Can someone help me with correcting my wrong answers.

Can someone help me with correcting my wrong answers.

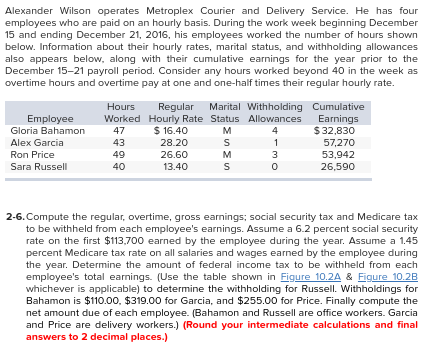

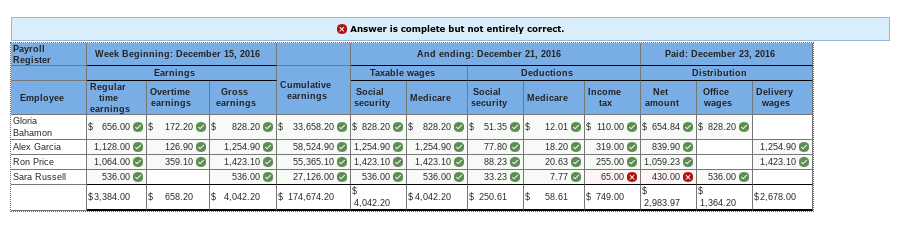

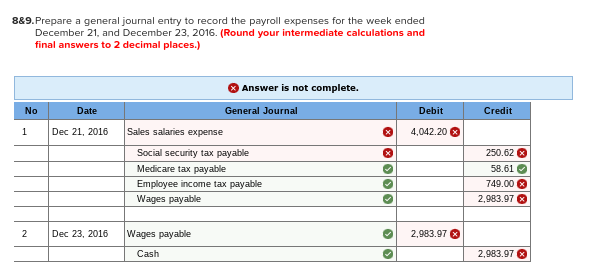

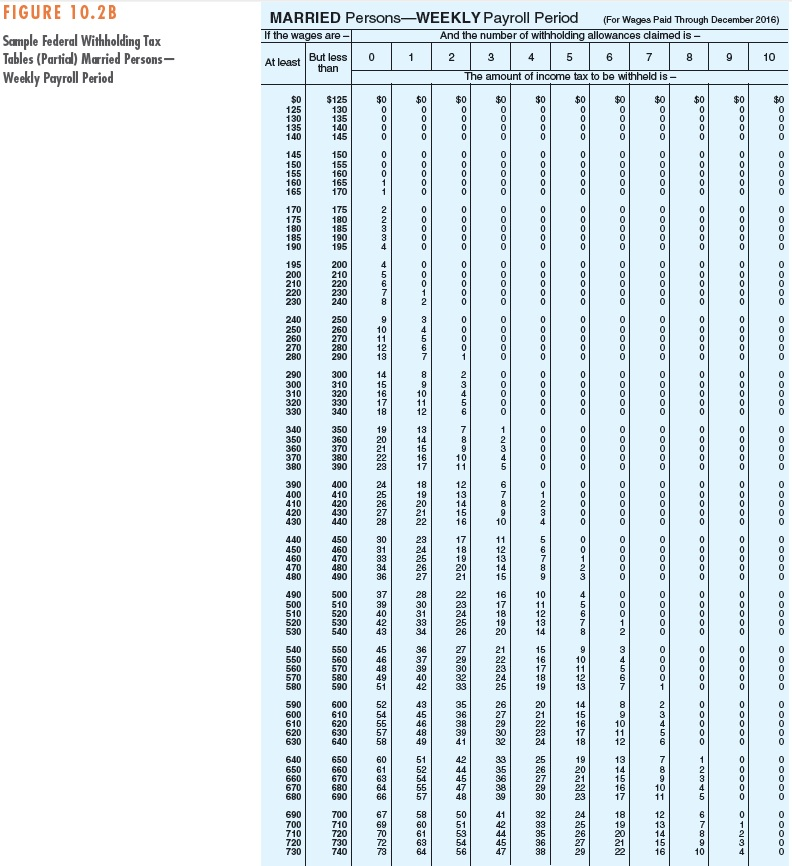

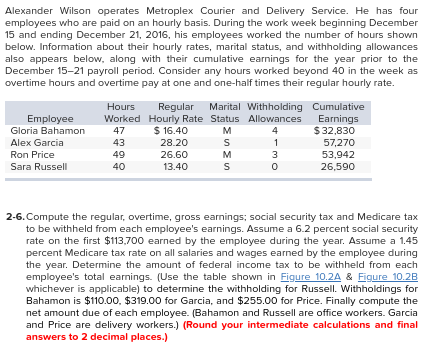

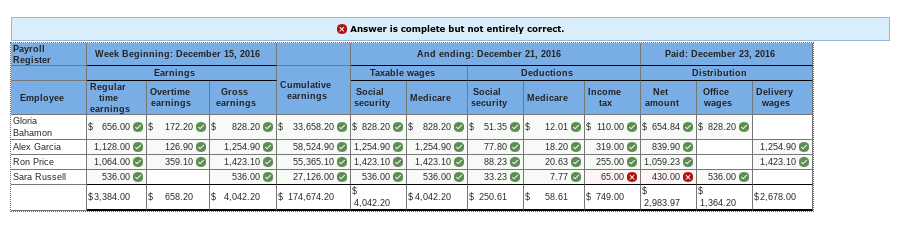

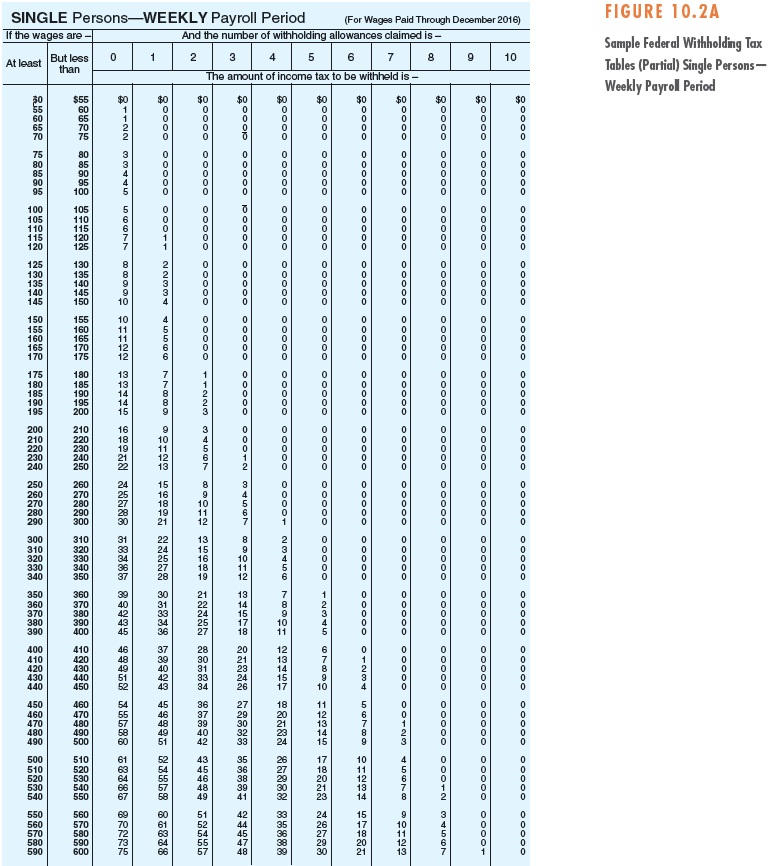

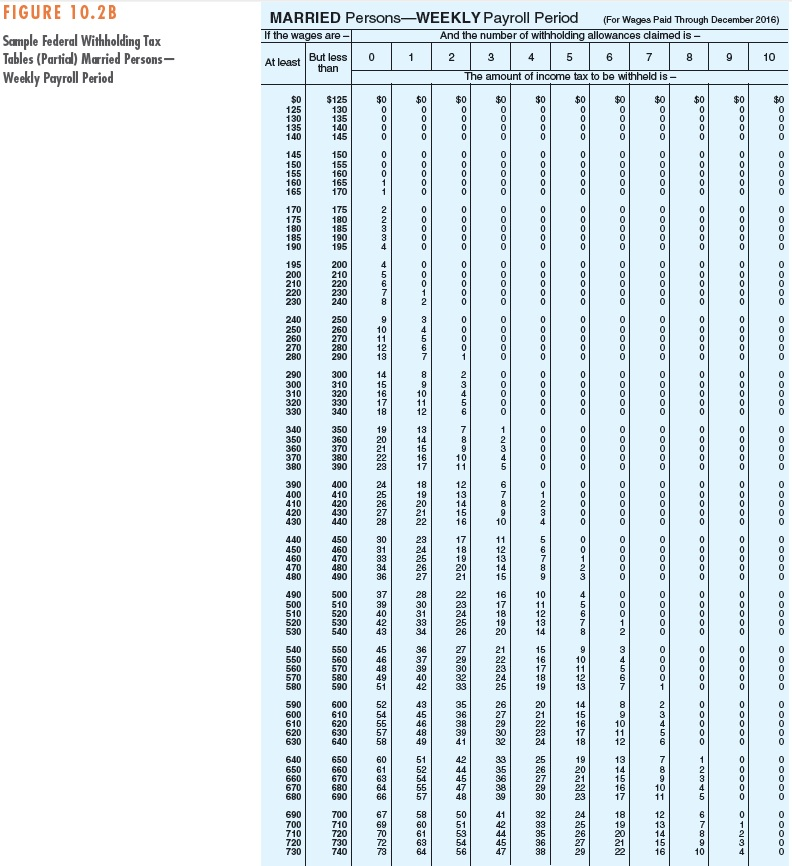

165 160 155 150 At least But less than 998 97 98 99 GEROS RER? 2887 0 van 8 98889 88982 8966 ARAS 8 48289 8898R D E DOOD WOOOWW -8 88899 89838 986 889 82898 S ou o 000VN ON A N OOO OOOOO 00008 ABER 8888 88889 1299918 A VOW N-000 20000 OOOOO OOOOO OOO OOOOO 0008 If the wages are - SINGLE Persons-WEEKLY Payroll Period And the number of withholding allowances claimed is - (For Wages Paid Through December 2016) 8888 88888 & BOOOO OOOOO OOOOOOOOOOOO000 0000 0000 0000 000 The amount of income tax to be withheld is - nas && 0099 20000 0000000000000000000000000000000000000000 18 von ANO DOOOO OOOOO OOOOO OOOOO OOOOOOOOOOOOOOO OOOOO OOOOO 00008 Tito VO WOO OOOOO OOO OOOOO OOOOO 00000 20000 OOOOO OOOOO 00000 20000 2000% 8 NOUAW NOOO OOOOO OOOOO OOOOO OOOOO D0000 00000 OOOOO OOOOO OOOOO OOOOO 0000 00008 0000 000000000000000000000000000000000000000000000000000000000000 0000- Weekly Payrol Period Tables (Partial) Single Persons- Sample Federal Withholding Tax FIGURE 10.2A FIGURE 10.2B Sample Federal Withholding Tax Tables (Partid) Married Persons- Weekly Payroll Period MARRIED Persons-WEEKLY Payroll Period (For Wages Paid Through December 2016) If the wages are And the number of withholding allowances claimed is - But less | 5 | 6 1 7 1 At least g than The amount of income tax to be withheld is 0 11 | 12 140 145 150 155 160 165 175 180 15 190 + - No D Em ; FW1 - A nA + | A . No - 490 500 50 520 530 540 550 F -N 560 570 FRP NN&RK