Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me with this assignment HDT Truck Company Case HDT Truck Company is a small firm located in Crown Point, Indiana and its

Can someone help me with this assignment

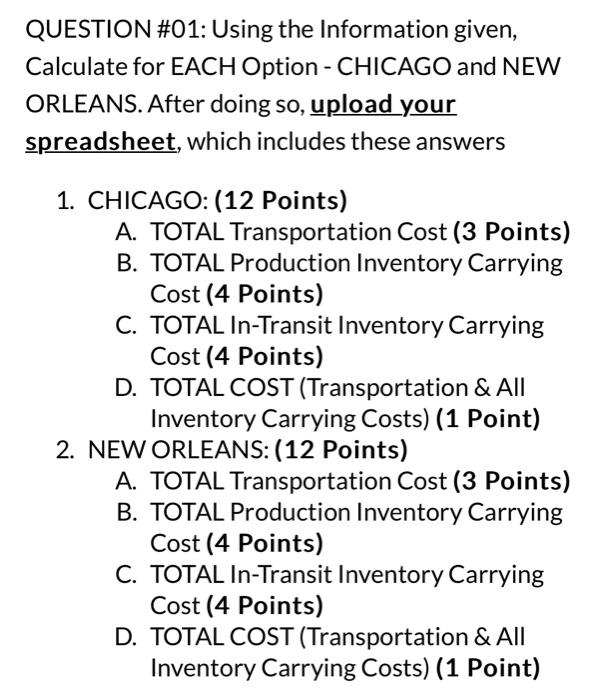

HDT Truck Company Case HDT Truck Company is a small firm located in Crown Point, Indiana and its only product is large trucks, built to individual customer specifications. HDT had been located in Crown Point since 1910. The firm once produced automobiles and light trucks as well, but dropped out of the auto business in 1924 and out of the light truck business in 1937 . The firm nearly went bankrupt, but by 1940 its fortunes were buoyed by receipt of several military contracts for "tank retrievers," which were large wheeled vehicles that could pull disabled tanks onto low trailers and haul them to locations where they could be repaired. HDT purchased all components from small manufacturers who were still clustered in the MilwaukeeDetroit-Toledo-Cleveland area. Essentially, all that HDT did was assemble the components into a specialized vehicle containing the combination of frame, power plant, transmission, axles, cab, etc., which was necessary to do the job. Due to the specialized nature of the trucks it manufacturers, HDT's "assembly" line is relatively slow moving. After wheels were attached to the frame and axles, the night shift labor force would push the chassis along to its next "station" on the line so it would be in place for the next day's shift. Using such production methods HDT was able to assemble two trucks per day. In late 2014, HDT received an order for 50 heavy trucks to be used in the oil fields of Venezuela. The terms of sale were delivery on or before Friday, June 5, 2015, at the port of Maracaibo, Venezuela. Under the terms of the Letter of Credit, HDT would receive US\$150,000 per truck, delivered ex-quay (DEQ), duty unpaid, at Maracaibo. Once each truck was unloaded, HDT would be paid for it. Chris Reynolds, production manager at HDT, estimated that production could start on Monday, March 23rd,2015, and the order would take 25 working days (5-day week) to complete. Since weekends were involved, the entire 50 trucks would be completed by Friday, April 24ot,2015. At the time the order was signed in 2014, Vic Gulllou, HDT's sales manager, argued that the "DEQ (duty unpaid) destination port" represented the best terms of sale since ocean charter rates were declining in 2015. This was after the build-up in the Middle East due to the conflicts in Yemen and the threat from ISIS, and due to the economic slowdown that continued to plague many western countries. Guillou predicted that by mid-2015 charter rates would be so low that the cheapest method of transport would be to load all 50 trucks onto one vessel. Norman Pon, HDT's treasurer, had countered that HDT should try to make a profit only from the manufacture of trucks since nobody in the firm knew much about ocean shipping. Gordon Robertson, HDT's President, was a gambler at heart, and disagreed with Pon. It was now March 2015, and Reynolds had the fifty-truck order scheduled to be on the line from March 23rd to April 24h, which represented about 2 trucks per working day. Other work was scheduled for the assembly line at the same time so the production schedule was considered to be "firm." Component parts for the trucks were already arriving. 1 I Page Pon looked at his cash flow projections, which were always made up for six weeks in advance, in this case through the first of April when some of the bills for components of the oil field trucks would come due. He called the Crown Point Bank & Trust Company, where HDT had a line of credit, and found that the current rate was 8.5 percent per annum. He then asked Bob Vanderpool, who was HDT's traffic manager, when the oil field trucks would arrive in Venezuela. "I don't know," was Vanderpool's reply, "I assumed Guillou had arranged for transportation at the time you decided to charge $150,000 per truck. But Ilil check further." He did, and phoned back to tell Pon that Guillou's secretary could find nothing in the files to indicate that Guillou had checked out charter rates. "That figures," muttered Pon, "would you mind doing some checking?" One week