Answered step by step

Verified Expert Solution

Question

1 Approved Answer

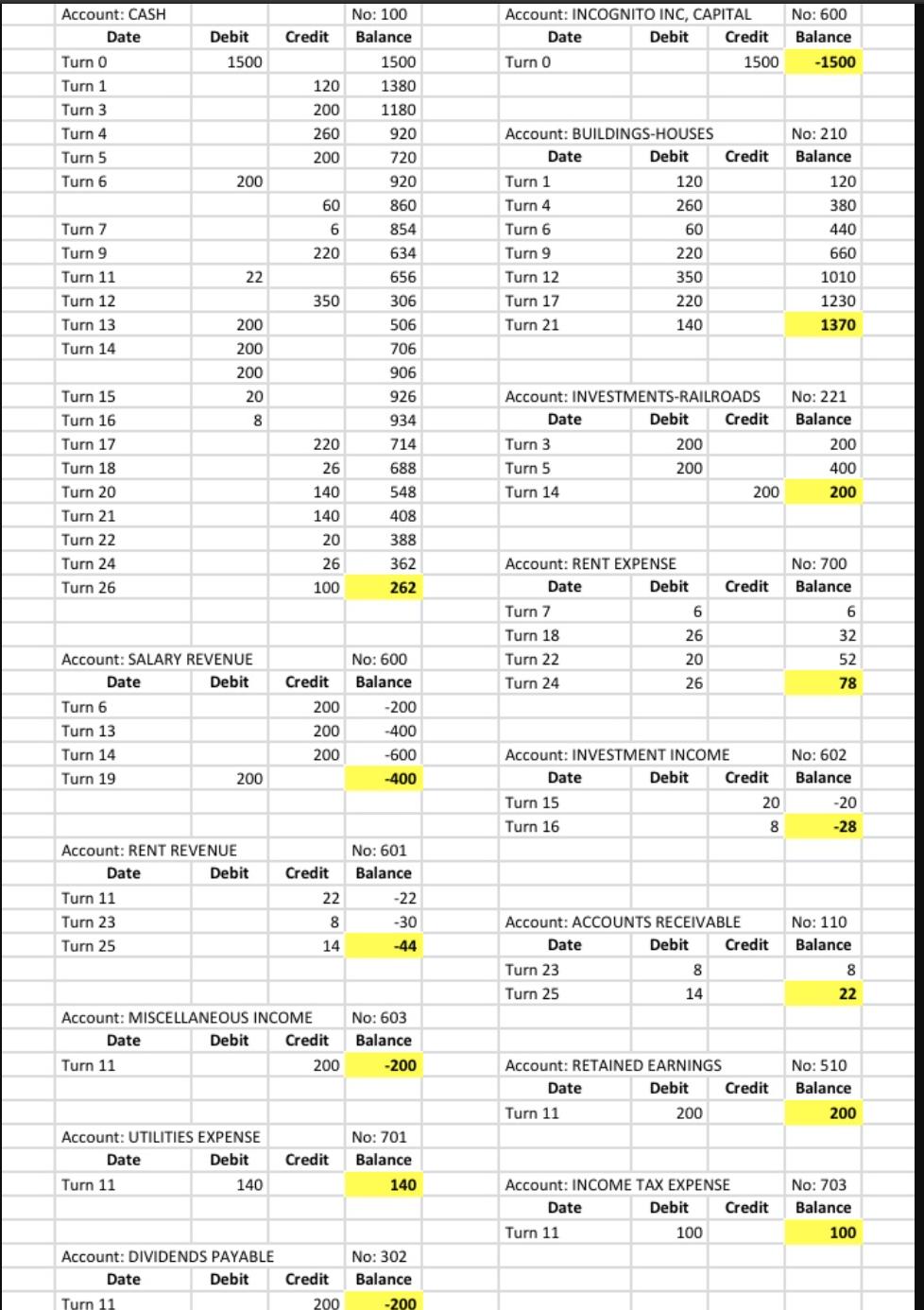

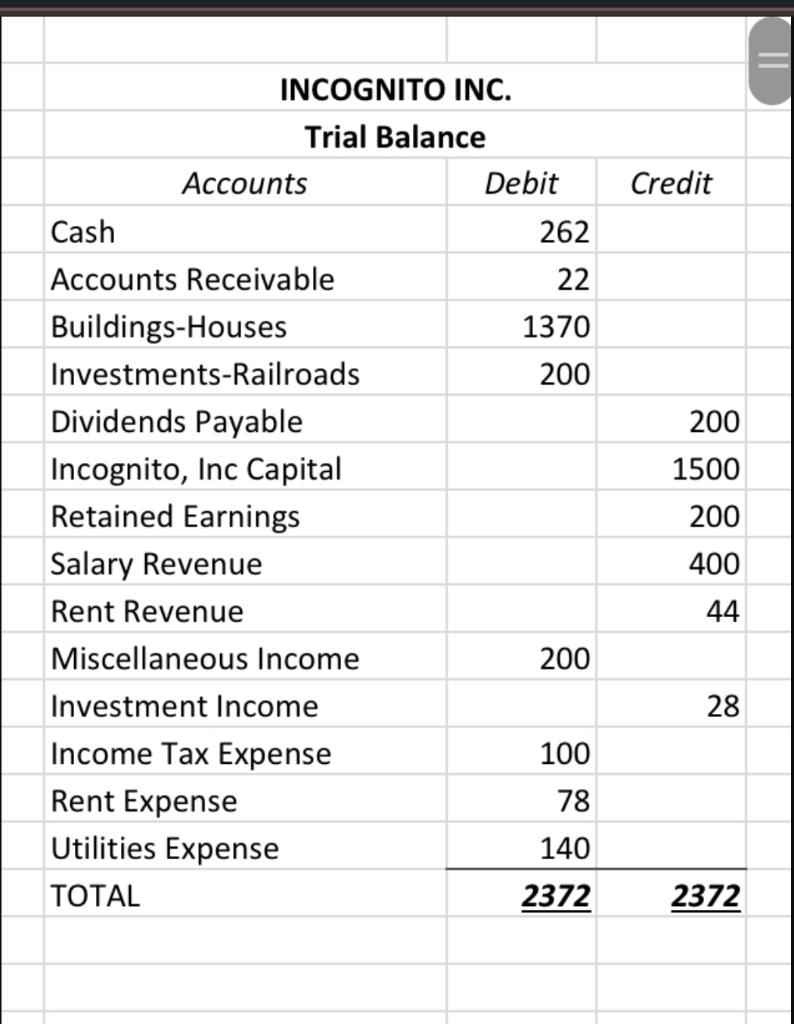

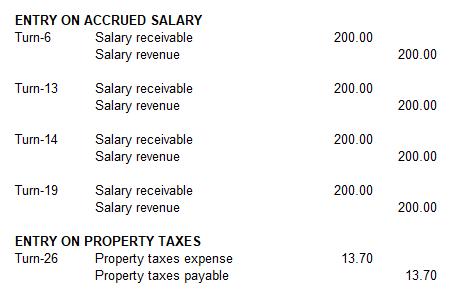

Compute entries for depreciation, accrued salary, and accrued property taxes in Accounting Cycle? Account: CASH Date Turn 0 Turn 1 Turn 3 Turn 4 Turn

Compute entries for depreciation, accrued salary, and accrued property taxes in Accounting Cycle?

Account: CASH Date Turn 0 Turn 1 Turn 3 Turn 4 Turn 5 Turn 6 Turn 7 Turn 9 Turn 11 Turn 12 Turn 13 Turn 14 Turn 15 Turn 16 Turn 17 Turn 18 Turn 20 Turn 21 Turn 22 Turn 24 Turn 26 Date Turn 6 Turn 13 Turn 14 Turn 19 Turn 11 Turn 23 Turn 25 Account: SALARY REVENUE Debit Date Turn 11 Debit Account: RENT REVENUE Date Debit Date 1500 Turn 11 200 22 Date 200 200 200 20 Turn 11 8 200 Account: UTILITIES EXPENSE Debit Debit Account: DIVIDENDS PAYABLE Debit 140 Credit Account: MISCELLANEOUS INCOME Credit 120 200 260 200 60 6 220 350 220 26 140 140 20 26 100 Credit 200 200 200 Credit 22 8 14 200 Credit