Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me with the calculations for these journal entries? Can someone help with the calculations for these journal entries?? I need to know

can someone help me with the calculations for these journal entries?

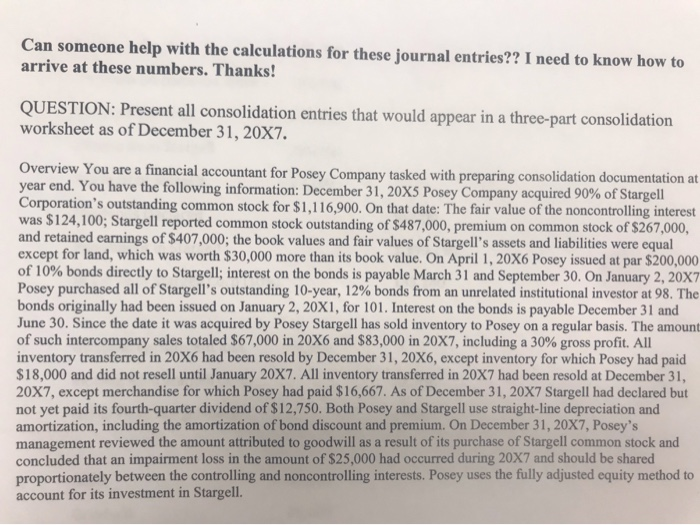

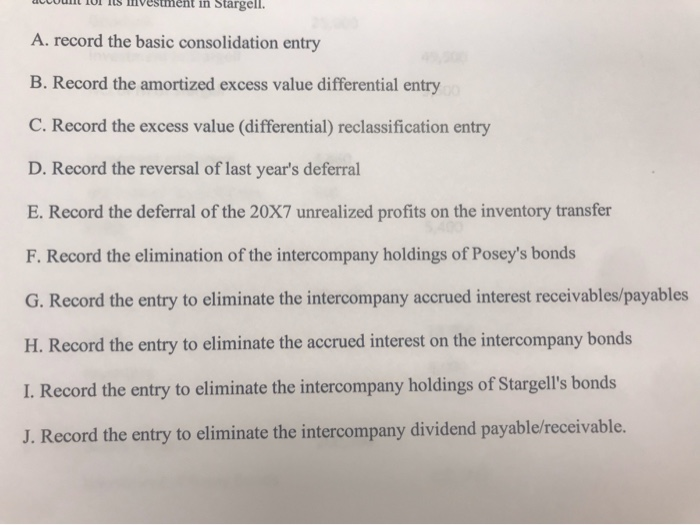

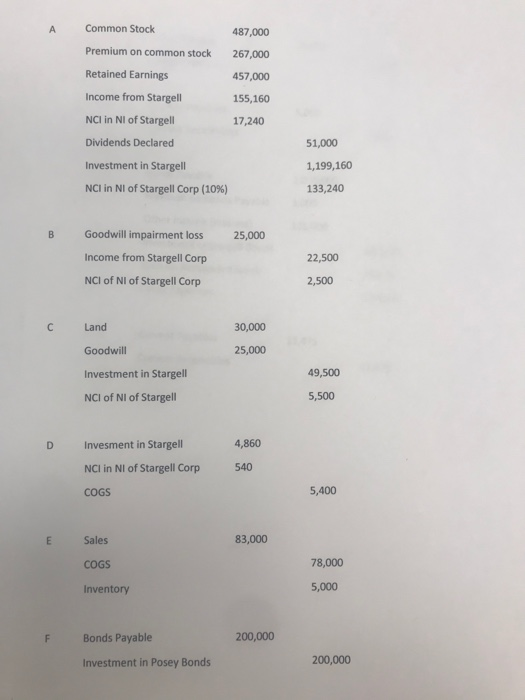

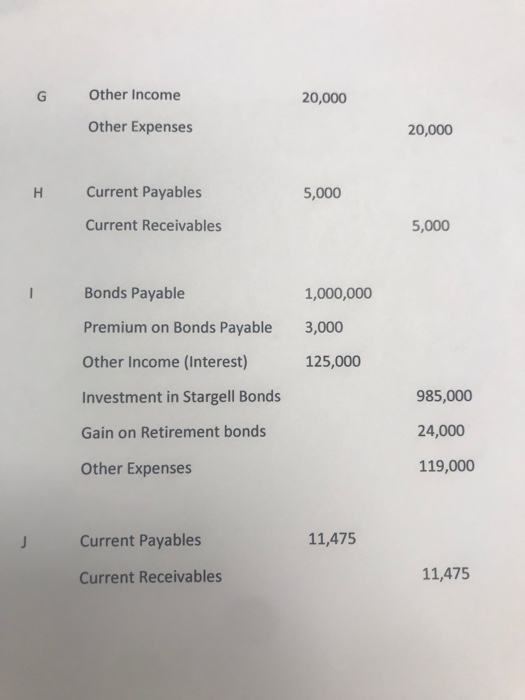

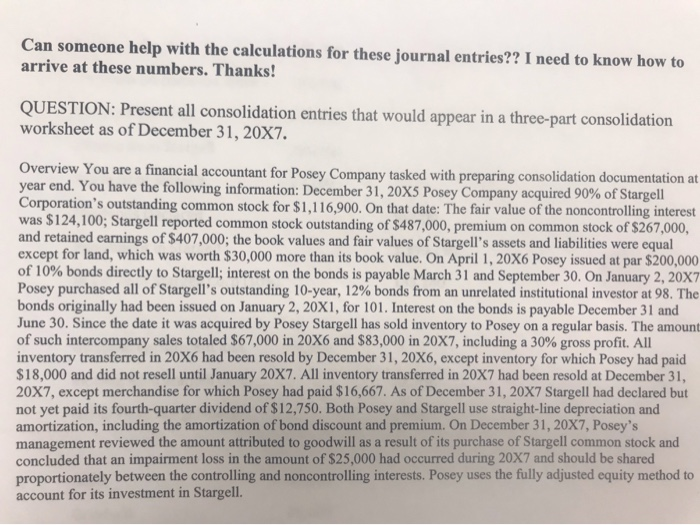

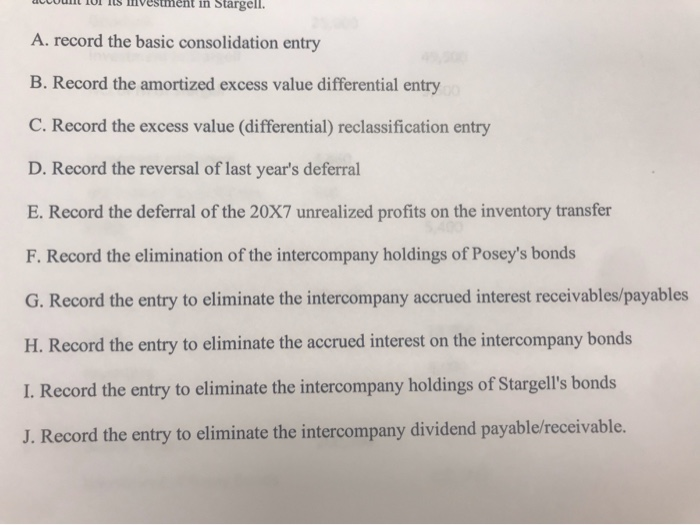

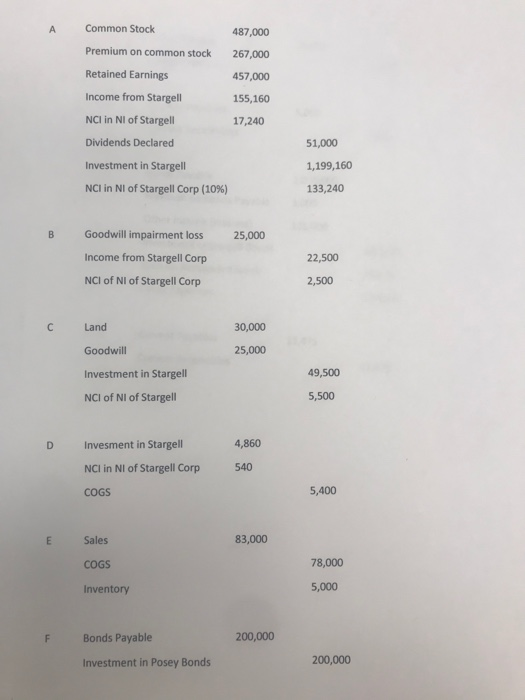

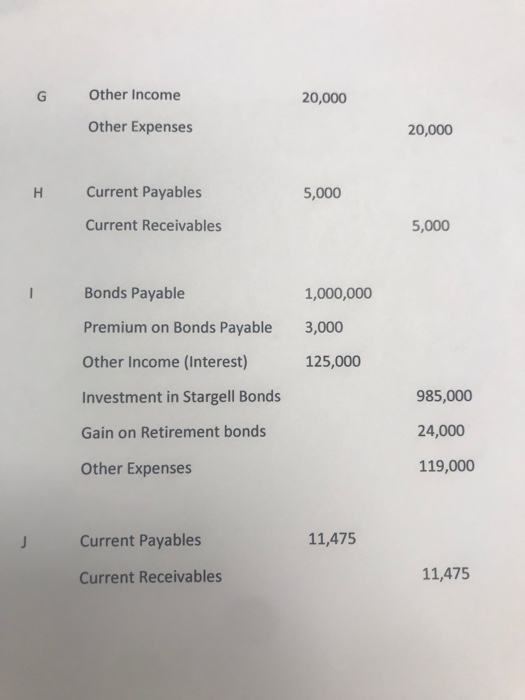

Can someone help with the calculations for these journal entries?? I need to know how to arrive at these numbers. Thanks! QUESTION: Present all consolidation entries that would appear in a three-part consolidation worksheet as of December 31, 20x7. Overview You are a financial accountant for Posey Company tasked with preparing consolidation documentation at year end. You have the following information: December 31, 20X5 Posey Company acquired 90% of Stargell Corporation's outstanding common stock for $1,116,900. On that date: The fair value of the noncontrolling interest was $124,100; Stargell reported common stock outstanding of $487,000, premium on common stock of $267,000, and retained earnings of $407,000; the book values and fair values of Stargell's assets and liabilities were equal except for land, which was worth $30,000 more than its book value. On April 1, 20X6 Posey issued at par $200,000 of 10% bonds directly to Stargell; interest on the bonds is payable March 31 and September 30. On January 2, 20X7 Posey purchased all of Stargell's outstanding 10-year, 12% bonds from an unrelated institutional investor at 98. The bonds originally had been issued on January 2, 20X1, for 101. Interest on the bonds is payable December 31 and June 30. Since the date it was acquired by Posey Stargell has sold inventory to Posey on a regular basis. The amount of such intercompany sales totaled $67,000 in 20X6 and $83,000 in 20X7, including a 30% gross profit. All inventory transferred in 20X6 had been resold by December 31, 20X6, except inventory for which Posey