can someone help me with this

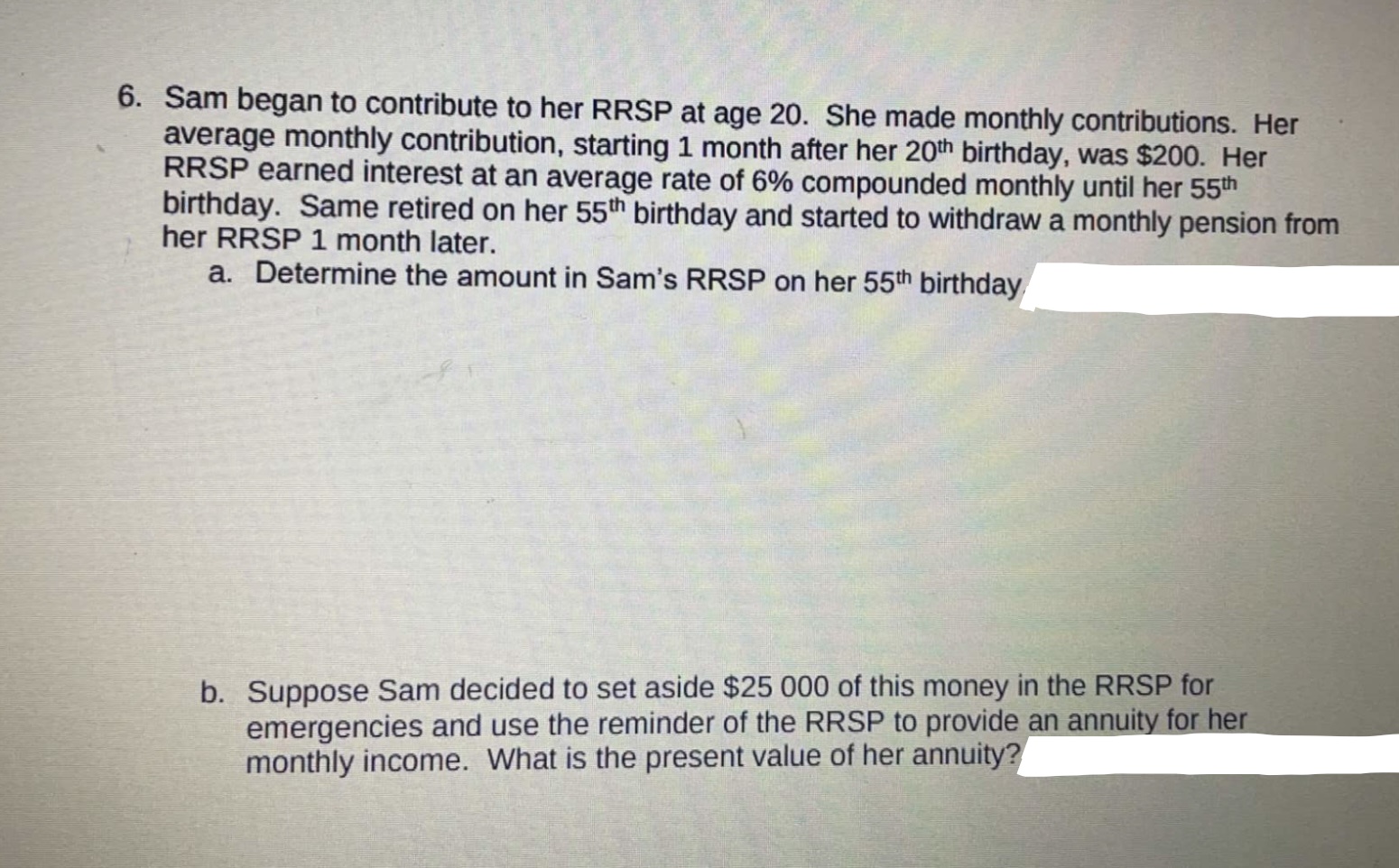

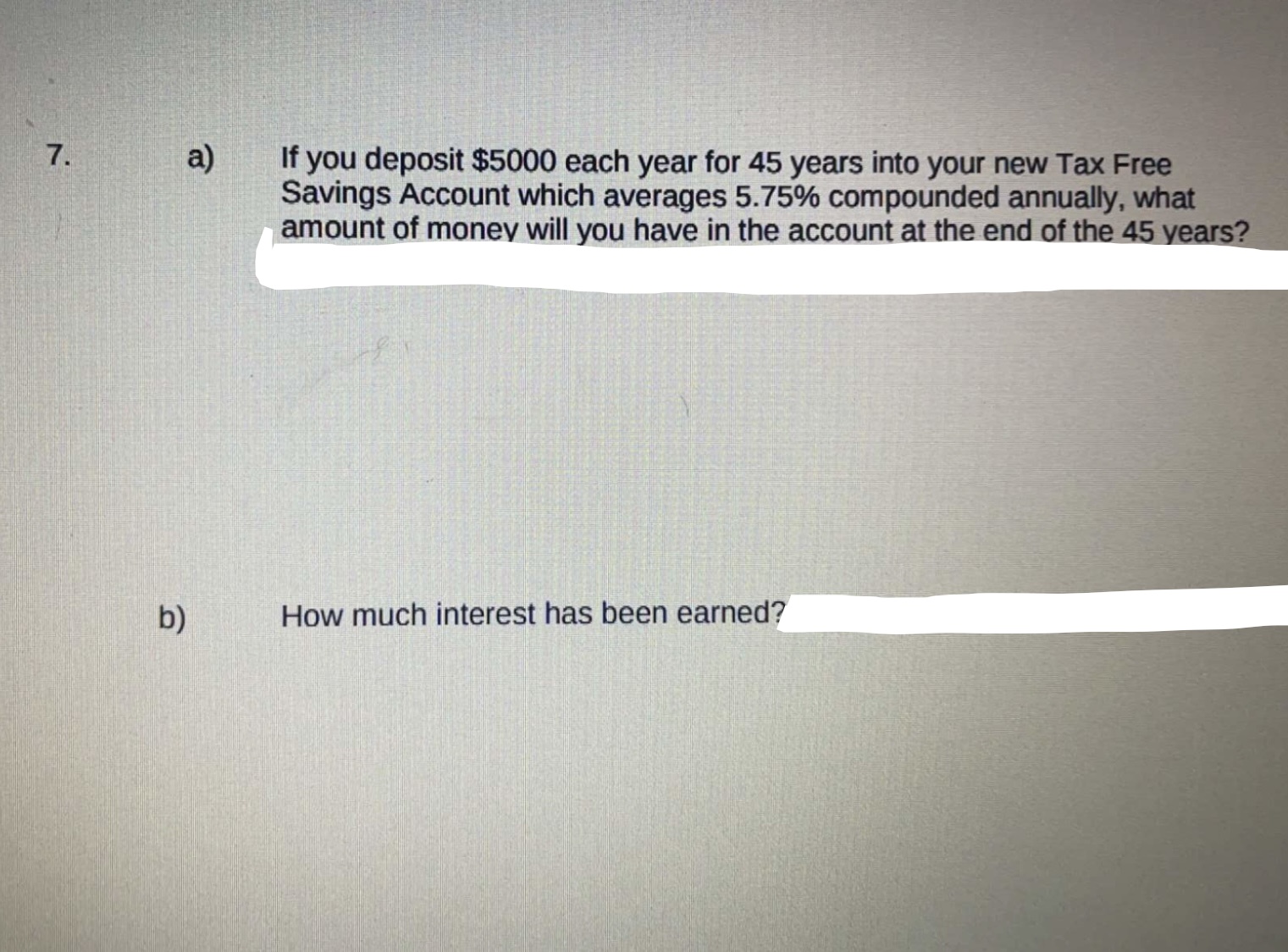

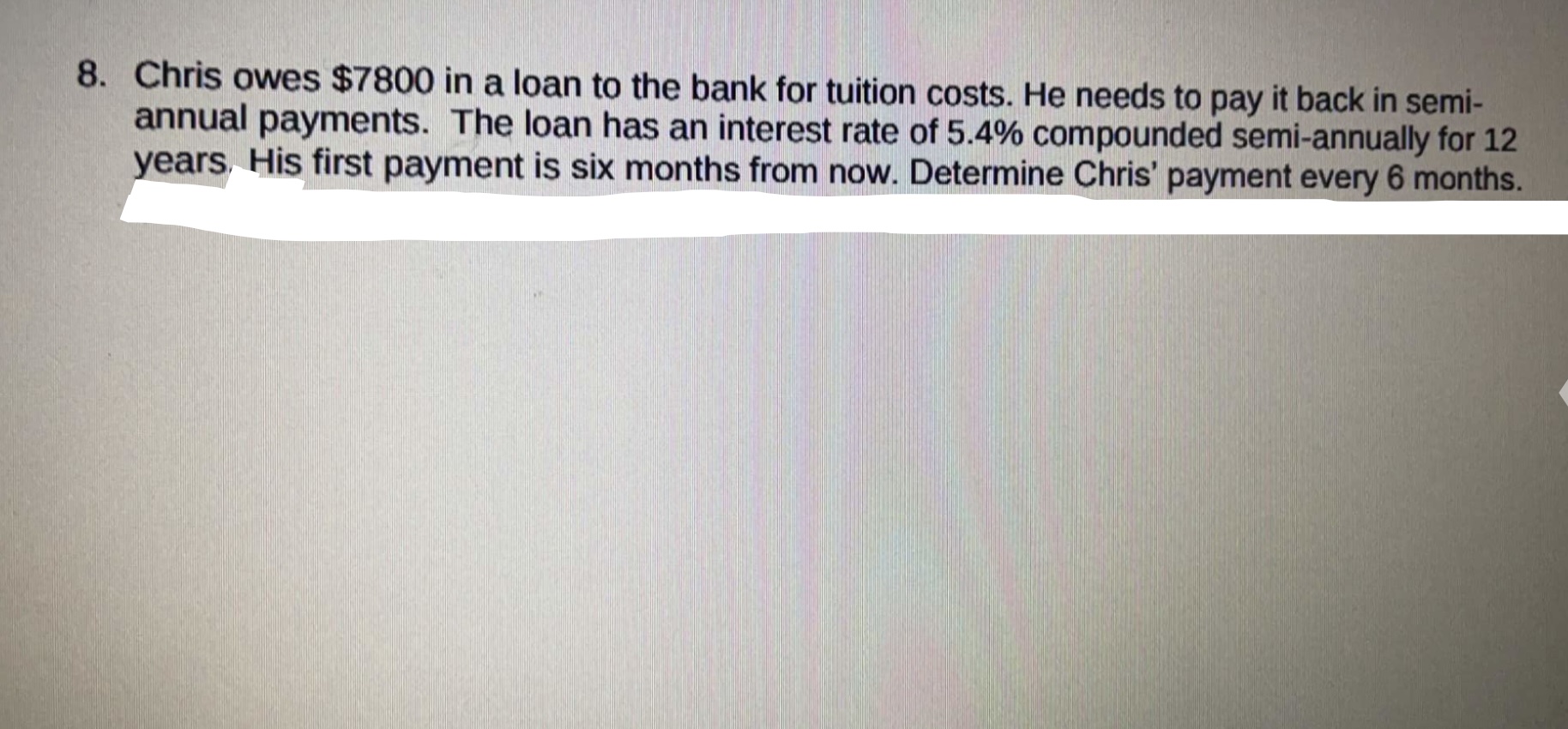

1. Galen is paying into an annuity. He deposits $50 at the end of each month for 6 years. If it earns 7.2% compounded monthly, what is the amount he has at the end of the 6 years?2. Sam wants to have an amount of $7500 in 5 years. He plans to begin making regular quarterly deposits starting 3 months from now into an account which earns interest at 6.25% compounded quarterly. a. What must his regular deposit be in order to achieve his goal? b. By the end of the 5 years, how much of his own money will he have deposited?3. Jenna won a lottery. She will receive a payment of $1500 per month for the next 10 years. The first payment will be made 1 month from now. a. How much money must the lottery corporation invest today at 8.4% compounded monthly to provide Jenna's