Credit 200 No: 100 Balance 1500 1380 1180 920 720 920 860 854 634 656 306 506 706 906 926 934 714 688 548 408 388 362 262 No: 600 Balance -200 -400 -600 -400 No: 601 Balance -22 -30 -44 No: 603 Balance -200 No: 701 Balance 140 No: 302 Balance -200 Account: INCOGNITO INC, CAPITAL Debit Credit Date Turn 0 Account: BUILDINGS-HOUSES Debit Date Turn 1 Turn 4 Turn 6 Turn 9 Turn 12 Turn 17 Turn 21 Date Turn 3 Turn 5 Turn 14 Account: INVESTMENTS-RAILROADS Debit Turn 7 Turn 18 Turn 22 Turn 24 Account: RENT EXPENSE Date Debit Date Turn 15 Turn 16 Date Turn 23 Turn 25 120 260 60 220 350 220 140 Account: INVESTMENT INCOME Date 200 200 Turn 11 6 26 20 26 Account: ACCOUNTS RECEIVABLE Date Turn 11 Account: RETAINED EARNINGS Debit Debit Credit 8 14 No: 600 Balance 1500 -1500 Credit Debit Credit 20 200 Credit 200 Account: INCOME TAX EXPENSE 8 Credit Credit Debit Credit 100 No: 210 Balance 120 380 440 660 1010 1230 1370 No: 221 Balance 200 400 200 No: 700 Balance 6 32 52 78 No: 602 Balance -20 -28 No: 110 Balance 8 22 No: 510 Balance 200 No: 703 Balance 100

