Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me with the JE's (dont worry about the numers ) 1) Record the journal entry for the purchase of all the raw

can someone help me with the JE's (dont worry about the numers )

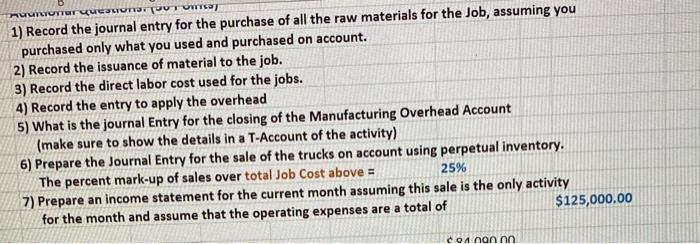

1) Record the journal entry for the purchase of all the raw materials for the Job, assuming you purchased only what you used and purchased on account. 2) Record the issuance of material to the job. 3) Record the direct labor cost used for the jobs. 4) Record the entry to apply the overhead 5) What is the journal Entry for the closing of the Manufacturing Overhead Account (make sure to show the details in a T-Account of the activity) 6) Prepare the Journal Entry for the sale of the trucks on account using perpetual inventory. The percent mark-up of sales over total Job Cost above = 25% 7) Prepare an income statement for the current month assuming this sale is the only activity for the month and assume that the operating expenses are a total of $125,000,00 1) Record the journal entry for the purchase of all the raw materials for the Job, assuming you purchased only what you used and purchased on account. 2) Record the issuance of material to the job. 3) Record the direct labor cost used for the jobs. 4) Record the entry to apply the overhead 5) What is the journal Entry for the closing of the Manufacturing Overhead Account (make sure to show the details in a T-Account of the activity) 6) Prepare the Journal Entry for the sale of the trucks on account using perpetual inventory. The percent mark-up of sales over total Job Cost above = 25% 7) Prepare an income statement for the current month assuming this sale is the only activity for the month and assume that the operating expenses are a total of $125,000,00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started