Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me convert my answers into cell formula. im lost begin{tabular}{|l|l|} hline 25 & Standard Cost Variance Analysis - Direct Materials hline

can someone help me convert my answers into cell formula. im lost

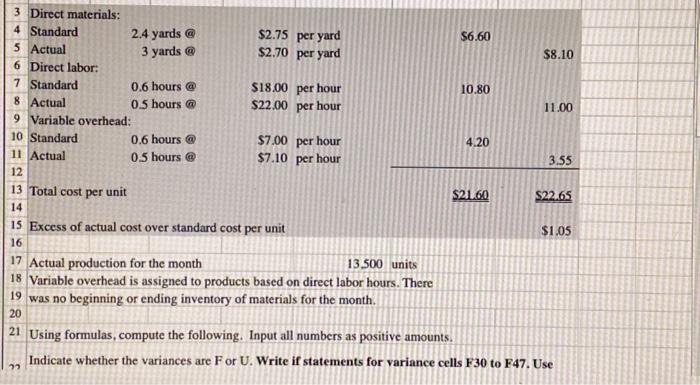

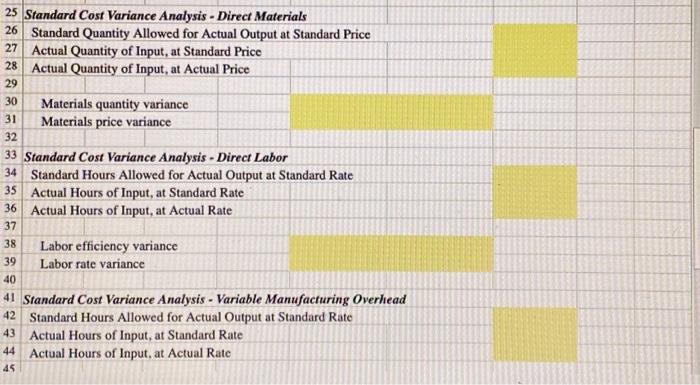

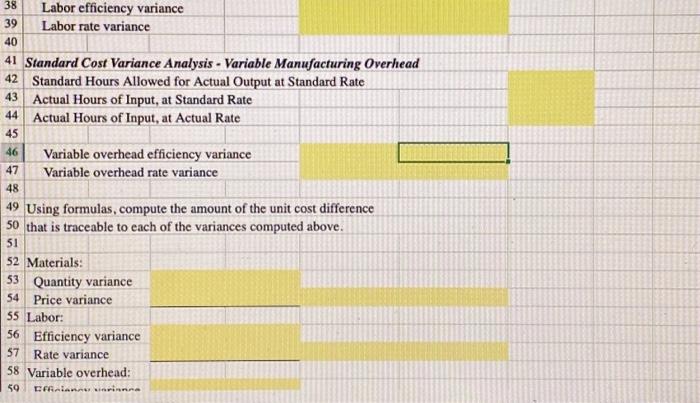

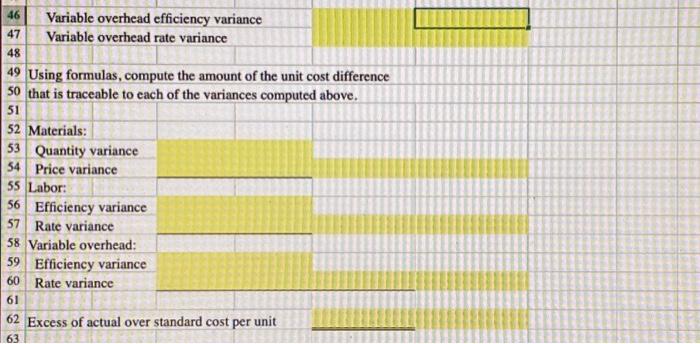

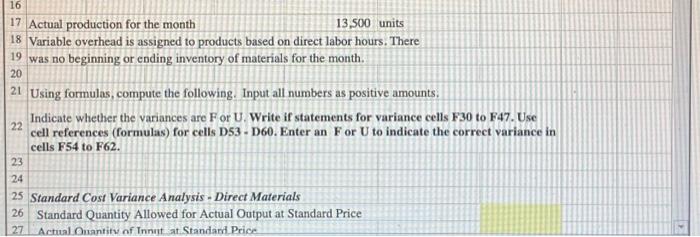

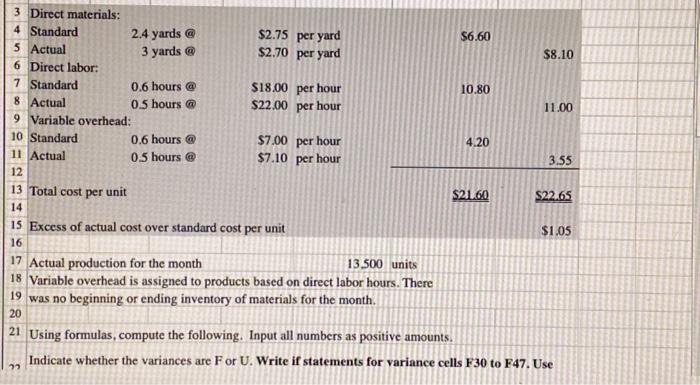

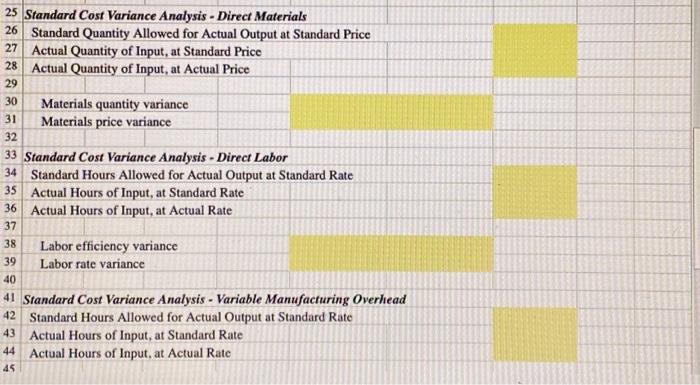

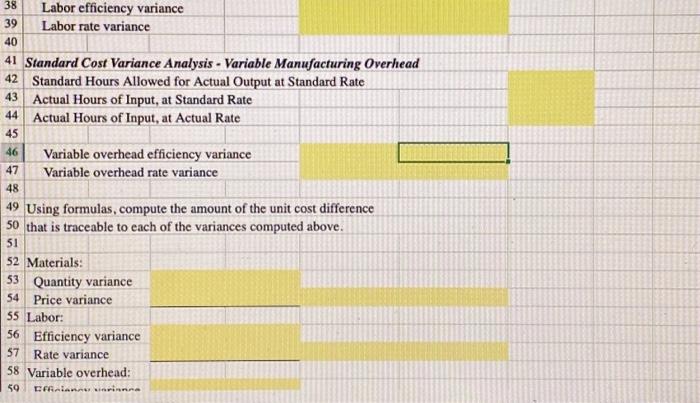

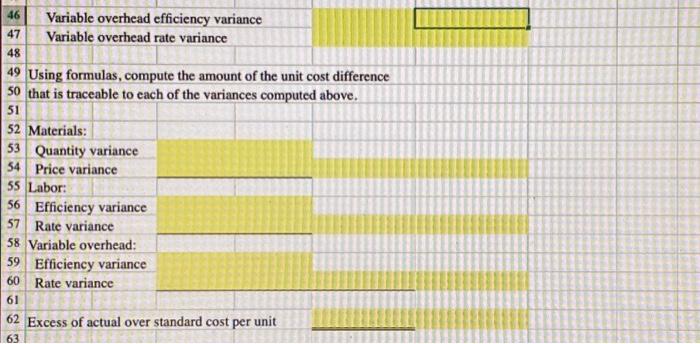

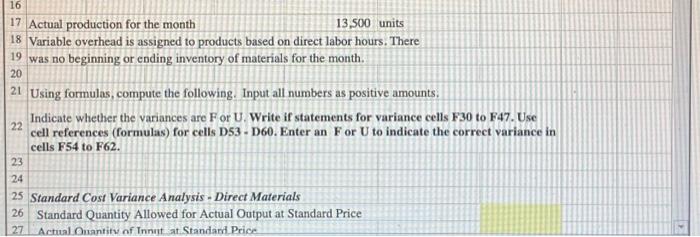

\\begin{tabular}{|l|l|} \\hline 25 & Standard Cost Variance Analysis - Direct Materials \\\\ \\hline 26 & Standard Quantity Allowed for Actual Output at Standard Price \\\\ \\hline 28 & Actual Quantity of Input, at Standard Price \\\\ \\hline 29 & Actual Quantity of Input, at Actual Price \\\\ \\hline 30 & Materials quantity variance \\\\ \\hline 31 & Materials price variance \\\\ \\hline 32 & \\\\ \\hline 33 & Standard Cost Variance Analysis - Direct Labor \\\\ \\hline 34 & Standard Hours Allowed for Actual Output at Standard Rate \\\\ \\hline 35 & Actual Hours of Input, at Standard Rate \\\\ \\hline 36 & Actual Hours of Input, at Actual Rate \\\\ \\hline 37 & \\\\ \\hline 38 & Labor efficiency variance \\\\ \\hline 39 & Labor rate variance \\\\ \\hline 40 & \\\\ \\hline 41 & Standard Cost Variance Analysis - Variable Manufacturing Overhead \\\\ \\hline 42 & Standard Hours Allowed for Actual Output at Standard Rate \\\\ \\hline 43 & Actual Hours of Input, at Standard Rate \\\\ \\hline 44 & Actual Hours of Input, at Actual Rate \\\\ \\hline 45 & \\end{tabular} \\begin{tabular}{|l|l|} \\hline 46 & Variable overhead efficiency variance \\\\ \\hline 47 & Variable overhead rate variance \\\\ \\hline 48 & \\\\ \\hline 49 & Using formulas, compute the amount of the unit cost difference \\\\ \\hline 50 & that is traceable to each of the variances computed above. \\\\ \\hline 51 & \\\\ \\hline 52 & Materials: \\\\ \\hline 53 & Quantity variance \\\\ \\hline 54 & Price variance \\\\ \\hline 55 & Labor: \\\\ \\hline 56 & Efficiency variance \\\\ \\hline 57 & Rate variance \\\\ \\hline 58 & Variable overhead: \\\\ \\hline 59 & Efficiency variance \\\\ \\hline 60 & Rate variance \\\\ \\hline 61 & \\\\ \\hline 62 & Excess of actual over standard cost per unit \\\\ \\hline 63 & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|} 16 & \\\\ 17 & Actual production for the month \\\\ 18 & Variable overhead is assigned to products based on direct labor hours. There \\\\ 19 & was no beginning or ending inventory of materials for the month. \\\\ 20 & \\\\ 21 & Using formulas, compute the following. Input all numbers as positive amounts. \\\\ 22 & Indicate whether