can someone help me with this include formulas too thanks

can someone help me with this include formulas too thanks

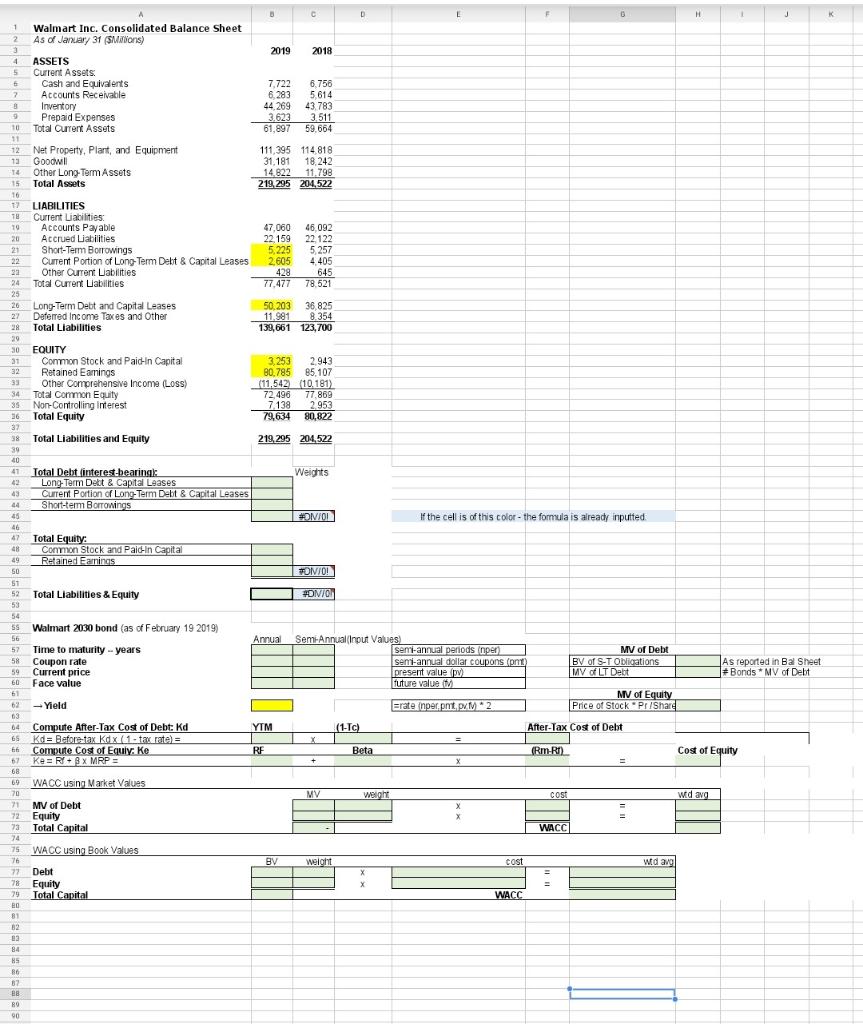

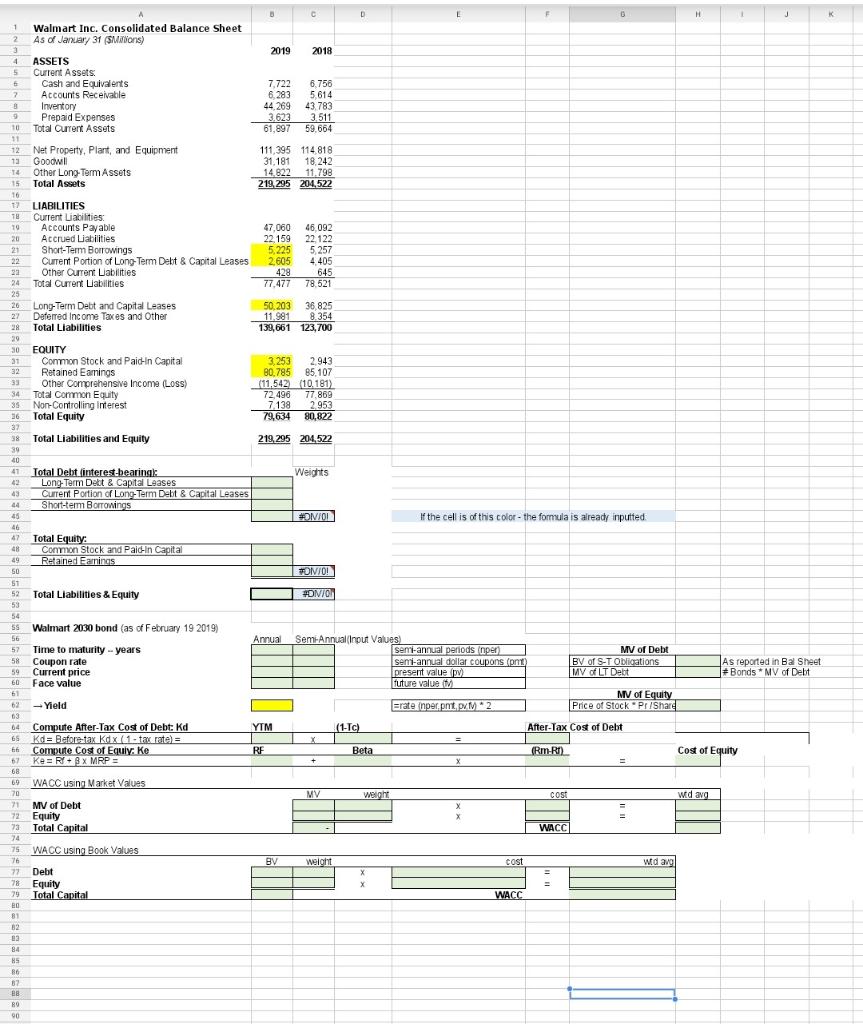

K 50.203 D F B H J 1 Walmart Inc. Consolidated Balance Sheet 2 As of January 31 (Millions) 3 2019 2018 4 ASSETS 5 Current Assets Cash and Equivalents 7.722 6.756 7 Accounts Receivable 6,283 5.614 Inventory 44.269 43.783 9 Prepaid Expenses 3.623 3.511 10 Total Current Assets 61,897 59.664 11 12 Net Property, Plant, and Equipment 111,395 114 818 Goodwill 31.181 18.242 18 Other Long-Term Assets 14.822 11 798 15 Total Assets 219 295 204.522 16 17 LIABILITIES TU Current Liabilities: 10 Accounts Payable 47,060 46,092 20 Accrued Liabilities 22.159 22. 122 21 Short-Term Borrowings 5.225 5257 22 Current Portion of Long Term Debt & Capital Leases 2605 4 405 39 Other Current Liabilities 428 645 24 Total Current Liabilities 77.477 78.521 25 26 Long-Term Debt and Capital Leases 36 825 27 Deferred Income Taxes and Other 11,991 8.354 28 Total Liabilities 139,661 123,700 39 30 EQUITY 31 Common Stock and Paid-in Capital 3,253 2.943 32 Retained Earnings 80.785 85,107 Other Comprehensve Income (LOSS) (11.542 (10.181) 34 Total Common Equity 72,496 77.869 35 Non-Controlling interest 7.138 2.953 36 Total Equity 79,634 80,822 37 38 Total Liabilities and Equity 219,295 204.522 39 40 41 Total Debt interest bearing Weights 42 -Capital Leases 43 Current Portion of Long-Term D. & Capital Leases 44 Short-term Borrowings 45 If the cell is of this color- the formula is already inputted 46 47 Total Equity: 48 Common Stock and Paid in Capital 49 Retained Fannings 50 TOIVIO! 