Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me with Q6 AND Q7? Examples - portfolio of two assets: Verify the following calculation. Q1 As an investor you are evaluating

can someone help me with Q6 AND Q7?

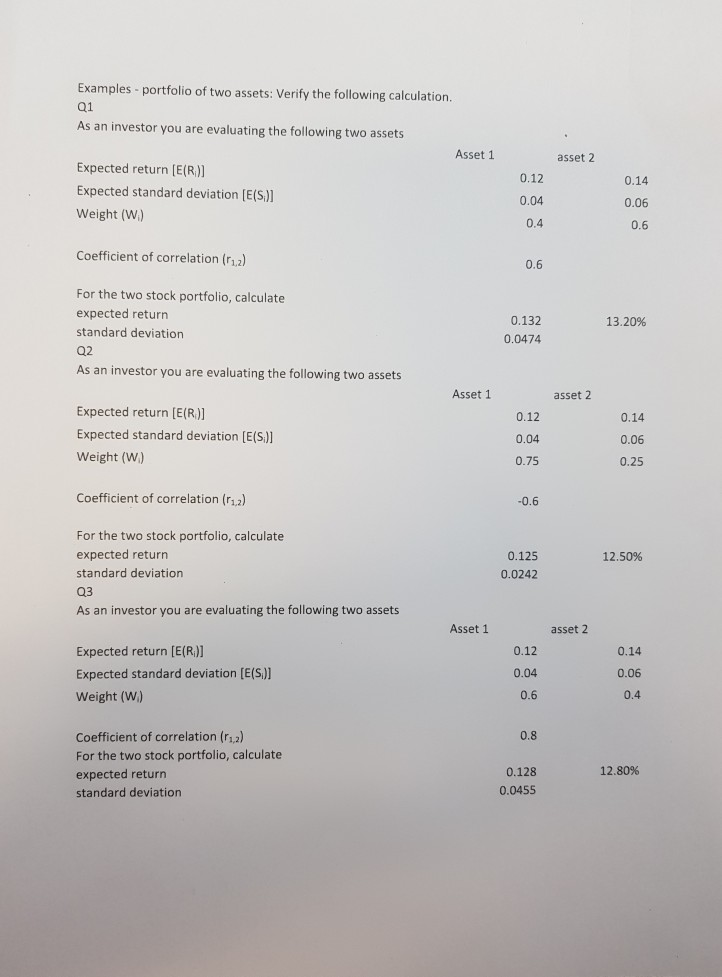

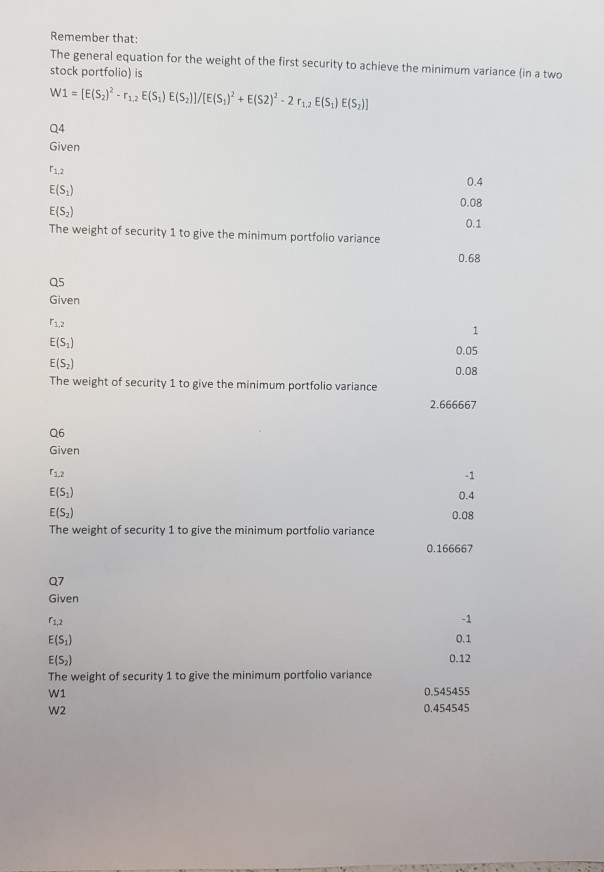

Examples - portfolio of two assets: Verify the following calculation. Q1 As an investor you are evaluating the following two assets Asset 1 asset 2 0.14 Expected return (E(R)] Expected standard deviation (E(S)] Weight (W) 0.12 0.04 0.4 Coefficient of correlation (112) For the two stock portfolio, calculate expected return standard deviation 13.20% 0.132 0.0474 Q2 As an investor you are evaluating the following two assets Asset 1 asset 2 0.14 Expected return [E(R)] Expected standard deviation [E(S)] Weight (W) 0.12 0.04 0.75 0.06 0.25 Coefficient of correlation (12) 12.50% For the two stock portfolio, calculate expected return standard deviation Q3 As an investor you are evaluating the following two assets 0.125 0.0242 Asset 1 asset 2 0.12 Expected return (E(R)] Expected standard deviation [E(S)] Weight (W) 0.14 0.06 0.4 0.8 Coefficient of correlation (12) For the two stock portfolio, calculate expected return standard deviation 12.80% 0.128 0.0455 Remember that: The general equation for the weight of the first security to achieve the minimum variance (in a two stock portfolio) is W1 = [E(52) - 11,2 E(S.) E(S)]/[E(S.) +E(S2) - 2 r12 (51) E(52)] Q4 Given E(S) E(S) The weight of security 1 to give the minimum portfolio variance 0.1 0.68 a5 Given 112 E(S) E(S) The weight of security 1 to give the minimum portfolio variance 0.05 0.08 2.666667 Given 112 E(S.) E(S) The weight of security 1 to give the minimum portfolio variance 0.4 0.08 0.166667 Q7 Given 11,2 0.1 0.12 E(S.) E(S) The weight of security 1 to give the minimum portfolio variance W1 0.545455 0.454545 W2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started