the variances are F or U. Write if statements for variance cells F30 to F47. Use \\\\ cell references (formulas) for cells D53 - D60. Enter an F or U to indicate the correct variance in \\\\ cells F54 to F62. \\\\ 23 & \\\\ 24 & \\\\ \\hline 25 & Standard Cost Variance Analysis - Direct Materials \\\\ 26 & Standard Quantity Allowed for Actual Output at Standard Price \\\\ 27 & Actual Onantitu of Innut at Standam. Price \\end{tabular} \\begin{tabular}{l|l|} \\hline 38 & Labor efficiency variance \\\\ \\hline 40 & Labor rate variance \\\\ \\hline 41 & Standard Cost Variance Analysis - Variable Manufacturing Overhead \\\\ \\hline 42 & Standard Hours Allowed for Actual Output at Standard Rate \\\\ \\hline 43 & Actual Hours of Input, at Standard Rate \\\\ \\hline 44 & Actual Hours of Input, at Actual Rate \\\\ \\hline 45 & \\\\ \\hline 46 & Variable overhead efficiency variance \\\\ \\hline 47 & Variable overhead rate variance \\\\ \\hline 48 & \\\\ \\hline 49 & Using formulas, compute the amount of the unit cost difference \\\\ \\hline 50 & that is traceable to each of the variances computed above. \\\\ \\hline 51 & \\\\ \\hline 52 & Materials: \\\\ \\hline 53 & Quantity variance \\\\ \\hline 54 & Price variance \\\\ \\hline 55 & Labor: \\\\ \\hline 56 & Efficiency variance \\\\ \\hline 57 & Rate variance \\\\ \\hline 58 & Variable overhead: \\\\ \\hline 59 & cefiniann. . arimn- \\\\ \\hline \\end{tabular}

