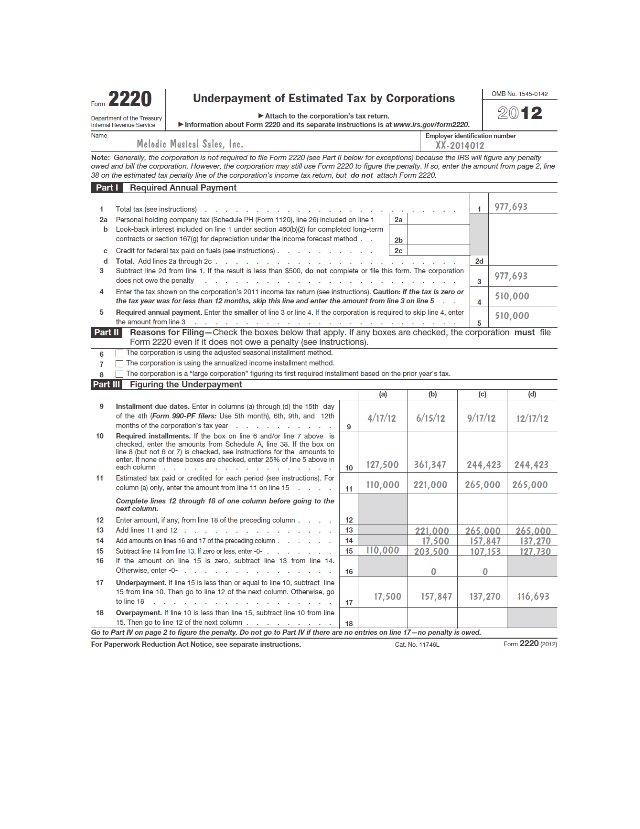

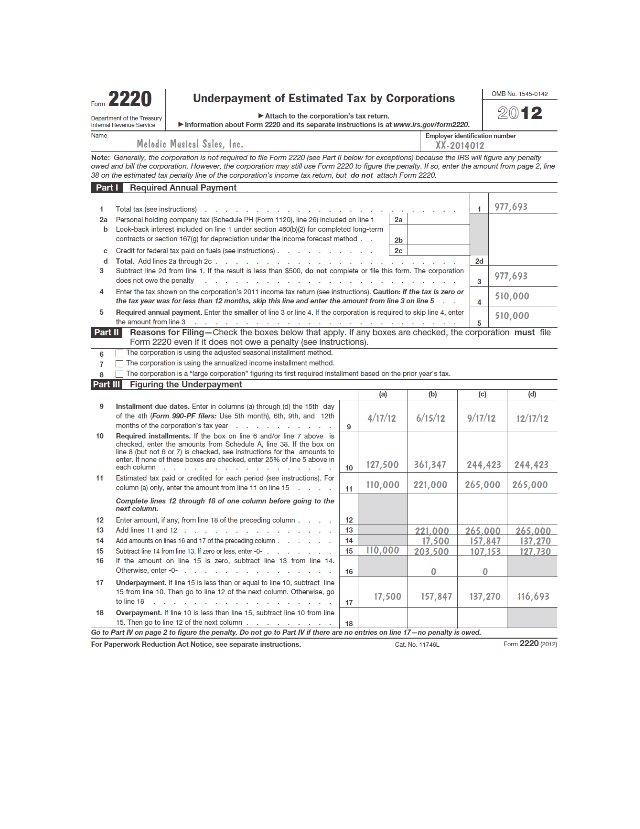

Can someone explain to me why Line 10 of the Form 2220 is different for each column? It says 25% of Line 5 but I'm not sure how to do the math here. Need tax expert FAST!

This is a TAX FORM 2220! I NEED A TAX EXPERT TO HELP ME WITH THIS BY SATURDAY PLEASE.

Pon 2220 2012 | OVB u. 1545-0142 Underpayment of Estimated Tax by Corporations Attach to the corporation's to return Ind r e SV T Information about Form 2220 and its separate instructions is at www.is.goviform2320. Employer endliwian nante Melodic Masital Sales, Inc. XX.2014012 Note: Generally, me corporation is not required to the Form 220 Hart il below for exceptional because the IRS w figure any penalty owed and the corporation. However, the corporation may use Form 2220 to figure the perly. If so, enter the amount fron page 2, re 30 on the estimated tax perity Ane of the corporandori's poome tax return, but do not attach Form 2220. Part Required Annual Payment 977,693 1 Totalt see instructions 2a Personal holding company tax SchedulPH Form 11201, line 26 included on line 1 2 b Look-back interest included on line 1 under section 480b (21 for completed long-term contracts or on 1671 low depreciation under the income forecast method.. C Credit for Mederal tax pad on instruction). . . . .. 2c Total Audines 2a through 20. . . . . . . . . . . . . . . 3 Subtract lined from line 1. If the resulta la transico, do not complete or to this form. The corporation 977,693 does not owg the penalty . . . . . . . . . . . . . . . . . . - 4 Enter the tax shown on the corporation's 2011 income tax rehme nstrictiona Cautions if the tax is zaroor 510 000 the tax or was for less than 12 months, skip thine and on the amount from lines on line 5 5 Required annual payment. Enter the smaller of line 3 or line 4. the corporation is requred to skip line 4. enter 510,000 the amount from line 3 Part II Reasons for Filing-Check the boxes bekw that apply. If any boxes are checked, the corporation must file Form 2220 even if it does not owe a penalty (see Instructions). The corporation is using the adjusted seasonal installment mothod 7 The corporation is in the annual income installment method The corporation is a large corporation" guring its first required installment based on the prior yoar's tal Part III Figuring the Underpayment (1) (c) 9 Installmont due dates. Entor in columns al through the 15th day of the ath Farm 900-PF : U sth month, th, 9th and 12th 4/17/126 /15/12 9/17/12 12/17/12 months of the corporation's tax year Required installments. If the box on line and or Ine 7 above is checked. enter the amounts from Schedule A line 38. If the bor un line but not for a chackad, SA Instructions for the amountain ontor. If none of those bons are chockad. antor 25% of line 5 above in 361,347 244,423 each court. 244,423 . . 10127,500 . . . . . . Estimated tax paid or credited for each period see instructions. For column only, nor the amount tromi 11 on line 15. 110,000 221,000 265,000 265,000 Complete lis 12 through 18 of cow before going to the next column 12 tramuntany, from line 13 of the preceding solum 13 Add in 11 and 12 . 221.000 265.000 265.000 14 Add amounts on ins10 and 17 of the preceding ect . . . . . 17,500 157.847 137.270 15 Sutra 14 lane 13. less, enter--- . . 15 110,000 203.500 107.153 127.730 16 the amount on line 15 ro, subtract line 18 trom line 14. Otherwise enter -- 17 Underpayment. Itine 15 a less than or equal to Ine 10, subtract line 15 tram Ina 10. Then go to na 12 ottenext column. Other go 17,500 157,847 137,270 116,693 o line 19 . . . 18 Overpayment. Ina 10 less than InA 15, subtract line 10 tram Ina 15. Then go to ine 12 of the next column. . . 18 Go to Part IV on page 2 to figure the penalty. Do not go to Part IV if there are no entries on line 17 -no penalty is owod. For Paperwork Reduction Act Notice, we separate instructions. Cal. No. 11746L Com 2220013) 10