Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help me with this case study? Markowitz won the Nobel Prize for his work in stock portfolio theory. He was the first to

Can someone help me with this case study?

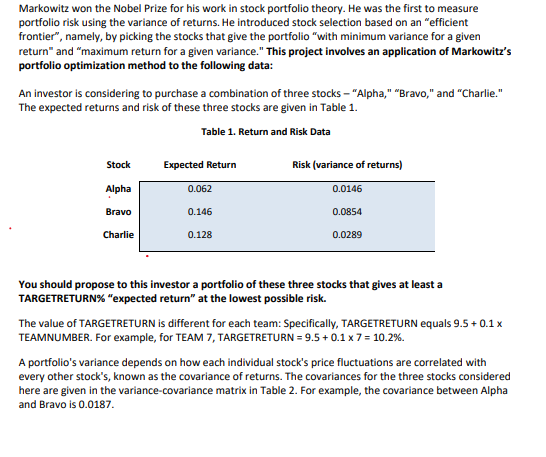

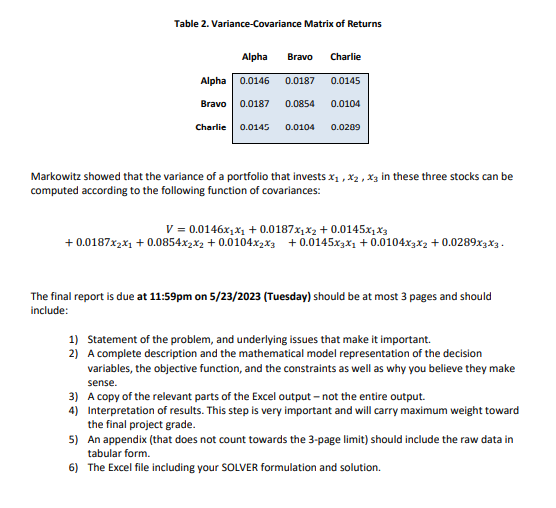

Markowitz won the Nobel Prize for his work in stock portfolio theory. He was the first to measure portfolio risk using the variance of returns. He introduced stock selection based on an "efficient frontier", namely, by picking the stocks that give the portfolio "with minimum variance for a given return" and "maximum return for a given variance." This project involves an application of Markowitz's portfolio optimization method to the following data: An investor is considering to purchase a combination of three stocks - "Alpha," "Bravo," and "Charlie." The expected returns and risk of these three stocks are given in Table 1. Table 1. Return and Risk Data You should propose to this investor a portfolio of these three stocks that gives at least a TARGETRETURN\% "expected return" at the lowest possible risk. The value of TARGETRETURN is different for each team: Specifically, TARGETRETURN equals 9.5+0.1x TEAMNUMBER. For example, for TEAM 7, TARGETRETURN =9.5+0.17=10.2%. A portfolio's variance depends on how each individual stock's price fluctuations are correlated with every other stock's, known as the covariance of returns. The covariances for the three stocks considered here are given in the variance-covariance matrix in Table 2. For example, the covariance between Alpha and Bravo is 0.0187 . Table 2. Variance-Covariance Matrix of Returns Markowitz showed that the variance of a portfolio that invests x1,x2,x3 in these three stocks can be computed according to the following function of covariances: V=0.0146x1x1+0.0187x1x2+0.0145x1x3+0.0187x2x1+0.0854x2x2+0.0104x2x3+0.0145x3x1+0.0104x3x2+0.0289x3x3 The final report is due at 11:59pm on 5/23/2023 (Tuesday) should be at most 3 pages and should include: 1) Statement of the problem, and underlying issues that make it important. 2) A complete description and the mathematical model representation of the decision variables, the objective function, and the constraints as well as why you believe they make sense. 3) A copy of the relevant parts of the Excel output - not the entire output. 4) Interpretation of results. This step is very important and will carry maximum weight toward the final project grade. 5) An appendix (that does not count towards the 3-page limit) should include the raw data in tabular form. 6) The Excel file including your SOLVER formulation and solution. Markowitz won the Nobel Prize for his work in stock portfolio theory. He was the first to measure portfolio risk using the variance of returns. He introduced stock selection based on an "efficient frontier", namely, by picking the stocks that give the portfolio "with minimum variance for a given return" and "maximum return for a given variance." This project involves an application of Markowitz's portfolio optimization method to the following data: An investor is considering to purchase a combination of three stocks - "Alpha," "Bravo," and "Charlie." The expected returns and risk of these three stocks are given in Table 1. Table 1. Return and Risk Data You should propose to this investor a portfolio of these three stocks that gives at least a TARGETRETURN\% "expected return" at the lowest possible risk. The value of TARGETRETURN is different for each team: Specifically, TARGETRETURN equals 9.5+0.1x TEAMNUMBER. For example, for TEAM 7, TARGETRETURN =9.5+0.17=10.2%. A portfolio's variance depends on how each individual stock's price fluctuations are correlated with every other stock's, known as the covariance of returns. The covariances for the three stocks considered here are given in the variance-covariance matrix in Table 2. For example, the covariance between Alpha and Bravo is 0.0187 . Table 2. Variance-Covariance Matrix of Returns Markowitz showed that the variance of a portfolio that invests x1,x2,x3 in these three stocks can be computed according to the following function of covariances: V=0.0146x1x1+0.0187x1x2+0.0145x1x3+0.0187x2x1+0.0854x2x2+0.0104x2x3+0.0145x3x1+0.0104x3x2+0.0289x3x3 The final report is due at 11:59pm on 5/23/2023 (Tuesday) should be at most 3 pages and should include: 1) Statement of the problem, and underlying issues that make it important. 2) A complete description and the mathematical model representation of the decision variables, the objective function, and the constraints as well as why you believe they make sense. 3) A copy of the relevant parts of the Excel output - not the entire output. 4) Interpretation of results. This step is very important and will carry maximum weight toward the final project grade. 5) An appendix (that does not count towards the 3-page limit) should include the raw data in tabular form. 6) The Excel file including your SOLVER formulation and solutionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started