Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me? chapter-17 , - ) . Review the Work-In-Process Inventory general ledger account you prepared in Requirement 2 X Sorry, that's not

Can someone help me?

Can someone help me?

chapter-17

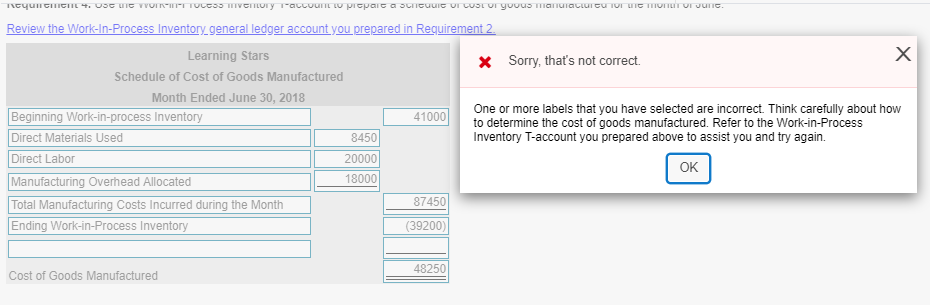

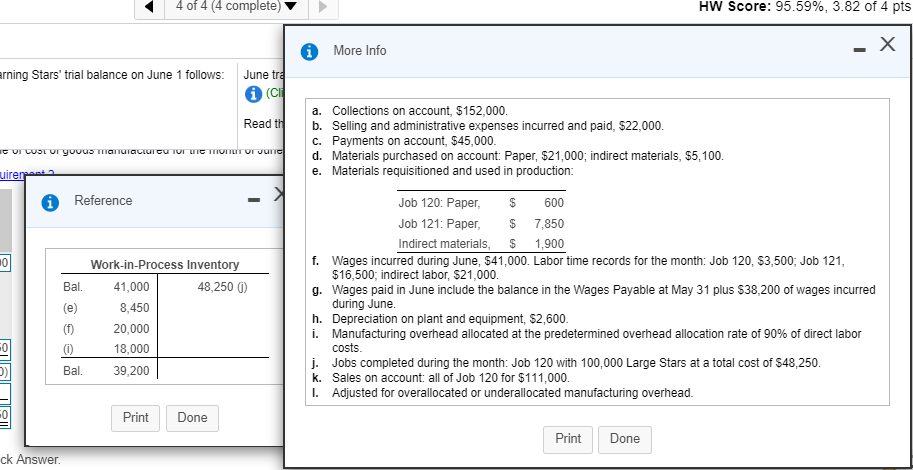

, - ) . Review the Work-In-Process Inventory general ledger account you prepared in Requirement 2 X Sorry, that's not correct. 41000 One or more labels that you have selected are incorrect. Think carefully about how to determine the cost of goods manufactured. Refer to the Work-in-Process Inventory T-account you prepared above to assist you and try again. Learning Stars Schedule of Cost of Goods Manufactured Month Ended June 30, 2018 Beginning Work-in-process Inventory Direct Materials Used 8450 Direct Labor 20000 Manufacturing Overhead Allocated Total Manufacturing Costs incurred during the Month Ending Work-in-Process Inventory OK 18000 87450 (39200) Cost of Goods Manufactured 4 of 4 (4 complete) HW Score: 95.59%, 3.82 of 4 pts More Info - X arning Stars' trial balance on June 1 follows: June tra (CE Read the a. Collections on account, $152,000. b. Selling and administrative expenses incurred and paid, $22,000. c. Payments on account, $45,000. d. Materials purchased on account: Paper, $21,000, indirect materials, $5,100. e. Materials requisitioned and used in production: CUI LUST Or yvuus mama LUI CU TOI ME MOTITUT June uireret A Reference Work-in-Process Inventory Bal. 41,000 48,2500 8,450 20,000 18,000 Bal. 39,200 Job 120: Paper, $ 600 Job 121: Paper, $ 7,850 Indirect materials, $ 1,900 f. Wages incurred during June, $41,000. Labor time records for the month: Job 120, $3,500, Job 121, $16,500; indirect labor, $21,000. g. Wages paid in June include the balance in the Wages Payable at May 31 plus $38,200 of wages incurred during June h. Depreciation on plant and equipment, $2,600. i. Manufacturing overhead allocated at the predetermined overhead allocation rate of 90% of direct labor costs. Jobs completed during the month Job 120 with 100,000 Large Stars at a total cost of $48,250. k. Sales on account: all of Job 120 for $111,000. I. Adjusted for overallocated or underallocated manufacturing overhead. Print Done Print Done ckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started