later, Vanderpool said he had done as much as he could and would turn the figures over to Pon. "We have two alternatives" said Vanderpool, "the 5t. Lawrence Seaway will open in April so we could use it. The problem is that the Seaway route is circuitcus, especially to reach Venezuela. Also, there aren't many scheduled Seaway sailings to that area, and since the Seaway will just be opening again, cargo space is hard to come by. Therefore, if we' re not going to charter a ship, the best bet is to use New Orleans." "What about chartering a ship?" asked Pon, "why not use New Orleans for that? "In theory, we could," answered Vanderpool, "but the size ship we want is rather small and not likely to be sailing into New Orleans. We could arrange to "share" a ship with another party but many bulk cargoes are pretty dusty and might not be compatible with our machinery. There is one foreign vessel, the Nola Pino, entering into the Great Lakes in April, which is still looking for an outbound charter. Seaway vessels, you know, are somewhat smaller because of the lock restrictions. If we want to charter that vessel, we'll have to move quickly, because if somebody else charters her, she's gone. At present, the ship is scheduled to be in Chicago the last week in April with a load of cocoa beans and ready for outbound loading April 25th. I think we could arrange a voyage charter for $117,000 lump sum. Thirty days would be enough time for her to load, transit the Seaway, reach Maracaibo and discharge the trucks. "Tell me about the aiternative," said Pon. "New Orleans has fairly frequent sailings to the area we want to reach," 5aid Vanderpool. "We could load and block at least two trucks per day on rail cars here, and send them to New Orleans. There is a ship scheduled to sail from New Orleans to Maracaibo every alternate day (i.e., every other day). It would take the trucks an average of four days to reach New Orleans where they would wait, at most, one day to be loaded aboard a ship. Sailing time to Maracaibo averages 8 days, a little more, a little less, depending on the amount of cargo to be handled at ports in between." "That averages to 13 days per truck," stated Pon who had been putting the figures in his computer. "What are the charges?" 2 I Eage Vanderpool answered: "It costs $70 to load and block two trucks on a flatcar, which is of course, $35 apiece as long as they move in pairs. Sticking to pairs, the rail rate for two on a flat car totals $970 to New Orleans, or $485 each. Switching and handling at New Orleans is $125 per truck and the ocean freight rate from New Orleans to Maracaibo is $3100 per truck. We also have to buy marine insurance which is about $875 per truck." "What are the costs if we charter the Nola Pino. You said it would be $117,000 for the vessel for thirty days. What else is involved?" "The best way of getting the trucks to port," said Vanderpool, "is again by rail. The loading and blocking would be only $30 per truck because we'd be doing all 50 at one time, and could be done in a day. The rail rate per truck would average out to $160 each and it would take one day for them to reach Chicago and another two days, to be loaded. We would be responsible for loading and stowing the cargo and this would cost $12,500 for all 50 trucks. The seaway tolls based on weight would be $54 per truck. At Maracaibo, the unloading costs will be $9,500 for the entire vessel, and it would take us one day. Marine insurance will be $1,160 per truck. We would also be responsible for paying the Port of Chicago wharfage charge of $14 per truck." "Well, what's the best way to get these trucks to Venezuela and fulfill the contract?" asked Pon. "It looks like another late night?" said Vanderpool. 1. CHICAGO: (12 Points) A. TOTAL Transportation Cost (3 Points) B. TOTAL Production Inventory Carrying Cost (4 Points) C. TOTAL In-Transit Inventory Carrying Cost (4 Points) D. TOTAL COST (Transportation \& All Inventory Carrying Costs) (1 Point) 2. NEW ORLEANS: (12 Points) A. TOTAL Transportation Cost (3 Points) B. TOTAL Production Inventory Carrying Cost (4 Points) C. TOTAL In-Transit Inventory Carrying Cost (4 Points) D. TOTAL COST (Transportation \& All Inventory Carrying Costs) (1 Point)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started