Question

Can someone help me provide Andover's income statement based on the below information so I can compare it with Danver's income statement? Thank you! ASSESSING

Can someone help me provide Andover's income statement based on the below information so I can compare it with Danver's income statement? Thank you!

ASSESSING THE FINANCIAL BENEFITS OF THE MOVE

While the move to Andover was conceptually appealing, other options were available. For example, the entire assembly operation could be outsourced. Ultimately, the decision about the fate of the monitor production operation would be determined based on profitability criteria. Would the move to Andover produce improved financial performance? Certainly, the move would require some investment and some moving cost. Any savings realized in the operations would have to pay that cost back relatively quickly.

Basically, the job of the assembly plant in Danvers was to manage costs while producing high-quality product in requisite volume. Drger Medical management, however, wanted to make sure that each plant utilized its asset base well, too. Therefore, the Danvers plant was treated as an investment center. Corporate management set specific transfer prices for each of the monitor models. Annual plant operating expenses were subtracted from the transfer price revenues to determine a measure of plant margin. A capital charge was subtracted from plant margin, resulting in "plant economic income." The capital charge reflected the cost of capital multiplied by total fixed plant assets plus inventory, since only these assets were under control of the plant manager. (Current assets and liabilities other than inventory were all managed at corporate headquarters.) There was a target return on sales of 12% after the capital charge. The rationale of this apparent double-hurdle was explained as follows:

All of the plant expenses become part of the final manufacturing costs for our products. Therefore, all of the plant costs pass through finished goods inventory and are expensed as cost of goods sold. The plant needs to generate income to cover its own investment, but then has to contribute to covering the overall corporate administrative costs. The 12% economic contribution accounts for the basic value created in the manufacture of the core instruments. Configuration, software loading, and accessory bundling in Lbeck contribute the remainder of the value of the final delivered product.

