Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me solve this one? Company Baldwin invested $33,740,000 in plant and equipment last year. The plant investment was funded with bonds at

Can someone help me solve this one?

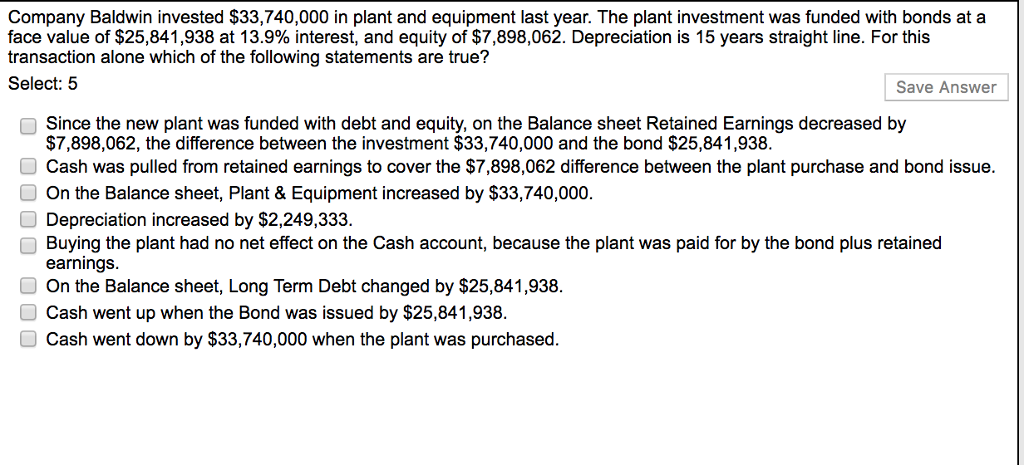

Company Baldwin invested $33,740,000 in plant and equipment last year. The plant investment was funded with bonds at a face value of $25,841,938 at 13.9% interest, and equity of $7,898,062. Depreciation is 15 years straight line. For this transaction alone which of the following statements are true? Select: 5 Save Answer Since the new plant was funded with debt and equity, on the Balance sheet Retained Earnings decreased by $7,898,062, the difference between the investment $33,740,000 and the bond $25,841,938 O Cash was pulled from retained earnings to cover the $7,898,062 difference between the plant purchase and bond issue. O On the Balance sheet, Plant & Equipment increased by $33,740,000. Depreciation increased by $2,249,333. Buying the plant had no net effect on the Cash account, because the plant was paid for by the bond plus retained earnings O On the Balance sheet, Long Term Debt changed by $25,841,938. O Cash went up when the Bond was issued by $25,841,938. O Cash went down by $33,740,000 when the plant was purchased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started