Can someone help me answer these in this format? thank you!!

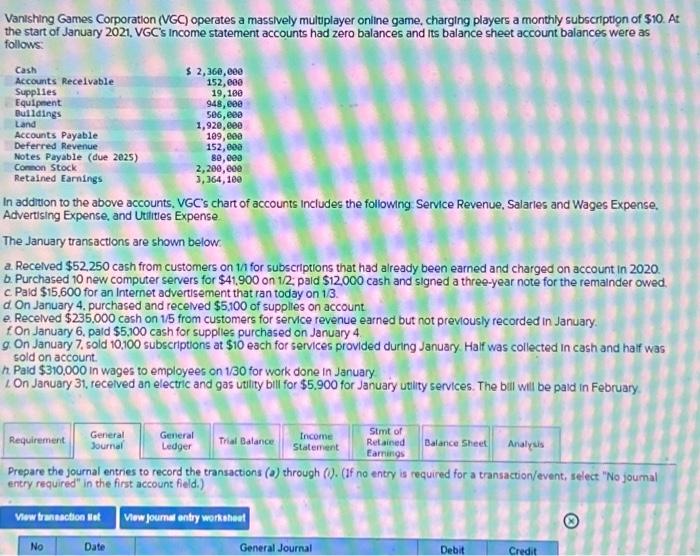

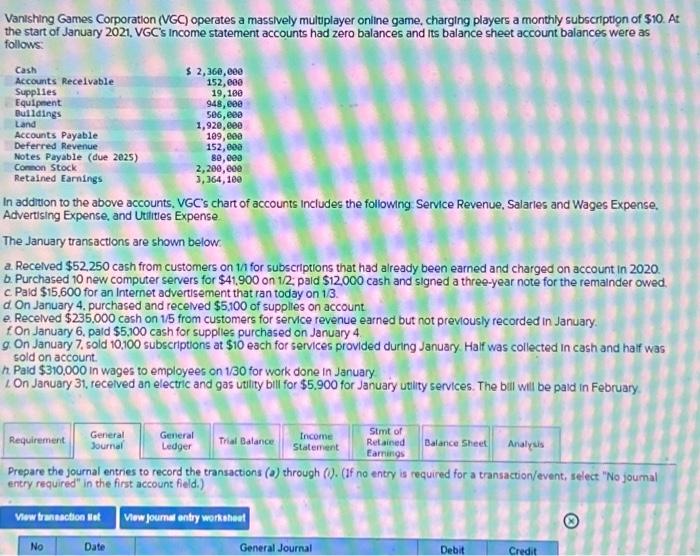

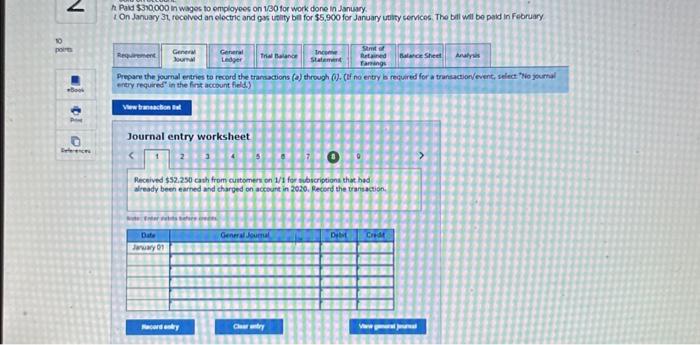

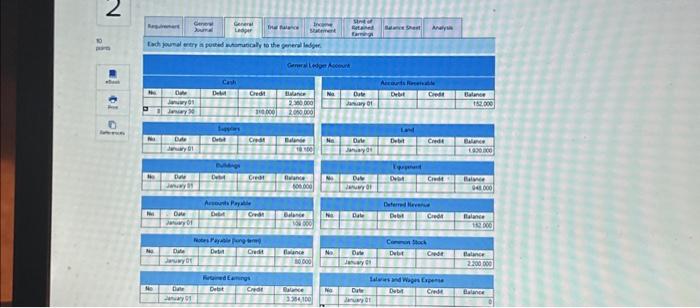

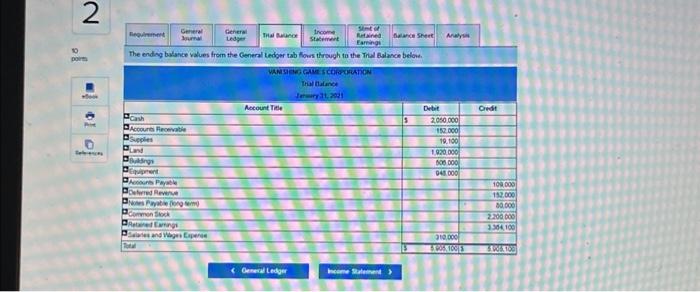

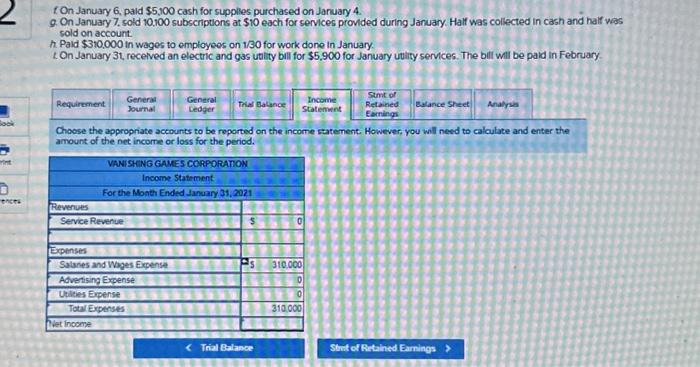

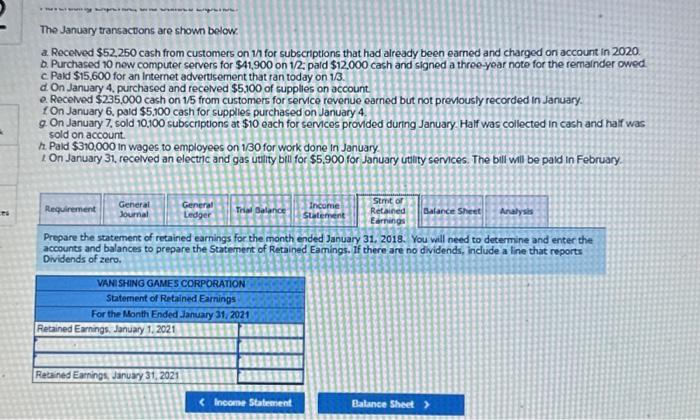

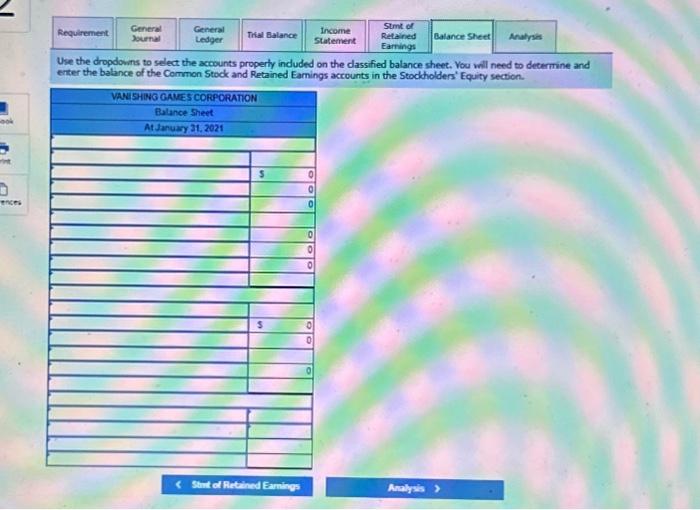

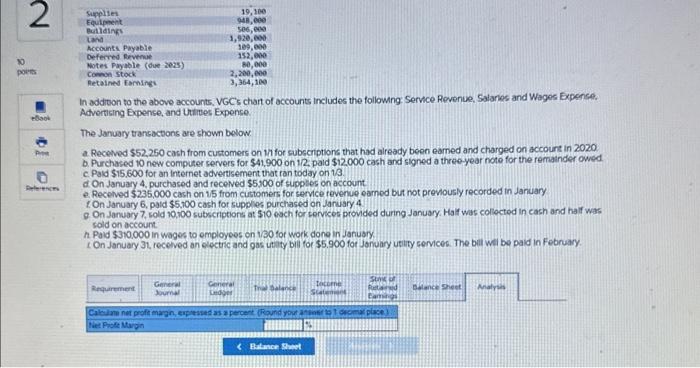

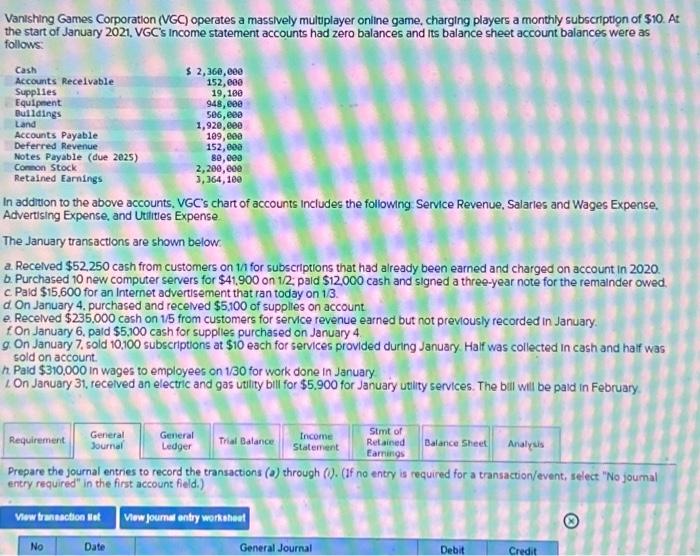

The ending balance values from the Ceneral Ledoer tab fous through to the Thul Ealance below. In additon to the above accounts, VGCs chant of accounts includes the followng Servce Revenue, Salaries and Wages Expanse. Advertising Expense, and Utimes Expense. The January trancactions are shown below. a Recelved $52,250 cash from customers on yifor subscriptions that had already beon earned and charged on accours in 2020 . a. Recelved $52,250 cach from customers on 11 for subscriptions that had already beon earned and charged on accours in 2020 , c. Paid $15.600 for an internet advertisement that ran today on 13. d. On January 4, purchased and receved $5,00 of supplios on account e. Recelved $235,000 cash on 15 from customers for service revenue earnod but not previously recorded in January t. On January 6, pald $5,100 cash for supplies purchased on Jariary 4 8. On January 7, sold 10,100 subscriptions at $10 esch for services provided during January. Haif was collected in cash and half was sold on account. h. Paid $310.000 in wages to employees on 130 tor work done in Janusy Vanishing Games Corporation (VGC) operates a massively multiplayer oniline game, charging players a monthly subscriptipn of $10. At the start of January 2021, VGC's income statement accounts had zero balances and its balance sheet account balances were as follows: In addition to the above accounts, VGC's chart of accounts Includes the followng Service Revenue, Salarles and Wages Expense, Advertising Expense, and Utities Expense The January transactions are shown below: a. Recelved $52.250 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020 . b. Purchased 10 new computer servers for $41,900 on 1/2; pald $12,000 cash and signed a three-year note for the remainder owed. c. Paid $15,600 for an Internet advertsement that ran today on 1/3. d. On January 4, purchased and recelved $5,100 of supplles on account. e. Recelved $235.000 cash on 1/5 from customers for service revenue earned but not previously recorded in January. fOn January 6, pald $5,100 cash for supplies purchased on January 4 g. On January 7, sold 10,100 subscriptions at $10 each for services provided