Answered step by step

Verified Expert Solution

Question

1 Approved Answer

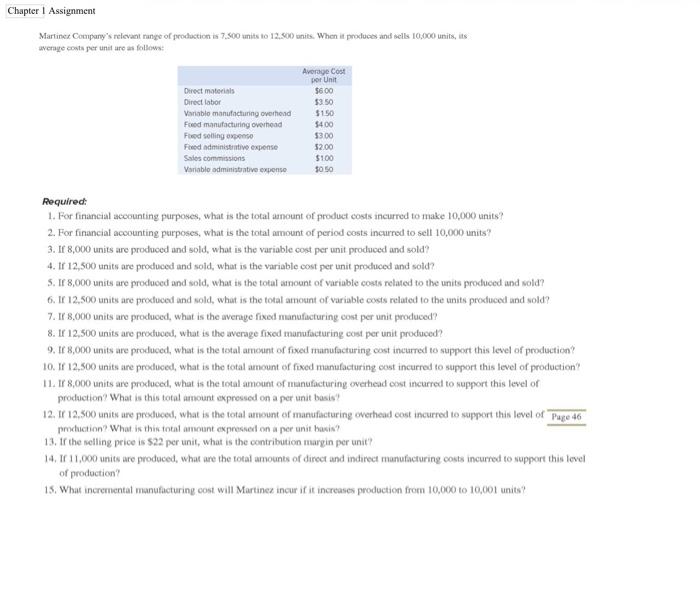

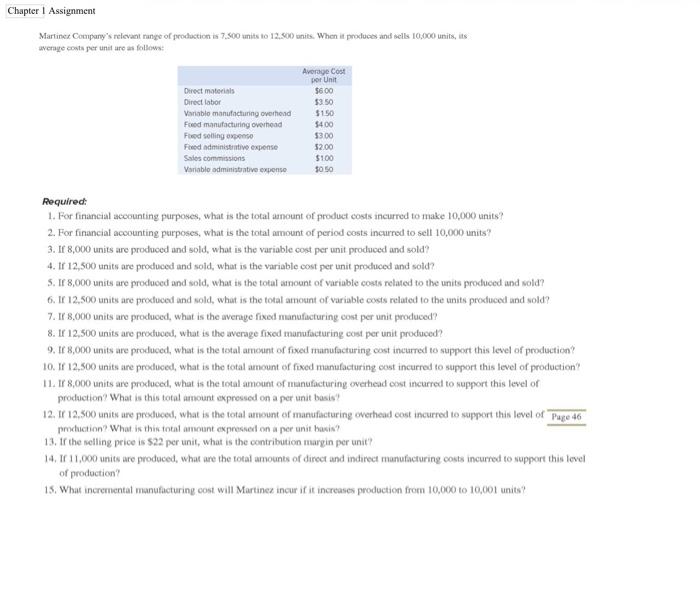

can someone help me with the last 2 questions please Chapter 1 Assignment Martinet Company's relevant runge of production is 7,500 units to 12.500 units.

