Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone explain how I should be entering this on the calculator? I use the data but I get a completely different answer. You have

Can someone explain how I should be entering this on the calculator? I use the data but I get a completely different answer.

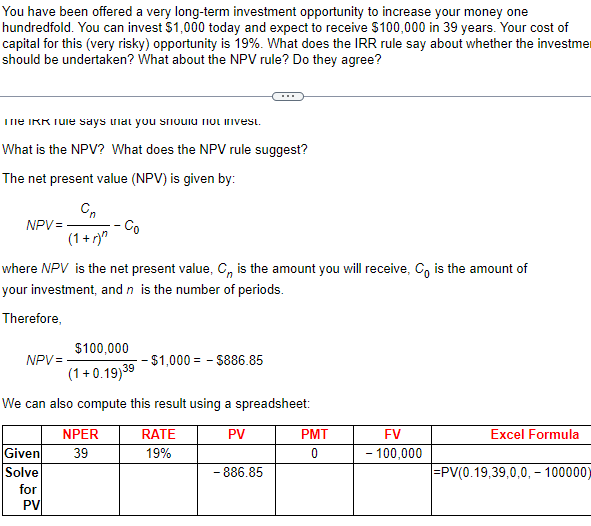

You have been offered a very long-term investment opportunity to increase your money one hundredfold. You can invest $1,000 today and expect to receive $100,000 in 39 years. Your cost of capital for this (very risky) opportunity is 19%. What does the IRR rule say about whether the investme should be undertaken? What about the NPV rule? Do they agree? I Ile IRR rule says ulat you srivuiu nul IIIvest. What is the NPV? What does the NPV rule suggest? The net present value (NPV) is given by: NPV=(1+r)nCnC0 where NPV is the net present value, Cn is the amount you will receive, C0 is the amount of your investment, and n is the number of periods. Therefore, NPV=(1+0.19)39$100,000$1,000=$886.85 We can also compute this result using a spreadsheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started