipment to Lost Company that cost $250,000 and that had accumulated depreciation of $100,000 on the date of sale. Fishbone received as consideration a 5% interest-bearing note requiring payments of $80,000 annually for 3 years. The first note payment is to be made on December 31, 2014. The prevailing rate of interest for a note of this type on January 1, 2014, was 5% 6. On January 1, 2014. Fishbone Corporation sold equipment to Lost Company that cost $250,000 and that had accumulated depreciation of $100,000 on the date of sale. Fishbone received as consideration a down payment of S100,000 and a $240,000 note, (which includes accrued interest @ 5%), due on December 31, 2016. The prevailing rate of interest for a note of this type on January 1, 2014, was 5%. 7. On January 1, 2014. Fishbone Corporation sold equipment to Lost Company that cost $250,000 and that had accumulated depreciation of S100,000 on the date of sale. Fishbone received as consideration a non-interest-bearing note requiring payments of $80,000 annually for 3 years. The first note payment is to be made on January 1, 2014 The prevailing rate of interest for a note of this type on January 1, 2014, was 5%. 8. On January 1, 2014, Fishbone Corporation (an equipment manufacturer) sold equipment to Lost Company that cost $150,000. Fishbone received as consideration a 5% interest-bearing note requiring payments of $80,000 annually for 3 years. The first note payment is to be made on December 31, 2014. The prevailing rate of interest for a note of this type on January 1, 2014, was 5%