Answered step by step

Verified Expert Solution

Question

1 Approved Answer

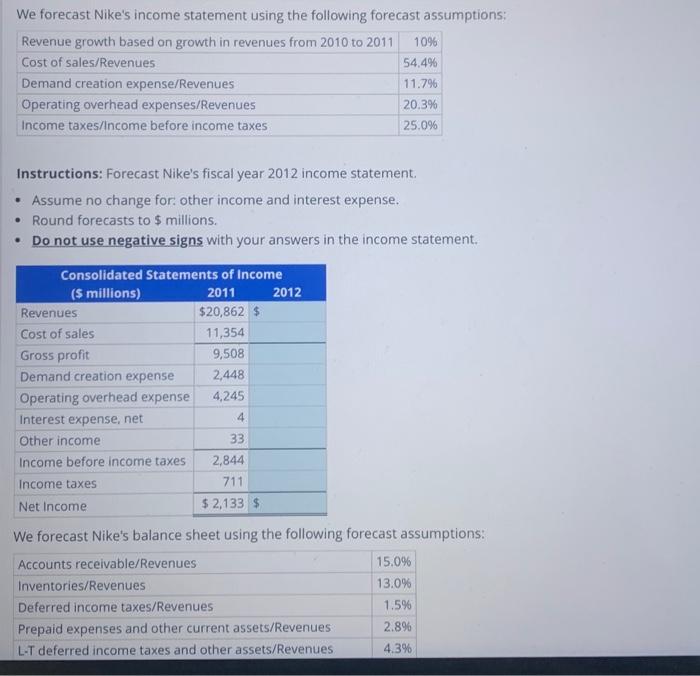

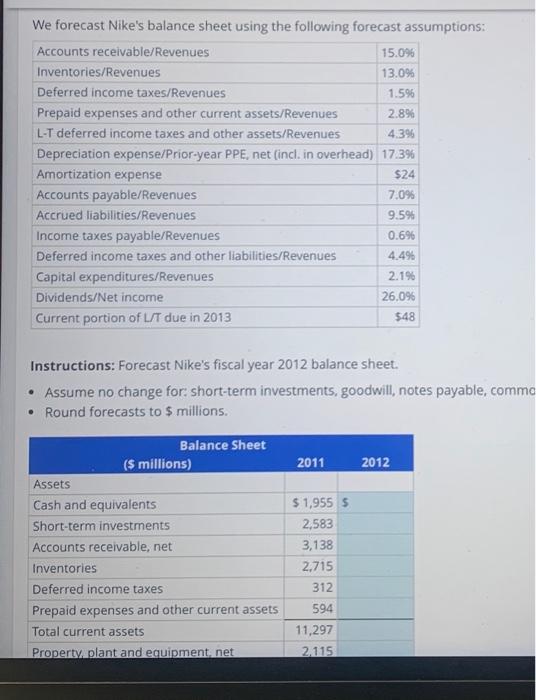

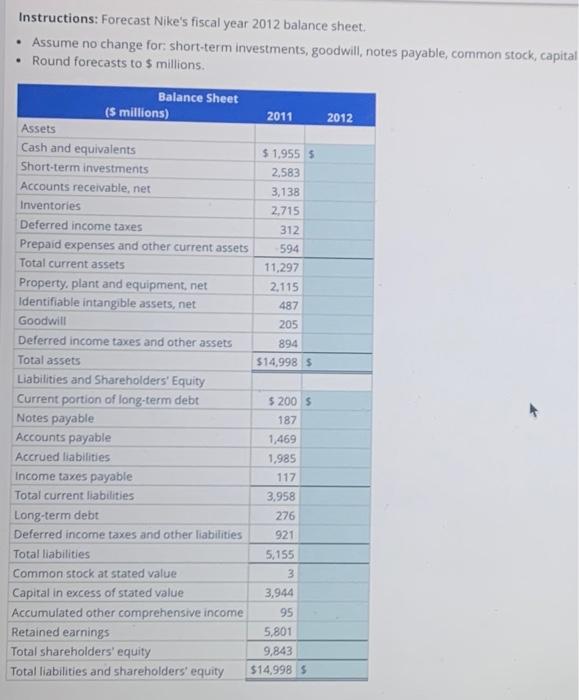

Can someone help me solve this please? Instructions: Forecast Nike's fiscal year 2012 balance sheet. - Assume no change for; short-term investments, goodwill, notes payable,

Can someone help me solve this please?