had paid $18,000 and did not resell until January 20X7. All inventory transferred in 20x7 had been resold at December 31, 20X7, except merchandise for which Posey had paid $16,667. As of December 31, 20X7 Stargell had declared but not yet paid its fourth-quarter dividend of $12,750. Both Posey and Stargell use straight-line depreciation and amortization, including the amortization of bond discount and premium. On December 31, 20X7, Posey's management reviewed the amount attributed to goodwill as a result of its purchase of Stargell common stock and concluded that an impairment loss in the amount of $25,000 had occurred during 20X7 and should be shared proportionately between the controlling and noncontrolling interests. Posey uses the fully adjusted equity method to account for its investment in Stargell. in Stargell. A. record the basic consolidation entry B. Record the amortized excess value differential entry C. Record the excess value (differential) reclassification entry D. Record the reversal of last year's deferral E. Record the deferral of the 20X7 unrealized profits on the inventory transfer F. Record the elimination of the intercompany holdings of Posey's bonds G. Record the entry to eliminate the intercompany accrued interest receivables/payables H. Record the entry to eliminate the accrued interest on the intercompany bonds I. Record the entry to eliminate the intercompany holdings of Stargell's bonds J. Record the entry to eliminate the intercompany dividend payable/receivable. Common Stock 487,000 Premium on common stock 267,000 Retained Earnings 457,000 Income from Stargell 155,160 NCI in NI of Stargell 17,240 Dividends Declared Investment in Stargell NCI in NI of Stargell Corp (10%) 51,000 1,199,160 133,240 B 25,000 Goodwill impairment loss Income from Stargell Corp NCI of NI of Stargell Corp 22,500 2,500 Land 30,000 Goodwill 25,000 49,500 Investment in Stargell NCI of NI of Stargell 5,500 D 4,860 Invesment in Stargell NCI in NI of Stargell Corp 540 COGS 5,400 E Sales 83,000 COGS 78,000 Inventory 5,000 F Bonds Payable 200,000 Investment in Posey Bonds 200,000 G Other Income 20,000 Other Expenses 20,000 H Current Payables 