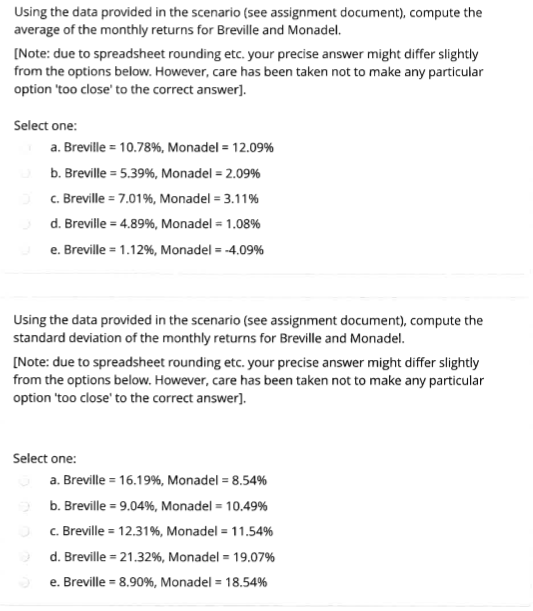

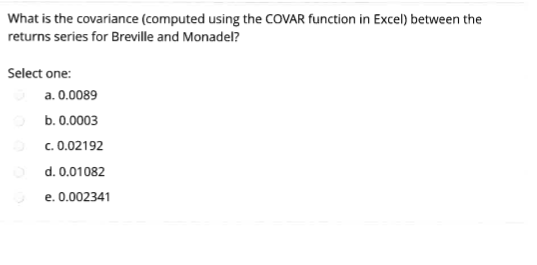

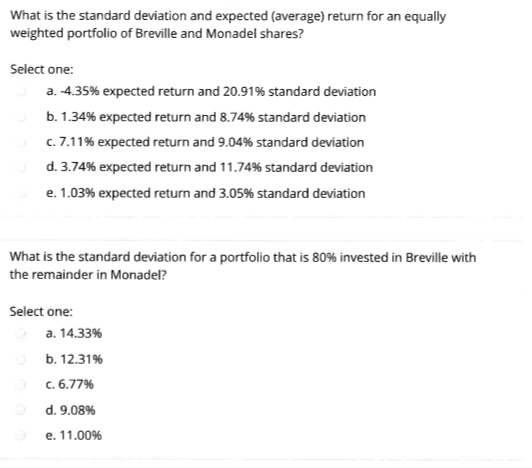

Question

Can someone help me with this and send met the excel file so i can see what functions have been used to answer the questions?

Can someone help me with this and send met the excel file so i can see what functions have been used to answer the questions?

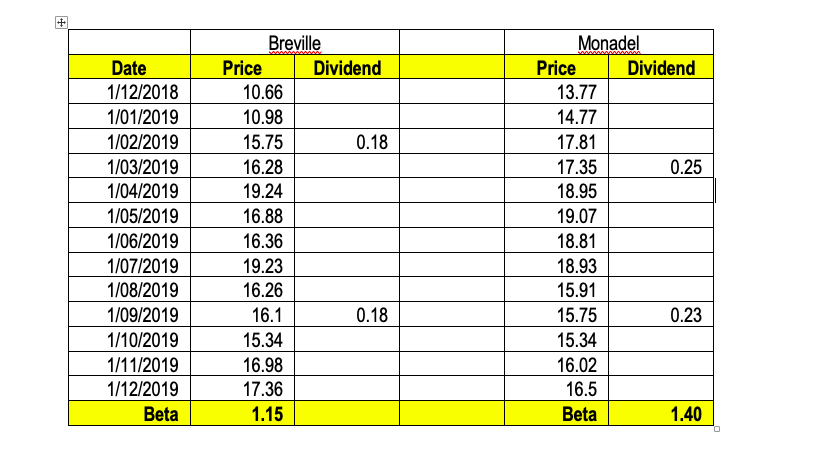

Scenario #3: Risk & Reward

Imagine, finally, that you are applying for a position as an analyst at Blackstone Asset Management. You are attending a testing session today. Some basic portfolio analysis skills will be tested. You have been given two series of prices (below) and you guess that you will have to compute the expected return and standard deviation (risk) for the two assets and portfolios containing different combinations of them. The company's recruiters have made it clear that you can bring your spreadsheet files with you to the test, a basic framework with as much work pre-done as possible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started