Can someone help me answer this question? Use the information below to answer a-d.

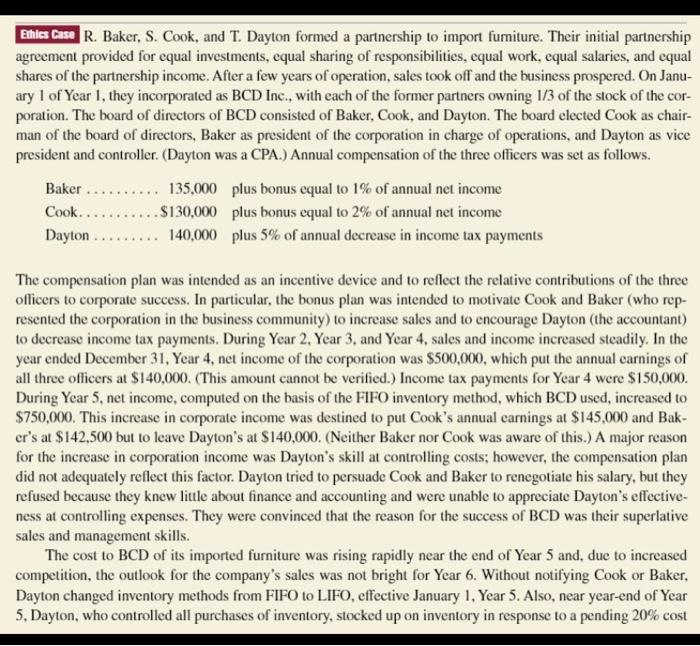

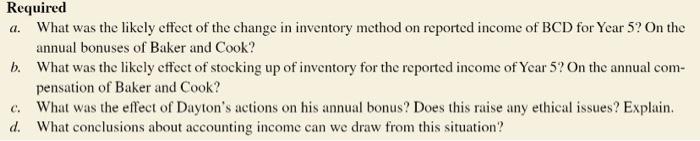

Eahies case R. Baker, S. Cook, and T. Dayton formed a partnership to import furniture. Their initial partnership agreement provided for equal investments, equal sharing of responsibilities, equal work, equal salaries, and equal shares of the partnership income. After a few years of operation, sales took off and the business prospered. On January 1 of Year 1 , they incorporated as BCD Inc., with each of the former partners owning 1/3 of the stock of the corporation. The board of directors of BCD consisted of Baker, Cook, and Dayton. The board elected Cook as chairman of the board of directors, Baker as president of the corporation in charge of operations, and Dayton as vice president and controller. (Dayton was a CPA.) Annual compensation of the three officers was set as follows. The compensation plan was intended as an incentive device and to reflect the relative contributions of the three officers to corporate success. In particular, the bonus plan was intended to motivate Cook and Baker (who represented the corporation in the business community) to increase sales and to encourage Dayton (the accountant) to decrease income tax payments. During Year 2, Year 3, and Year 4, sales and income increased steadily. In the year ended December 31 , Year 4 , net income of the corporation was $500,000, which put the annual earnings of all three officers at $140,000. (This amount cannot be verified.) Income tax payments for Year 4 were $150,000. During Year 5, net income, computed on the basis of the FIFO inventory method, which BCD used, increased to $750,000. This increase in corporate income was destined to put Cook's annual earnings at $145,000 and Baker's at $142,500 but to leave Dayton's at $140,000. (Neither Baker nor Cook was aware of this.) A major reason for the increase in corporation income was Dayton's skill at controlling costs; however, the compensation plan did not adequately reflect this factor. Dayton tried to persuade Cook and Baker to renegotiate his salary, but they refused because they knew little about finance and accounting and were unable to appreciate Dayton's effectiveness at controlling expenses. They were convinced that the reason for the success of BCD was their superlative sales and management skills. The cost to BCD of its imported furniture was rising rapidly near the end of Year 5 and, due to increased competition, the outlook for the company's sales was not bright for Year 6. Without notifying Cook or Baker, Dayton changed inventory methods from FIFO to LIFO, effective January 1, Year 5. Also, near year-end of Year 5, Dayton, who controlled all purchases of inventory, stocked up on inventory in response to a pending 20% cost increase announced by BCD's suppliers; the price increase was to become effective in January of Year 6. Because of the change to LIFO, income tax payments for Year 5 decreased to $70,000. a. What was the likely effect of the change in inventory method on reported income of BCD for Year 5 ? On the annual bonuses of Baker and Cook? b. What was the likely effect of stocking up of inventory for the reported income of Year 5 ? On the annual compensation of Baker and Cook? c. What was the effect of Dayton's actions on his annual bonus? Does this raise any ethical issues? Explain. d. What conclusions about accounting income can we draw from this situation