Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone help me with this assignment ? L04-1,4-2,43,4-4 Recording Transactions (Including Adjusting and Closing Entries), Preparing a Complete COMP4-1 Set of Financial Statements, and

can someone help me with this assignment ?

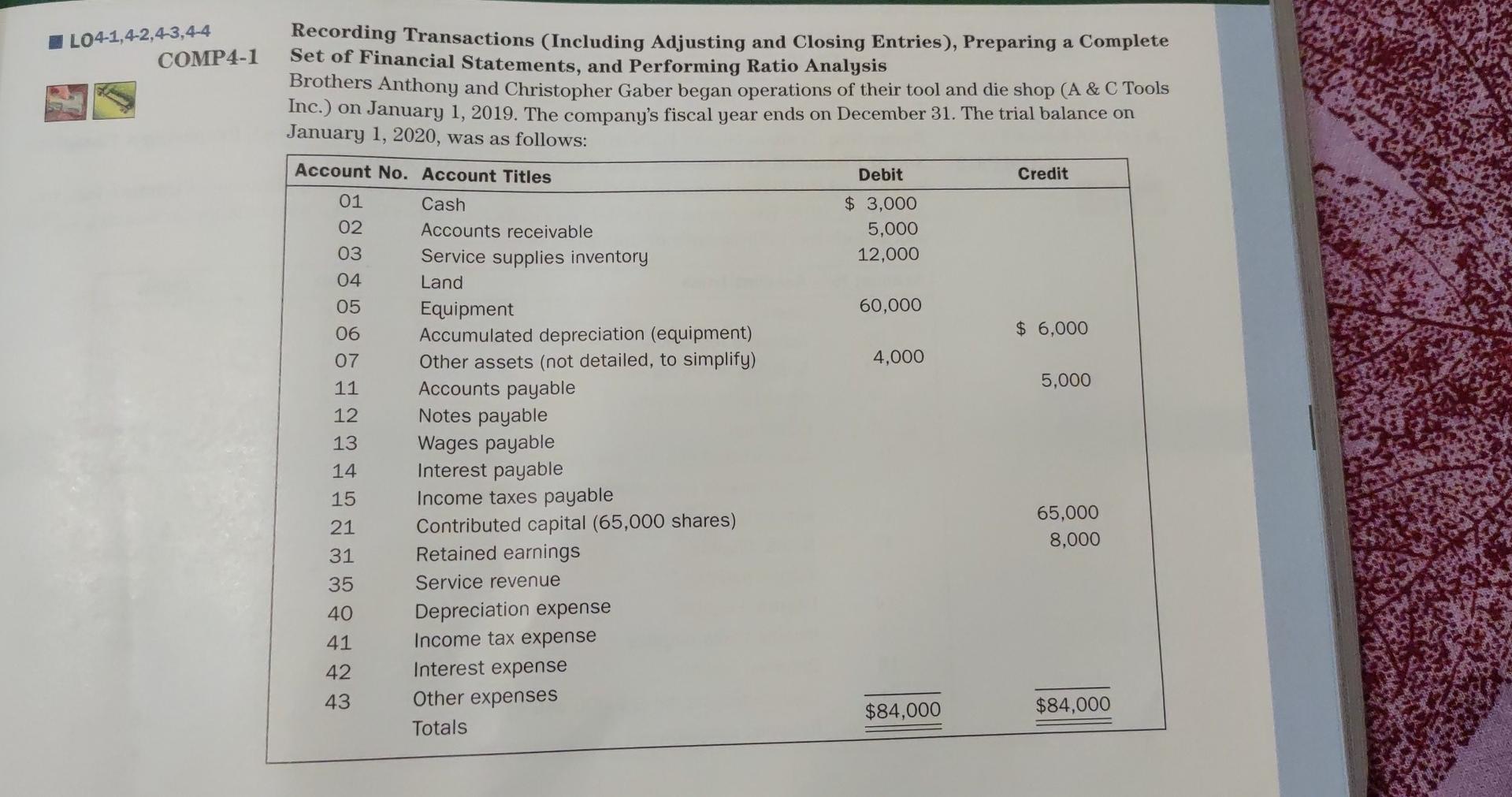

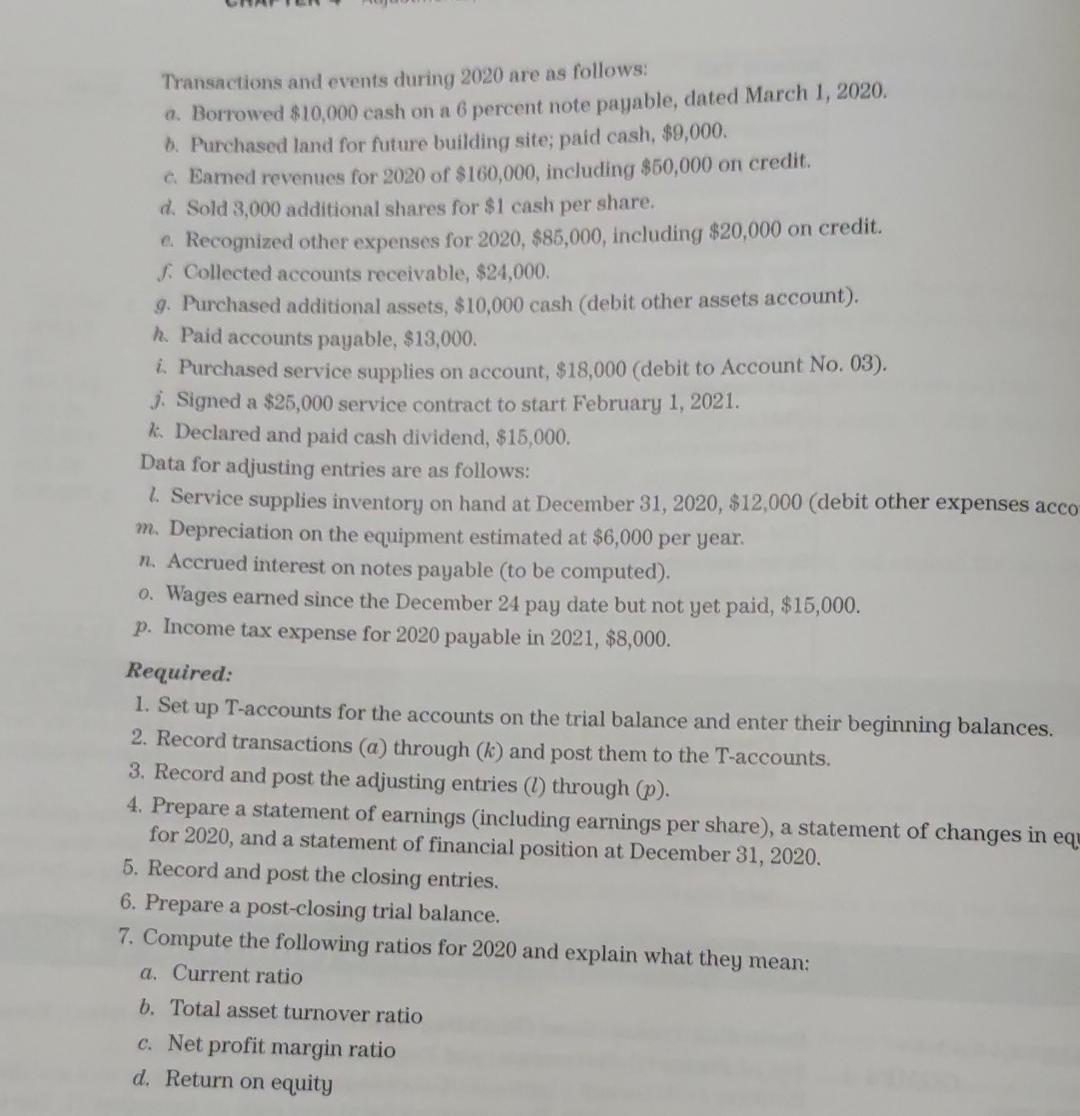

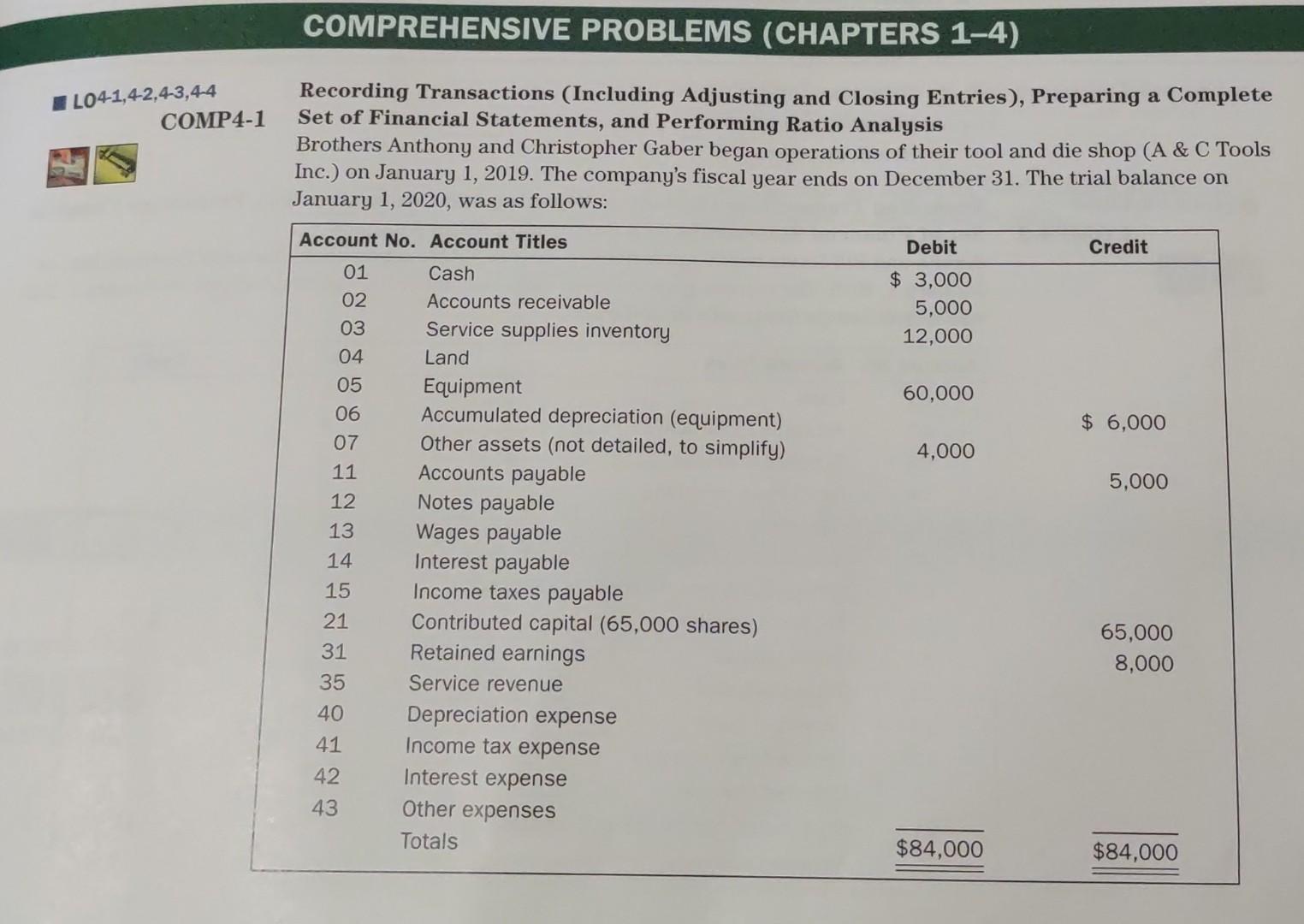

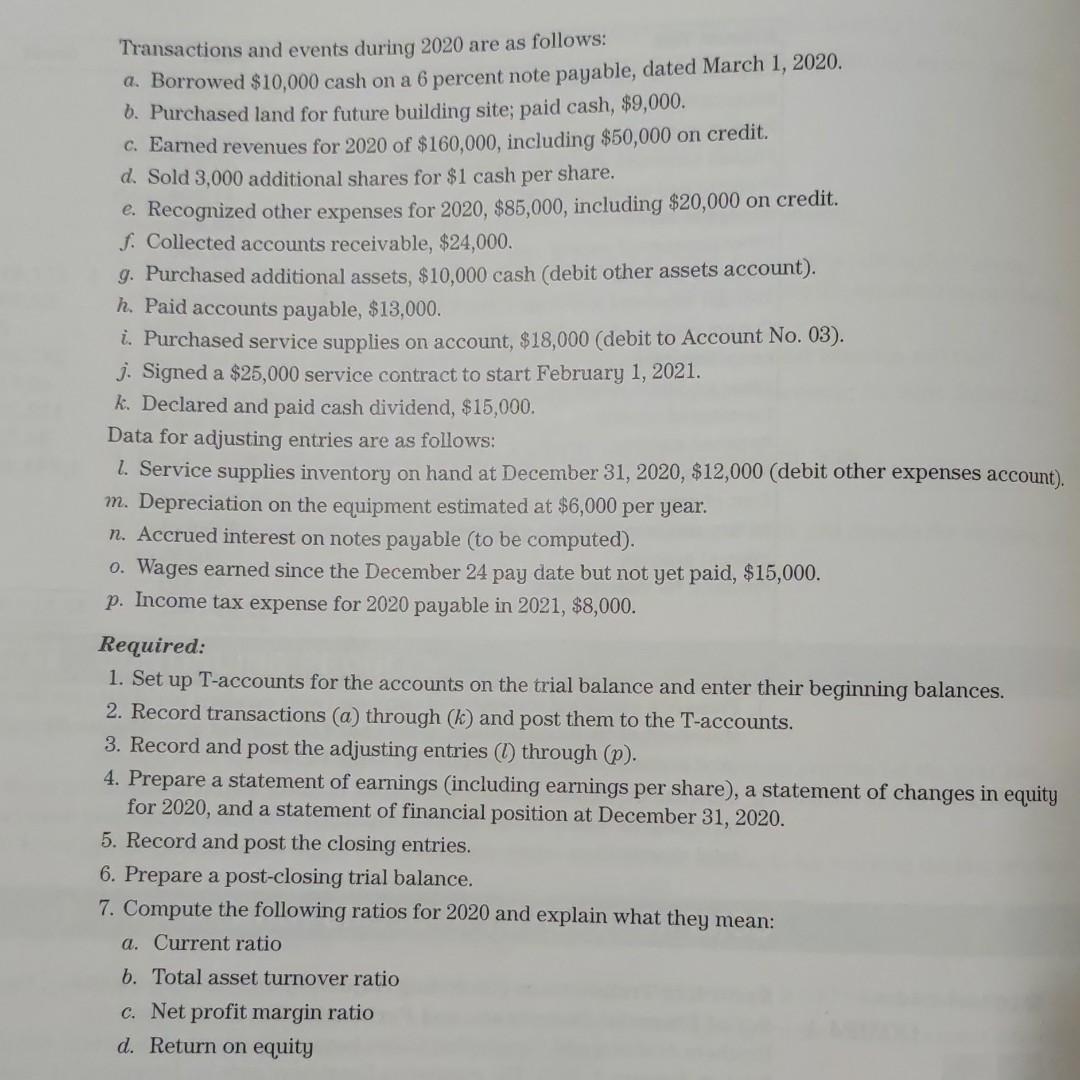

L04-1,4-2,43,4-4 Recording Transactions (Including Adjusting and Closing Entries), Preparing a Complete COMP4-1 Set of Financial Statements, and Performing Ratio Analysis Brothers Anthony and Christopher Gaber began operations of their tool and die shop (A \& C Tools Inc.) on January 1, 2019. The company's fiscal year ends on December 31. The trial balance on January 1, 2020, was as follows: Transactions and events during 2020 are as follows: a. Borowed $10,000 cash on a 6 percent note payable, dated March 