51 52 Total Liabilities & Equity #ON/OF 53 54 5s Walmart 2030 bond (as of February 19 2019) 56 Annual Semi-AnnualInput Values - 57 Time to maturity -- years semi-annual periods (nper MV of Debt 58 Coupon rate semi-annual dollar coupons (pnt BV of S-T Obligations As reported in Bal Sheet 59 Current price present value MV of LT Debt #Bonds * MV of Debt 60 Face value future value 61 MV of Equity 63 Yield Eratenper.pt pt 2 Price of Stock PL/Share 63 64 Compute After-Tax Cost of Debt: Kd YTM (1-Tc) After-Tax Cost of Debt 65 Kd= Before tax Kdx (1 - tax rate) = X tot Compute Cost of Equiy ke RF Beta (Rm-R1) Cost of Equity 07 Ke=BX MRP X 68 69 WACC using Market Values MY weicht COSE wid avg 71 MV of Debt 72 Equity 73 Total Capital WACC 74 75 WACC using Book Values 76 BV weight cost wid ang 77 Debt 78 Equity 79 Total Capital WACC ONION + 81 82 23 84 85 86 87 28 BO 00 K 50.203 D F B H J 1 Walmart Inc. Consolidated Balance Sheet 2 As of January 31 (Millions) 3 2019 2018 4 ASSETS 5 Current Assets Cash and Equivalents 7.722 6.756 7 Accounts Receivable 6,283 5.614 Inventory 44.269 43.783 9 Prepaid Expenses 3.623 3.511 10 Total Current Assets 61,897 59.664 11 12 Net Property, Plant, and Equipment 111,395 114 818 Goodwill 31.181 18.242 18 Other Long-Term Assets 14.822 11 798 15 Total Assets 219 295 204.522 16 17 LIABILITIES TU Current Liabilities: 10 Accounts Payable 47,060 46,092 20 Accrued Liabilities 22.159 22. 