Step by Step Solution

★★★★★

3.43 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

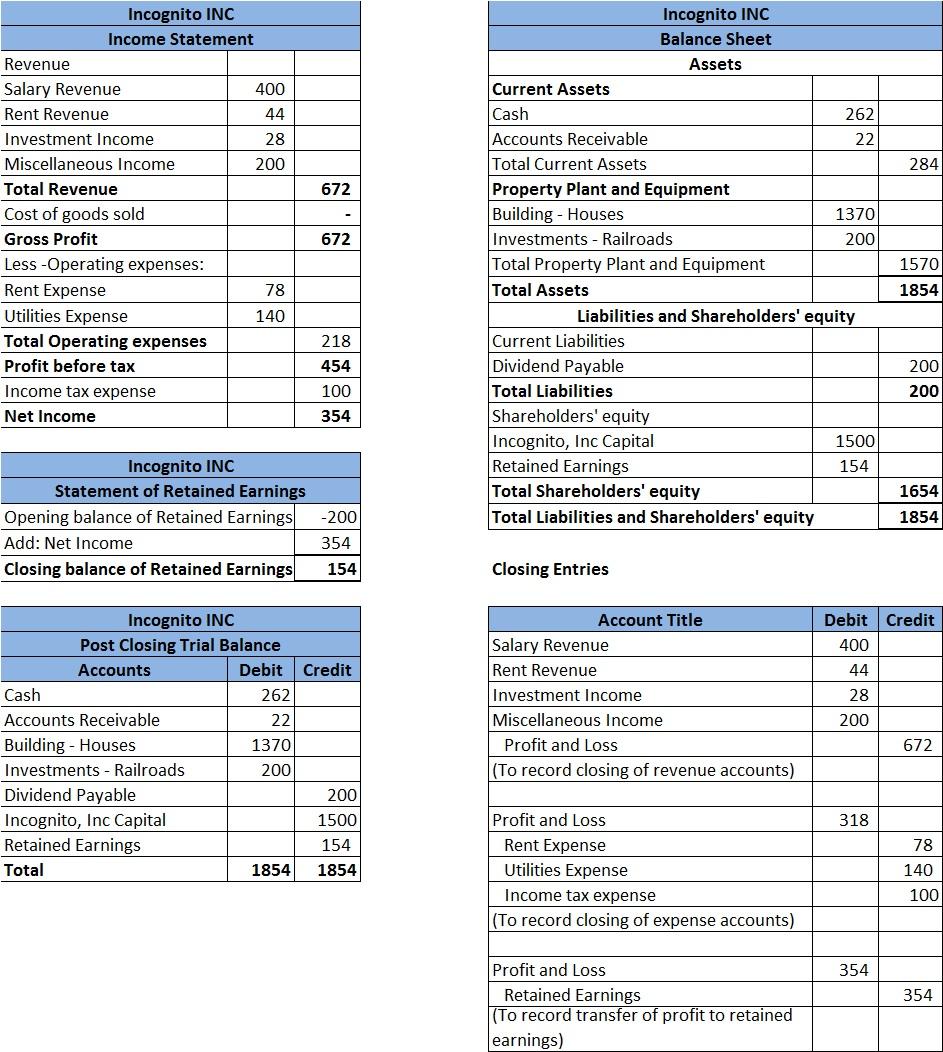

ANSWER Accounting cycle is a process of recording all the financial transactions and processing them ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started