1, 2020. b. Purchased land for future building site; paid cash, $9,000. c. Earned revenues for 2020 of $160,000, including $50,000 on credit. d. Sold 3,000 additional shares for $1 cash per share. c. Recognized other expenses for 2020,$85,000, including $20,000 on credit. f. Collected accounts receivable, $24,000. g. Purchased additional assets, $10,000 cash (debit other assets account). h. Paid accounts payable, $13,000. i. Purchased service supplies on account, $18,000 (debit to Account No. 03). j. Signed a $25,000 service contract to start February 1, 2021. k. Declared and paid cash dividend, $15,000. Data for adjusting entries are as follows: 2. Service supplies inventory on hand at December 31, 2020, \$12,000 (debit other expenses acc m. Depreciation on the equipment estimated at $6,000 per year. n. Accrued interest on notes payable (to be computed). o. Wages earned since the December 24 pay date but not yet paid, $15,000. p. Income tax expense for 2020 payable in 2021,$8,000. Required: 1. Set up T-accounts for the accounts on the trial balance and enter their beginning balances. 2. Record transactions (a) through (k) and post them to the T-accounts. 3. Record and post the adjusting entries (l) through (p). 4. Prepare a statement of earnings (including earnings per share), a statement of changes in ec for 2020, and a statement of financial position at December 31, 2020. 5. Record and post the closing entries. 6. Prepare a post-closing trial balance. 7. Compute the following ratios for 2020 and explain what they mean: a. Current ratio b. Total asset turnover ratio c. Net profit margin ratio d. Return on equity Recording Transactions (Including Adjusting and Closing Entries), Preparing a Complete Set of Financial Statements, and Performing Ratio Analysis Brothers Anthony and Christopher Gaber began operations of their tool and die shop (A \& C Tools Inc.) on January 1, 2019. The