Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone explain how to get Beginning R/E (retained earnings)? it says thats its $14,000 in part B but im not sure how to get

can someone explain how to get Beginning R/E (retained earnings)? it says thats its $14,000 in part B but im not sure how to get that number! thank you :)

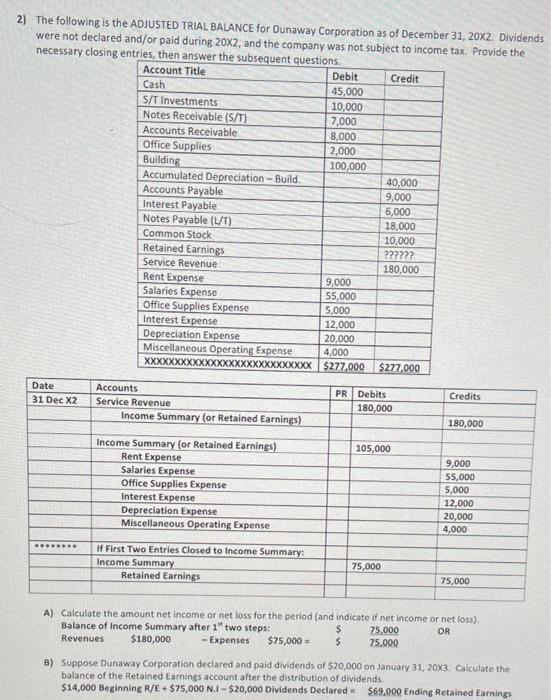

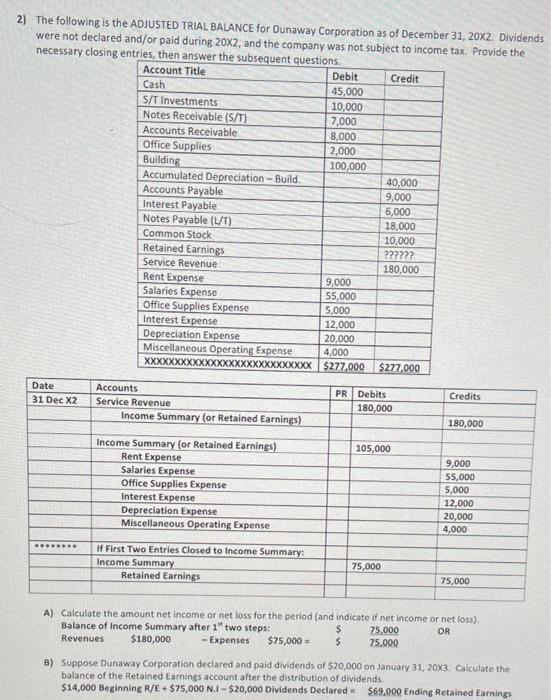

2) The following is the ADJUSTED TRIAL BALANCE for Dunaway Corporation as of December 31, 20x2. Dividends were not declared and/or paid during 20X2, and the company was not subject to income tax. Provide the necessary closing entries, then answer the subsequent questions. Account Title Debit Credit Cash 45,000 S/T Investments 10,000 Notes Receivable (S/T) 7,000 Accounts Receivable 8,000 Office Supplies 2,000 Building 100,000 Accumulated Depreciation - Build 40,000 Accounts Payable 9,000 Interest Payable 6,000 Notes Payable (L/1) 18,000 Common Stock 10,000 Retained Earnings ?????? Service Revenue 180,000 Rent Expense 9,000 Salaries Expense 55,000 Office Supplies Expense 5,000 Interest Expense 12,000 Depreciation Expense 20,000 Miscellaneous Operating Expense 4,000 XXXXXXX XXXXXXXXXXXXXXXX $277,000 $277.000 Date 31 Dec X2 Accounts Service Revenue Income Summary (or Retained Earnings) PR Debits 180,000 Credits 180,000 105,000 Income Summary (or Retained Earnings) Rent Expense Salaries Expense Office Supplies Expense Interest Expense Depreciation Expense Miscellaneous Operating Expense 9,000 55,000 5,000 12,000 20,000 4,000 8. If First Two Entries Closed to Income Summary: Income Summary Retained Earnings 75,000 75,000 A) Calculate the amount net income or net loss for the period (and indicate if net income or net loss): Balance of Income Summary after 1" two steps: $ 75,000 OR Revenues $180,000 Expenses $75,000 = $ 75,000 B) Suppose Dunaway Corporation declared and paid dividends of $20,000 on January 31, 20X3. Calculate the balance of the Retained Earnings account after the distribution of dividends. $14,000 Beginning R/E + $75,000 N.I- $20,000 Dividends Declared = $69.000 Ending Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started