Answered step by step

Verified Expert Solution

Question

1 Approved Answer

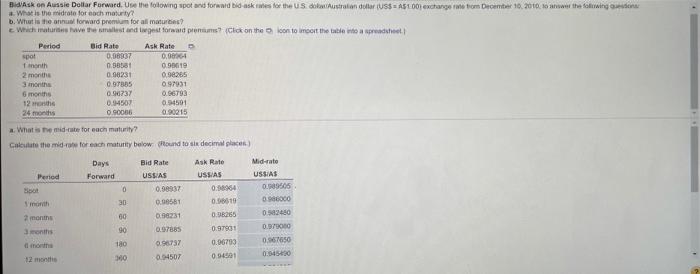

can someone help me on part B and C BASK on Aussie Dollar Forward. Use the following spot and forward bid asks for the US

can someone help me on part B and C

BASK on Aussie Dollar Forward. Use the following spot and forward bid asks for the US doba Austration dollar (US$=A500) exchange tiom December 10, 2016. ww. the following # What is the midrate for och maturity? b. What is the forward premium for all matur Which mature we them and get forward rem? (Click on the con tomoot the word Period Bid Rate Ask Rate spot 0.08937 0.0016 month 0.58581 0.99010 2 months 018231 0.98265 3 months 0.97385 097931 6 months 0.10737 0.66793 12 months 0.44507 054501 24 months 09006 090215 What is the mid-rate for each maturity? Calculate the mid for each maturity below found to six decimal places) Days Bid Rate Ask Rate Mid-rato Period Forward USSIA USIAS USLAS Sot 0 0.00332 0:08:54 0.003505 north 30 0.00561 0.56619 098600 2 months 60 0.98231 0.00265 02480 onths 90 0.57885 0.9700 0.97931 180 0.96737 0.06700 067650 12 months 30 4507 09401 BASK on Aussie Dollar Forward. Use the following spot and forward bid asks for the US doba Austration dollar (US$=A500) exchange tiom December 10, 2016. ww. the following # What is the midrate for och maturity? b. What is the forward premium for all matur Which mature we them and get forward rem? (Click on the con tomoot the word Period Bid Rate Ask Rate spot 0.08937 0.0016 month 0.58581 0.99010 2 months 018231 0.98265 3 months 0.97385 097931 6 months 0.10737 0.66793 12 months 0.44507 054501 24 months 09006 090215 What is the mid-rate for each maturity? Calculate the mid for each maturity below found to six decimal places) Days Bid Rate Ask Rate Mid-rato Period Forward USSIA USIAS USLAS Sot 0 0.00332 0:08:54 0.003505 north 30 0.00561 0.56619 098600 2 months 60 0.98231 0.00265 02480 onths 90 0.57885 0.9700 0.97931 180 0.96737 0.06700 067650 12 months 30 4507 09401 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started