Answered step by step

Verified Expert Solution

Question

1 Approved Answer

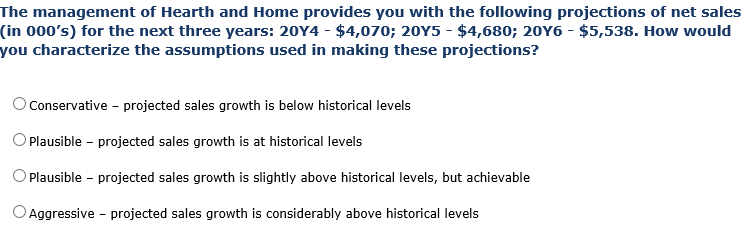

Can someone help. I don't believe the answer is C or D. Thanks The management of Hearth and Home provides you with the following projections

Can someone help. I don't believe the answer is C or D. Thanks

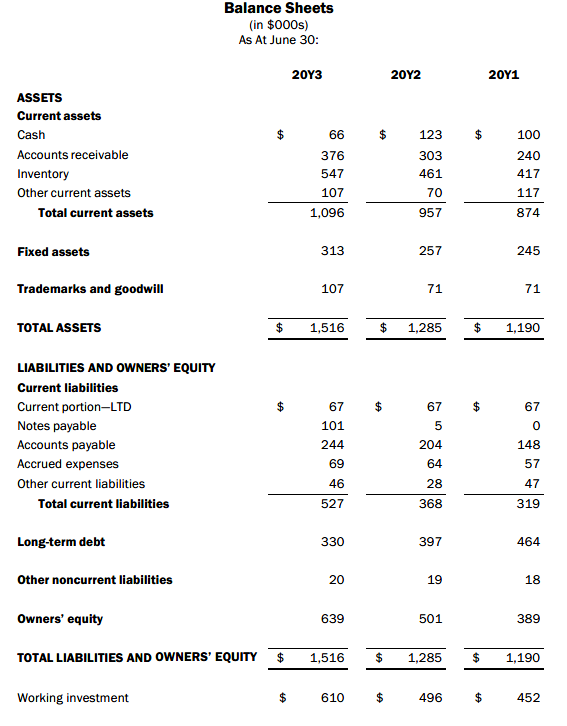

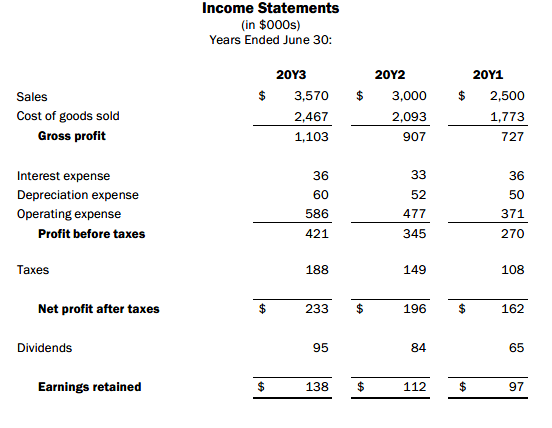

The management of Hearth and Home provides you with the following projections of net sales (in 000's) for the next three years: 2044 - $4,070; 2045 - $4,680; 2076 - $5,538. How would you characterize the assumptions used in making these projections? O Conservative - projected sales growth is below historical levels O Plausible - projected sales growth is at historical levels O Plausible - projected sales growth is slightly above historical levels, but achievable O Aggressive - projected sales growth is considerably above historical levels Balance Sheets (in $000s) As At June 30: 20Y3 20Y2 20Y1 ASSETS Current assets Cash Accounts receivable Inventory Other current assets Total current assets 66 376 547 123 303 461 100 240 107 70 117 874 1,096 957 Fixed assets 313 245 Trademarks and goodwill 107 71 TOTAL ASSETS $ 1,516 $ 1,285 $ 1,190 67 $ 67 $ 67 67 LIABILITIES AND OWNERS' EQUITY Current liabilities Current portion-LTD Notes payable Accounts payable Accrued expenses Other current liabilities Total current liabilities Long-term debt 464 Other noncurrent liabilities 18 Owners' equity 389 TOTAL LIABILITIES AND OWNERS' EQUITY $ 1,516 $ 1,285 $ 1,190 Working investment $ 610 $ 496 $ 452 Income Statements in $000s) Years Ended June 30: $ $ $ Sales Cost of goods sold Gross profit 20Y3 3,570 2,467 1,103 2012 3,000 2,093 907 20Y1 2,500 1,773 727 36 Interest expense Depreciation expense Operating expense Profit before taxes 36 60 586 421 50 371 270 Taxes 188 108 Net profit after taxes 233 $ 196 $ 162 Dividends 95 Earnings retained s 138 112 5 97Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started