122 21 Short-Term Borrowings 5.225 5257 22 Current Portion of Long Term Debt & Capital Leases 2605 4 405 39 Other Current Liabilities 428 645 24 Total Current Liabilities 77.477 78.521 25 26 Long-Term Debt and Capital Leases 36 825 27 Deferred Income Taxes and Other 11,991 8.354 28 Total Liabilities 139,661 123,700 39 30 EQUITY 31 Common Stock and Paid-in Capital 3,253 2.943 32 Retained Earnings 80.785 85,107 Other Comprehensve Income (LOSS) (11.542 (10.181) 34 Total Common Equity 72,496 77.869 35 Non-Controlling interest 7.138 2.953 36 Total Equity 79,634 80,822 37 38 Total Liabilities and Equity 219,295 204.522 39 40 41 Total Debt interest bearing Weights 42 -Capital Leases 43 Current Portion of Long-Term D. & Capital Leases 44 Short-term Borrowings 45 If the cell is of this color- the formula is already inputted 46 47 Total Equity: 48 Common Stock and Paid in Capital 49 Retained Fannings 50 TOIVIO! 51 52 Total Liabilities & Equity #ON/OF 53 54 5s Walmart 2030 bond (as of February 19 2019) 56 Annual Semi-AnnualInput Values - 57 Time to maturity -- years semi-annual periods (nper MV of Debt 58 Coupon rate semi-annual dollar coupons (pnt BV of S-T Obligations As reported in Bal Sheet 59 Current price present value MV of LT Debt #Bonds * MV of Debt 60 Face value future value 61 MV of Equity 63 Yield Eratenper.pt pt 2 Price of Stock PL/Share 63 64 Compute After-Tax Cost of Debt: Kd YTM (1-Tc) After-Tax Cost of Debt 65 Kd= Before tax Kdx (1 - tax rate) = X tot Compute Cost of Equiy ke RF Beta (Rm-R1) Cost of Equity 07 Ke=BX MRP X 68 69 WACC using Market Values MY weicht COSE wid avg 71 MV of Debt 72 Equity 73 Total Capital WACC 74 75 WACC using Book Values 76 BV weight cost wid ang 77 Debt 78 Equity 79 Total Capital WACC ONION + 81 82 23 84 85 86 87 28 BO 00

can someone help me with this include formulas too thanks

can someone help me with this include formulas too thanks