during January. Half was collected in cash and half was sold on account. h. Paid $310,000 in wages to employees on 1/30 for work done in January LOn January 31 , recelved an electric and gas utility bill for $5,900 for January utlity services. The bill will be paid in February. Prepare the journal entries to record the transactions (a) through (0). (If no entry is required for a transaction/event, select "No joumal entry required" in the first accouns field.) Use the dropdowns to select the accounts properly induded on the dassified balance sheet. Vou will need to detarmine and enter the balance of the Common Stock and Retained Eamings accounts in the Stockholders' Equity section. t On January 6, pald \$5,00 cash for supplles purchased on Jaruary 4. 9. On January 7, sold 10,100 subscriptions at $10 each for services provided during January. Half was collected in cash and half was sold on account. h. Paid $310,000 in wages to employeos on 1/30 for work done in January. t. On January 3t, recelved an electric and gas utility bill for $5,900 for January utility services. The bill will be paid in February. Choose the appropriate accounts to be reported on the income ratement. However, you will need to calculate and enter the amount of the net incorne or loss for the period. h Paid $370000 in wagos to employees on 1/30 for work done in Junuary. t On January 32 , fecelved an eloctric and gas tnity bet for $5,900 for January utity services. The bil wall be paid in Feoruary enery requires" in the fint acoount field) Journal entry worksheet 2345470 Rectived $52.250 auh from cuntomen on 1/1 for subscriptions that had already been earned and charged on actount in 2020. Pectord the varnaction. The January transactions are shown below: a. Recelved $52,250 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020 . b. Purchased 10 new computer servers for $41,900 on 1/2 pald $12,000 cash and signed a three-year note for the remainder owed. C. Pald $15,600 for an Internet advertsement that ran today on 1/3. d. On January 4, purchased and recelved $5,100 of supplies on account. e. Recelved $235,000 cash on 1/5 from customers for servce revenue earned but not prevously recorded in January. t On January 6, paid $5,100 cash for supplies purchased on January 4 . g. On January 7, sold 10,100 subscriptions at $10 each for semces provided during January. Half was collected in cash and half was sold on account. h. Pald $310,000 in wages to employees on 1/30 for work done in January. t On January 31 , recelved an electric and gas utility bill for $5,900 for January uthity semces. The bill will be pald in February. Propare the statement