5,000 Current Receivables 5,000 - Bonds Payable 1,000,000 Premium on Bonds Payable 3,000 Other Income (Interest) 125,000 Investment in Stargell Bonds 985,000 Gain on Retirement bonds 24,000 Other Expenses 119,000 Current Payables 11,475 Current Receivables 11,475 Can someone help with the calculations for these journal entries?? I need to know how to arrive at these numbers. Thanks! QUESTION: Present all consolidation entries that would appear in a three-part consolidation worksheet as of December 31, 20x7. Overview You are a financial accountant for Posey Company tasked with preparing consolidation documentation at year end. You have the following information: December 31, 20X5 Posey Company acquired 90% of Stargell Corporation's outstanding common stock for $1,116,900. On that date: The fair value of the noncontrolling interest was $124,100; Stargell reported common stock outstanding of $487,000, premium on common stock of $267,000, and retained earnings of $407,000; the book values and fair values of Stargell's assets and liabilities were equal except for land, which was worth $30,000 more than its book value. On April 1, 20X6 Posey issued at par $200,000 of 10% bonds directly to Stargell; interest on the bonds is payable March 31 and September 30. On January 2, 20X7 Posey purchased all of Stargell's outstanding 10-year, 12% bonds from an unrelated institutional investor at 98. The bonds originally had been issued on January 2, 20X1, for 101. Interest on the bonds is payable December 31 and June 30. Since the date it was acquired by Posey Stargell has sold inventory to Posey on a regular basis. The amount of such intercompany sales totaled $67,000 in 20X6 and $83,000 in 20X7, including a 30% gross profit. All inventory transferred in 20X6 had been resold by December 31, 20X6, except inventory for which Posey had paid $18,000 and did not resell until January 20X7. All inventory transferred in 20x7 had been resold at December 31, 20X7, except merchandise for which Posey had paid $16,667. As of December 31, 20X7 Stargell had declared but not yet paid its fourth-quarter dividend of $12,750. Both Posey and Stargell use straight-line