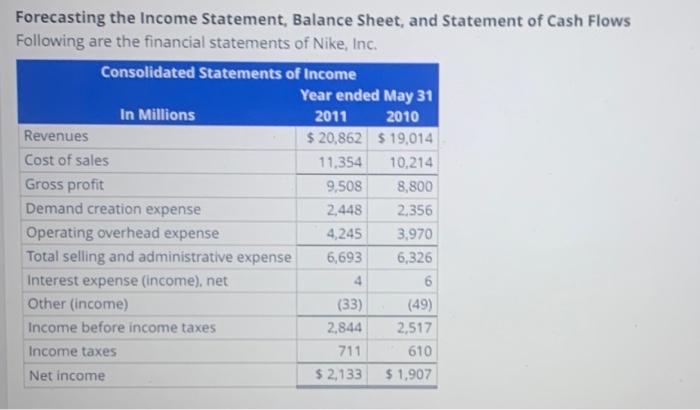

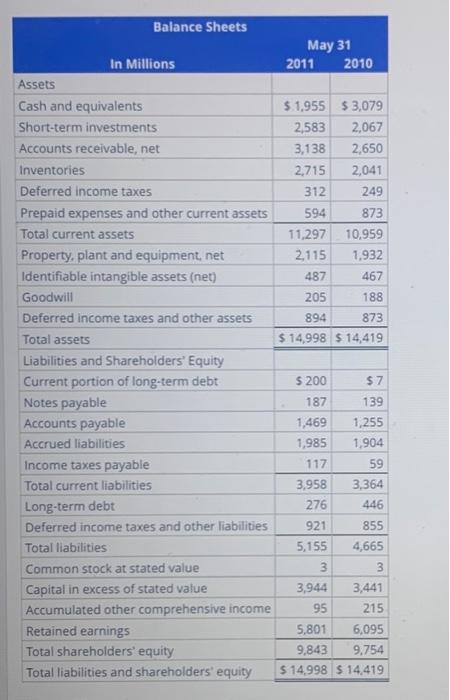

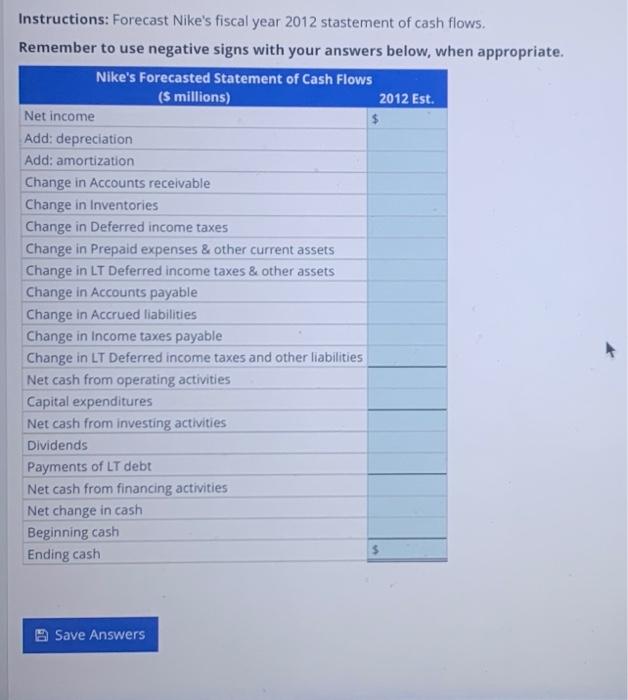

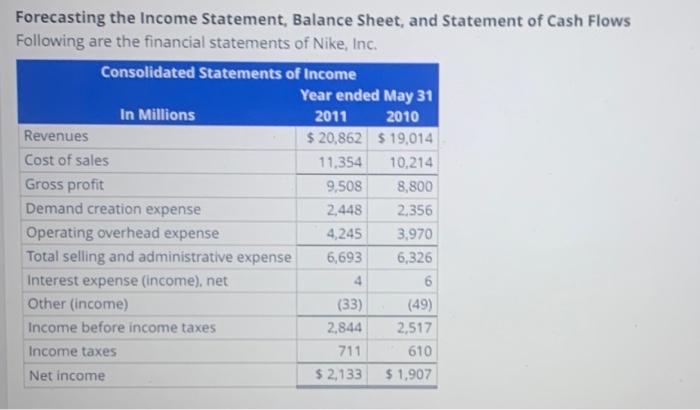

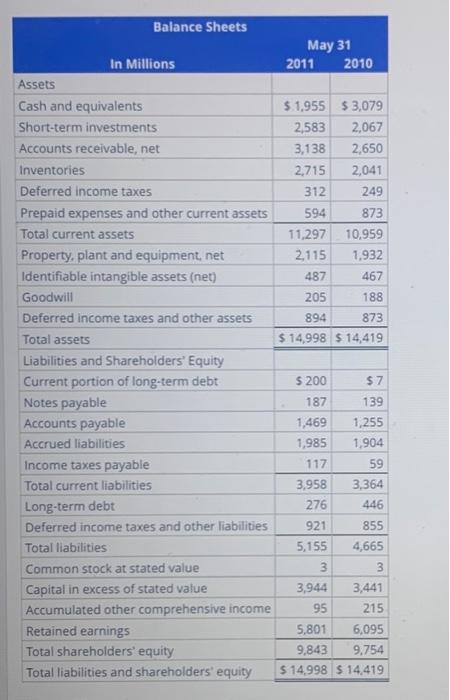

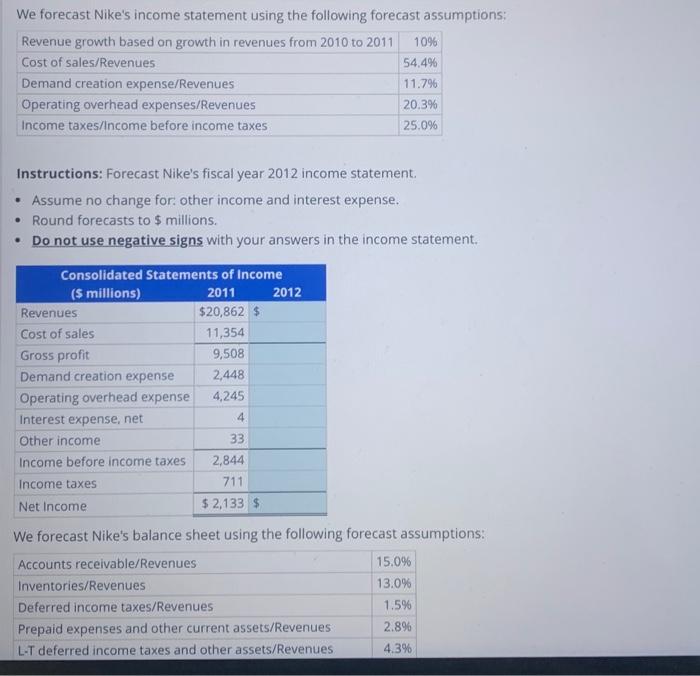

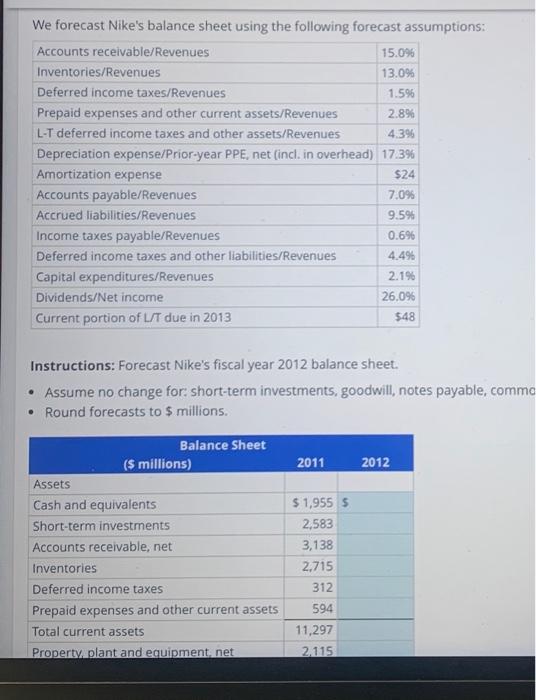

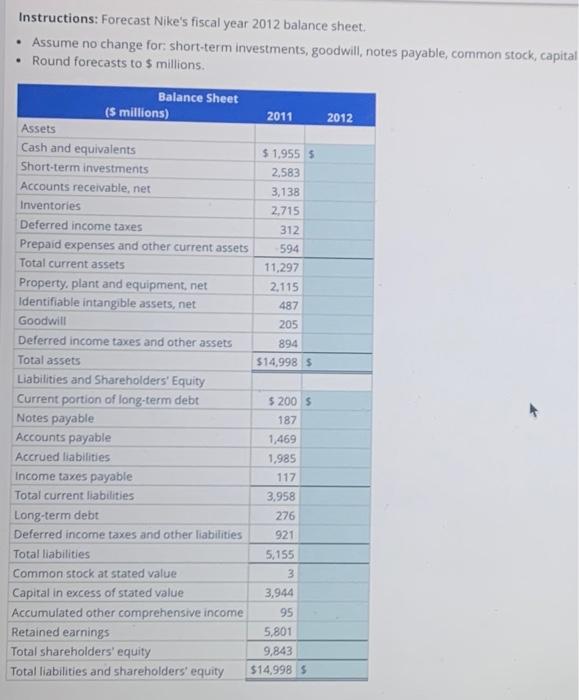

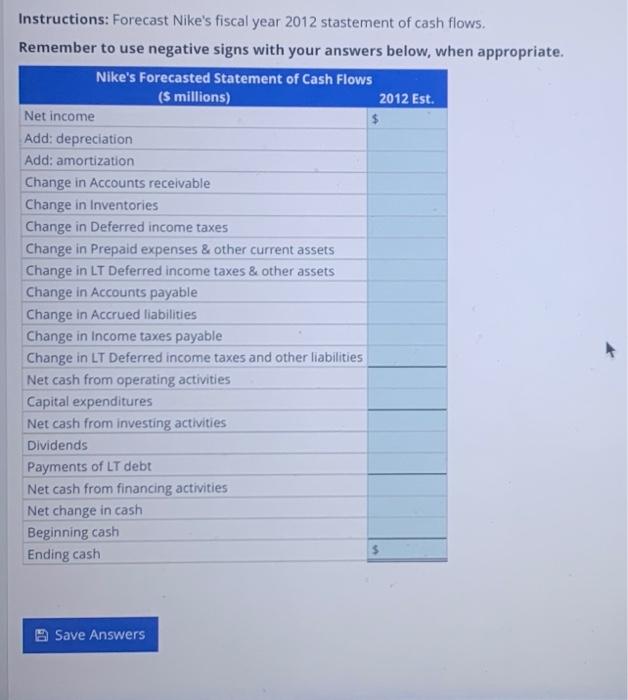

Instructions: Forecast Nike's fiscal year 2012 balance sheet. - Assume no change for; short-term investments, goodwill, notes payable, common stock, capita - Round forecasts to 5 millions. We forecast Nike's income statement using the following forecast assumptions: Instructions: Forecast Nike's fiscal year 2012 income statement. - Assume no change for: other income and interest expense. - Round forecasts to $ millions. - Do not use negative signs with your answers in the income statement. We forecast Nike's balance sheet using the following forecast assumptions: \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Balance Sheets } \\ \hline \multirow[b]{2}{*}{ In Millions } & \multicolumn{2}{|c|}{ May 31} \\ \hline & 2011 & 2010 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline Cash and equivalents & 5.1,955 & $3,079 \\ \hline Short-term investments & 2,583 & 2,067 \\ \hline Accounts receivable, net & 3,138 & 2,650 \\ \hline Inventories & 2,715 & 2,041 \\ \hline Deferred income taxes & 312 & 249 \\ \hline Prepaid expenses and other current assets & 594 & 873 \\ \hline Total current assets & 11,297 & 10,959 \\ \hline Property, plant and equipment, net & 2,115 & 1,932 \\ \hline Identifiable intangible assets (net) & 487 & 467 \\ \hline Goodwill & 205 & 188 \\ \hline Deferred income taxes and other assets & 894 & 873 \\ \hline Total assets & $14,998 & $14,419 \\ \hline \multicolumn{3}{|l|}{ Liabilities and Shareholders' Equity } \\ \hline Current portion of long-term debt & 5200 & $7 \\ \hline Notes payable & 187 & 139 \\ \hline Accounts payable & 1,469 & 1,255 \\ \hline Accrued liabilities & 1,985 & 1,904 \\ \hline Income taxes payable & 117 & 59 \\ \hline Total current liabilities & 3,958 & 3,364 \\ \hline Long-term debt & 276 & 446 \\ \hline Deferred income taxes and other liabilities & 921 & 855 \\ \hline Total liabilities & 5,155 & 4,665 \\ \hline Common stock at stated value & 3 & 3 \\ \hline Capital in excess of stated value & 3,944 & 3,441 \\ \hline Accumulated other comprehensive income & 95 & 215 \\ \hline Retained earnings & 5,801 & 6,095 \\ \hline Total shareholders' equity & 9,843 & 9,754 \\ \hline Total liabilities and shareholders' equity & $14,998 & $14.419 \\ \hline \end{tabular} We forecast Nike's balance sheet using the following forecast assumptions: Instructions: Forecast Nike's fiscal year 2012 balance sheet. - Assume no change for: short-term investments, goodwill, notes payable, commo - Round forecasts to $ millions. Forecasting the Income Statement, Balance Sheet, and Statement of Cash Flows Following are the financial statements of Nike, Inc. Instructions: Forecast Nike's fiscal year 2012 stastement of cash flows. Remember to use negative signs with your answers below. when appropriate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started