\\begin{tabular}{|l|l|} \\hline 25 & Standard Cost Variance Analysis - Direct Materials \\\\ \\hline 26 & Standard Quantity Allowed for Actual Output at Standard Price \\\\ \\hline 28 & Actual Quantity of Input, at Standard Price \\\\ \\hline 29 & Actual Quantity of Input, at Actual Price \\\\ \\hline 30 & Materials quantity variance \\\\ \\hline 31 & Materials price variance \\\\ \\hline 32 & \\\\ \\hline 33 & Standard Cost Variance Analysis - Direct Labor \\\\ \\hline 34 & Standard Hours Allowed for Actual Output at Standard Rate \\\\ \\hline 35 & Actual Hours of Input, at Standard Rate \\\\ \\hline 36 & Actual Hours of Input, at Actual Rate \\\\ \\hline 37 & \\\\ \\hline 38 & Labor efficiency variance \\\\ \\hline 39 & Labor rate variance \\\\ \\hline 40 & \\\\ \\hline 41 & Standard Cost Variance Analysis - Variable Manufacturing Overhead \\\\ \\hline 42 & Standard Hours Allowed for Actual Output at Standard Rate \\\\ \\hline 43 & Actual Hours of Input, at Standard Rate \\\\ \\hline 44 & Actual Hours of Input, at Actual Rate \\\\ \\hline 45 & \\end{tabular} \\begin{tabular}{|l|l|} \\hline 46 & Variable overhead efficiency variance \\\\ \\hline 47 & Variable overhead rate variance \\\\ \\hline 48 & \\\\ \\hline 49 & Using formulas, compute the amount of the unit cost difference \\\\ \\hline 50 & that is traceable to each of the variances computed above. \\\\ \\hline 51 & \\\\ \\hline 52 & Materials: \\\\ \\hline 53 & Quantity variance \\\\ \\hline 54 & Price variance \\\\ \\hline 55 & Labor: \\\\ \\hline 56 & Efficiency variance \\\\ \\hline 57 & Rate variance \\\\ \\hline 58 & Variable overhead: \\\\ \\hline 59 & Efficiency variance \\\\ \\hline 60 & Rate variance \\\\ \\hline 61 & \\\\ \\hline 62 & Excess of actual over standard cost per unit \\\\ \\hline 63 & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|} 16 & \\\\ 17 & Actual production for the month \\\\ 18 & Variable overhead is assigned to products based on direct labor hours. There \\\\ 19 & was no beginning or ending inventory of materials for the month. \\\\ 20 & \\\\ 21 & Using formulas, compute the following. Input all numbers as positive amounts. \\\\ 22 & Indicate whether the variances are F or U. Write if statements for variance cells F30 to F47. Use \\\\ cell references (formulas) for cells D53 - D60. Enter an F or U to indicate the correct variance in \\\\ cells F54 to F62. \\\\ 23 & \\\\ 24 & \\\\ \\hline 25 & Standard Cost Variance Analysis - Direct Materials \\\\ 26 & Standard Quantity Allowed for Actual Output at Standard Price \\\\ 27 & Actual Onantitu of Innut at Standam. Price \\end{tabular} \\begin{tabular}{l|l|} \\hline 38 & Labor efficiency variance \\\\ \\hline 40 & Labor rate variance \\\\ \\hline 41 & Standard Cost Variance Analysis - Variable Manufacturing Overhead \\\\ \\hline 42 & Standard Hours Allowed for Actual Output at Standard Rate \\\\ \\hline 43 & Actual Hours of Input, at Standard Rate \\\\ \\hline 44 & Actual Hours of Input, at Actual Rate \\\\ \\hline 45 & \\\\ \\hline 46 & Variable overhead efficiency variance \\\\ \\hline 47 & Variable overhead rate variance \\\\ \\hline 48 & \\\\ \\hline 49 & Using formulas, compute the amount of the unit cost difference \\\\ \\hline 50 & that is traceable to each of the variances computed above. \\\\ \\hline 51 & \\\\ \\hline 52 & Materials: \\\\ \\hline 53 & Quantity variance \\\\ \\hline 54 & Price variance \\\\ \\hline 55 & Labor: \\\\ \\hline 56 & Efficiency variance \\\\ \\hline 57 & Rate variance \\\\ \\hline 58 & Variable overhead: \\\\ \\hline 59 & cefiniann. . arimn- \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started