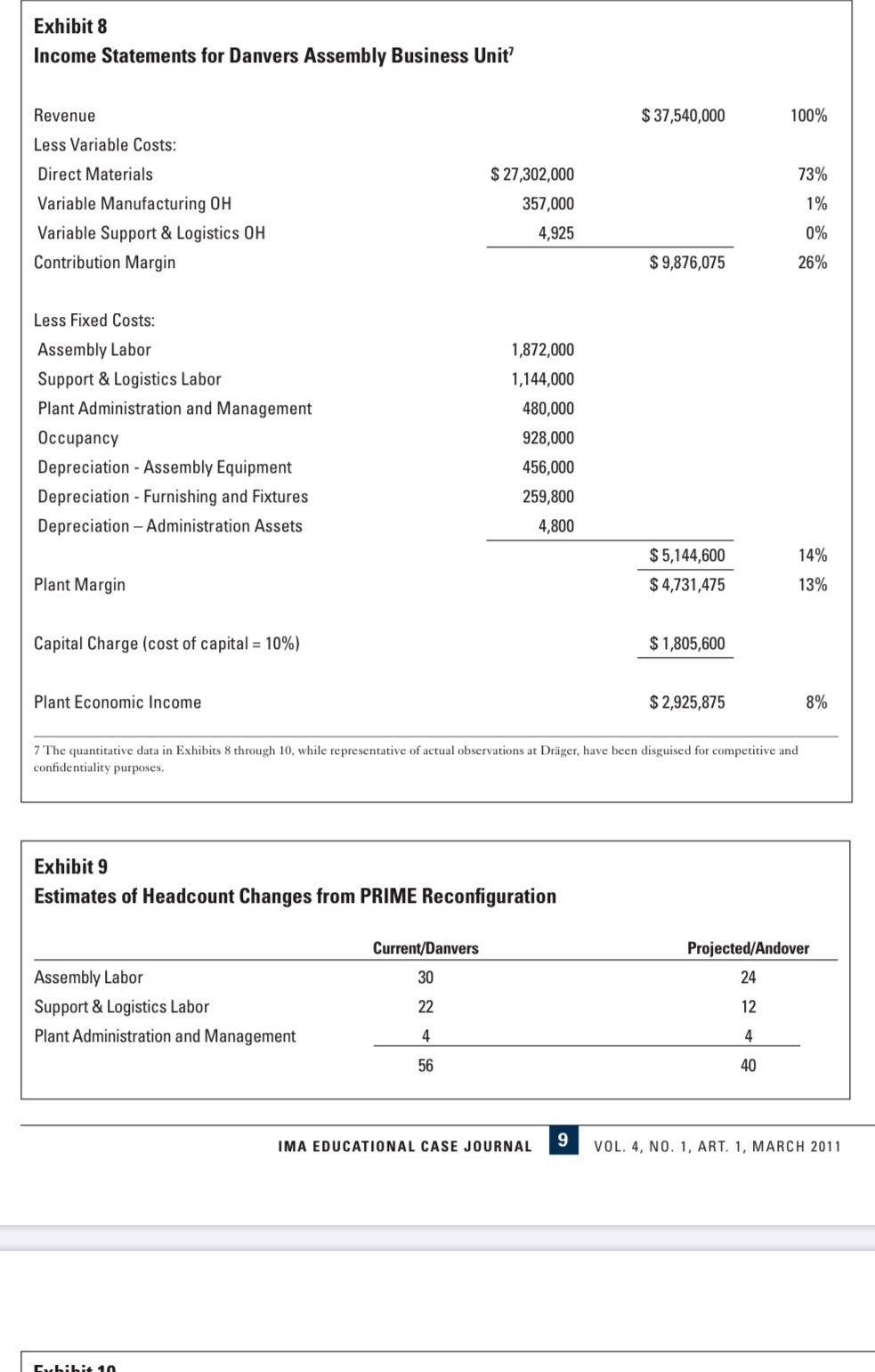

The performance results for 2008 operations in Danvers are shown in Exhibit 8. Demand volume in units at Danvers had risen by doubledigit rates through 2006, but tumbled by 5% in 2007. Plant margin had fallen. There was a variety of factors that may have accounted for this. General economic conditions had led to diminished demand recently as hospitals and other health care facilities decided to defer purchases of new equipment. Lower market prices had restored demand volume in 2008, but not plant margin. Those lower market prices had, in turn, pushed back the transfer prices for Danvers, resulting in a drop in margins. Not only would the new arrangement in Andover have to cope with the lower prices, but it would also be beneficial if the plant margin were less sensitive to changes in demand. Bill Nicholson's PRIME team reviewed a wide array of effects that the proposed move would have. Exhibit 9 contains a table specifying the expected headcount reductions. Exhibit 10 contains some excerpts from the team's written report related to costs and savings.

Exhibit 10: Excerpts from the Report on Potential Costs and Savings from Move to Andover

Some of the costs and savings related to the move are obvious. Certainly, a move to Andover would eliminate the need to pay the $400,000 per year lease in Danvers. Additionally, the costs of maintaining, heating, cooling, and securing the Danvers facility would be eliminated by the move. If the assembly operation could be successfully fit into the available space in Andover, it would simply be allocated a share of the current Andover facility occupancy costs. Based on space occupied, we estimate the assembly operation's share of Andover's occupancy cost to be $499,000 per year. There will have to be some investment in preparing the Andover facilities to house an assembly operation, including some equipment modification. The major expenditure will be for new ambient testing systems. Each system, consisting of a server and 50 test stations, will cost $600,000 to build and install. All of the old testing machines will be fully depreciated by the end of 2008 and sold for their salvage value for a net effect of no gain or loss. We estimate the economic life of these systems to be 10 years. We can move and reuse about half of the furnishings and fixtures currently in Danvers in the new facility in Andover. The remaining fixtures are leasehold improvements made to the building and cannot be moved. Those assets would have to be written off, except, luckily, they will be fully depreciated at the end of 2008. In Andover, we will have to spend $100,000 on new furnishings and fixtures to prepare the building for the assembly operation. Following company policy, those new leasehold improvements will be depreciated over 10 years. We can move all of the administration and management assets, which are primarily desks, computers, and other office furnishings. These were all replaced recently, so annual expenses related to their depreciation will remain unchanged. We have planned the logistics on the move itself to be possible to execute over a three-day holiday weekend. There should be no loss of productive time. This will require several weekends of preparation and planning, however. There will be an out-of-pocket cost of $157,000 attached to the move. The move will create savings in Andover. One immediate effect will be the removal of the need to shuttle engineers, parts, and equipment back and forth between Andover and Danvers. We estimate this savings to be $300,000 per year in combined out-of-pocket costs and recovery of lost engineer's time. The out-of-pocket costs are the shuttle driver, whose fully-loaded annual cost is $35,000, and the annual lease, maintenance, and operating costs of the van. These costs are $10,000 per year. Another savings in Andover will come from the reassignment of occupancy costs currently covered by the existing business to the assembly operation. As detailed elsewhere in this report, we estimate that $499,000 per year will be reallocated to the assembly operation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started