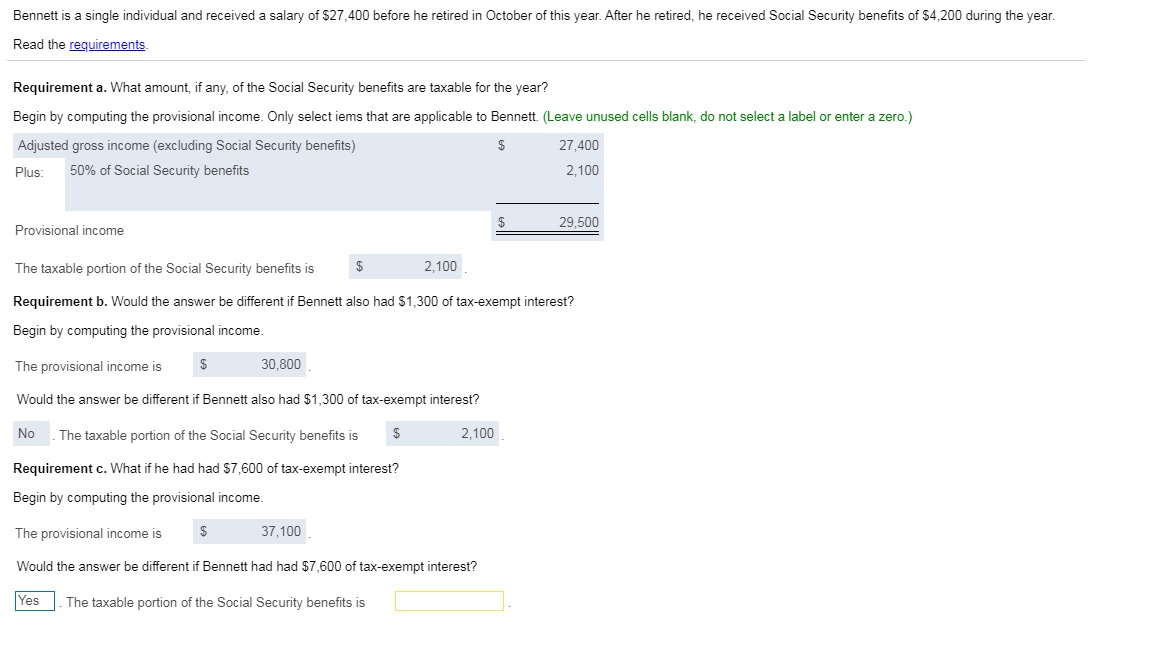

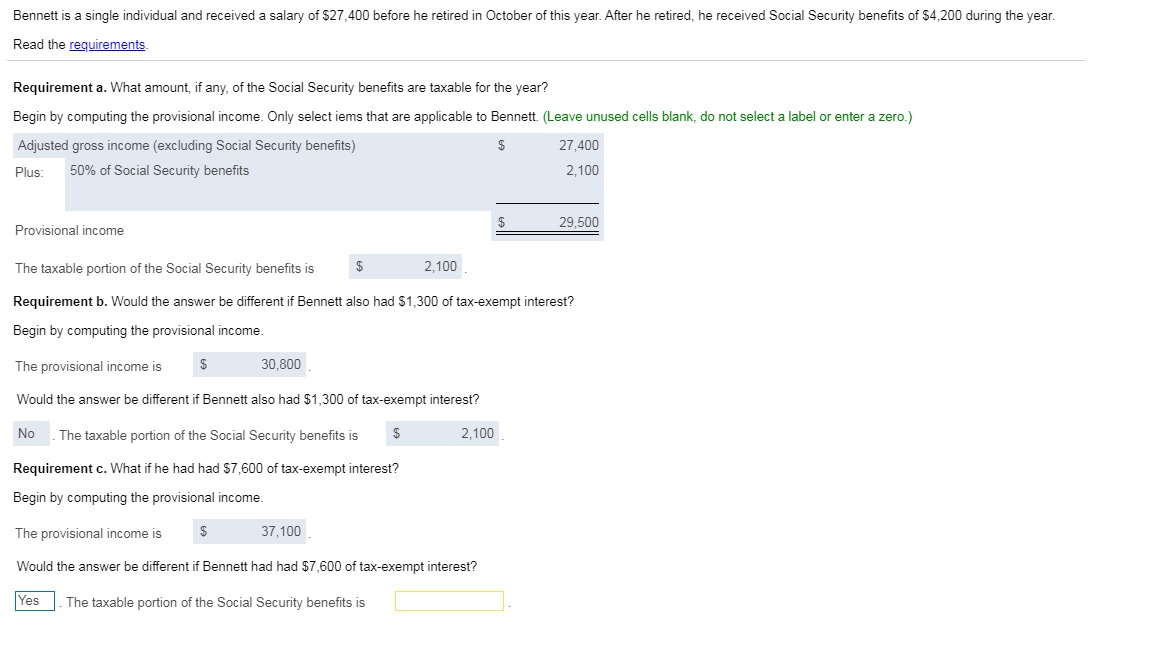

Can someone help me with the last part "Would the answer be different if Bennett had had $7,600 of tax-exempt interest?"

Bennett is a single individual and received a salary of $27,400 before he retired in October of this year. After he retired, he received Social Security benefits of $4,200 during the year. Read the requirements Requirement a. What amount, if any, of the Social Security benefits are taxable for the year? Begin by computing the provisional income. Only select iems that are applicable to Bennett. (Leave unused cells blank, do not select a label or enter a zero.) Adjusted gross income (excluding Social Security benefits) $ 27,400 Plus: 50% of Social Security benefits 2,100 Provisional income 29,500 The taxable portion of the Social Security benefits is $ 2,100 Requirement b. Would the answer be different if Bennett also had $1,300 of tax-exempt interest? Begin by computing the provisional income. The provisional income is $ 30,800 Would the answer be different if Bennett also had $1,300 of tax-exempt interest? No The taxable portion of the Social Security benefits is $ 2.100 Requirement c. What if he had had $7,600 of tax-exempt interest? Begin by computing the provisional income. The provisional income is $ 37,100 Would the answer be different if Bennett had had $7,600 of tax-exempt interest? Yes . The taxable portion of the Social Security benefits is Bennett is a single individual and received a salary of $27,400 before he retired in October of this year. After he retired, he received Social Security benefits of $4,200 during the year. Read the requirements Requirement a. What amount, if any, of the Social Security benefits are taxable for the year? Begin by computing the provisional income. Only select iems that are applicable to Bennett. (Leave unused cells blank, do not select a label or enter a zero.) Adjusted gross income (excluding Social Security benefits) $ 27,400 Plus: 50% of Social Security benefits 2,100 Provisional income 29,500 The taxable portion of the Social Security benefits is $ 2,100 Requirement b. Would the answer be different if Bennett also had $1,300 of tax-exempt interest? Begin by computing the provisional income. The provisional income is $ 30,800 Would the answer be different if Bennett also had $1,300 of tax-exempt interest? No The taxable portion of the Social Security benefits is $ 2.100 Requirement c. What if he had had $7,600 of tax-exempt interest? Begin by computing the provisional income. The provisional income is $ 37,100 Would the answer be different if Bennett had had $7,600 of tax-exempt interest? Yes . The taxable portion of the Social Security benefits is