of retained earnings for the month ended January 31, 2018. You wall need to determine and enter the accounts and balances to prepare the Statement of Retained Eamings. If there are no dividends, include a line that reports Dividends of zero. The ending balance values from the Ceneral Ledoer tab fous through to the Thul Ealance below. In additon to the above accounts, VGCs chant of accounts includes the followng Servce Revenue, Salaries and Wages Expanse. Advertising Expense, and Utimes Expense. The January trancactions are shown below. a Recelved $52,250 cash from customers on yifor subscriptions that had already beon earned and charged on accours in 2020 . a. Recelved $52,250 cach from customers on 11 for subscriptions that had already beon earned and charged on accours in 2020 , c. Paid $15.600 for an internet advertisement that ran today on 13. d. On January 4, purchased and receved $5,00 of supplios on account e. Recelved $235,000 cash on 15 from customers for service revenue earnod but not previously recorded in January t. On January 6, pald $5,100 cash for supplies purchased on Jariary 4 8. On January 7, sold 10,100 subscriptions at $10 esch for services provided during January. Haif was collected in cash and half was sold on account. h. Paid $310.000 in wages to employees on 130 tor work done in Janusy Vanishing Games Corporation (VGC) operates a massively multiplayer oniline game, charging players a monthly subscriptipn of $10. At the start of January 2021, VGC's income statement accounts had zero balances and its balance sheet account balances were as follows: In addition to the above accounts, VGC's chart of accounts Includes the followng Service Revenue, Salarles and Wages Expense, Advertising Expense, and Utities Expense The January transactions are shown below: a. Recelved $52.250 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020 . b. Purchased 10 new computer servers for $41,900 on 1/2; pald $12,000 cash and signed a three-year note for the remainder owed. c. Paid $15,600 for an Internet advertsement that ran today on 1/3. d. On January 4, purchased and recelved $5,100 of supplles on account. e. Recelved $235.000 cash on 1/5 from customers for service revenue earned but not previously recorded in January. fOn January 6, pald $5,100 cash for supplies purchased on January 4 g. On January 7, sold 10,100 subscriptions at $10 each for services provided during January. Half was collected in cash and half was sold on account. h. Paid $310,000 in wages to employees on 1/30 for work done in January LOn January 31 , recelved an electric and gas utility bill for $5,900 for January utlity services. The