prize for the next 10 years? b. Over the 10 years, how much money will Jenna receive? c. How much interest has the lottery corporation's investment earned?4. William has $7800 to invest today. He decides to purchase an annuity which pays 5.4% compounded semi-annually for 12 years. His first withdrawal is six months from now. Determine William's withdrawal every 6 months. 5. Simone wants to finance a car loan of $18 000 at 5.4% compounded monthly. She can choose a term of either 36 months or 48 months. (USE TVM Solver) Calculate how much Simone pays per month if she chooses a term of i) 36 months ii) 48 months N= N= IZ= 1%= PV= PMT= PMT= FV= FU= P/Y= P/Y= C/Y= C/Y= PMT: ENC BEGIN PMT : ENC BEGIN6. Sam began to contribute to her RRSP at age 20. She made monthly contributions. Her average monthly contribution, starting 1 month after her 20th birthday, was $200. Her RRSP earned interest at an average rate of 6% compounded monthly until her 55th birthday. Same retired on her 55th birthday and started to withdraw a monthly pension from her RRSP 1 month later. a. Determine the amount in Sam's RRSP on her 55th birthday b. Suppose Sam decided to set aside $25 000 of this money in the RRSP for emergencies and use the reminder of the RRSP to provide an annuity for her monthly income. What is the present value of her annuity?7. a) If you deposit $5000 each year for 45 years into your new Tax Free Savings Account which averages 5.75% compounded annually, what amount of money will you have in the account at the end of the 45 years? b How much interest has been earned?8. Chris owes $7800 in a loan to the bank for tuition costs. He needs to pay it back in semi- annual payments. The loan has an interest rate of 5.4% compounded semi-annually for 12 years, His first payment is six months from now. Determine Chris' payment every 6 months