KN&RM MAW 6 kyonk 590 or 0 630 RE 40 65) HAS ED 670 680 700 N RS A SH s MY Alexander Wilson operates Metroplex Courier and Delivery Service. He has four employees who are paid on an hourly basis. During the work week beginning December 15 and ending December 21, 2016, his employees worked the number of hours shown below. Information about their hourly rates, marital status, and withholding allowances also appears below, along with their cumulative earnings for the year prior to the December 15-21 payroll period. Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-half times their regular hourly rate. Employee Gloria Bahamon Alex Garcia Ron Price Sara Russell Hours Regular Marital Withholding Cumulative Worked Hourly Rate Status Allowances Earnings 47 $ 16.40 M $ 32,830 43 28.20 57,270 49 26.60 M 53,942 40 13.40 S 0 26,590 2.6. Compute the regular, overtime, gross earnings, social security tax and Medicare tax to be withheld from each employee's earnings. Assume a 6.2 percent social security rate on the first $113.700 earned by the employee during the year. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Determine the amount of federal income tax to be withheld from each employee's total earnings. (Use the table shown in Figure 10.2A & Eigure 10.28 whichever is applicable) to determine the withholding for Russell. Withholdings for Bahamon is $110.00. $319.00 for Garcia, and $255.00 for Price. Finally compute the net amount due of each employee. (Bahamon and Russell are office workers. Garcia and Price are delivery workers.) (Round your intermediate calculations and final answers to 2 decimal places.) Answer is complete but not entirely correct. Payroll Register Week Beginning: December 15, 2016 And ending: December 21, 2016 Paid: December 23, 2016 Earnings Taxable wages Deductions Distribution Regular time earnings Employee Overtime earnings Cumulative