company's fiscal year ends on December 31. The trial balance on January 1, 2020, was as follows: Transactions and events during 2020 are as follows: a. Borrowed $10,000 cash on a 6 percent note payable, dated March 1,2020. b. Purchased land for future building site; paid cash, $9,000. c. Earned revenues for 2020 of $160,000, including $50,000 on credit. d. Sold 3,000 additional shares for $1 cash per share. e. Recognized other expenses for 2020,$85,000, including $20,000 on credit. f. Collected accounts receivable, $24,000. g. Purchased additional assets, $10,000 cash (debit other assets account). h. Paid accounts payable, $13,000. i. Purchased service supplies on account, $18,000 (debit to Account No. 03). j. Signed a $25,000 service contract to start February 1, 2021. k. Declared and paid cash dividend, $15,000. Data for adjusting entries are as follows: l. Service supplies inventory on hand at December 31, 2020, \$12,000 (debit other expenses account). m. Depreciation on the equipment estimated at $6,000 per year. n. Accrued interest on notes payable (to be computed). o. Wages earned since the December 24 pay date but not yet paid, $15,000. p. Income tax expense for 2020 payable in 2021,$8,000. Required: 1. Set up T-accounts for the accounts on the trial balance and enter their beginning balances. 2. Record transactions (a) through (k) and post them to the T-accounts. 3. Record and post the adjusting entries (l) through (p). 4. Prepare a statement of earnings (including earnings per share), a statement of changes in equity for 2020, and a statement of financial position at December 31, 2020. 5. Record and post the closing entries. 6. Prepare a post-closing trial balance. 7. Compute the following ratios for 2020 and explain what they mean: a. Current ratio b. Total asset turnover ratio c. Net profit margin ratio d. Return on equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started