depreciation and amortization, including the amortization of bond discount and premium. On December 31, 20X7, Posey's management reviewed the amount attributed to goodwill as a result of its purchase of Stargell common stock and concluded that an impairment loss in the amount of $25,000 had occurred during 20X7 and should be shared proportionately between the controlling and noncontrolling interests. Posey uses the fully adjusted equity method to account for its investment in Stargell. in Stargell. A. record the basic consolidation entry B. Record the amortized excess value differential entry C. Record the excess value (differential) reclassification entry D. Record the reversal of last year's deferral E. Record the deferral of the 20X7 unrealized profits on the inventory transfer F. Record the elimination of the intercompany holdings of Posey's bonds G. Record the entry to eliminate the intercompany accrued interest receivables/payables H. Record the entry to eliminate the accrued interest on the intercompany bonds I. Record the entry to eliminate the intercompany holdings of Stargell's bonds J. Record the entry to eliminate the intercompany dividend payable/receivable. Common Stock 487,000 Premium on common stock 267,000 Retained Earnings 457,000 Income from Stargell 155,160 NCI in NI of Stargell 17,240 Dividends Declared Investment in Stargell NCI in NI of Stargell Corp (10%) 51,000 1,199,160 133,240 B 25,000 Goodwill impairment loss Income from Stargell Corp NCI of NI of Stargell Corp 22,500 2,500 Land 30,000 Goodwill 25,000 49,500 Investment in Stargell NCI of NI of Stargell 5,500 D 4,860 Invesment in Stargell NCI in NI of Stargell Corp 540 COGS 5,400 E Sales 83,000 COGS 78,000 Inventory 5,000 F Bonds Payable 200,000 Investment in Posey Bonds 200,000 G Other Income 20,000 Other Expenses 20,000 H Current Payables 5,000 Current Receivables 5,000 - Bonds Payable 1,000,000 Premium on Bonds Payable 3,000 Other Income (Interest) 125,000 Investment in Stargell Bonds 985,000 Gain on Retirement bonds 24,000 Other Expenses 119,000 Current Payables 11,475 Current Receivables 11,475

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started