bill will be paid in February. Prepare the journal entries to record the transactions (a) through (0). (If no entry is required for a transaction/event, select "No joumal entry required" in the first accouns field.) Use the dropdowns to select the accounts properly induded on the dassified balance sheet. Vou will need to detarmine and enter the balance of the Common Stock and Retained Eamings accounts in the Stockholders' Equity section. t On January 6, pald \$5,00 cash for supplles purchased on Jaruary 4. 9. On January 7, sold 10,100 subscriptions at $10 each for services provided during January. Half was collected in cash and half was sold on account. h. Paid $310,000 in wages to employeos on 1/30 for work done in January. t. On January 3t, recelved an electric and gas utility bill for $5,900 for January utility services. The bill will be paid in February. Choose the appropriate accounts to be reported on the income ratement. However, you will need to calculate and enter the amount of the net incorne or loss for the period. h Paid $370000 in wagos to employees on 1/30 for work done in Junuary. t On January 32 , fecelved an eloctric and gas tnity bet for $5,900 for January utity services. The bil wall be paid in Feoruary enery requires" in the fint acoount field) Journal entry worksheet 2345470 Rectived $52.250 auh from cuntomen on 1/1 for subscriptions that had already been earned and charged on actount in 2020. Pectord the varnaction. The January transactions are shown below: a. Recelved $52,250 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020 . b. Purchased 10 new computer servers for $41,900 on 1/2 pald $12,000 cash and signed a three-year note for the remainder owed. C. Pald $15,600 for an Internet advertsement that ran today on 1/3. d. On January 4, purchased and recelved $5,100 of supplies on account. e. Recelved $235,000 cash on 1/5 from customers for servce revenue earned but not prevously recorded in January. t On January 6, paid $5,100 cash for supplies purchased on January 4 . g. On January 7, sold 10,100 subscriptions at $10 each for semces provided during January. Half was collected in cash and half was sold on account. h. Pald $310,000 in wages to employees on 1/30 for work done in January. t On January 31 , recelved an electric and gas utility bill for $5,900 for January uthity semces. The bill will be pald in February. Propare the statement of retained earnings for the month ended January 31, 2018. You wall need to determine and enter the accounts and balances to prepare the Statement of Retained Eamings. If there are no dividends, include a line that reports Dividends of zero