Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me with the unanswered portion? Thanks Anthony and Michelle were not only best friends, they were coworkers - coworkers who were very

Can someone help me with the unanswered portion? Thanks

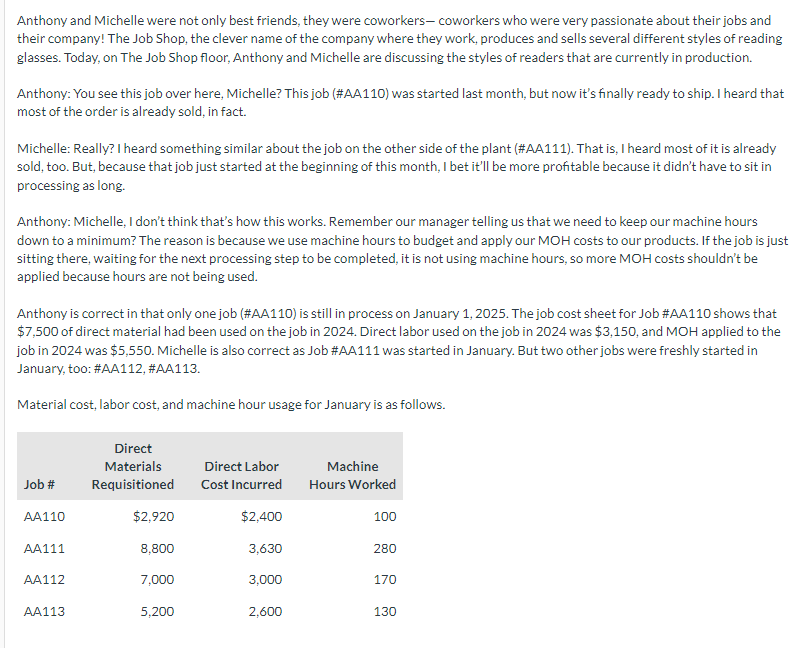

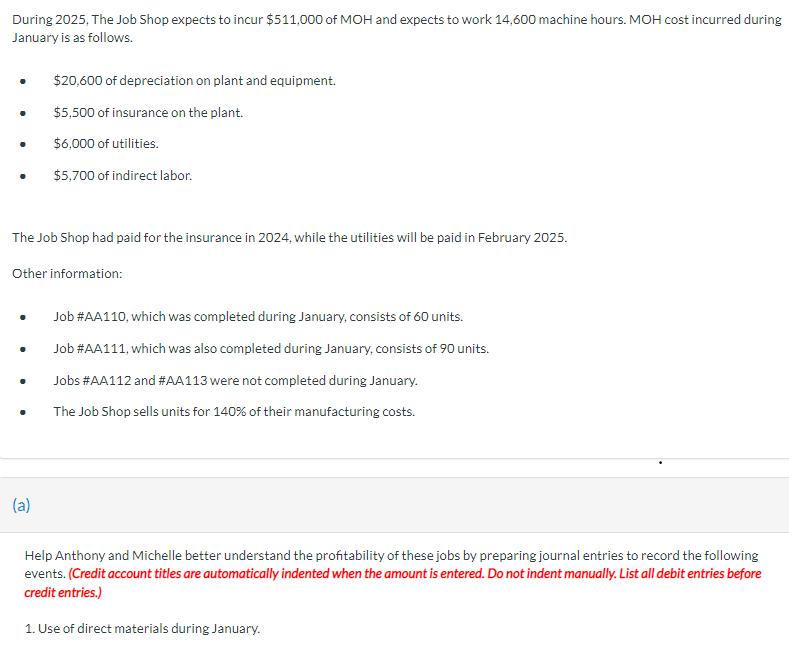

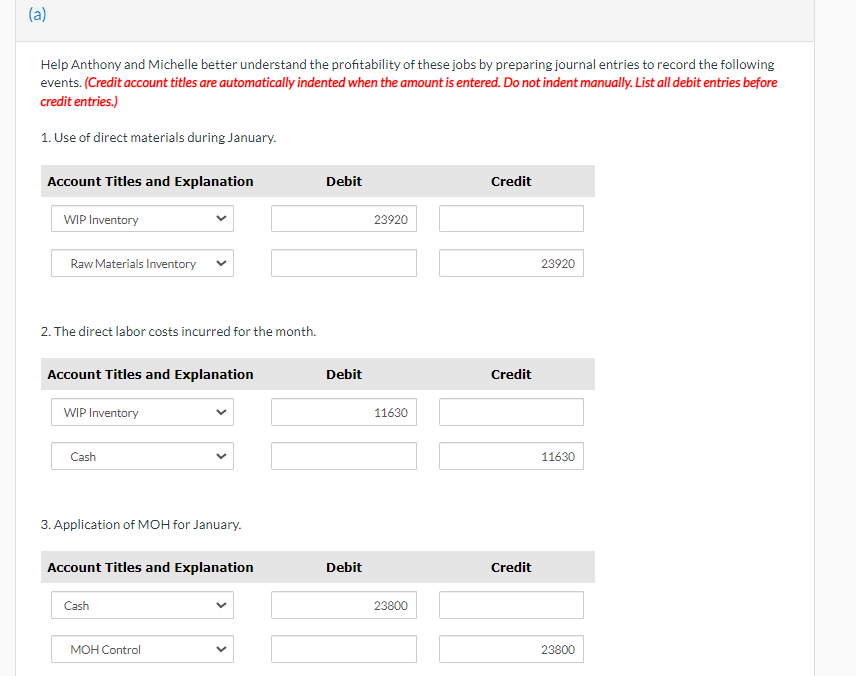

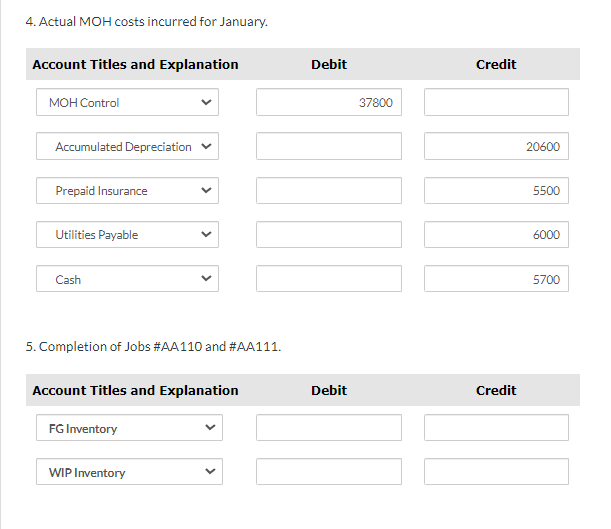

Anthony and Michelle were not only best friends, they were coworkers - coworkers who were very passionate about their jobs and their company! The Job Shop, the clever name of the company where they work, produces and sells several different styles of reading glasses. Today, on The Job Shop floor, Anthony and Michelle are discussing the styles of readers that are currently in production. Anthony: You see this job over here, Michelle? This job (#AA110) was started last month, but now it's finally ready to ship. I heard that most of the order is already sold, in fact. Michelle: Really? I heard something similar about the job on the other side of the plant (#AA111). That is, I heard most of it is already sold, too. But, because that job just started at the beginning of this month, I bet it'll be more profitable because it didn't have to sit in processing as long. Anthony: Michelle, I don't think that's how this works. Remember our manager telling us that we need to keep our machine hours down to a minimum? The reason is because we use machine hours to budget and apply our MOH costs to our products. If the job is just sitting there, waiting for the next processing step to be completed, it is not using machine hours, so more MOH costs shouldn't be applied because hours are not being used. Anthony is correct in that only one job (#AA110) is still in process on January 1, 2025. The job cost sheet for Job #AA110 shows that $7,500 of direct material had been used on the job in 2024. Direct labor used on the job in 2024 was $3,150, and MOH applied to the job in 2024 was $5,550. Michelle is also correct as Job #AA111 was started in January. But two other jobs were freshly started in January, too: #AA112, #AA113. During 2025 , The Job Shop expects to incur $511,000 of MOH and expects to work 14,600 machine hours. MOH cost incurred during January is as follows. - $20,600 of depreciation on plant and equipment. - $5,500 of insurance on the plant. - $6,000 of utilities. - $5,700 of indirect labor. The Job Shop had paid for the insurance in 2024 , while the utilities will be paid in February 2025. Other information: - Job #AA110, which was completed during January, consists of 60 units. - Job#AA111, which was also completed during January, consists of 90 units. - Jobs #AA112 and #AA113 were not completed during January. - The Job Shop sells units for 140% of their manufacturing costs. (a) Help Anthony and Michelle better understand the profitability of these jobs by preparing journal entries to record the following events. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) 1. Use of direct materials during January. Help Anthony and Michelle better understand the profitability of these jobs by preparing journal entries to record the following events. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) 1. Use of direct materials during January. 2. The direct labor costs incurred for the month. 3. Application of MOH for January. 4. Actual MOH costs incurred for January. 5. Completion of Jobs #AA110 and #AA111Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started