can someone help me with the last 2 questions please

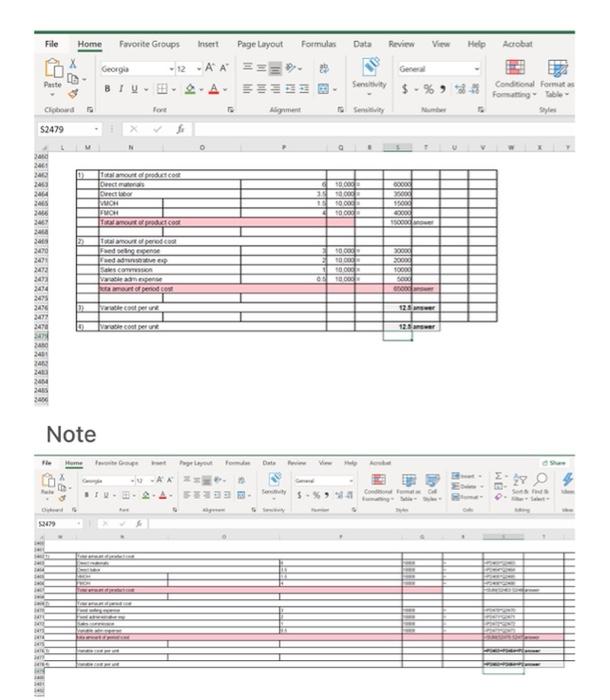

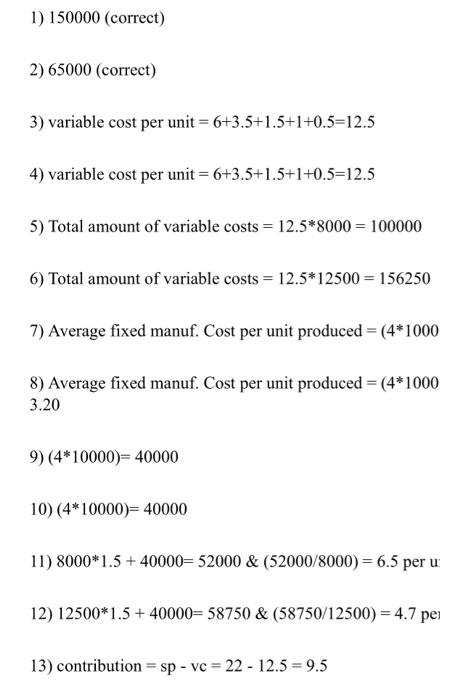

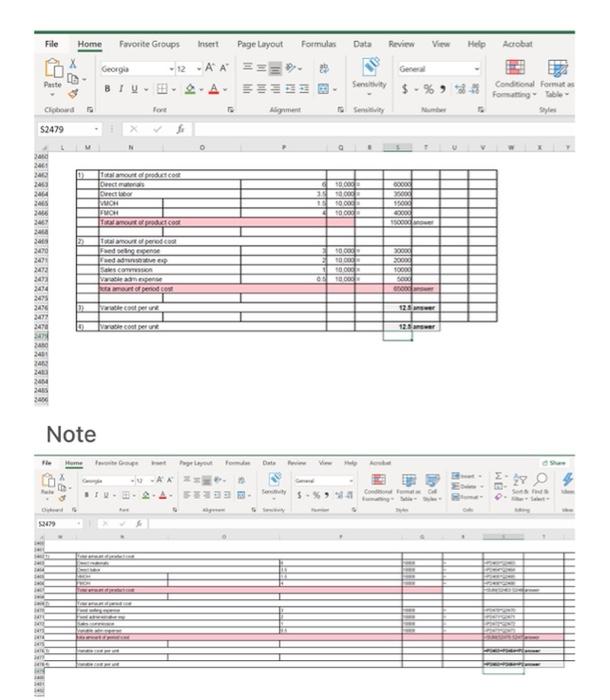

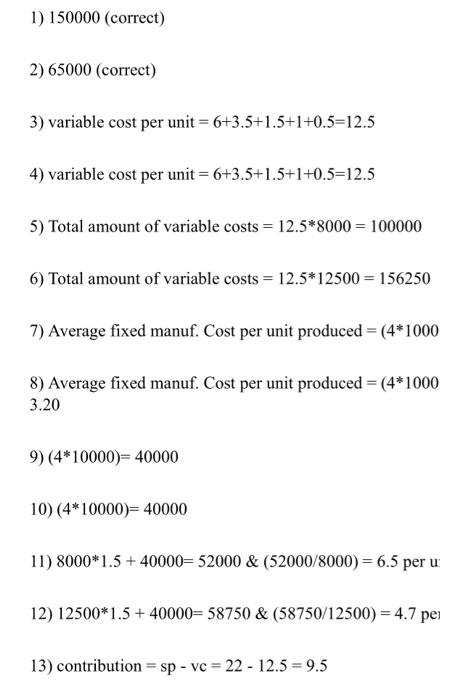

Chapter 1 Assignment Martinet Company's relevant runge of production is 7,500 units to 12.500 units. When it produces and sells 10,000 units, its wenye costa per unit are as follows: Direct matris Direct labor Variable manufacturing overtond Fored manufacturing overhead Fred Selling Fred administrative expense Sales commissions Variable administrative expense Average Cost por Unit 5600 $3.50 $150 $400 5300 32.00 $100 50 50 Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 10,000 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 10,000 units? 3. If 8,000 units are produced and sold, what is the variable cost per unit produced and sold? 4. Ir 12,500 units are produced and sold, what is the variable cost per unit produced and sold? 5. If 8,000 units are produced and sold, what is the total amount of variable costs related to the units produced and sold? 6.16 12.500 units are produced and sold, what is the total amount of variable costs related to the units produced and sold? 7. If 8,000 units are produced, what is the average fixed manufacturing cost per unit produced 8. I 12,500 units are produced, what is the average fixed manufacturing cost per unit produced? 9.16 8,000 units are produced, what is the total amount of fixeil manufacturing cost incurred to support this level of production 10. If 12,500 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production 11. If 8,000 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis? 12. Ir 12,500 units are proxluced, what is the total amount of manufacturing overhead cost incurred to support this level of Page 46 prochuction? What is this total amount expressed on a per unit basis? 13. If the selling price is $22 per unit, what is the contribution margin per unit? 14. IF 11.000 units are produced, what are the total amounts of direct and indirect manufacturing costs incurred to support this level of production 15. What incremental manufacturing cost will Martinez incur if it increases production from 10,000 to 10,00 units? File Data Review Help Acrobat Home Favorite Groups Insert Page Layout Formulas Georgia -12 AA 22. BIA Putte Sen $ -% 93 Conditional Formats Forge Syles For Aliment S2479 O D ad 2011 240 2453 2464 2008 2006 tout Sections DO LODU 1 1 HON HON 10 000 10 100 000 100 NUEL 2468 Se 12 to pre.co Fund Donde OD 30000 20000 IND 2000 201 2012 23 2474 ICON wa 800 POG SON D ver 125 2494 2477 2474 473 240 12.5 war W 24 24 2014 SURE Note Mume - AZ * 2 4 Co ST VIRE 10 RE SH - 1) 150000 (correct) 2) 65000 (correct) 3) variable cost per unit =6+3.5+1.5+1+0.5=12.5 4) variable cost per unit = 6+3.5+1.5+1+0.5=12.5 5) Total amount of variable costs = 12.5*8000 = 100000 6) Total amount of variable costs = 12.5*12500 = 156250 7) Average fixed manuf. Cost per unit produced = (4*1000 8) Average fixed manuf. Cost per unit produced = (4*1000 3.20 9) (4*10000)= 40000 10) (4*10000= 40000 11) 8000*1.5 + 40000= 52000 & (52000/8000) = 6.5 per u 12) 12500*1.5 + 40000= 58750 & (58750/12500) = 4.7 per 13) contribution = sp - vc = 22 - 12.5 = 9.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started