Can someone help me solve this Optimization of industrial systems problem? You can use information from the Factory Physics 3rd edition book

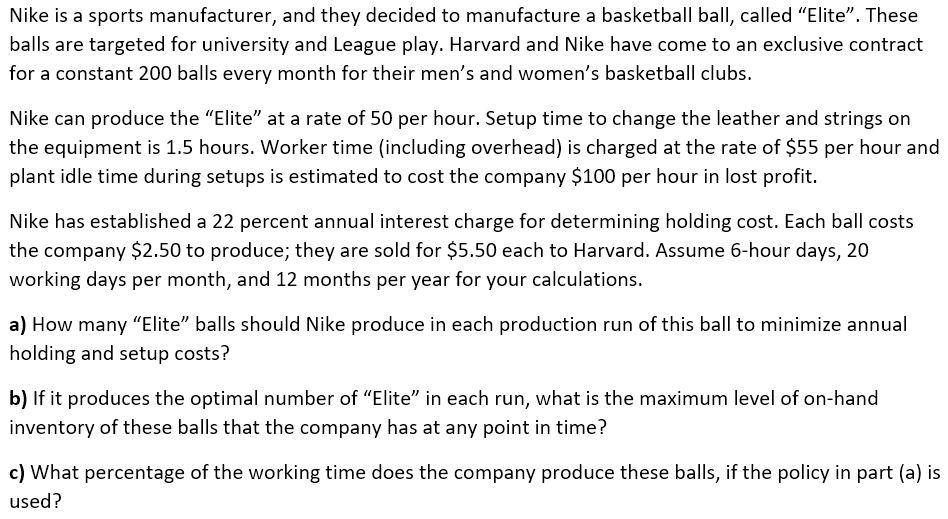

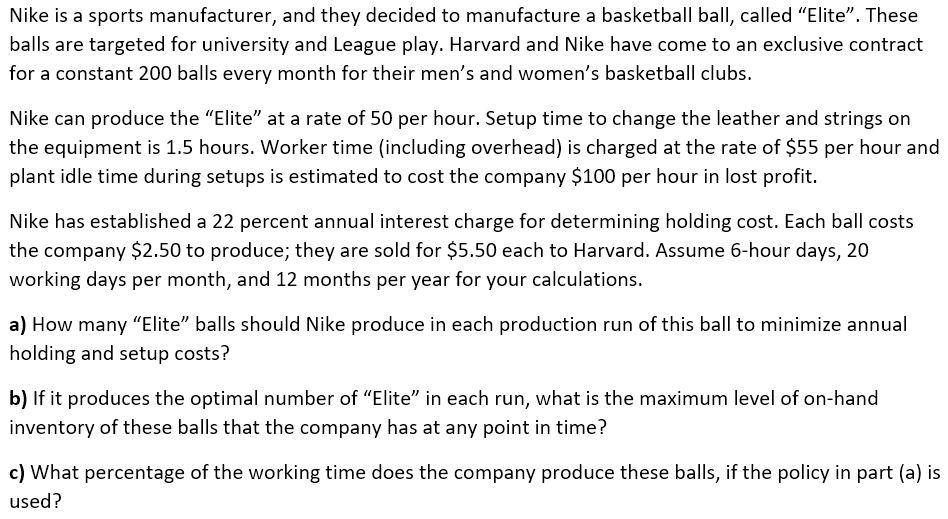

Nike is a sports manufacturer, and they decided to manufacture a basketball ball, called "Elite". These balls are targeted for university and League play. Harvard and Nike have come to an exclusive contract for a constant 200 balls every month for their men's and women's basketball clubs. Nike can produce the "Elite" at a rate of 50 per hour. Setup time to change the leather and strings on the equipment is 1.5 hours. Worker time (including overhead) is charged at the rate of $55 per hour and plant idle time during setups is estimated to cost the company $100 per hour in lost profit. Nike has established a 22 percent annual interest charge for determining holding cost. Each ball costs the company \$2.50 to produce; they are sold for $5.50 each to Harvard. Assume 6-hour days, 20 working days per month, and 12 months per year for your calculations. a) How many "Elite" balls should Nike produce in each production run of this ball to minimize annual holding and setup costs? b) If it produces the optimal number of "Elite" in each run, what is the maximum level of on-hand inventory of these balls that the company has at any point in time? c) What percentage of the working time does the company produce these balls, if the policy in part (a) is used? Nike is a sports manufacturer, and they decided to manufacture a basketball ball, called "Elite". These balls are targeted for university and League play. Harvard and Nike have come to an exclusive contract for a constant 200 balls every month for their men's and women's basketball clubs. Nike can produce the "Elite" at a rate of 50 per hour. Setup time to change the leather and strings on the equipment is 1.5 hours. Worker time (including overhead) is charged at the rate of $55 per hour and plant idle time during setups is estimated to cost the company $100 per hour in lost profit. Nike has established a 22 percent annual interest charge for determining holding cost. Each ball costs the company \$2.50 to produce; they are sold for $5.50 each to Harvard. Assume 6-hour days, 20 working days per month, and 12 months per year for your calculations. a) How many "Elite" balls should Nike produce in each production run of this ball to minimize annual holding and setup costs? b) If it produces the optimal number of "Elite" in each run, what is the maximum level of on-hand inventory of these balls that the company has at any point in time? c) What percentage of the working time does the company produce these balls, if the policy in part (a) is used