earnings Gross earnings Social security Medicare Social security Medicare Income tax Office wages Delivery wages amount Gloria $ $ $ 828.20 Bahamon Alex Garcia 172.20 126.90 359.10 1 $ 656.00 1,128.00 1,064.00 536.00 $3,384.00 Ron Price $ 828.20 1,254.90 1.423.10 536.00 $ 4,042.20 $ 33,658.20 58,524.90 55,365.10 27,126.00 $ 174,674.20 $ 828.20 .254.90 1,423.10 536.00 2.042.20 $ 828.20 1,254.90 1 ,423.10 536.00 $4,042.20 $ 51.35 77.80 88.23 33.23 $ 250.61 12.01 18.20 20.63 7.77 58.61 $ 110.00 319.00 255.00 65.00 $ 749.00 $ 654.84 839.90 1,059.23 430.00 2.983.07 1.254.90 1,423.10 Sara Russel 1 536.00 $ 658.20 $ 1.364.20 $2,678.00 8&9. Prepare a general journal entry to record the payroll expenses for the week ended December 21, and December 23, 2016. (Round your intermediate calculations and final answers to 2 decimal places.) Answer is not complete. No Date Debit Credit 1 Dec 21, 2016 4,042.20 General Journal Sales salaries expense Social security tax payable Medicare tax payable Employee income tax payable Wages payable 250.62% 58.61 749.00 2,983.97 Dec 23, 2016 2.983.97 Wages payable Cash 2.983.97 165 160 155 150 At least But less than 998 97 98 99 GEROS RER? 2887 0 van 8 98889 88982 8966 ARAS 8 48289 8898R D E DOOD WOOOWW -8 88899 89838 986 889 82898 S ou o 000VN ON A N OOO OOOOO 00008 ABER 8888 88889 1299918 A VOW N-000 20000 OOOOO OOOOO OOO OOOOO 0008 If the wages are - SINGLE Persons-WEEKLY Payroll Period And the number of withholding allowances claimed is - (For Wages Paid Through December 2016) 8888 88888 & BOOOO OOOOO OOOOOOOOOOOO000 0000 0000 0000 000 The amount of income tax to be withheld is - nas && 0099 20000 0000000000000000000000000000000000000000 18 von ANO DOOOO OOOOO OOOOO OOOOO OOOOOOOOOOOOOOO OOOOO OOOOO 00008 Tito VO WOO OOOOO OOO OOOOO OOOOO 00000 20000 OOOOO OOOOO 00000 20000 2000% 8 NOUAW NOOO OOOOO OOOOO OOOOO OOOOO D0000 00000 OOOOO