Answered step by step

Verified Expert Solution

Question

1 Approved Answer

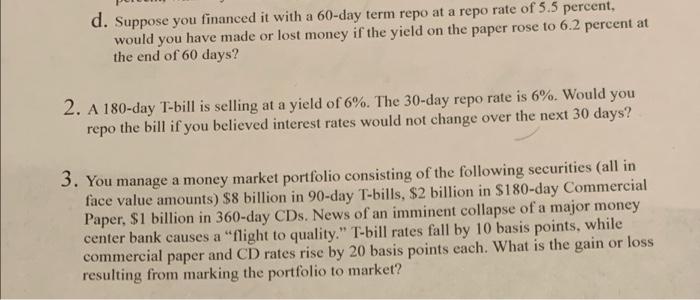

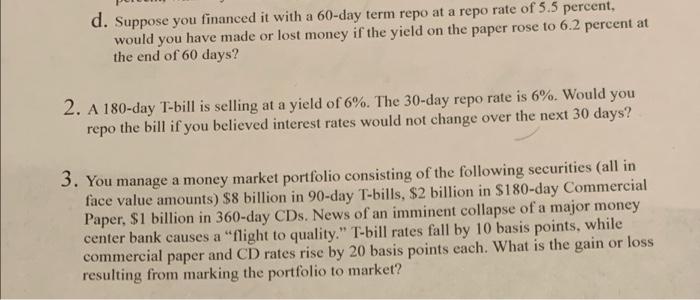

can someone help me ans the following qurstion d. Suppose you financed it with a 60-day term repo at a repo rate of 5.5 percent,

can someone help me ans the following qurstion

d. Suppose you financed it with a 60-day term repo at a repo rate of 5.5 percent, would you have made or lost money if the yield on the paper rose to 6.2 percent at the end of 60 days? 2. A 180-day T-bill is selling at a yield of 6%. The 30-day repo rate is 6%. Would you repo the bill if you believed interest rates would not change over the next 30 days? 3. You manage a money market portfolio consisting of the following securities (all in face value amounts) $8 billion in 90-day T-bills, $2 billion in $180-day Commercial Paper, $1 billion in 360-day CDs. News of an imminent collapse of a major money center bank causes a "flight to quality." T-bill rates fall by 10 basis points, while commercial paper and CD rates rise by 20 basis points each. What is the gain or loss resulting from marking the portfolio to market? d. Suppose you financed it with a 60-day term repo at a repo rate of 5.5 percent, would you have made or lost money if the yield on the paper rose to 6.2 percent at the end of 60 days? 2. A 180-day T-bill is selling at a yield of 6%. The 30-day repo rate is 6%. Would you repo the bill if you believed interest rates would not change over the next 30 days? 3. You manage a money market portfolio consisting of the following securities (all in face value amounts) $8 billion in 90-day T-bills, $2 billion in $180-day Commercial Paper, $1 billion in 360-day CDs. News of an imminent collapse of a major money center bank causes a "flight to quality." T-bill rates fall by 10 basis points, while commercial paper and CD rates rise by 20 basis points each. What is the gain or loss resulting from marking the portfolio to market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started