Answered step by step

Verified Expert Solution

Question

1 Approved Answer

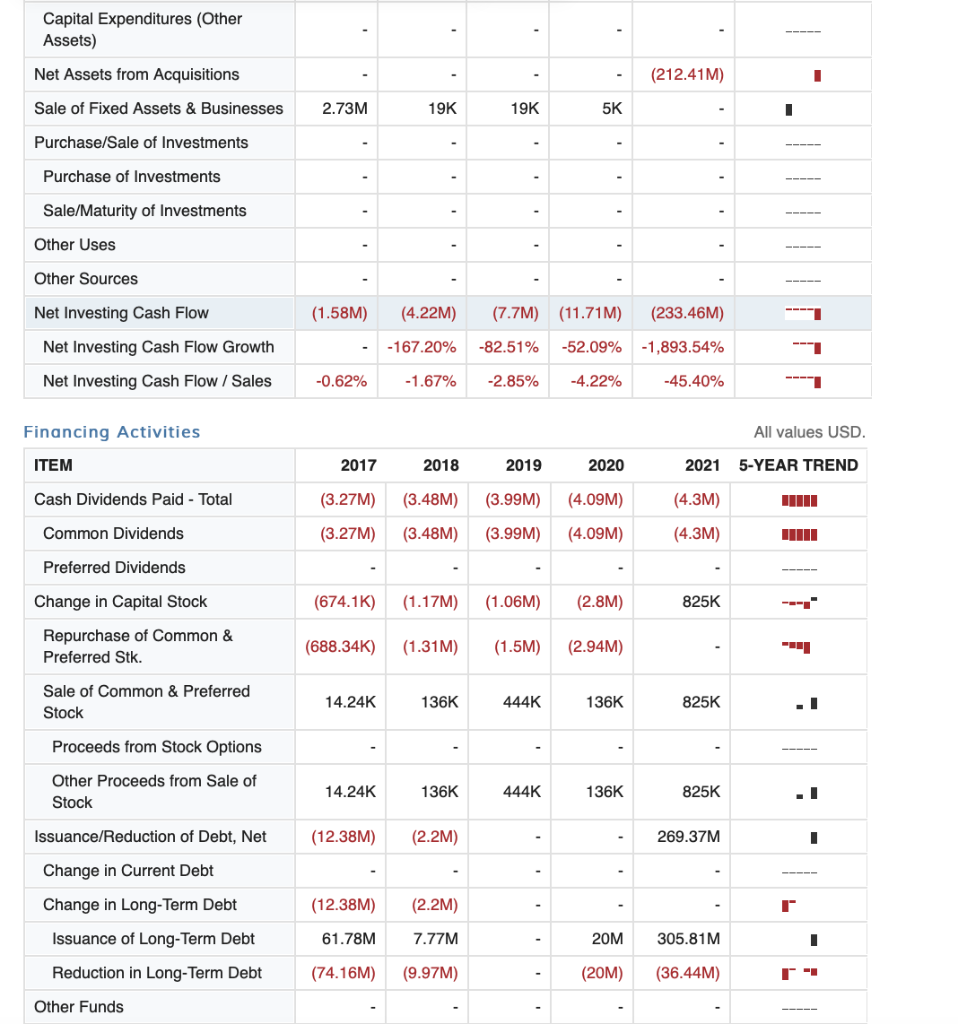

Can someone help me explain some changes that have happened with the financing activities from 2020 to 2021. Capital Expenditures (Other Assets) Net Assets from

Can someone help me explain some changes that have happened with the financing activities from 2020 to 2021.

Capital Expenditures (Other Assets) Net Assets from Acquisitions (212.41M) 1 Sale of Fixed Assets & Businesses 2.73M 19K 19K 5K I Purchase/Sale of Investments Purchase of Investments Sale/Maturity of Investments - Other Uses Other Sources Net Investing Cash Flow (1.58M) (4.22M) (7.7M) (11.71M) (233.46M) Net Investing Cash Flow Growth - 167.20% -82.51% -52.09% -1,893.54% Net Investing Cash Flow / Sales -0.62% -1.67% -2.85% -4.22% -45.40% 1 Financing Activities All values USD. ITEM 2017 2018 2019 2020 2021 5-YEAR TREND Cash Dividends Paid - Total (3.27M) (3.99M) (4.09M) (4.3M) (3.48M) (3.48M) Common Dividends (3.27M) (3.99M) (4.09M) (4.3M) Preferred Dividends Change in Capital Stock (674.1K) (1.17M) (1.06M) (2.8M) 825K ---- Repurchase of Common & Preferred Stk. (688.34K) (1.31M) (1.5M) (2.94M) Sale of Common & Preferred Stock 14.24K 136K 444K 136K 825K .1 Proceeds from Stock Options Other Proceeds from Sale of Stock 14.24K 136K 444K 136K 825K . Issuance/Reduction of Debt, Net (12.38M) (2.2M) 269.37M - Change in Current Debt Change in Long-Term Debt (12.38M) (2.2M) - r 1 Issuance of Long-Term Debt 61.78M 7.77M - 20M 305.81M 1 Reduction in Long-Term Debt (74.16M) (9.97M) (20M) (36.44M) T Other Funds Capital Expenditures (Other Assets) Net Assets from Acquisitions (212.41M) 1 Sale of Fixed Assets & Businesses 2.73M 19K 19K 5K I Purchase/Sale of Investments Purchase of Investments Sale/Maturity of Investments - Other Uses Other Sources Net Investing Cash Flow (1.58M) (4.22M) (7.7M) (11.71M) (233.46M) Net Investing Cash Flow Growth - 167.20% -82.51% -52.09% -1,893.54% Net Investing Cash Flow / Sales -0.62% -1.67% -2.85% -4.22% -45.40% 1 Financing Activities All values USD. ITEM 2017 2018 2019 2020 2021 5-YEAR TREND Cash Dividends Paid - Total (3.27M) (3.99M) (4.09M) (4.3M) (3.48M) (3.48M) Common Dividends (3.27M) (3.99M) (4.09M) (4.3M) Preferred Dividends Change in Capital Stock (674.1K) (1.17M) (1.06M) (2.8M) 825K ---- Repurchase of Common & Preferred Stk. (688.34K) (1.31M) (1.5M) (2.94M) Sale of Common & Preferred Stock 14.24K 136K 444K 136K 825K .1 Proceeds from Stock Options Other Proceeds from Sale of Stock 14.24K 136K 444K 136K 825K . Issuance/Reduction of Debt, Net (12.38M) (2.2M) 269.37M - Change in Current Debt Change in Long-Term Debt (12.38M) (2.2M) - r 1 Issuance of Long-Term Debt 61.78M 7.77M - 20M 305.81M 1 Reduction in Long-Term Debt (74.16M) (9.97M) (20M) (36.44M) T Other FundsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started