OOOOO OOOOO OOOOO 0000 00008 0000 000000000000000000000000000000000000000000000000000000000000 0000- Weekly Payrol Period Tables (Partial) Single Persons- Sample Federal Withholding Tax FIGURE 10.2A FIGURE 10.2B Sample Federal Withholding Tax Tables (Partid) Married Persons- Weekly Payroll Period MARRIED Persons-WEEKLY Payroll Period (For Wages Paid Through December 2016) If the wages are And the number of withholding allowances claimed is - But less | 5 | 6 1 7 1 At least g than The amount of income tax to be withheld is 0 11 | 12 140 145 150 155 160 165 175 180 15 190 + - No D Em ; FW1 - A nA + | A . No - 490 500 50 520 530 540 550 F -N 560 570 FRP NN&RK KN&RM MAW 6 kyonk 590 or 0 630 RE 40 65) HAS ED 670 680 700 N RS A SH s MY Alexander Wilson operates Metroplex Courier and Delivery Service. He has four employees who are paid on an hourly basis. During the work week beginning December 15 and ending December 21, 2016, his employees worked the number of hours shown below. Information about their hourly rates, marital status, and withholding allowances also appears below, along with their cumulative earnings for the year prior to the December 15-21 payroll period. Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-half times their regular hourly rate. Employee Gloria Bahamon Alex Garcia Ron Price Sara Russell Hours Regular Marital Withholding Cumulative Worked Hourly Rate Status Allowances Earnings 47 $ 16.40 M $ 32,830 43 28.20 57,270 49 26.60 M 53,942 40 13.40 S 0 26,590 2.6. Compute the regular, overtime, gross earnings, social security tax and Medicare tax to be withheld from each employee's earnings. Assume a 6.2 percent social security rate on the first $113.700 earned by the employee during the year. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Determine the amount of federal income tax to be withheld from each employee's total earnings. (Use the table shown in Figure 10.2A & Eigure 10.28 whichever is applicable) to determine the withholding for Russell. Withholdings for Bahamon is $110.00. $319.00 for Garcia, and $255.00 for Price. Finally compute the net amount due of each employee. (Bahamon and Russell are office workers. Garcia and Price are delivery workers.) (Round your intermediate calculations and final answers to 2 decimal places.) Answer is complete but not entirely correct. Payroll Register Week Beginning: December 15, 2016 And ending: December 21, 2016 Paid: December 23, 2016 Earnings Taxable wages Deductions Distribution Regular time earnings Employee Overtime earnings Cumulative earnings Gross earnings Social security Medicare Social security Medicare Income tax Office wages Delivery wages amount Gloria $ $ $ 828.20 Bahamon Alex Garcia 172.20 126.90 359.10 1 $ 656.00 1,128.00 1,064.00 536.00 $3,384.00 Ron Price $ 828.20 1,254.90 1.423.10 536.00 $ 4,042.20 $ 33,658.20 58,524.90 55,365.10 27,126.00 $ 174,674.20 $ 828.20 .254.90 1,423.10 536.00 2.042.20 $ 828.20 1,254.90 1 ,423.10 536.00 $4,042.20 $ 51.35 77.80 88.23 33.23 $ 250.61 12.01 18.20 20.63 7.77 58.61 $ 110.00 319.00 255.00 65.00 $ 749.00 $ 654.84 839.90 1,059.23 430.00 2.983.07 1.254.90 1,423.10 Sara Russel 1 536.00 $ 658.20 $ 1.364.20 $2,678.00 8&9. Prepare a general journal entry to record the payroll expenses for the week ended December 21, and December 23, 2016. (Round your intermediate calculations and final answers to 2 decimal places.) Answer is not complete. No Date Debit Credit 1 Dec 21, 2016 4,042.20 General Journal Sales salaries expense Social security tax payable Medicare tax payable Employee income tax payable Wages payable 250.62% 58.61 749.00 2,983.97 Dec 23, 2016 2.983.97 Wages payable Cash 2.983.97

Can someone help me with correcting my wrong answers.

Can someone help me with correcting my wrong answers.